Ruby Martinez-Berrier and Marycruz De Leon

Texas’ economy typically outpaces the nation, leading in job, GDP and population growth. This trend has continued today with the latest economic indicators detailing Texas job growth. Given Texas’ strong economic performance compared with the U.S., one might think the state’s small businesses would outperform those nationwide. According to responses to the Small Business Credit Survey for employer firms, though, Texas small businesses are in poorer financial condition, have less access to credit and have more outstanding debt than small businesses in the U.S.

Are Texas small businesses suffering from limited resources?

According to a report from the U.S. Chamber of Commerce, small businesses employ 61.6 million people, representing nearly half of all U.S. workers. Additionally, small businesses have made up over 40 percent of U.S. gross domestic product (GDP) since the early 1990s. With small businesses having such a significant impact on economic outcomes, the Federal Reserve seeks to continually measure their performance and understand the challenges they face.

In support of this effort, the Federal Reserve deploys its Small Business Credit Survey (SBCS) to collect information on firm performance, finance and debt conditions, challenges and demographics. Small business are defined as those with under 500 employees. Responses to the SBCS are collected from September to November from across the United States and published annually.

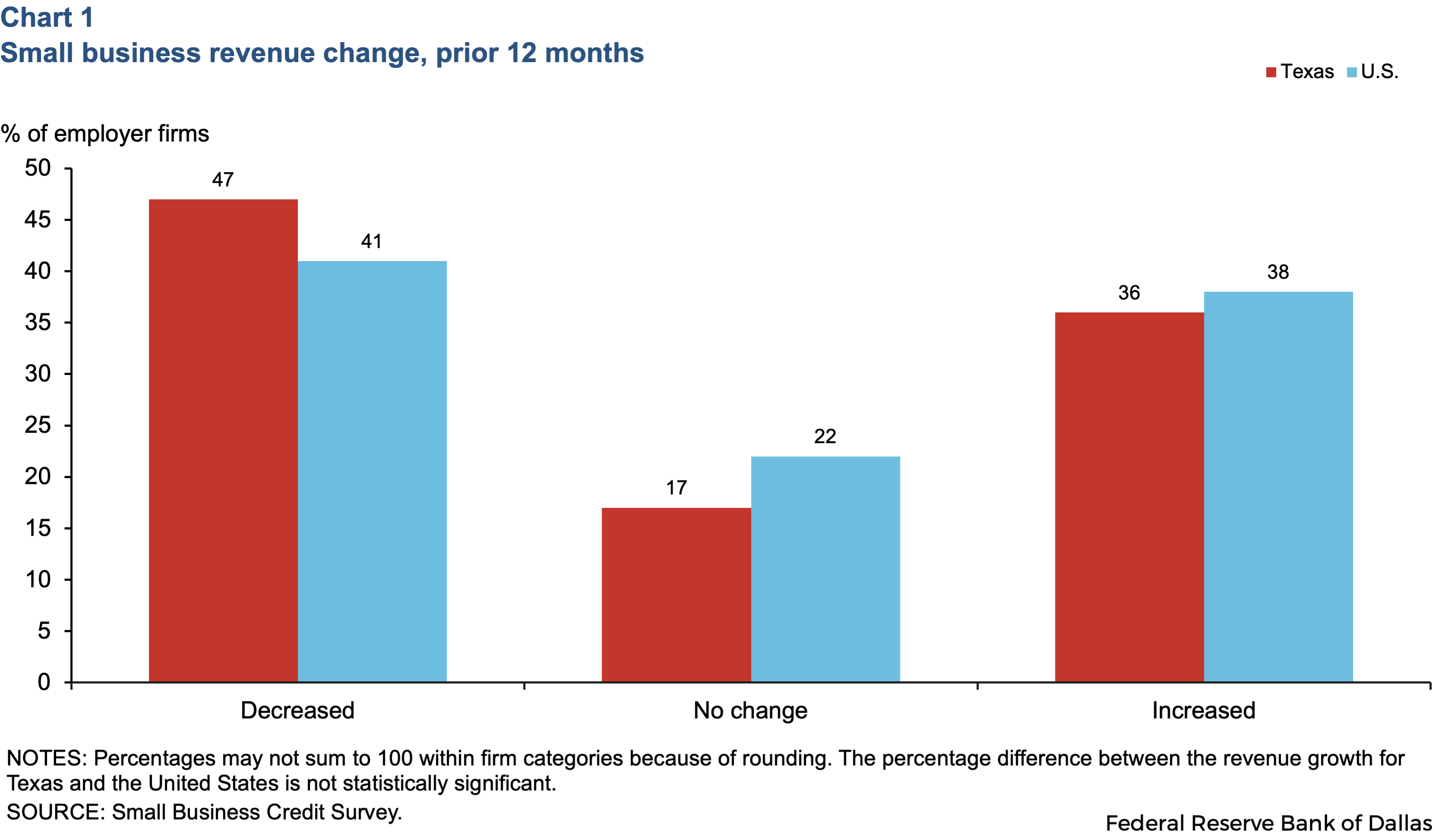

The most recent chartbook on Texas employer firms shows some shared characteristics with national trends. A majority of respondents from both Texas and the U.S. reported a decrease in revenue, and half of firms reported no change in employment. Regarding financial health, the majority of small businesses in the state and country said they were in fair or better condition.

While nationwide firms reported declines in revenue, the share of firms reporting a decrease was larger in Texas (Chart 1). In addition, Current Population Survey data reveal the average income for Texas small business owners is lower than the national small business owner average for the same year. A Small Business Administration report likewise showed average payrolls for U.S. small businesses were higher than that of small businesses in Texas. Texas firms were also four percentage points more likely to report being in poor financial health than firms nationwide.

