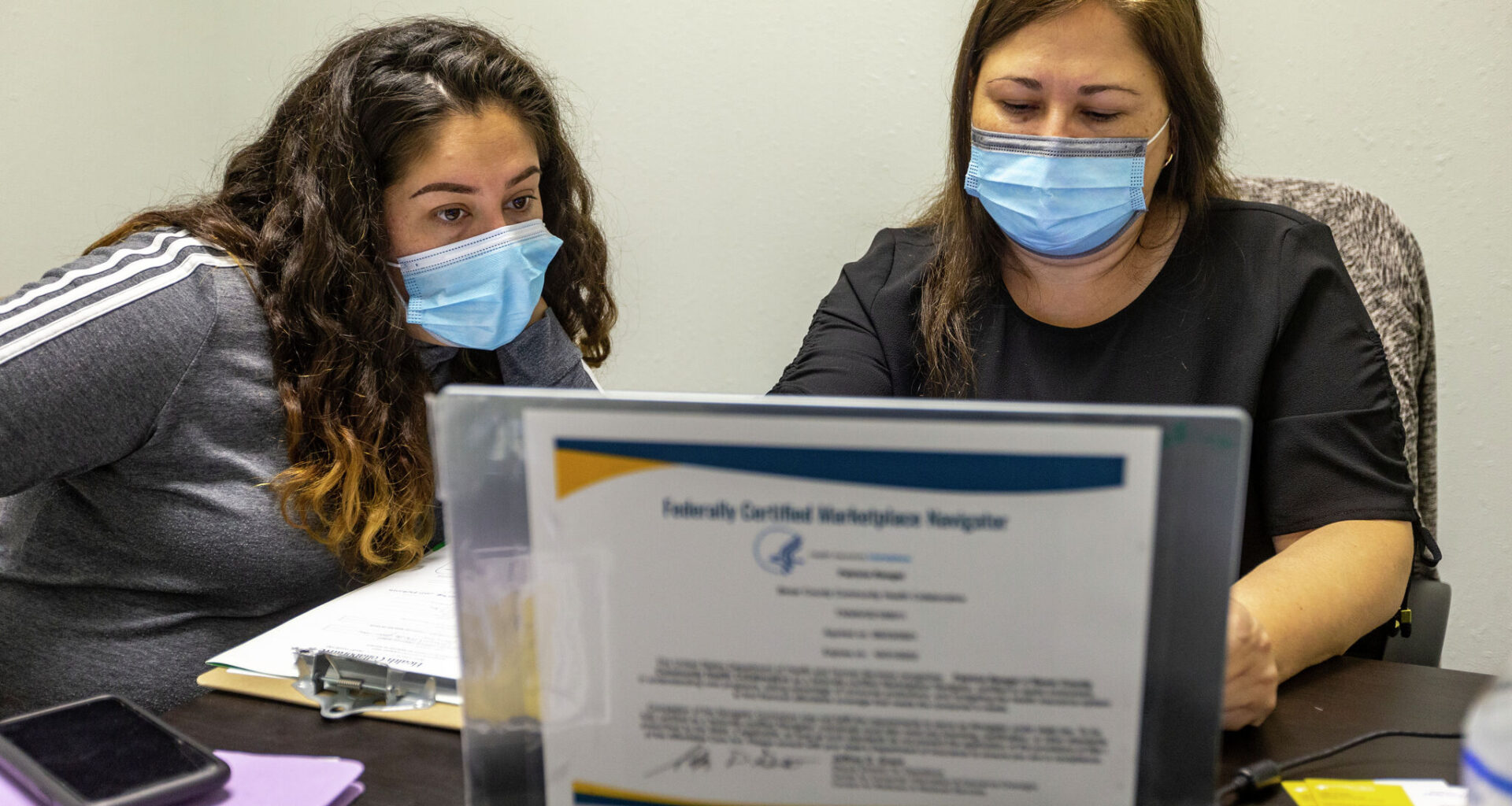

Client Jlyssa Jauert, left, watches as Affordable Care Act navigator Patricia Rangel enter information to select a health plan for Jauert in 2024. The Marketplace opened on Nov. 1. In Austin, people can find help enrolling at the Prosper Health centers.

San Antonio Express-News file photo

People who get their health care through the Affordable Care Act Marketplace might soon see the cost of their health care more than double.

