SCRANTON — After tabling it earlier this month, Lackawanna County commissioners unanimously approved Wednesday a 2026 county budget that does not include a property tax hike.

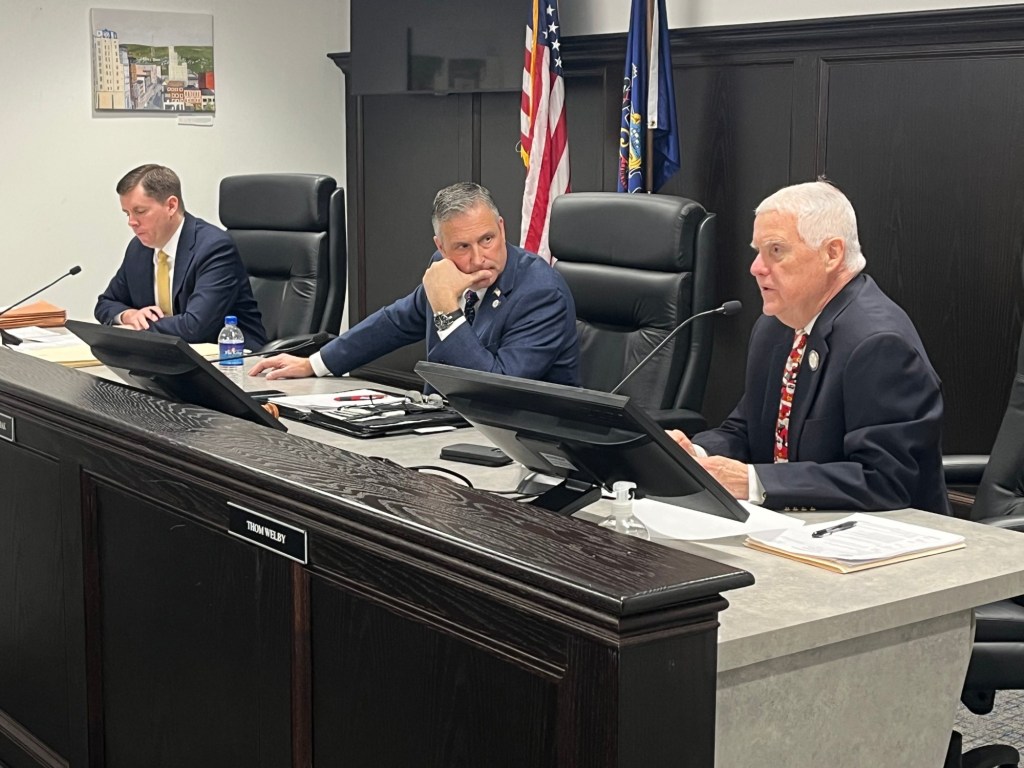

Meeting Wednesday for the last time in what’s been a turbulent 2025 for county government, Democratic Commissioners Bill Gaughan and Thom Welby and Republican Commissioner Chris Chermak voted 3-0 to adopt the almost $181 million spending plan, capping a budget process that partially overlapped with the much longer and considerably more acrimonious process of filling former Democratic Commissioner Matt McGloin’s vacant seat.

Welby, the winner of a Nov. 4 special election to fill the remainder of McGloin’s unexpired term running into early January 2028, replaced interim Democratic Commissioner Brenda Sacco in late November. Sacco had accepted a temporary appointment the month prior, an appointment long delayed by an acrimonious monthslong legal battle Gaughan and the county initiated in March, and held the seat for about 35 days. Frequent sparring among the commissioners continued during her tenure.

Against that backdrop, the budget was a bright spot. Gaughan and Chermak, often at odds over the vacancy and how to fill it, both endorsed the proposed spending plan they introduced together in mid-October. Welby ultimately got on board, too, despite some misgivings about certain overtime line items.

The new-look board of commissioners tabled a final vote on the budget Dec. 3, citing uncertainty over electricity costs the county would incur in 2026. Beyond giving officials more time to quantify the impact of increasing electricity rates, delaying the budget vote also gave Welby more time to review the budget crafted before he took office on Nov. 25.

After adopting the budget Wednesday, commissioners approved a five-year extension of the county’s electricity supply contract with Constellation Energy. Extending the Constellation contract, which locks the county into a set per kilowatt-hour rate, was deemed the best option for the county that also received a pair of proposals from other providers: Ohio-based IGS Energy and Virginia-based WGL Energy, county Chief Financial Officer David Bulzoni said.

Officials anticipate a gross increase in electricity costs of about 42%, but also anticipate a 5-10% reduction in energy use due to improvements stemming from an energy savings project. The net result would see the county’s budget for electricity costs increase to about $1.33 million next year.

The tax-hike-free 2026 budget follows a 2025 budget that hiked taxes nearly 33%, a whopping increase Gaughan and McGloin approved last year to mitigate a long-developing financial crisis. Next year’s budget also coincides with the implementation of new assessed property values calculated during the county’s first comprehensive reassessment since 1968.

Because reassessment must be revenue neutral for the county and other taxing bodies, tax rates will fall next year when new, higher assessments take effect to ensure those entities collect essentially the same amount of property tax revenue after reassessment as they did before. The county’s tax rate will fall next year from 89.98 to just 5.79 mills, a mill being a $1 tax on every $1,000 of assessed value.

The reassessment also means 2026 tax bills may fluctuate compared to 2025 despite the county not raising taxes.

Check back for updates.