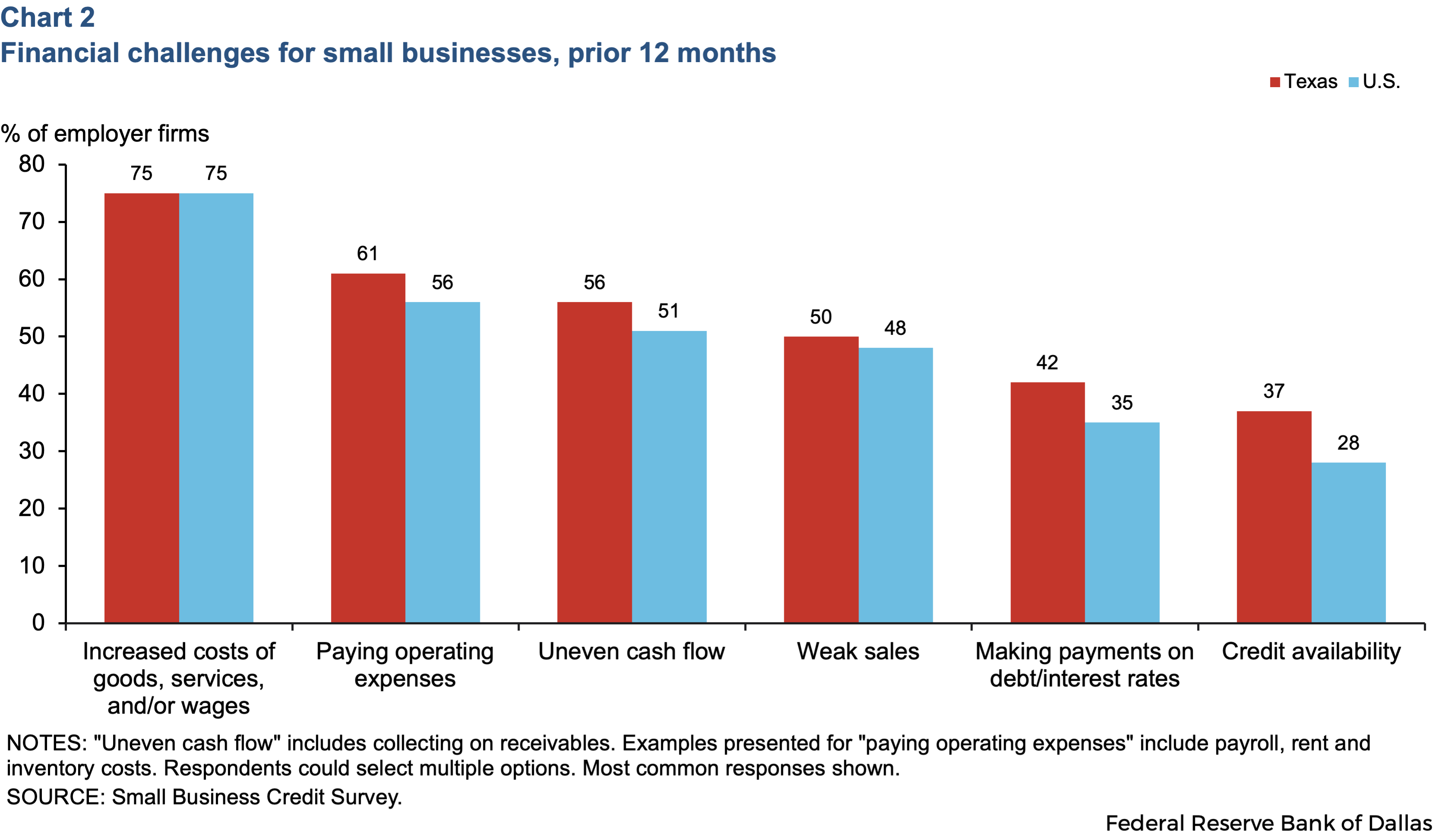

When it comes to financial challenges, both Texas and U.S. small businesses reported increased costs and paying operating expenses as the top two issues they face (Chart 2). However, Texas saw significantly higher rates of firms reporting challenges with credit availability.

