The words “bank” and “fun” don’t often go in the same sentence — unless you’re Rob Holmes, chairman, president and CEO of Texas Capital.

“Bankers here are having fun,” he told The Dallas Morning News in an interview. “Because with wins, you have fun.”

And recently, Texas Capital has done a lot of winning.

The Dallas-based bank posted its best quarter under Holmes’ leadership yet in its third-quarter report, hitting the quantitative and qualitative goals it set in 2021 as part of its transformation into a full-service financial institution. Texas Capital’s shares, traded on the Nasdaq, are up over 11% year-to-date, outpacing an index of broader regional bank stocks.

Bank earnings numbers are complicated, but the trick to hitting them was simple for Texas Capital: people.

Business Briefing

“I came here to build something special in a special place with people who care about each other,” Holmes said. “It’s different.”

The Texas Capital trading floor pictured, Wednesday, Nov. 12, 2025, in Dallas.

Elías Valverde II / Staff Photographer

In need of a transformation

Holmes came to Texas Capital in January 2021, after a 31-year career with J.P. Morgan Chase. With a true Texan sensibility — kudos to Highland Park High School, University of Texas at Austin and Southern Methodist University education — Holmes entered with a vision to dig the firm out of a period of struggle, and transform it into a full-service financial institution.

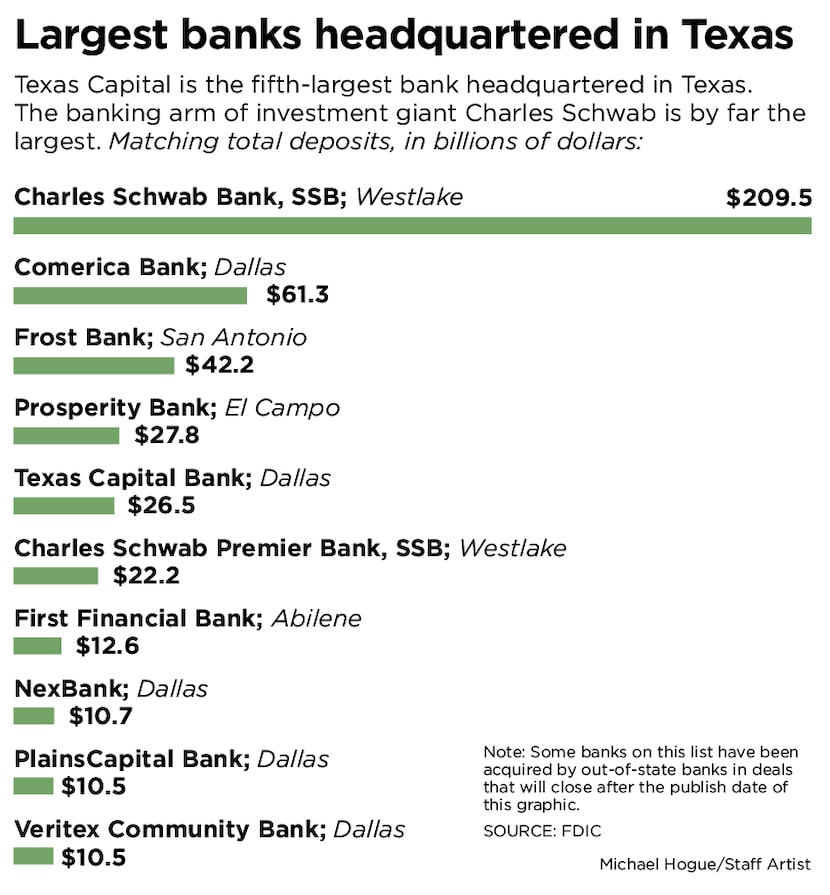

Texas Capital — which now has more that $26 billion in deposits and is the fifth-largest Texas-headquartered bank, per the latest Federal Deposit Insurance Corp. data — was founded in 1998, raising a then-record $80 million in startup capital.

