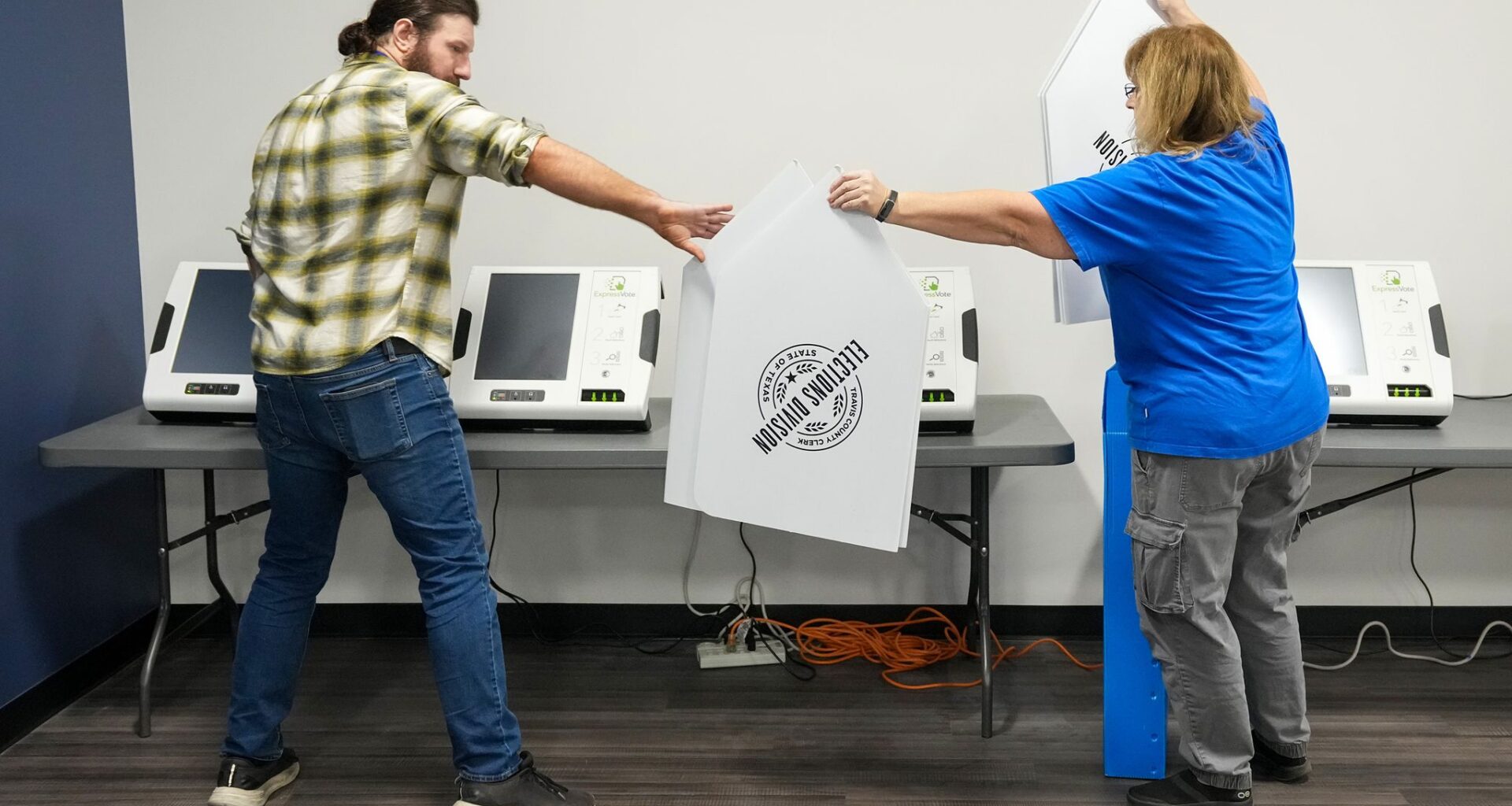

Travis County election technicians Daniel Boyer and Angela Smith set up voting machines at a polling place at the Travis County Clerk Office in Austin Thursday, Oct. 16, 2025.

Jay Janner/Austin American-Statesman

Austin voters will decide on the city’s steepest property tax rate hike in at least 20 years this November.

Facing a projected $33.4 million budget shortfall, the City Council approved a $6.3 billion budget that depends on a 20% increase in the city’s portion of property taxes. That’s well above a 3.5% annual cap set by the Texas Legislature in 2019 as part of an effort to rein in property tax increases. If a local taxing entity like the city of Austin wants to exceed that cap, it must get voter approval through a tax rate election.

Article continues below this ad

City leaders say the increase is needed to maintain basic services, while business groups say it could worsen Austin’s affordability crisis.

Early voting starts Oct. 20 and runs through Oct. 31. Election Day is Nov. 4.

What is Prop Q?

Campaign signs for and against Prop Q are posted on East Riverside Drive in Austin on Thursday, Oct. 16, 2025.

