When it comes to the 17 constitutional amendments on the Nov. 4 ballot, El Paso Republicans and Democrats have at least a little common ground.

Early voting ended Friday, Oct. 31. In El Paso, more than 21,000 ballots — out of the city’s 518,387 registered voters — had been cast. That leaves many votes still to be cast on Election Day.

While local races dominate the current ballot in the El Paso area, the constitutional amendments offer voters across Texas an opportunity to make meaningful changes to state law.

A view of the Texas Capitol building from Congress avenue on Aug. 13, 2025

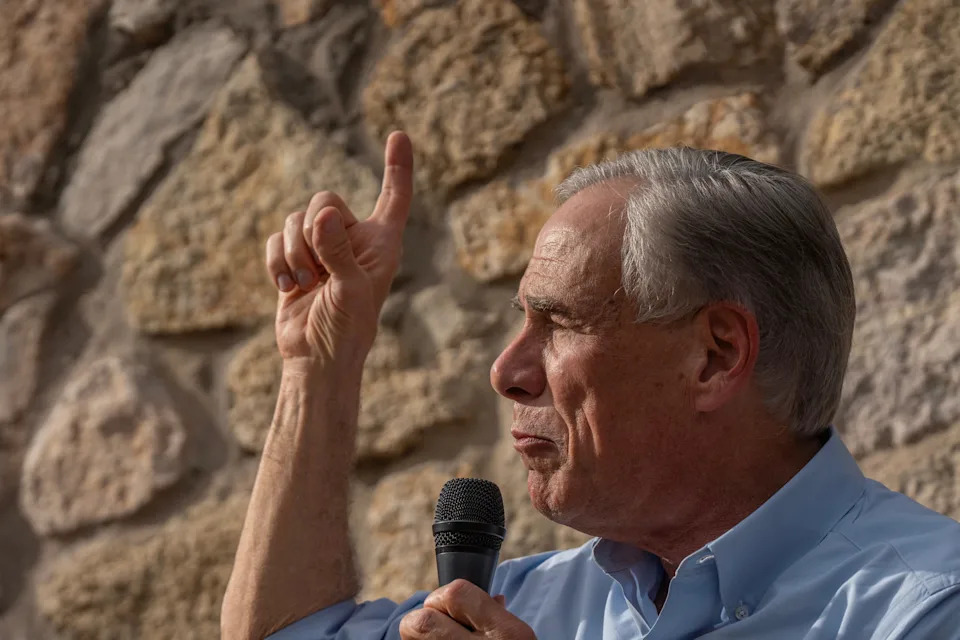

“These constitutional amendments give voters the opportunity to eliminate burdensome taxes, protect freedom, and make Texas even stronger,” said Gov. Greg Abbott in a news release. “From cutting taxes to strengthening public safety and improving education, this election is critical.”

But while Abbott is hailing the amendments as an opportunity to secure “conservative victories” made over the recent legislative session, Democrats are nearly as enthused, though differences of opinion still exist.

The following is the ballot language for each proposed amendment, along with a breakdown of where the El Paso County Republicans and Democrats stand.

Some of the propositions would add constitutional amendments to prevent problems that do not exist. The topics are related to taxation and voting.

Proposition 1

“The constitutional amendment providing for the creation of the permanent technical institution infrastructure fund and the available workforce education fund to support the capital needs of educational programs offered by the Texas State Technical College System.”

El Paso County Republicans and Democrats are united in their support for Proposition 1.

In a news release, the El Paso County Republican Party supported the proposition, arguing that it will allow “Texans to get help to pay their tuition to learn a trade instead of going to a liberal college.”

More: Gov. Greg Abbott rallies El Paso voters ahead of Nov. 4 election on 17 Texas amendments

The El Paso County Democratic Party offered its support because it will “better support students by upgrading their campuses and equipment and would ensure more stable funding in the future for the Texas State Technical College System.

“Texas State Technical Colleges give students hands-on skills that lead to good-paying jobs,” said state Sen. Cesar Blanco, D-El Paso, in an email. “This proposition would invest $850 million to help modernize their campuses and expand training programs, opening doors for more West Texans to build careers in fields like healthcare, energy, and manufacturing without having to leave home.”

Proposition 2

“The constitutional amendment prohibiting the imposition of a tax on the realized or unrealized capital gains of an individual, family, estate, or trust.”

Essentially a tax break for the wealthy, the two parties are divided on Proposition 2: El Paso Republicans urge support, while El Paso Democrats oppose it.

Where the local Republican Party believes the amendment will allow Texans to keep more of what they earn, local Democrats asserted that the amendment would prevent “future legislatures from imposing a capital gains tax during unexpected economic hardships and encourage business entities to organize as business trusts to avoid paying franchise taxes.”