Michael Hogue / Staff Artist

But leading up to 2020, things started to go awry. Texas Capital primarily dealt in the loan-focused commercial banking sector, but expenses were outpacing growth. After trading at an all-time high of over $100 per share in May 2018, Texas Capital stock had sunk to just $50 in December of the same year.

A merger with the McKinney-based Independent Bank Group promised to alleviate some of Texas Capital’s problems, but that imploded in early 2020 and its stock price tanked to just over $20. Both banks blamed the onset of the pandemic for the deal falling through, and then-Texas Capital CEO C. Keith Cargill resigned his post immediately.

‘People were pretty cynical’

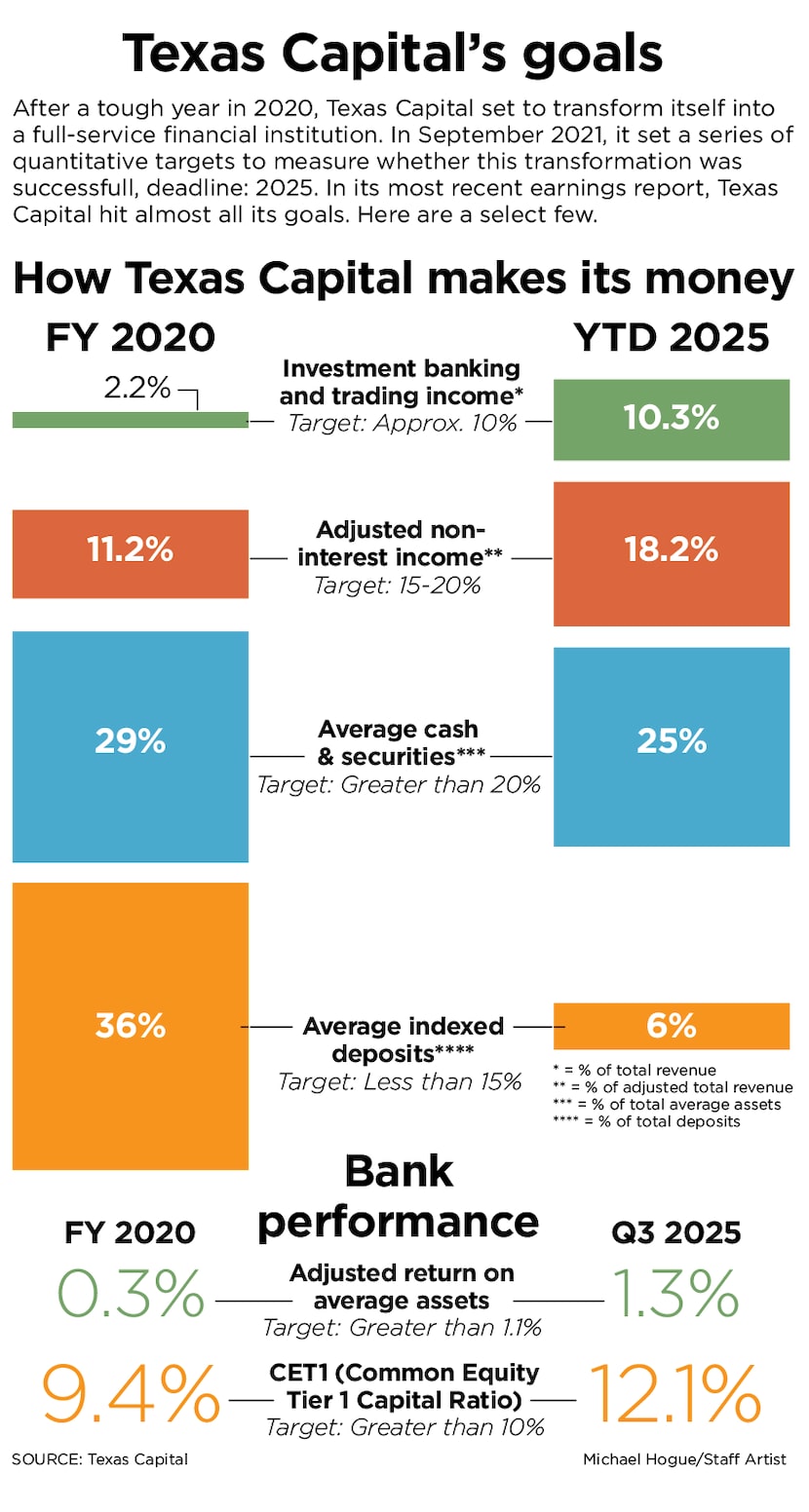

Holmes had a tall order when he replaced interim head Larry L. Helm: bring a once-shining beacon of Texas business success back to its former glory. To do that, he announced a new strategic plan on Sept. 1, 2021, which included a list of quantitative goals covering everything from revenue diversification and performance metrics to hiring quotas. The deadline to hit them: 2025.

“The first year there was a lot of skepticism,” Holmes said. “People were pretty cynical.”

Now, not so much. Holmes added an investment banking and trading division, emphasized payments over deposits, and focused on treasury management. In its third-quarter earnings report, that paid off and Texas Capital hit nearly all of its goals.

Investment banking and trading income grew from just 2.2% of total income in 2020 to 10.3%, surpassing a 10% target. Adjusted non-interest income grew from 11.2% to 18.2%, right in the sweet spot of the 15-20% standard set in 2021.

Meanwhile, the financial base is more stable. Average indexed deposits, which can be volatile, made up 36% of total deposits in 2020. The goal was under 15%, and year-to-date they make up just 6% of Texas Capital’s total deposits. At the same time, average cash and securities have stayed steady over 20%.

Texas Capital now boasts a higher capital ratio to buffer against potential financial crises. Meanwhile, its adjusted return on average assets — a key indicator of bank profitability — has climbed above the industry average, growing from .33% in 2020 to 1.3% in the third quarter.