At the heart of the weeks-long federal government shutdown is the ending of the enhanced subsidies for people who get their insurance through the Affordable Care Act’s Marketplace. In Texas, that’s through Healthcare.gov. The enhanced subsidies started in 2021 to help people gain insurance during the COVID-19 pandemic. Those enhanced subsidies are set to end beginning in January, unless the U.S. Congress agrees to extend them.

Article continues below this ad

The Healthcare.gov Marketplace opens again Saturday. People have until Dec. 15 to sign up for a plan that starts Jan. 1 or through Jan. 15 to start their plan on Feb. 1.

Sharon Alvis, the CEO of Austin-based Sendero Health Plans, which provides plans on the Marketplace, said she is worried that people will go onto the Marketplace and have “sticker shock” and won’t sign up for a plan.

People have relied on the Marketplace when they make too much to qualify for government programs like Medicaid, Medicare and CHIP and do not have an employer-based plan. Many people in the Marketplace are early retirees, gig workers, freelance or contract employees, part-time employees or they work for a small business that cannot afford to provide insurance.

Article continues below this ad

How much subsidies people receive depends on the number of people in their family, their ages as well as their income. Currently, people going through the Marketplace play 0% to 8.5% of their annual income in monthly premiums. Next year, they can expect to pay up to 9.96% of their annual income, said Louise Norris, a health policy analyst with the consumer group Healthinsurance.org. On average, people can expect to pay 114% more for their health care through the Marketplace in 2026 than this year.

As a contractor, Castillo doesn’t have any health insurance, and he is asking the hospital to waive his bills from his long ICU stay. The COVID-19 pandemic caused Congress to increase the federal subsidies in 2021, but now those subsidies are ending in 2026, making the Affordable Care Act Marketplace not as affordable for many people. More than 1 million Texans are expected to drop their health care coverage.

LOLA GOMEZ/AMERICAN-STATESMAN, Austin American-Statesman

How did the enhanced subsidies affect health care in Texas?

The Commonwealth Fund, a nonpartisan group, offers these facts:

Article continues below this ad

Enrollment in the Marketplace increased by 190% in Texas once the enhanced subsidies went into effect.

This year, 3.8 million people in Texas used Healthcare.gov to get their health insurance.

This year, 97% of those enrolled in the Marketplace in Texas received a subsidy.

Without the enhanced subsidies, almost 1.4 million people are expected to become uninsured in Texas, about one-fourth of all people in the country who are expected to become uninsured because of the lost subsidies.

Currently, in Travis County, 144,947 people receive their health care through the Marketplace, including 18,573 children, said Lynn Cowles at the nonprofit Every Texan.

The past four years have proven “people want health insurance,” said Stacey Pogue, an Austin-based research fellow at the Center on Health Insurance Reforms at Georgetown University. “They will sign up at a price point they can afford.”

For providers, the potential increase in people who will go without insurance is troubling.

Article continues below this ad

“What we typically see when people lose health coverage is they just wait longer,” said Dr. Manish Naik, the chief medical officer at Austin Regional Clinic. If they have allergies or a rash, they might not see a doctor. With more serious symptoms, “they wait until it gets bad enough. The worry is people aren’t going to come in until it’s very late.”

They also might skip those annual visits and screenings, which makes finding problems early almost impossible. Their cost of care will increase, as will long-term problems and the potential risk of death.

Big Pink Bus mammography technologist Ginza Lopez demonstrates the mammography machine. People without insurance might skip annual screenings like a mammogram and end up finding health concerns at a later stage, making treatment more expensive.

Aaron E. Martinez / American-Statesman

What else will affect the price of health care for 2026?

Insurance providers in the Marketplace have increased their rates as well. Blue Cross Blue Shield of Texas, for example, said its rates increased between 7.5% and 62.4%. In Travis County, one Sendero bronze plan increased from $1,199.42 monthly premium with no subsidies in 2025 for a family of four to $1,383.26 in 2026. Some people in Texas will see Marketplace rates more than double when you add the cost increases and the subsidy decreases.

Article continues below this ad

The cost of health care plans are increasing in general in Texas, in part, because of the fear that the younger, healthier people will no longer opt-in for health care because of the decrease in subsidies. When the risk pool is heavily weighted with the unhealthy, high-users of health care, costs increase. When the number of uninsured people increase, providers like hospitals have to raise their prices and pass those on to the people with insurance to cover the cost of the uninsured as well as the people who have Medicaid and Medicare, which does not fully cover the cost of care provided, said St. David’s HealthCare CEO and President David Huffstutler.