Texas Gov. Greg Abbott speaks during a “Get Out the Vote” rally at Rivier Cocina & Cantina in El Paso, Texas, Thursday, Oct. 23, 2025. About 150 supporters attended the event, while a dozen protestors demonstrated across the street.

For his part, Blanco broke from the El Paso Democrats on Proposition 2.

“This amendment prohibits the state from taxing capital gains,” he said. “While Texas doesn’t have that tax today, this keeps our system stable for families and small businesses. I supported it because it provides predictability and stability for families, small businesses, and retirees planning their futures, while keeping Texas competitive and fair.”

Proposition 3

“The constitutional amendment requiring the denial of bail under certain circumstances to persons accused of certain offenses punishable as a felony.”

El Paso Republicans and Democrats were once again unified on Proposition 3.

El Paso County Republicans opposed the measure, believing it would stand in the way of judges doing their jobs, while El Paso County Democrats opposed it because the amendment “creates a rigid, constitutionally enforced mandate that risks overreach, erodes due process, and expands the scope of government authority without adequate safeguards.”

More: About 750 new laws will go into effect in Texas on Sept. 1. Here are some significant ones.

Again, Blanco took a different position.

“Public safety and fairness go hand in hand,” he said. “This proposition allows judges to deny bail to individuals accused of certain violent or sexual offenses when there’s clear evidence they are a real threat to the community, helping keep El Paso one of the safest cities in the country while protecting due process and judicial discretion.”

Proposition 4

“The constitutional amendment to dedicate a portion of the revenue derived from state sales and use taxes to the Texas water fund and to provide for the allocation and use of that revenue.”

El Paso Republicans and Democrats were unsurprisingly unified on Proposition 4, with both noting the critical need for water across Texas.

“In West Texas, water is life,” Blanco said. “If approved, this proposition would dedicate up to $1 billion per year from state sales-tax revenue into the Texas Water Fund for water and wastewater infrastructure statewide. A reliable water supply protects our families, our farms and ranches, and Texas’s future growth.”

Proposition 5

“The constitutional amendment authorizing the legislature to exempt from ad valorem taxation tangible personal property consisting of animal feed held by the owner of the property for sale at retail.”

Again, the two parties are divided on Proposition 5, with El Paso Republicans supporting the measure and El Paso Democrats opposing it.

The El Paso County Republican Party voiced its support for the proposition because “there might be less taxes,” while Democrats opposed the measure because it gives “feed sellers an unfair tax break, as almost all other forms of inventory are subject to property tax, reduce local property tax revenue, and require the state to help school districts make up for that loss.”

Santa Teresa Cattle Union and Union Ganadera Ciudad Juárez show cattle enclosures with cattle in January of 2025. The cattle were removed from the enclosure after concerns over spread of the parasitic screwworm. The trade again stopped this May with the same concerns.

Again, Blanco broke ranks with local Democrats to support the proposal.

“Feed stores, ranchers, and agricultural suppliers are vital to our rural economy,” he said. “This amendment would authorize the legislature to exempt inventory of animal feed for retail sale from property taxation, a targeted and fair fix that helps keep local agricultural businesses strong and supports the broader farm and ranch supply chain in our region.”

Proposition 6

“The constitutional amendment prohibiting the legislature from enacting a law imposing an occupation tax on certain entities that enter into transactions conveying securities or imposing a tax on certain securities transactions.”

Again, El Paso Republicans support Proposition 6, believing it might lower taxes, while Democrats oppose it because it “would prevent the state from creating new taxes on securities transactions, such as stock trading, and from taxing those who operate or work in the securities market, including financial institutions, brokers, and dealers.”

And yet again, Blanco did not find common ground with his local party.

“Prop 6 stops Texas from adding new taxes or fees on buying and selling investments or on brokers who handle those trades, helping keep retirement savings and investments growing without new state costs, stock trades or investment brokers, aiming to protect retirement savers and investment growth from added state costs,” he said.

Proposition 7

“The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation of all or part of the market value of the residence homestead of the surviving spouse of a veteran who died as a result of a condition or disease that is presumed under federal law to have been service-connected.”

While both parties supported Proposition 7, El Paso Democrats’ support came with a disclaimer.

“(We) wish to remind voters that the state legislature is responsible for determining the budget,” the party wrote in its voter guide. “If this provision were to remove the state legislature’s ability to balance the state budget in the future, it would have significant implications. This provision negatively affects school districts’ ability to raise revenue and keep taxes low, thereby hindering their ability to provide for the education of their students.”