“I don’t know of another firm with this big of a transformation that hit every one of their qualitative and quantitative goals, both announced and also promised to the board and shareholders,” Holmes said.

Michael Hogue / Staff Artist

Hiring spree

To accomplish its transformation, Texas Capital prioritized people on all fronts, both those it hires and employs and those it serves.

According to its Sept. 1, 2021 presentation, Texas Capital strove, “to be the flagship financial services firm in Texas serving the best clients in our markets.”

The very first tenet listed to accomplish that was to be the, “Employer of choice in Texas for people interested in growing their career in financial services.”

Holmes said 90% of the people at Texas Capital, which employed 1,818 people as of Dec. 31, are new since starting the transformation, and the company’s retention of juniors has been so good that they only need to hire 35 interns this year. Over 3,000 people applied for those positions.

Texas Capital Center pictured, Wednesday, Nov. 12, 2025, in Dallas.

Elías Valverde II / Staff Photographer

Increasing benefits was one major way to get people in the door and keep them there. Holmes noted there are better parental benefits now than before, and the higher-paid employees at Texas Capital pay a “dramatically higher” share of the benefits for lower-paid employees than when they started the transformation.

You don’t have to take his word for it. Of the 15 benefits reviews former employees have posted to Glassdoor in the past year, only three were three-star reviews. The rest were four- and five-star reviews, with many praising Texas Capital’s 401K match and the health savings account.

Meanwhile, the bank added headcount and invested in greater training for employees, reflected in an $86 million jump in salaries and benefits expenses from 2021 to 2022, per the bank’s 2022 annual report. In 2024, the median employee made $152,500.

“We’ve improved the benefits for employees here dramatically from day one, and we keep doing it,” he said. “There’s a real investment in the employee base. I just don’t think we could have done this without it.”

