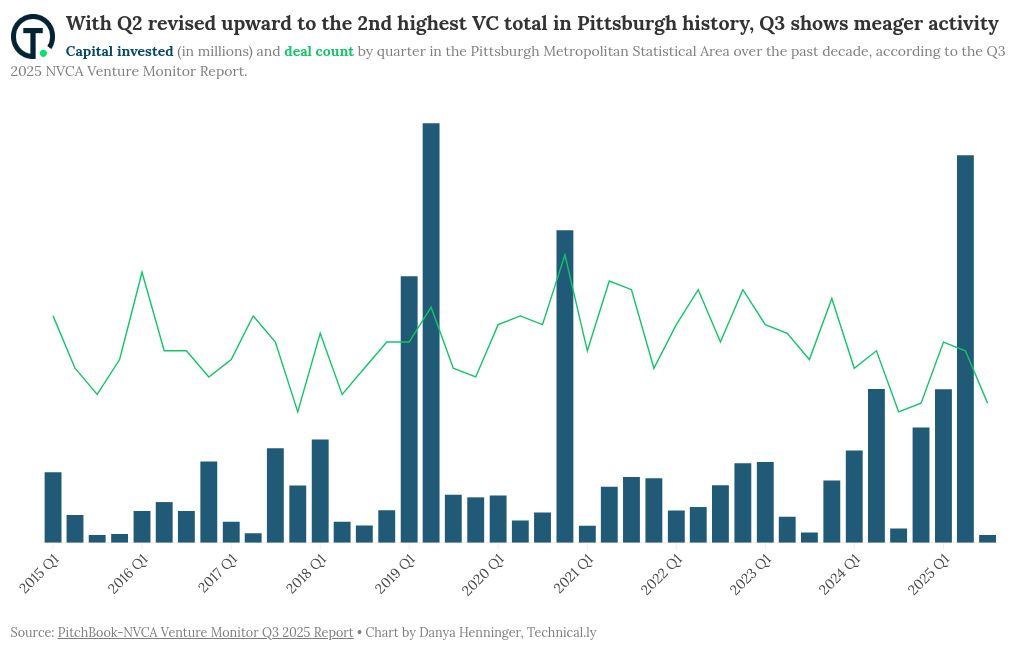

Venture capital funding in Pittsburgh plunged to a record low last quarter, marking the smallest total in more than a decade.

Local companies raised just $19.4 million across 16 deals in Q3, according to the latest Venture Monitor report from PitchBook and the National Venture Capital Association (NVCA). The steep drop contrasts sharply with the previous quarter, when local startups raised nearly $1 billion combined.

Despite the slowdown, AI companies once again dominated local deal flow, mirroring national trends that favor AI investments. Still, more than half of the total raised in Q3 was carried by a single deal, showing that investors are still favoring fewer, larger deals with later-stage startups.

AI startup funding is a sign of “rising tides for Pittsburgh.”

Nhi Lê, an investor at Alpha Intelligence Capital

“We are in the early days of the adoption curve,” Ven Raju, president and CEO of the startup ecosystem organization Innovation Works, told Technical.ly, “and it remains to be seen whether the trillions of dollars invested in AI infrastructure, chip development, models and applications will derive near-term value and returns.”

Mine Vision Systems, an East Liberty-based mining technology startup, led the quarter by securing $11.5 million in later-stage funding primarily to expand hiring in the Pittsburgh area.

The company develops visual intelligence and automation tools for the mining industry – aligning with the ongoing trend that companies producing AI products often lead Pittsburgh fundraising rounds.

“We’ve seen Sequoia, a16z and others with deep pockets make their first investments in Pittsburgh in the last few years,” Raju said. “That’s not a one-off trend either – both of those firms have now invested in multiple companies in the region, showing growing commitment from some of the world’s most prominent VCs.”

PitchBook data can fluctuate, as past revisions show. Q2 was initially reported as $600.8 million across 19 deals, but the latest report amended that to $977.3 million across 22 deals.

AI dominates, raking in the majority of Pittsburgh VC

Recent funding trends suggest Pittsburgh’s growing reputation as an AI hub isn’t just hype.

At September’s AI Horizons summit, local advocacy group AI Strike Team claimed Pittsburgh leads all US tech cities outside Silicon Valley in the concentration of AI investment, with roughly 80% of local venture dollars going to AI-related companies.

Since Q1 2023, most venture capital funding in the Pittsburgh region has gone to AI companies, according to PitchBook data. In 2025, 73% of Pittsburgh’s VC funding went to AI companies during Q1 and 98% in Q2.

AI startup funding is a sign of “rising tides for Pittsburgh,” according to Nhi Lê, an investor at Alpha Intelligence Capital. The international firm has been spending more time on the ground in Pittsburgh in recent years because it believes “this ecosystem can produce multiple fund-returning companies,” Lê told Technical.ly.

However, that funding still needs to convert into successful returns from scalable, enduring companies, she said.

Pittsburgh isn’t an outlier. AI is driving deal activity nationwide.

So far this year, AI and machine learning startups have accounted for 64% of total venture deal value, despite making up only 38% of deals, according to the report. AI has also captured the majority of capital deployment in Q3 as well, according to Nizar Tarhuni, PitchBook’s executive vice president of research and market intelligence.

“While this surge has fueled optimism around a potential rebound,” Tarhuni said, “the broader market tells a more complex story.”

Liquidity remains constrained, meaning it’s still hard for investors to cash out on their investments through IPOs or acquisitions. Plus, raising new funds is getting harder as limited partners — the institutional investors that back VCs — pull back amid the tighter liquidity.

At this pace, 2025 could mark the weakest year for venture fundraising since 2017, according to the PitchBook report.

A new world or big bubble?

There are likely to be winners and losers of the AI stack, according to Raju. During the dot-com era, there was significant investment in e-commerce that eventually turned into real dominant players in the sector like Amazon and Walmart.

Of course, an over-concentration in one sector carries predictable risks, Raju said, but Pittsburgh’s exposure to those risks is limited thanks to its broad strengths in life sciences, deep tech and robotics.

As for those non-AI startups, they’re still attracting capital, Lê said, even as AI continues to dominate investor attention.

“I’d argue that the same fundraising principles apply for successful AI and non-AI companies,” Lê said. “Build your company and fundraising pitch around a strong executive team, problem and solution clarity, moat, a credible plan and traction.”