More: Voters will have final say on billions of tax cuts for Texas homeowners, businesses

Blanco did not share the El Paso Democrats’ apprehension.

“El Paso has a proud military community with thousands of military families who have served and sacrificed so much for our country,” he said. “This proposition makes sure that if a veteran passes away from a service-related illness or injury, their surviving spouse, as long as they have not remarried, can keep their property tax exemption on the family home. It’s a simple but meaningful way to honor veterans’ sacrifice and help ensure their loved ones aren’t left behind.”

Proposition 8

“This amendment would permanently prohibit the Texas Legislature from imposing a state tax on the property of a deceased individual’s estate because of the individual’s death, which would include an estate, inheritance, or death tax. Texas does not currently have a death or inheritance tax.”

Another attempt at a permanent tax break for the wealthy, the parties are not surprisingly at odds over Proposition 8. El Paso Republicans are supporting the measure, while El Paso Democrats say it “could limit future legislatures from restoring this potential revenue source.”

Again, Blanco sided with Republicans.

“This proposition bans the state from imposing an estate, inheritance, or gift tax,” he said. “I supported it because families who’ve worked hard to build a small business or farm shouldn’t be taxed again when passing it on to their kids. It keeps opportunity in Texas communities, not in bureaucracy.”

Proposition 9

“The constitutional amendment to authorize the legislature to exempt from ad valorem taxation a portion of the market value of tangible personal property a person owns that is held or used for the production of income.”

Again, the two parties were divided on Proposition 9, with El Paso Republicans supporting it because it will “help slow the cost of living,” and El Paso Democrats opposing it over potential unintended consequences.

“While proponents argue that this amendment would reduce the tax burden on businesses and incentivize them to move to Texas, it would cost the state an estimated $193.5 million from general revenue in 2027 and more than $100 million annually from general revenue in subsequent fiscal years to make up for the lost revenue,” the party wrote. “Additionally, other taxing entities, such as cities and counties, would also have to raise tax rates to make up for the lost revenue or go without it, according to a fiscal note from the Legislative Budget Board.”

Yet again, Blanco disagreed.

Sen. Cesar Blanco, D-El Paso, speaks during the groundbreaking ceremony Wednesday, Sept. 17, 2025, at the Texas Tech Health El Paso campus for the Fox Cancer Center, the region’s first comprehensive cancer facility.

“Small business owners, mechanics, and tradespeople depend on their tools to make a living,” he said. “This proposition would raise the exemption on equipment and tools used to produce income, offering real tax relief to everyday workers who keep our economy running, not just large corporations.”

Proposition 10

“The constitutional amendment to authorize the legislature to provide for a temporary exemption from ad valorem taxation of the appraised value of an improvement to a residence homestead that is completely destroyed by a fire.”

Consensus was easy to reach on Proposition 10, with both parties supporting the measure.

“When disaster strikes, no family should be taxed on a home they’ve lost,” Blanco said. “This amendment lets the Legislature provide a one-time tax break on the damaged part of your home to help Texans rebuild and recover after fires or other devastating events, so you’re not taxed on something you no longer have.”

Proposition 11

“The constitutional amendment authorizing the legislature to increase the amount of the exemption from ad valorem taxation by a school district of the market value of the residence homestead of a person who is elderly or disabled.”

Both parties supported Proposition 11, though El Paso Democrats worried that the bill might shift its impact onto younger Texans.

“(We) wish to remind voters that the state legislature is responsible for determining the budget,” the party wrote. “If this provision were to remove the state legislature’s ability to balance the state budget in the future, it would have significant implications. This will decrease tax revenue for school districts. It will cost more than $1.2 billion for the next two fiscal years, and up to $477 million annually thereafter. This provision negatively affects school districts’ ability to raise revenue and keep taxes low, thereby hindering their ability to provide for the education of their students.”

More: Private school vouchers are now law in Texas. Here’s how they will work.

Blanco offered no such reservations.

“Rising property taxes hit hardest for seniors and Texans with disabilities living on fixed incomes,” he said. “Increasing their school property tax exemption to $200,000 provides meaningful relief and helps them keep the homes they’ve built their lives in.”

Proposition 12

“The constitutional amendment regarding the membership of the State Commission on Judicial Conduct, the membership of the tribunal to review the commission’s recommendations, and the authority of the commission, the tribunal, and the Texas Supreme Court to more effectively sanction judges and justices for judicial misconduct.”

The two parties found little common ground on Proposition 12, a thinly-veiled attempt by the conservative majority to stifle rulings they disagree with. El Paso Republicans support the measure, while Democrats fear that Gov. Greg Abbott and the Texas Supreme Court could not be relied upon “to ensure fair, unbiased appointments.”