All the hospital systems worry about what will happen when the enhanced subsidies end and have been in Washington lobbying to have them extended.

“We are deeply concerned about the loss of the subsidies,” said John Thresher, the chief strategy office at Ascension Texas. “All that ends up happening is shifting the cost from one bucket to another.”

For people who get their insurance through their employer, they also are seeing increased rates because of this.

Article continues below this ad

Georgetown medics prepare to take a man to Ascension Seton Hospital in Round Rock in 2023. People still will have access to emergency care, but affordable care will be less available for many people who don’t have employer-provided care.

Ricardo B. Brazziell / Austin American-Statesman, Austin American-Statesman

How will these changes affect people locally?

We looked at available Healthcare.gov plans in Travis County and compared the 2025 rates and the 2026 rates for a 40-year-old single person, a 40-year-old couple, a couple age 40 with two children, and a 60-year-old couple. There are hundreds of plans to choose from. We pulled out the lowest monthly cost plans and the lowest deductible plans, and the lowest income level where subsidies start and the level where subsidies end.

The biggest differences in 2026 are found at income levels were subsidies end as well as the costs of the plans even before the subsidies are added.

Article continues below this ad

Here’s what we found for a single person age 40:

For a single person, age 40, they can get a no-cost monthly plan for 2026 if they make $22,000 a year (the salary in which the subsidies kick in) because of $559 a month in subsidies. That plan has a $4,700 deductible and a $9,800 maximum out of pocket cost. But, if they are willing to pay $11.81 a month, they can get a $0 deductible plan with $10,150 in total out of pocket costs.

Once that single person makes $63,000 a year, they no longer qualify for subsidies and the least expensive plan is $432.65 a month with a $7,500 deductible and a $10,000 maximum out of pocket cost, or they can pay $570.81 a month and get a $0 deductible, $10,150 maximum out of pocket plan.

In 2025, at $22,000 in income, the single person could get a plan for $0 monthly cost, $0 deductible, $1,700 maximum out of pocket cost. They could receive subsidies until $74,000 income and find a plan for $375.15 a month, $7,500 deductible and $9,200 maximum out of pocket cost, or a $548.96 a month plan, with $0 deductible and $9,100 maximum out of pocket cost.

Article continues below this ad

Here’s what we found for a couple age 40:

For 2026, a couple both at age 40 making $23,000 can get $1,212 in subsidies, and find a $0 monthly cost, $700 deductible and $17,500 maximum, or an $1.26 monthly plan, with a $0 deductible and $20,300 maximum. If that couple makes $85,000, they no longer can get a subsidy and would pay $865.30 a month for a $15,000 deductible, $20,000 out-of-pocket maximum plan or $1,141.62 a month for a $0 deductible, $20,300 a month plan.

In 2025, that couple making $23,000 could get $1,047 in subsidies and a $0 monthly cost, $0 deductible and $3,400 maximum out-of-pocket plan. That same couple could get subsidies until $148,000, and at which point they can find a plan with a $750.30 monthly cost, $15,000 deductible or $18,400 maximum, or choose a $0 deductible plan with $1,097.92 monthly cost and $18,200 maximum.

Here’s what we found for a couple age 60:

Article continues below this ad

For 2026, this couple making $22,000 could get $2,616 per month in subsidies and find a $0 monthly, $0 deductible, $4,400 maximum. This couple can get subsidies up to $84,000. But at $85,000, they can expect to pay the full amount of $1,837.58 a month, with a $15,000 deductible and $20,000 maximum. If they want a $0 deductible plan, they will pay $2,424.38 a month with a $20,300 maximum.

In 2025, this couple could get subsidies starting at $21,000 and $2,224 a month in subsidies with $0 monthly cost, $0 deductible and $3,400 maximum. They would receive subsidies up to $313,000. At $314,000, they would pay $1,587.36 a month for a $15,000 deductible, $18,400 maximum plan or $2,331.56 a month for a $0 deductible, $18,200 plan.