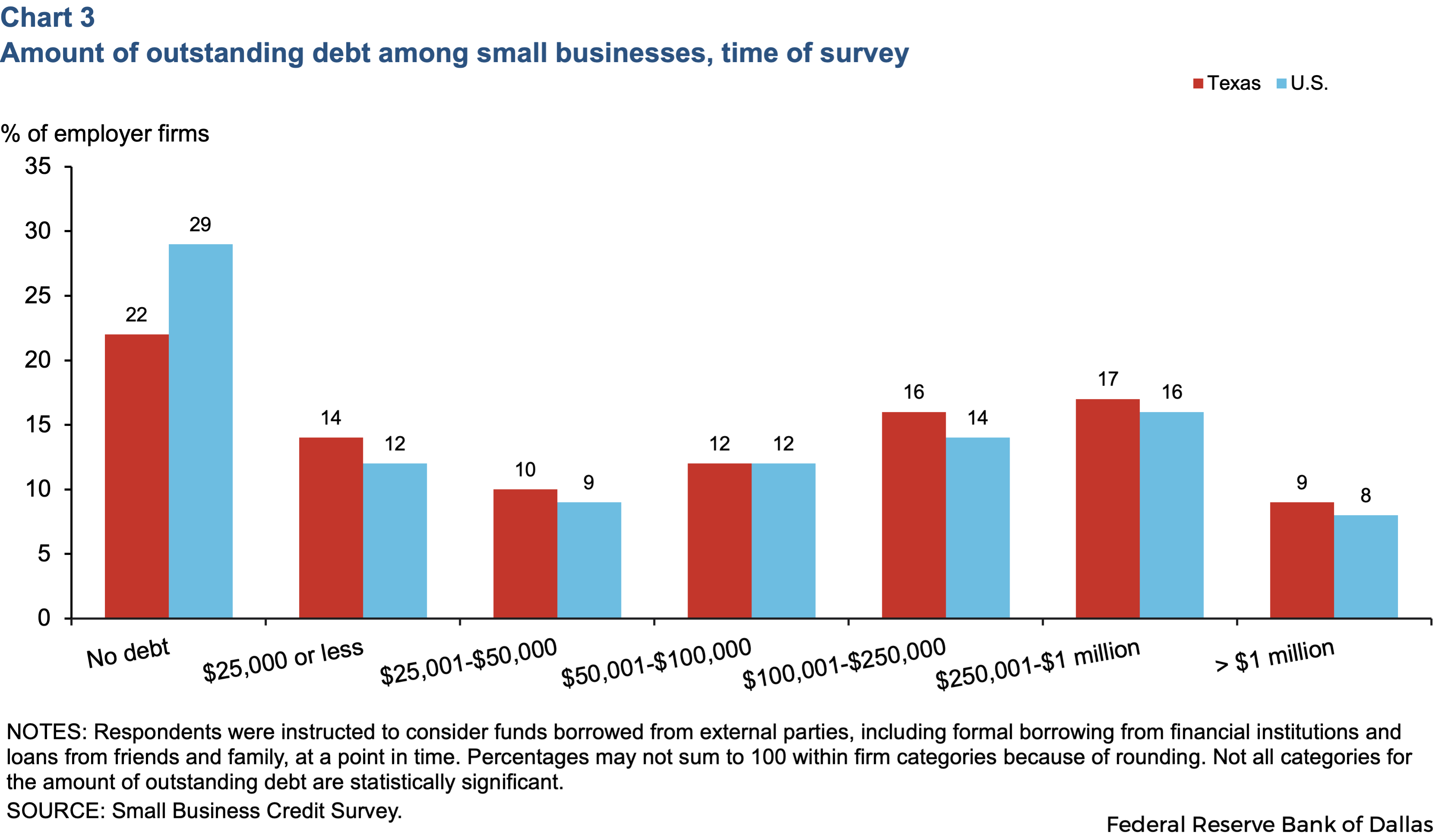

While the use of personal funds was the most commonly reported response to addressing financial challenges, debt and financing are also options that many small businesses pursue to expand. Texas trailed the nation on several debt and financing metrics including more outstanding debt, greater demand for financing and lower loan approval ratings.

When asked how much outstanding debt they held, the most common response from both Texas and U.S. firms was none at all. However, U.S. firms were seven percentage points more likely to report being debt-free (Chart 3). Additionally, Texas firms reported having more debt across almost all outstanding debt amount categories.

