El Paso Electric is in the final stages of securing a rate increase from the Public Utility Commission of Texas that could lift average household electric bills in El Paso by as much as $22 per month, but PUC staffers say the utility is asking to make too much profit off of customers.

How much profit El Paso Electric is allowed to earn is a key point of contention that the state’s public utility commissioners will have to decide before issuing a final decision on the utility’s rate increase request, likely in December.

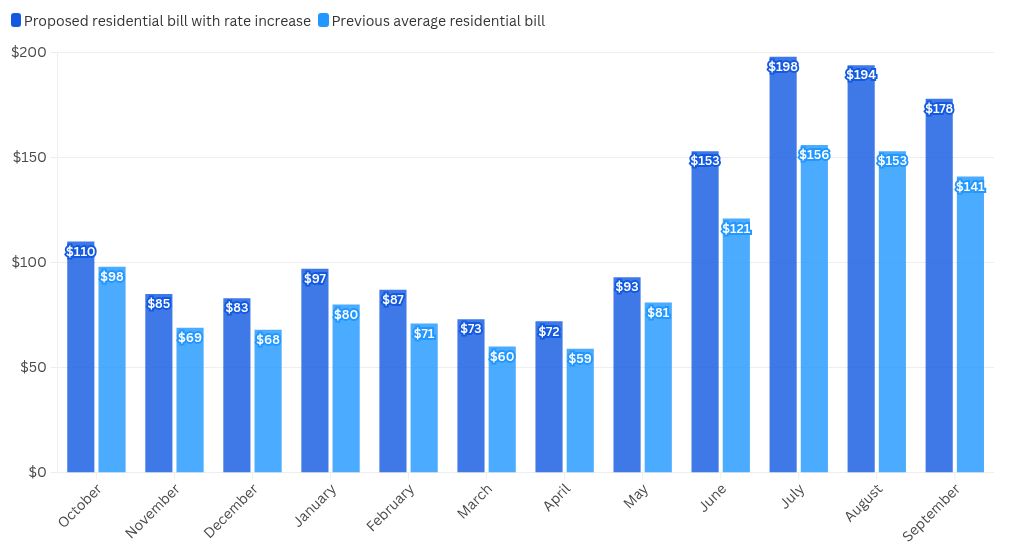

If its rate request is approved as is, El Paso Electric has said the average residential customers’ annual bills will rise to $1,423 from $1,157 currently – or $118 monthly on average compared with an average bill of $96 currently.

“Overall, you’re seeing a growing concern about affordability for ratepayers, particularly residential ratepayers … as everyone is getting squeezed to death with rising prices, whether that’s food, whether that’s cost of living,” said Krysti Shallenberger, research and communications manager for the Energy and Policy Institute, a national nonprofit that advocates for expanding renewable energy and often opposes utility rate hikes.

“That concern comes in very clear from the staff recommendation,” she said.

El Paso Electric has said it needs to boost its authorized rate of return so that its shareholder has enough incentive to put up money to fund the utility’s construction projects instead of piling cash into the stock market or any other investment option.

A proposal for a decision on the rate case is set for Dec. 9.

El Paso Electric’s Rio Grande Power Plant on Doniphan Drive, Thursday, March 16, 2023. (Corrie Boudreaux/El Paso Matters)

El Paso Electric’s Rio Grande Power Plant on Doniphan Drive, Thursday, March 16, 2023. (Corrie Boudreaux/El Paso Matters)

PUC staffers are urging the state’s utility commissioners to allow El Paso Electric’s lone shareholder – a J.P. Morgan-owned investment fund – to earn a 9.65% shareholder profit margin, instead of the 10.7% profit margin that El Paso Electric is seeking. When El Paso Electric last raised rates in 2021, the PUC authorized the utility to earn a return on equity of 9.35%.

A 1 percentage point increase of shareholder profit appears minor. But, all else equal, a shareholder profit margin of 10.7% would allow El Paso Electric to collect about $66 million more from its customers in Texas annually compared with the PUC staff’s recommended 9.65% shareholder profit margin, according to an El Paso Matters analysis of the utility’s requested capital structure and profit margin it detailed in filings submitted to the PUC.

Monopoly utilities in Texas and most other states make money by spending on capital investments, such as power plants or substations. Then, utilities ask their state regulators to let them set rates to recoup from customers the money the utility spent on capital assets, plus a predetermined profit margin.

Since many U.S. electric utilities are monopolies, they’re not allowed to set their own prices. In most states, a public utility commission determines the profit margin that monopoly utilities are allowed to make, and it also approves or rejects rate hike requests. Texas utilities are required to conduct a rate review at least every four years.

Shallenberger said it’s a crapshoot of whether the state’s three public utility commissioners, who are appointed by Gov. Greg Abbott, will agree with the PUC staffers’ recommendations and approve a smaller profit margin than what El Paso Electric is seeking.

El Paso Electric is asking for a rate increase because the utility said it needs to collect an additional $85 million from customers annually to pay off the capital investments the utility has made since its last rate hike in 2021, plus its requested profit margin.

El Paso Electric said, since late 2020, it has spent $1.55 billion on capital investments such as new power generation resources – primarily the utility’s $217 million Newman 6 natural gas power plant in far Northeast El Paso. It’s also replacing wooden power poles with steel poles and is building new substations to deliver electricity as El Paso sprawls out further.

The utility said it has spent almost $560 million since 2020 to improve its distribution system – the poles and wires that deliver low-voltage electricity throughout El Paso’s neighborhoods.