How about a family of four with parents age 40, a 10-year-old son and 7-year-old daughter?:

Next year, that family of four can get subsidies once they make $67,000. Before that, the children would be eligible for CHIP or Medicaid, and the parents might be eligible for the couple rates. This family at $67,000 would get $1,576 a month in subsidies and find a $0 monthly plan with $15,000 deductible, $20,000 maximum or a $211.98 monthly plan with $0 deductible and $20,300 maximum. At $129,000 they no longer receive subsidies, and can expect to pay $1,383.26 a month with a $15,000 deductible, $20,000 maximum or $1,824.98 a month with $0 deductible and $20,300 maximum.

Article continues below this ad

This year, that family making $67,000 could get $1,556 in subsidies and find a plan for $0 a month, $9,000 deductible and $18,400 a month, or a $199.12 a month plan with $0 deductible and $18,200 maximum. They can get subsidies up to $240,000 income, and find a plan for $1,199.42 a month, a enh$15,000 deductible and $18,400 maximum, or choose a $0 deductible plan for $1,754.12 a month and a $18,200 maximum.

Hospitals like Ascension Seton Medical Center will continue to care for people without insurance. All three local hospital systems are expecting to see more patients without insurance because of the reduction in federal subsidies on the Marketplace.

Sara Diggins/Austin American-Statesman

What should I consider when looking at Marketplace plans?

Don’t just auto-enroll on what you currently have, Cowles said.

Article continues below this ad

Read everything carefully. With more than a hundred plans, each plan is nuanced.

Make sure you accurately report your income. If you guess wrong, you could be either missing out on subsidies or owe subsidies back to the government.

Don’t judge a plan based on bronze, silver or gold. Sometimes a bronze plan can be better than a silver or a silver better than a gold, but note that some people receive extra subsidies if they choose certain silver plans. Those plans are noted on the website.

What is included in the plan? Is dental included? Are your doctors on the plan? What about your favorite pharmacy?

Article continues below this ad

What are the prices? Yes, care about monthly premiums, deductibles and maximum out-of-pocket costs, but also care about co-pays, drug costs and emergency room visit payments.

What’s important to you? Would you rather have a low co-pay for doctor visits or is a higher co-pay but a low deductible important? Is the maximum out-of-pocket expense the most important thing or is it the monthly cost? Is the plan eligible for a before-taxes health saving account?

Is a catastrophic plan better than nothing? Some people, particularly healthy, younger people can qualify for these plans, but they tend to cover only a major health event. Norris said sometimes you can find a bronze plan for less than a catastrophic plan.

What about a short-term plan? These typically do not do what people expect from an insurance plan.

Article continues below this ad

What help is available?

This year, Pogue said, it’s especially important to get help. While the federal government drastically cut the funding for navigators, Austin-Travis County’s hospital district Central Health has put its funding toward helping local nonprofit Foundation Communities run its Prosper Health Coverage centers, which have certified health navigators that do not get paid based on the plan you choose. It is expecting to help 5,000 people for free this year.

“With more than 100 plans available, it can be overwhelming to find the right plan,” said Erika Leos of Foundation Communities. “We are here to help sort through the plans and find the right one.”

You can make an appointment at foundcom.org/health-coverage or by calling 512-381-4520.

Article continues below this ad

Can Congress still increase subsidies after the Marketplace opens?

Yes. “Everything is on the table,” Norris said. Pogue said if that happens, even after plans go in effect, people could receive repayments for what they have spent.

What can I do if I cannot afford health insurance?

“One thing people should remember is that even an expensive plan will likely cost less than one trip to the emergency room, and will definitely cost less than the ongoing treatment of a serious illness,” said Leos of Foundation Communities. “However, if they truly can’t afford a plan from the Marketplace this year, we will discuss the other options available in the community.”

Article continues below this ad

Locally, we have three federally qualified health centers: CommUnityCare, Lone Star Circle of Care and People’s Community Clinic. They provide primary and some specialty care on a fee scale based on your income.

If you make below 200% of the federal poverty level and live in Travis County, Central Health’s Medical Assistance Program acts like health insurance and is available for free or at a lower cost.

Check with your current providers. Austin Regional Clinic will see patients who don’t have insurance and offers a discount over its posted rates. It also has a telehealth plan with one-time, monthly and annual rates that can be more affordable for in-person visits.

Article continues below this ad

Look for discount rates for medications through services like GoodRX or Amazon’s prescription service. You also can check with drug companies directly for programs.

Ask about charity care if you find yourself in the hospital. Hospitals have an obligation to treat you in the emergency room to get you to a stable place, but they do not have to provide further treatment such as a surgery or a hospital stay.