If you are inside the Texas Triangle and complaining about the state of single-family homebuilding, you are not seeing the opportunity correctly.

Replacing California as “the engine”

The Texas Triangle today looks a lot like Southern California in scale and Hg weight. But Texas is growing faster, is less constrained by land and regulation, and is more affordable for firms and households.

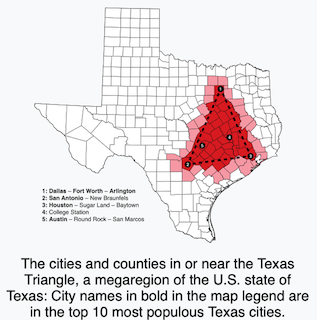

In 2004, the Texas Triangle encompassed five of the 20 largest U.S. cities and accounted for more than 70% of Texans, with a population of 13.8 million. By 2025, the Triangle’s population had reached nearly 23 million, reflecting rapid growth throughout much of Texas.

DFW star shines

The Dallas/Fort Worth metroplex has grown faster, both relatively and in absolute terms, over the past 30 years than Southern California did during its “growth heyday” from 1960 to 1990, driven mainly by lower land costs, pro-growth policies, and business in-migration. SoCal’s earlier boom, by contrast, was anchored in aerospace/defense and coastal urbanization.

Metrics, head-to-head

Dallas/Fort Worth’s metro population rose from about 3.9 million in 1990 to roughly 8.3–8.4 million in the mid‑2020s, more than doubling over ~35 years (around 115–120% growth), indicating that a whopping 37% of the Texas Triangle’s growth is happening at ground zero in DFW alone.

Southern California’s core counties (Los Angeles, Orange, San Diego, Riverside, and San Bernardino) grew from roughly 10–11 million people in 1960 to around 16–18 million by 1990, implying growth of roughly 50–70% over 30 years, depending on the exact county bundle.

On a percentage basis, DFW’s modern era has outpaced SoCal’s 1960–1990 boom, and DFW is now adding people and housing faster relative to its size than today’s coastal California metros.

Where the growth is happening

In DFW, the strongest growth has been on the suburban and exurban fringe: Collin, Denton, Kaufman, Rockwall, and other collar counties have posted double‑digit growth rates in just a few years, reflecting greenfield single‑family and industrial development.

Within DFW, expansion is occurring along major highway corridors (e.g., north along US‑75 and the Dallas North Tollway, west along I‑30/I‑20, and south along I‑35W/US‑67), with substantial employment nodes in Plano/Frisco, Las Colinas, and Alliance/DFW Airport.

During Southern California’s 1960–1990 period, growth shifted from the Los Angeles Basin to suburban Orange County and the Inland Empire (Riverside/San Bernardino), driven by housing demand, freeways, and spillover from older job centers.

DFW growth has reached Oklahoma. I believe the West is the future. Consider Waxahachie, Grandview, Godley, Aledo, and Weatherford. If you are unfamiliar with these cities, you are falling behind or spending too much time far north.

Why DFW is growing faster now

Costs and land supply: DFW has relatively abundant flat, developable land on all sides, enabling large master‑planned subdivisions and industrial parks. In contrast, SoCal’s major metros are constrained by the ocean, mountains, and earlier urbanization, which drove up land and construction costs decades ago.

Regulatory and tax climate

Texas combines no personal income tax with comparatively lighter land‑use regulation and faster permitting, lowering total occupancy costs for employers and households relative to California. Corporate and talent migration: DFW has attracted a wave of corporate relocations and expansions (finance, insurance, tech, logistics), and domestic in‑migration is now a primary population driver, often drawing from high‑cost states such as California.

What drove the 1960-to-1990 Southern California surge

Aerospace and defense engine: Postwar Southern California became a national center for aircraft, aerospace, and defense manufacturing, at times accounting for 20–30% of U.S. aircraft‑manufacturing employment and supporting hundreds of thousands of high‑wage jobs.

Federal spending, the Cold War, and large federal defense contracts and military installations fueled job creation and rapid suburbanization throughout the LA Basin, Orange County, and San Diego.