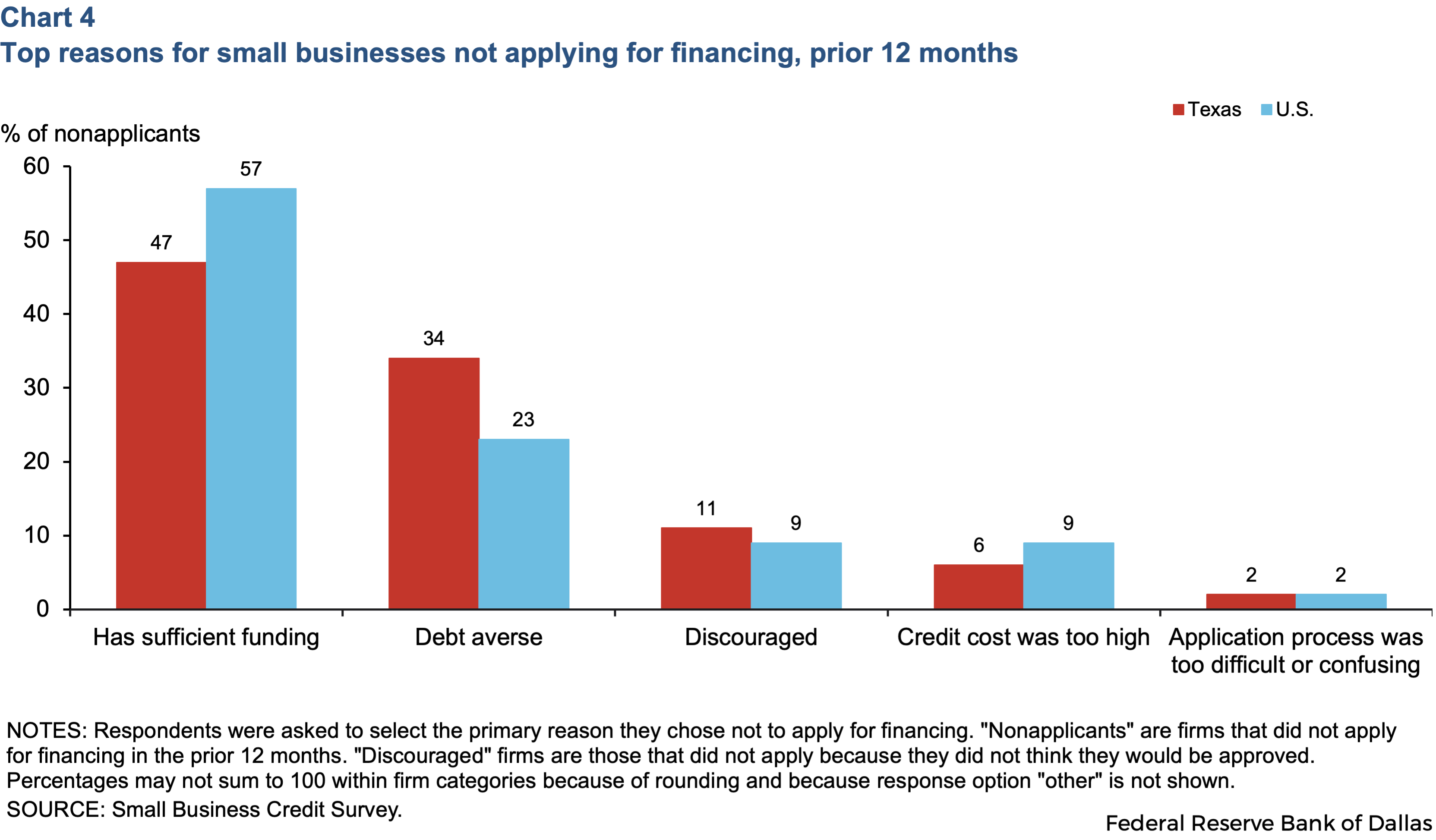

Over half of both U.S. and Texas firms reported applying for financing. For those that chose not to apply for financing, the primary reason was already having sufficient funding (Chart 4). However, 10 percentage points more U.S. firms reported having sufficient financing compared with Texas firms. Among reasons for not applying for financing, 11 percentage points more Texas firms cited being debt averse.