And the utility said it has spent $180 million since 2020 on its transmission system, or the big towers that transport electricity across long distances. One example of that is a $41 million project in which the utility replaced 300 wooden poles with steel poles in the Gila National Forest, where transmission lines ferry power generated at the Palo Verde Nuclear Plant in Arizona.

If approved as is, El Paso Electric’s rate hike proposal – with a higher profit margin – would mean its owners and investors would likely see millions of dollars of additional profits in the coming years in the form of dividends from the utility funded by higher customer bills. It’s also possible that its owner, Infrastructure Investments Fund, may choose to re-invest some amount of future profits into El Paso Electric’s infrastructure instead of taking dividends from the utility.

From 2022 through 2024, El Paso Electric paid $491.8 million in total dividends to IIF, or an average of $164 million annually, according to regulatory filings submitted to the PUC.

“They claim (the rate increase) is for reliability and resiliency, but they also have, as we’ve noted many times, increased profits for their shareholders, and EPE is owned by a private investment firm,” Shallenberger said. “And, so, really, this will just really help their profit margin.”

El Paso Electric’s requested 10.7% return on equity would be higher than the shareholder profit margin most utilities are allowed to earn. For comparison, the average return on equity that regulators throughout the United States. authorized for electric utilities was 9.68% in rate cases decided in the first half of 2024, according to S&P Global.

Back in January just after El Paso Electric filed a rate increase application, James Schichtl, a vice president with El Paso Electric, said in an interview that the 10.7% rate of return El Paso Electric is requesting is in line with what other utilities also initially ask for in rate increase proposals, before the authorized rate of return gets whittled down during negotiations.

Beyond the profit margin El Paso Electric is allowed to earn, another major item the PUC will have to decide on is whether the utility overspent on the Newman 6 power plant. The utility spent $217 million to build the 228-megawatt, natural gas-fired unit that started producing electricity in late 2023, around six months behind schedule and about $47 million over the utility’s initial cost estimate.

PUC staffers argue the utility shouldn’t be allowed to charge customers for that $47 million cost overrun. Instead, El Paso Electric should only be allowed to recoup $170 million from customers for that plant and eat the cost the utility spent above that amount.

“Newman Unit 6 was put into service over half a year late and almost $50 million over budget,” PUC staffers wrote in testimony submitted to the PUC. “EPE argued, and continues to argue, that it should be allowed to burden Texas ratepayers with the cost of EPE’s failure to budget in a prudent fashion.”

El Paso Electric has consistently argued that it was struck by unavoidable inflation and cost escalations while constructing Newman 6 caused by the COVID-19 pandemic and Russia’s invasion of Ukraine. Utilities across the United States also experienced project cost increases in recent years, and El Paso Electric isn’t at fault for spending more than it budgeted for Newman 6 in initial cost estimates it developed in 2017, the utility has argued.

“Exceeding an original cost estimate, by itself, is no evidence of imprudent action or inaction,” El Paso Electric told the PUC.

Other entities such as the city of El Paso and the Office of Public Utility Counsel, a consumer advocate, have also argued to the PUC that El Paso Electric shouldn’t be able to charge customers for the full $217 million it paid to build Newman 6. The state’s utility commissioners will ultimately decide whether El Paso Electric is allowed to fully recover the plant’s construction cost when they issue a decision on the rate case in December.

Shallenberger of the Energy and Policy Institute said utilities such as El Paso Electric are experiencing huge cost overruns while building natural gas power plants, while at the same time trying to make it more expensive for homeowners to install rooftop solar panel systems.

“These proposals to build these costly gas plants are really going to cost residential ratepayers quite a bit of money,” she said.

She added that utilities such as El Paso Electric should be trying to make it cheaper for homeowners to install rooftop solar systems and home batteries for energy resources instead of overspending to build big gas-fired power plants.

“These natural gas plant cost overruns are concerning,” Shallenberger said. And (PUC staff) are really trying to protect ratepayers from those impacts as much as possible.”

Newman 6 is now perhaps the most significant single source of local electricity generation for the El Paso region. Natural gas turbines produced 42% of the electricity the utility sold to customers last year, and the Newman power station is by far the utility’s biggest gas plant.

Newman 6 Settlement

There’s another much smaller but controversial item El Paso Electric is seeking to charge to customers as part of its proposed rate increase.

El Paso Electric in 2021 agreed to a settlement with New Mexico environmental groups who were seeking to block construction of the Newman 6 plant, which is located near Chaparral, New Mexico, just south of the Texas-New Mexico state line.

In exchange for the groups dropping their opposition to the plant’s construction, El Paso Electric made various commitments such as controlling the facility’s air pollution, and the utility also paid $440,000 to the environmental groups, including the Sierra Club and others.

Environmental advocates in turn used a portion of that settlement cash to fund the 2023 campaign for the ballot measure Proposition K, also known as the climate charter. The measure sought to enact a wide range of environmental policies in El Paso, including studying a city takeover of El Paso Electric, but it was rejected by over 81% of voters in the November 2023 election.

Now, El Paso Electric is seeking to charge customers to recover that settlement cost. In other words, El Paso Electric’s customers in Texas will – at least partially – retroactively fund the Proposition K campaign if the rate increase is approved as is.

“EPE did not agree to forgo recovery of the settlement payments in this base rate case,” El Paso Electric said in filings.

Related

LISTEN: EL PASO MATTERS PODCAST