Yet again, Blanco disagreed.

“Expanding the State Commission on Judicial Conduct to include more everyday Texans gives the public a stronger voice in holding judges accountable,” he said. “This change helps ensure our courts operate with transparency, fairness, and the highest ethical standards — values every Texan deserves from their justice system.”

Proposition 13

“The constitutional amendment to increase the amount of the exemption of residence homesteads from ad valorem taxation by a school district from $100,000 to $140,000.”

Both parties agreed that Proposition 13 represents an opportunity to relieve the burden on Texas taxpayers.

“This raises the school district homestead exemption from $100,000 to $140,000, cutting property taxes for homeowners,” Blanco said. “I supported it because working families need real and lasting tax relief. This measure helps without pulling dollars away from our public schools, ensuring both homeowners and classrooms benefit.”

Proposition 14

“The constitutional amendment providing for the establishment of the Dementia Prevention and Research Institute of Texas, establishing the Dementia Prevention and Research Fund to provide money for research on and prevention and treatment of dementia, Alzheimer’s disease, Parkinson’s disease, and related disorders in this state, and transferring to that fund $3 billion from state general revenue.”

Unlike the other propositions, both parties expressed reservations about Proposition 14, noting that funds could be easily mismanaged or abused.

“We are not against the purpose,” El Paso Democrats wrote, “we are against the decision makers that (have) proven they will help their donors first, not the people of Texas.”

More: Senior Fund: Alzheimer’s disease, diabetes take toll on 91-year-old woman, caregiver son

Blanco, on the other hand, offered unbridled support for the measure.

“El Paso is among the hardest-hit areas in Texas by dementia, and far too many families have watched their loved ones suffer without effective treatment options,” he said. “This proposition is about making a change, investing in research to improve care, uncover solutions, and ensuring Texas leads the fight against dementia.”

Proposition 15

“The constitutional amendment affirming that parents are the primary decision makers for their children.”

While El Paso Republicans voiced support for the proposal because “parents have the right to raise their children,” El Paso Democrats expressed concern and opposition to the measure because “it fails to articulate a clear plan for protecting and upholding children’s rights.”

“Furthermore, the amendment’s language may lead to a determination that a parent’s rights are adequately fulfilled,” El Paso Democrats wrote. “This provision puts children who are being abused at even greater risk than they are today, with current laws that protect parents. This provision can also negatively affect marginalized children whose parents disagree with them. This provision can also negatively impact protections and rights from (Child Protective Services), teachers, grandparents, and other professionals who interact with children.”

Again, Blanco seemed to agree with Republicans’ position.

“Parents are central to children’s education, and strong public schools are the foundation of our communities,” he said. “This measure affirms that balance, empowering families while ensuring every child has access to a safe, high-quality public education.”

Proposition 16

“The constitutional amendment clarifying that a voter must be a United States citizen.”

El Paso Republicans support Proposition 16 because “foreigners shouldn’t vote in our elections,” despite already existing laws that only allow U.S. citizens to vote. El Paso Democrats, unsurprisingly, oppose the measure.

“This amendment to the Texas Constitution only serves one purpose: To feed into the narrative of Donald Trump’s 2020 big lie that millions of non-citizens voted in the election,” Democrats wrote.

Conversely, Blanco seemed to take a middle-road approach to the measure.

“Only U.S. citizens can vote in Texas elections — that’s already the law,” he said. “This amendment simply reaffirms it in the Constitution to clear up confusion and help strengthen confidence in our elections. Our focus must remain on protecting access to the ballot box and ensuring every eligible Texan can make their voice heard.”

Proposition 17

“The constitutional amendment to authorize the legislature to provide for an exemption from ad valorem taxation of the amount of the market value of real property located in a county that borders the United Mexican States that arises from the installation or construction on the property of border security infrastructure and related improvements.”

Once again, the two parties are divided on Proposition 17 — El Paso Republicans supports the plan on the basis that it will “stop some of the increases on taxes,” while El Paso Democrats oppose the proposition because “the state should not incentivize border security infrastructure construction on private land, especially for potential state-supported surveillance or construction of the wall, furthering their political agenda and narrative that border communities are unsafe.”

Blanco did not share his party’s worries.

“This ensures that border landowners who voluntarily assist with security projects aren’t penalized through higher property taxes,” he said. “This proposition is rooted in fairness and respect for private property rights while addressing local challenges responsibly.”

Adam Powell covers government and politics for the El Paso Times and can be reached via email at apowell@elpasotimes.com.

This article originally appeared on El Paso Times: El Paso Democrats, GOP agree on these Texas propositions: See list