Jay Janner/Austin American-Statesman

Proposition Q asks voters to approve a property tax rate of $0.57 per $100 in valuation — about 5 cents higher than what’s allowed under the 2019 state law. The tax hike would generate roughly $110 million for the city’s general fund next year.

Article continues below this ad

A sign opposing Proposition Q is seen off I-35 and Onion Creek Parkway in Austin, Tuesday, Oct. 14, 2025.

Mikala Compton/Austin American-Statesman

For the average homeowner with a property valued at about $500,000, the passage of Prop Q would add about $300 to their annual city property tax bill. This year, the average homeowner paid $1,969 in city taxes.

How would Austin spend the money?

That $110 million would go toward a variety of initiatives but most fall under one of four categories: homelessness programs, park maintenance and public health and safety.

Article continues below this ad

Some of the largest proposed expenditures include:

$20.4 million for up to 350 new rapid rehousing units and expanded emergency shelter beds and services

$3 million for rental and move-in assistance for people leaving shelters

$3.1 million for 24/7 mental health crisis response, including new EMS units

$8.3 million for Fire Department overtime, $5.1 million for EMS staffing and mental health response expansion

$8.3 million for parks maintenance and wildfire prevention

$1.9 million workforce programs, including the Austin Civilian Conservation Corps

Other notable expenditures include $11.5 million to continue emergency shelter operations at the Marshalling Yard and the Eighth Street Shelter; $800,000 for a one-time $500 stipend for city employees ineligible for remote work; and $517,000 to continue funding 20 positions added last year for parks and cemetery maintenance.

For a full list, please visit: https://www.austintexas.gov/page/ballot-propositions.

Article continues below this ad

Who’s in favor of Prop Q?

The majority of the City Council, homelessness advocates and two unions representing city employees support Prop Q.

A PAC called Love Austin is leading the push, arguing that Prop Q protects core services.

“This isn’t about taxes — it’s about our values,” said Love Austin leader Joe Cascino, also a political consultant who has worked as Austin Mayor Kirk Watson’s campaign manager.

Article continues below this ad

Groups backing Prop Q include Caritas of Austin, The Other Ones Foundation, AFSCME Local 1620 and the Austin EMS Association, whose leaders have argued the city can’t sustain essential services — or help vulnerable residents — without new revenue.

Supporters of Proposition Q attend a news conference to announce the “Care Not Cuts” campaign at Parque Zaragosa on Tuesday, Sept. 30, 2025. A coalition of unions, first responders, social workers, and community leaders announced a coalition of over 20 organizations in support of the upcoming City of Austin’s tax rate election Proposition Q.

Jay Janner/Austin American-Statesman

“Austin is growing, and our EMS needs to grow too,” said EMS Association President James Monks.

Council Member Ryan Alter said the investment could yield long-term savings: “If we can get someone into housing instead of jail or an ER, we save money.”

Article continues below this ad

The Travis County Democratic Party narrowly endorsed Prop Q, and a coalition called Care not Cuts — made up of unions and community groups — has launched a campaign to rally support.

Notably, leadership for the Austin Police Association and Austin Fire Association said their unions would remain neutral on the initiative.

Who’s against Prop Q?

Austin’s business community and conservative activists say the tax hike is too steep.

Article continues below this ad

The Austin Chamber of Commerce, Real Estate Council of Austin, and Austin Apartment Association oppose Prop Q, warning that it could drive up housing costs and hurt economic growth.

“This dramatic increase will push people out of Austin,” Chamber Board Chair Mark Ramseur said.

Apartment Association CEO Emily Blair said multifamily property taxes could rise 35%, hitting renters hardest.

The conservative PAC Save Austin Now, which successfully campaigned for the city’s public camping ban, is also urging a “no” vote.

Article continues below this ad

“If the city were serious about affordability, it wouldn’t raise property taxes,” co-chair Steven Brown said.

A pedestrian walks past a sign that displays opposition to Proposition Q in East Austin, Tuesday, Oct. 14, 2025.

Mikala Compton/Austin American-Statesman

What if Prop Q fails?

In short, the City Council would have to go back to the drawing board to find budget cuts — and members have said nothing’s off limits.

Article continues below this ad

In August when the council approved the 2025-26 budget, it also passed a resolution from Council Member Mike Siegel stating that if Prop Q failed, it would not trigger across-the-board cuts to city services.

Instead, the council would determine specific reductions to balance the budget in the weeks after the election.

“Without the [tax rate election], everything will be on the table in terms of how to reduce expenditures and get back to a balanced budget,” Siegel said.

That could include cuts to public safety budgets, which make up two-thirds of the city’s general fund. Recent police and fire labor contracts allow for temporary pay cuts if a tax rate election fails, though Watson and others say that’s unlikely.

Article continues below this ad

No matter what Austin voters decide, city property taxes will increase next year. That’s because the city will raise the rate by 3.5%, which would add just over $100 to the average tax bill.

Beyond Prop Q

Travis County has already voted to raise its property tax rate by 9.12% next year — a one-time increase tied to the governor’s disaster declaration after July’s floods.

Article continues below this ad

Homeowners can expect about $200 more in county taxes as a result, plus smaller hikes for Central Health and Austin Community College.