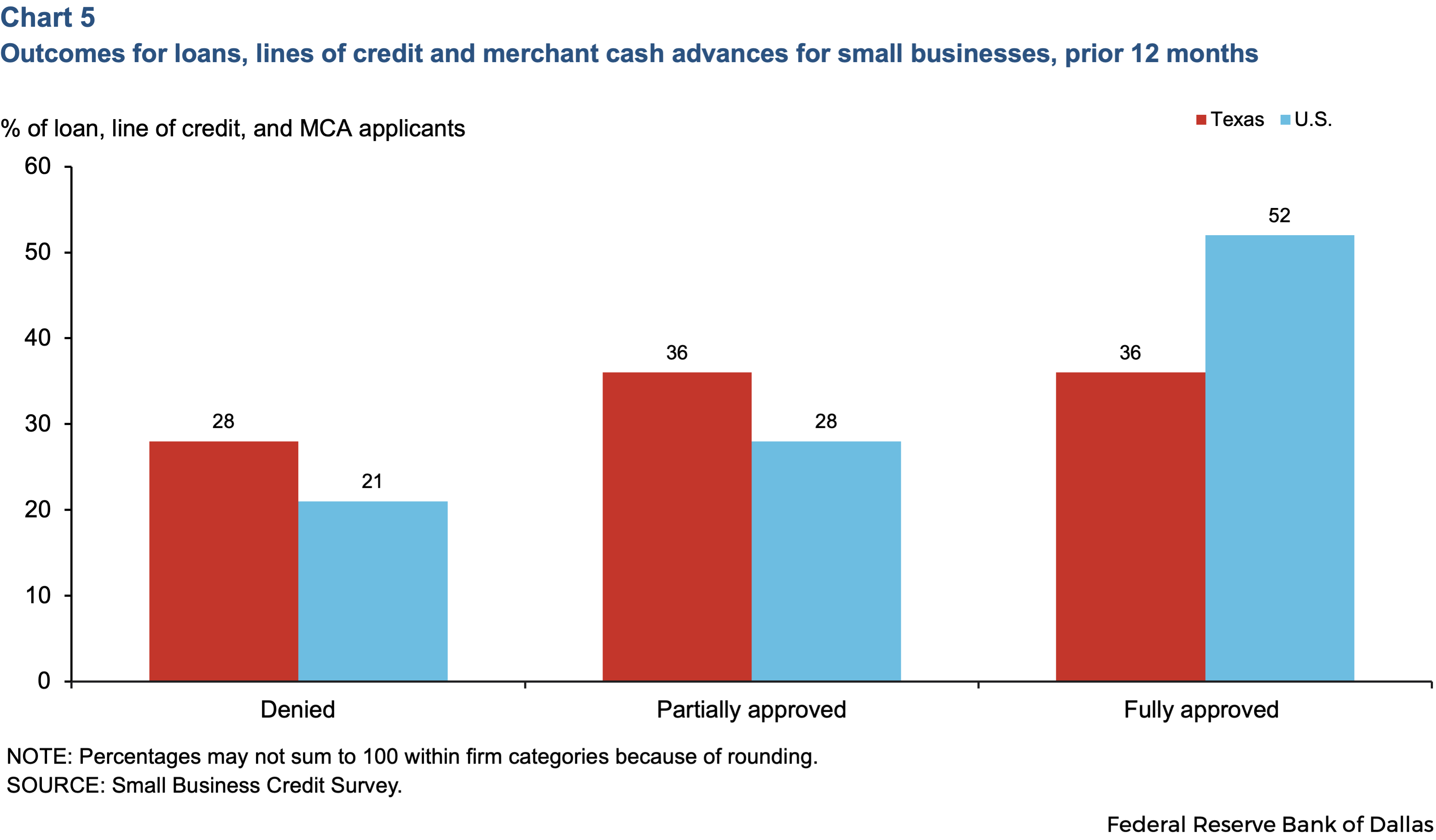

Regarding credit applications for loans, lines of credit or merchant cash advances, in both the U.S. and Texas, most firms reported not applying for loans. Yet, the credit application rate for Texas firms was eight percentage points higher than for U.S. firms. The approval rates were mixed, with most firms being partially or fully approved (Chart 5). Texas firms were 16 percentage points less likely to be fully approved and 7 percentage points more likely to be denied financing than their U.S. counterparts.