Early-stage suburbanization

The 1960–1990 SoCal window captured a classic freeway‑driven suburban boom from a relatively low base, but by the late 1980s the region was becoming “built‑out” and felt the drag of high housing costs and congestion.

Tale of the tape

In SoCal’s 1960–1990 era, growth was explosive in absolute terms but moderated as the region matured, costs rose, and the aerospace/defense sector began restructuring by the late 1980s. DFW over the past ~30 years has combined Sun Belt-style population growth with a relatively unconstrained land market and a business climate that is currently drawing both jobs and migrants from California, resulting in stronger percentage growth from a smaller base.

Follow the money, follow the volume

For decades, large publics treated Texas as the volume engine and California as the margin engine: one analysis found that the same house could sell for roughly $300,000 in Texas and around $800,000 in California, with far fewer active communities per capita in California, making “anything you build” on entitled land in coastal markets extremely high-margin but constrained in unit count.

At the same time, California’s entitlement, fee, and construction environment pushed costs and timelines so high that multifamily construction is now about 2.3 times more expensive per rentable square foot there than in Texas, with impact and development fees alone averaging about $29,000 per unit in California versus under $5,000 in Texas, and projects often taking nearly two extra years.

Today, the script has flipped: Texas is not just the unit machine; it is increasingly where the profits are, because builders can capture both volume and margin in the same markets. Texas accounts for about 15% of all U.S. new-home permits, despite having only about 9% of the population. Its big three metros built roughly 300% more homes than California’s top three metros in a recent year, even though the Texas trio has an 11% smaller population, giving large builders both scale and operating leverage.

That range is consistent with DFW’s ranking as a top one, two, or three metro for building permits and new-home volume nationally. With lower land costs, dramatically lower fees, faster approvals, and sustained in-migration, Texas can often deliver homes at less than half the per-square-foot cost of California. That is why capital and corporate relocations, including companies moving their HQ from California to Texas, increasingly treat Texas as the profit center rather than just the volume outlet to balance California’s margins.

Pay dirt

Since 2020, several hundred major companies have relocated their headquarters from California to Texas. Many aren’t small outfits either; they’re big-name companies with thousands of employees and market caps or revenues in the billions. One comprehensive relocation tracker tallied just over 200 headquarters moves to Texas between 2020 and mid-2025, and about half of those came directly from California, underscoring how strong the California-to-Texas pipeline has become in this latest wave. This list represents over $2 trillion in market cap and at least $230 billion in annual revenue that has come home to Texas over the past five years. Here are the top 20.

Oracle – Moved from Redwood City, CA to Frisco TX

Tesla – Relocated its corporate headquarters from Palo Alto, CA to Austin, TX

Hewlett Packard Enterprise (HPE) – Shifted HQ from San Jose, CA to Houston, TX

Charles Schwab – Moved headquarters from San Francisco, CA to Westlake, TX

CBRE – Global headquarters moved from Los Angeles, CA to Dallas, TX

Realtor.com – Headquartered in Santa Clara, CA before relocating to Austin, TX

SpaceX – Officially moved its headquarters from Hawthorne, CA to Texas

X (formerly Twitter) – Relocated from San Francisco, CA to Austin, TX

Ruiz Foods – Moved from California to Frisco, TX

Informativ – Relocated from CA to Frisco, TX

Wiley X – Headquarters moved from CA to Frisco, TX

Kelly-Moore Paints – Relocated from San Carlos, CA to Irving, TX

Cacique Foods – Moved HQ from Monrovia, CA to Irving, TX

Quickfee Solutions – Moved from California to Plano, TX

Inbenta – AI company moved from CA to Allen, TX

Frontier Communications – Relocated from Norwalk, CA to Dallas,

KWK Management – Wealth management firm moved from CA to Houston, TX

FileTrail – Moved from San Jose, CA to Austin, TX

SignEasy – Relocated from San Francisco, CA to Dallas, TX

Aeromax Industries – From Canoga Park, CA to Fort Worth, TX

Related