PHILADELPHIA, Pa. – Carpenter Technology reported this morning that it slightly missed revenue projections for its fiscal second quarter of 2026 but exceeded earnings projections by over 12.5%. The result was a decline in its stock price of over 6% at 10 a.m.

The company, which was founded and maintains large manufacturing facilities in Berks County, claims it cemented several long-term agreements with companies in its largest end-use market, aerospace, and also realized substantial growth in the Specialty Alloys Operations (SAO) segment.

“The second quarter of fiscal year 2026 generated $155.2 million of operating income,” said Tony R. Thene, Chairman and CEO of Carpenter Technology, in a statement. “The record quarter was an increase of 31.0 % over the previous second fiscal quarter.”

Carpenter Technology 2Q Financial Highlights

Thene said the quarterly performance was driven by the SAO segment, which continued to expand adjusted operating margins. Reaching 33.1 % in the quarter, up from 28.3 percent in the second quarter a year ago, the SAO segment realized $174.6 million in operating income, its best quarter on record.

Thene commented, “Demand in our Aerospace and Defense end-use market continues to accelerate as customers gain confidence with the ramping build rates. Notably, we saw bookings for Commercial Aerospace increase 23 percent sequentially. Given the strong demand outlook, our customers continue to be focused on securing their supply. To that end, we completed negotiations on three additional long-term agreements with aerospace customers, realizing significant value.”

Thene also noted that given the strong demand environment and the visibility the company has for the second half of the fiscal year, it is raising its guidance to $680 million to $700 million, a 30 % to 33 % increase over the company’s record fiscal year 2025 earnings.

Carpenter expects to generate at least $280 million in adjusted free cash flow in fiscal year 2026. With a strong balance sheet and meaningful adjusted free cash flow, the company said it will continue to take a balanced approach to capital allocation: sustaining its current asset base to achieve its targets, investing in high value growth initiatives like a recently announced brownfield capacity expansion, and returning cash to shareholders. To that end, Carpenter said it executed $32.1 million in share repurchases in the quarter against its $400 million repurchase program.

“Looking over the long term,” Thene commented, “our broad portfolio of specialized solutions, increasing productivity, optimizing product mix and pricing actions will continue to drive growth well into the future. Together with our investments to accelerate growth, we are positioned to achieve and exceed our goals over the long-term.”

About Carpenter Technology

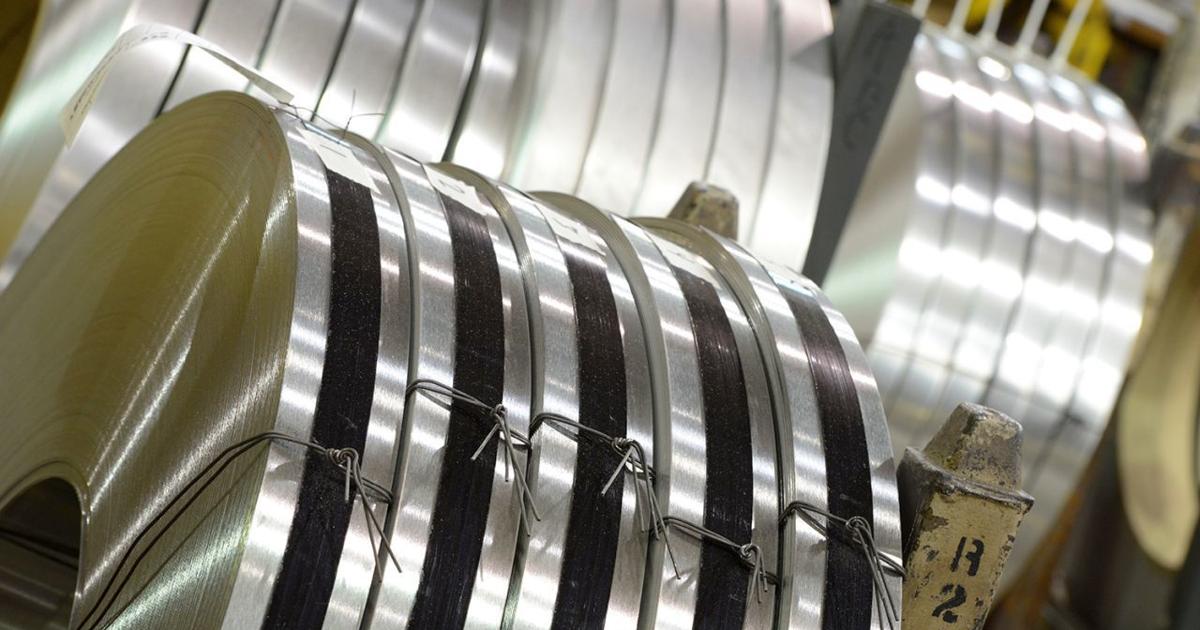

Carpenter Technology Corporation (NYSE: CRS) makes high-performance specialty alloy-based materials and process solutions for critical applications in the aerospace, defense, medical, transportation, energy, industrial, and consumer electronics markets. Founded in 1889, Carpenter Technology has evolved to become a pioneer in premium specialty alloys, including titanium, nickel, and cobalt, as well as alloys specifically engineered for additive manufacturing processes and soft magnetics applications.