William T. Chittenden, the president of the Southwest Graduate School of Banking at SMU’s Cox Business School, noted that Texas Capital has also gotten to ride the wave of “Y’all Street” and financial institutions planting roots in the state.

Texas has surpassed New York in the number of financial services workers, and desires among that population are shifting toward a different kind of living.

“It’s attractive for folks moving from a high-tax state like New York with terrible weather, to come to a wonderful state like Texas, where you’ve got no income tax, you’ve got a relatively low cost of living, you can afford to buy a home here,” he said. “All of that makes Texas attractive for these financial professionals.”

Or as Holmes put it: “You don’t have to leave the state to work on Wall Street.”

A stock ticker is seen near a Y’all Street sign at Texas Capital, Wednesday, Nov. 12, 2025, in Dallas.

Elías Valverde II / Staff Photographer

‘Client obsession’

Now able to attract top-tier talent to Texas Capital, Holmes credits “every employee” with effectively executing the bank’s transformation. It required buy-in from every position into a new culture of “client obsession.”

“We run the bank from a very conservative posture as it relates to risk, and a very aggressive posture as it relates to client obsession,” Holmes said.

It starts at the top, with defined routines and workflows to keep everyone accountable to the mission. Holmes’ operating council, made up of executives of each branch of the company, meets every Monday morning for four hours to go over “every function, every line of business.” Then, they have monthly business reviews that go deep, quarterly reviews that go deeper, and continual revisions to the annual operating plan.

“What’d you say you were gonna do last week? And did you do it? What’d you say you’re gonna do next week?” Holmes said. “We keep track of exactly what we said we’re going to do, and did we do it or not, on a weekly, monthly, quarterly and annual basis.”

A major part of Texas Capital’s success has been deepening relationships with clients, first by working with low-risk, respected entities, then treating them well enough that they tell their peers to bank at Texas Capital, too.

To do that, the bank has doubled the number of client-facing roles since embarking on its transformation, and those workers are empowered to put the client first, no matter what.

“At a lot of banks, [if] the client has a need for capital, the banker offers them a loan and asks for a deposit. We don’t do that,” Holmes said. “We’re indifferent if they use our balance sheet or somebody else’s, we just want to get the right solution for them. We don’t ask our clients for deposits. We tell them how we can solve their working capital problem.”

Holmes himself is very involved with clients and a visible presence at Texas Capital’s Uptown headquarters. He sees his role of CEO of the company as that of a provider, making sure his employees have the resources to be successful, then getting out of the way and letting them do just that.

But while he described everyone he’s hired at Texas Capital as “smarter and better than me,” there’s one thing he’s the best at.

“I’ve made more client calls every year than anybody here. A couple of times, people try to compete with me. They can’t,” he joked. “But if they don’t see me doing it, they’re not gonna do it, right? Plus, it’s fun. That’s the fun part of the business. It’s not fun sitting in the boardroom. It’s fun to be with clients.”

The junior experience was a point of emphasis for Holmes, who spoke about the importance of learning and training the next generation of financial professionals — in office.

After the pandemic sent workers everywhere behind a Zoom camera, Texas Capital brought its employees back to five-days-a-week in-office in mid-2021. In today’s world of hybrid work arrangements, that might be a polarizing decision. Yet, like many banking executives, Holmes is a firm believer in in-person collaboration — especially for junior employees. He referenced his own son, who works in private equity.

“I want my kid in the office working his ass off, because that’s what he’s supposed to do,” Holmes said. “You don’t pass down [the culture] if you’re remote.”

Exterior shot of Texas Capital on McKinney Avenue in Uptown Dallas.

Texas Capital Bank / Texas Capital Bank

For what it’s worth, Texas Capital has a very nice Uptown Dallas headquarters. In 2022, the bank announced a new 15-year lease on an increased 200,000 square feet of space that would rename the entire building the “Texas Capital Center.” Two existing floors would be remodeled.