Texas small businesses optimistic despite significant challenges

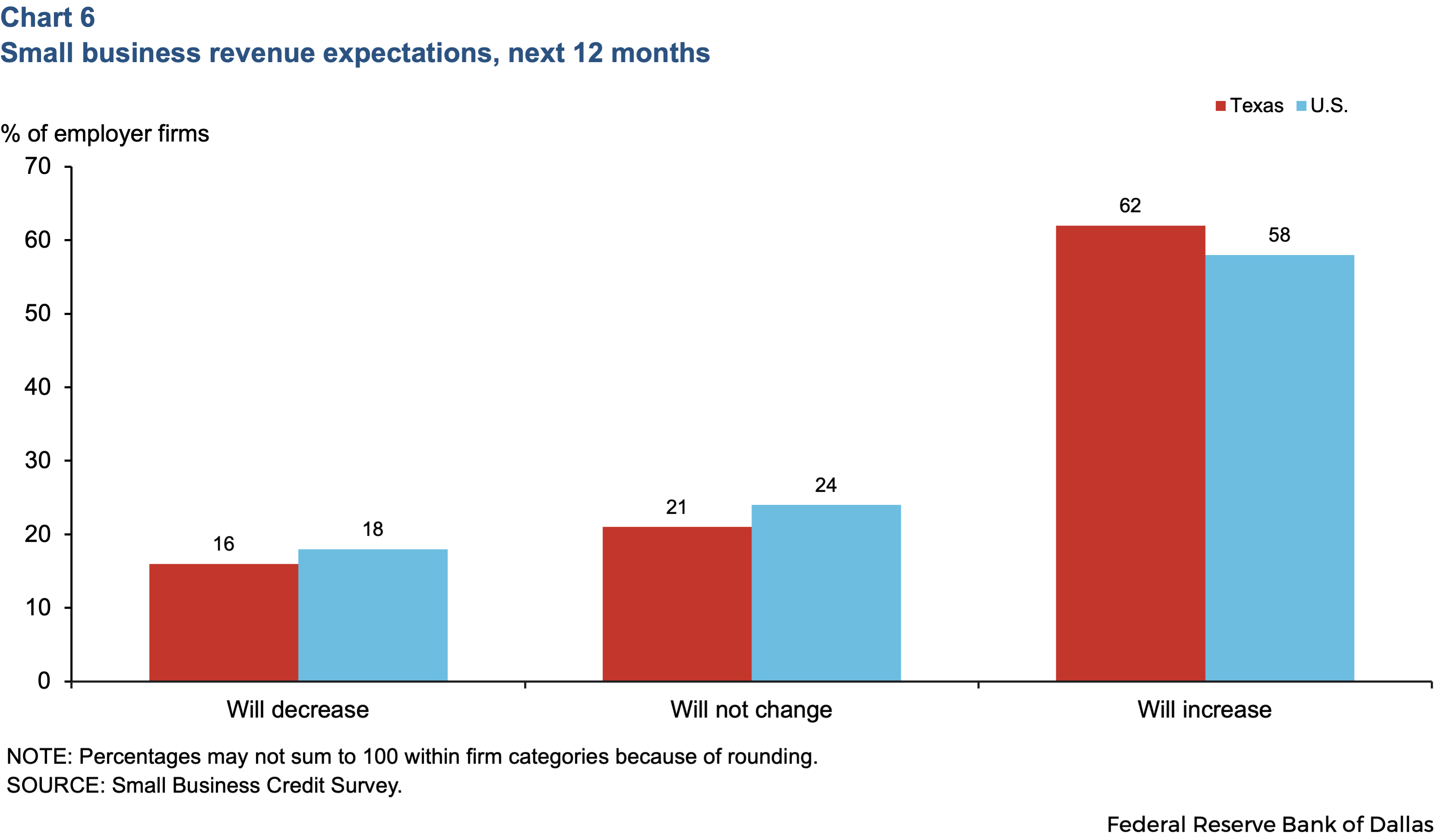

SBCS results suggest small businesses in Texas may be disadvantaged compared to their counterparts around the U.S., with Texas firms more likely to face revenue declines, significant financial challenges and less access to credit. Despite these challenges, Texas firms expressed overarchingly positive expectations about the future of business, with 62 percent of respondents expecting revenue to increase in the following 12 months (Chart 6).

Since the last SBCS was distributed, though, there have been significant policy changes that have impacted small businesses. In the past several months, local community representatives have shared with the Dallas Fed that small businesses are struggling to react to rapid and varied changes to tariff policies. Some have sought alternative suppliers, and others stocked up on inventory in February and March to delay the impacts of tariffs. Additionally, some intermediaries reported lower demand, which they attribute to lower consumer spending driven by increased economic uncertainty.

Continued research to support small businesses

Small businesses are a vital component of the Texas economy, yet SBCS data suggest a divergence between the performance of small businesses in Texas and broader national trends. To better understand the gap between the state economy and small businesses, we must continue to gather data across Texas to measure small business performance and identify their challenges. Small businesses and intermediaries can help by signing up to participate in the Small Business Credit Survey to share their experiences.

About the authors

Ruby Martinez-Berrier

is an advisor in Community Development at the Federal Reserve Bank of Dallas.

Marycruz De Leon

is a senior outreach advisor in the San Antonio Branch of the Federal Reserve Bank of Dallas.

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.