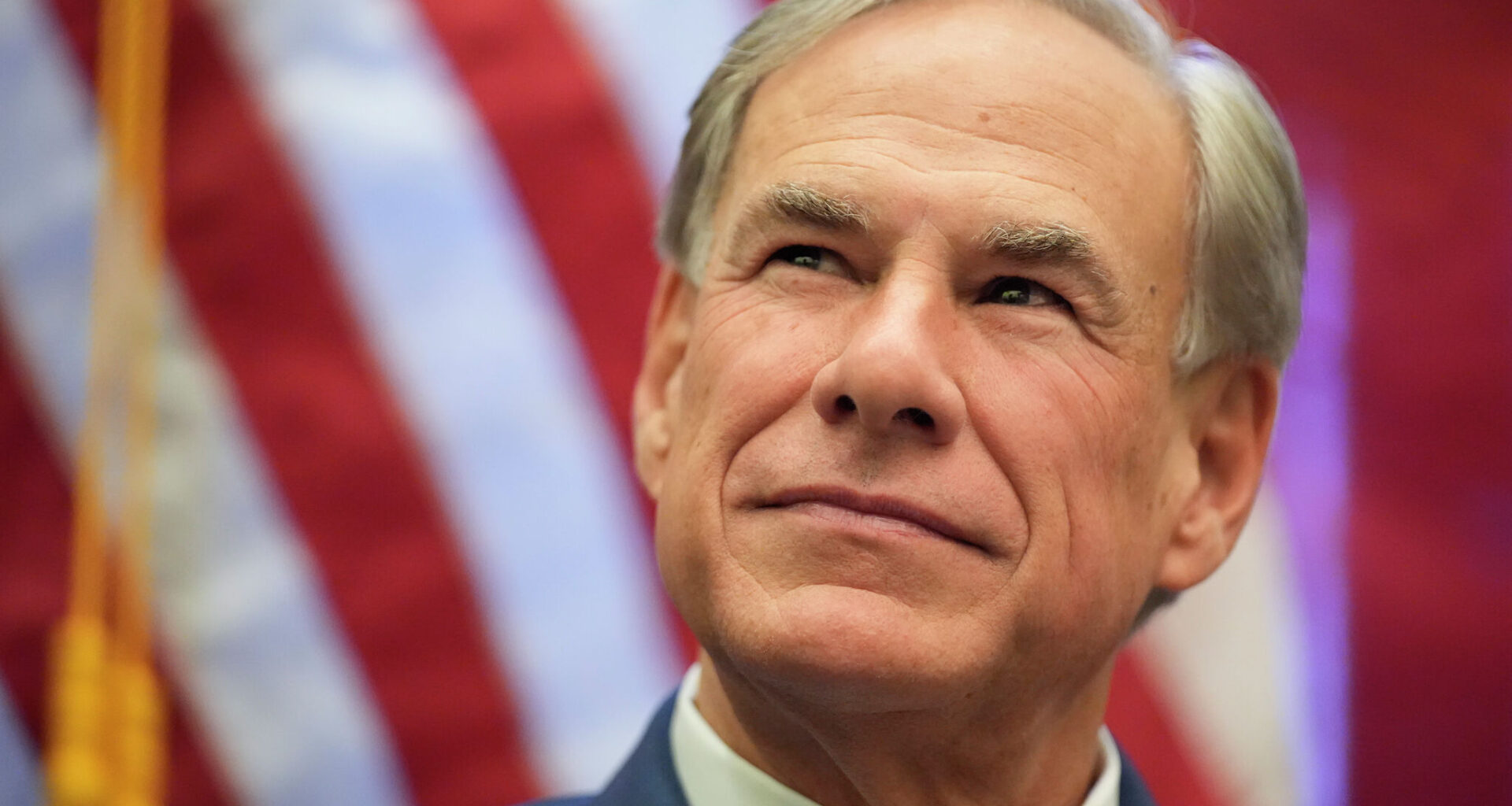

Just days before Austin voters head to the polls to decide the fate of a proposed 20% property tax increase, Texas Gov. Greg Abbott has offered his opinion on the divisive local ballot measure for the first time.

Abbott urged Austinites to vote “no” on Proposition Q, which would generate $110 million in additional property tax revenue that the city of Austin would use to fund a variety of initiatives, including homelessness services, parks maintenance and public safety investments. The owner of a typical home valued at $500,000 would pay about $300 a year more in city property taxes if the measure passes Tuesday.

“If you live in Austin, go vote on Tuesday AGAINST Prop. Q — against raising your property taxes even more,” the governor wrote in a post on X just after 9:30 p.m. Sunday.

Austin City Council members using your property tax dollars to give to political organizations.

That should ALREADY be illegal.

If not, we must make it illegal next session.

In the meantime, if you live in Austin, go vote on Tuesday AGAINST Prop. Q — against raising your…

— Greg Abbott (@GregAbbott_TX) November 3, 2025

Abbott referenced an American-Statesman report from Sunday that revealed questionable spending by some Austin City Council members, including donating taxpayer funds to political and advocacy organizations.

“Austin City Council members using your property tax dollars to give to political organizations. That should ALREADY be illegal. If not, we must make it illegal next session,” Abbott said.

But Prop Q supporters say Abbott is the reason the city is in a financial predicament in the first place.

“Of course Abbott is against Prop Q, it’s part of his war on cities,” Doug Greco, chair of the Travis County Democratic Party, said in a statement. The local party endorsed Prop Q by a two-thirds vote in September.

In 2019, Abbott signed into law Senate Bill 2 — a measure intended to rein in local property taxes in the state by limiting tax revenue growth to 3.5% year-over-year. Before SB 2, local governments could raise property tax revenues by up to 8% before voters had a say. An automatic tax-rate election is now triggered if a local taxing entity increases rates by more than 3.5%.

“The only reason we’re in this situation is Abbott’s 3½% revenue cap he signed into law in 2019 to strangle cities’ ability to invest in working people through education, job training, social services, and housing,” Greco said.