The remodel of the building’s seventh floor, the main floor, was completed in 2024, and it’s all marble accents, modern finishes and natural light. The space has a trading floor for investment bankers, an event space for guest speakers, a full studio, and boardrooms galore that welcome visitors with personalized messages.

The Texas Capital trading floor pictured, Wednesday, Nov. 12, 2025, in Dallas.

Elías Valverde II / Staff Photographer

Texas Capital moves across a stock ticker above the trading floor, Wednesday, Nov. 12, 2025, in Dallas.

Elías Valverde II / Staff Photographer

Walking through the bustling floor, one can’t help but feel it’s a physical representation of both Texas Capital’s transformation and its investment in its employees.

“We wanted our employees to have a little swagger, and I think this place helped,” Holmes said.

Playing the field

Texas Capital’s transformation came just in the nick of time. A pandemic recession and world-historic inflation in 2022 notwithstanding, the past few years have been a tumultuous time for regional banks.

Silicon Valley Bank, Signature Bank and First Republic Bank all collapsed in 2023, and Silvergate voluntarily liquidated. Ever since, investors in the segment have been skittish, only exacerbated by loan and fraud issues, like Fifth Third Bank’s recent $178 million loss post-Tricolor bankruptcy.

Amid concerns about the health of regional banks, the KBW Regional Banking Index, from investment banking firm Keefe, Bruyette & Woods, is marginally in the red this year, while the firm’s index tracking large-cap banks is up 13.5%.

To keep up with their larger competition, regional banks are merging left and right — especially in North Texas, buoyed by a consolidation-friendly federal regulatory environment. This year alone, Veritex Vista and, most notably, Comerica were all bought up by outside banks.

As successful as Texas Capital’s turnaround has been, it was, in many ways, simply necessary to survive, given headwinds.

“Texas Capital is, ballpark, the 70th-largest bank in the country, and if you’re going to compete in those top 100 banks, you pretty much need to be a full-service provider,” said SMU’s Chittenden.

In Chittenden’s view, Texas Capital hitting its goals is certainly an accomplishment, but it’s too soon to ring any victory bells.

“It’s good news. The third quarter was great. But trends don’t happen in one quarter,” he said. “One quarter is not going to make a great year or a great trend, but it’s definitely obviously a move in the right direction.”

Still, Holmes is confident that Texas Capital’s multifaceted people-first approach has growth potential beyond being a one-quarter wonder. And he isn’t worried about what has transpired elsewhere in the space, saying regional banks are not all the same.

“There’s high-quality banks, there’s poor-quality banks. And I argue that the regional banking crisis of ’23 wasn’t a regional banking crisis. … It was two or three poor strategies executed by poor management teams, because the rest of the banks did just fine,” he argued.

“Every single thing we did, we did to de-risk the bank, and that made it more profitable, which is really interesting,” he said. “And in the end, the profitability that has been achieved is through structural changes that make the earnings much higher quality and repeatable. It’s not a one-off. It’s broad.”

As for a merger or acquisition, that hasn’t been on the menu. If Texas Capital were looking to sell, Holmes said, it wouldn’t have put in the effort to become a full-service institution. And you acquire to get into a better market than your own, get better talent than you can attract, or access a product you can’t build.

“We built probably the most broad financial services platform there is below a money center bank. We’ve attracted the talent … And we’re in the best market in maybe the world,” Holmes said.

Texas Capital

As well as the bank can measure, Holmes believes Texas Capital is the No. 1 lender in Texas to Texas-based businesses. With out-of-state banks moving into town, Holmes recognizes that 82% of people born in Texas stay in Texas and Texans like to do business with other Texans.

For now, continuing to serve the Lone Star State and its relentless growth is the strategy, and Texas Capital believes no one is better positioned to do that than the bank built here.

“To have local decision-making in Texas with a money center platform is pretty powerful. We feel like we can out-local the global money center banks and beat the local banks with a money center platform,” Holmes said.

“We have built the first full-service financial services firm ever headquartered in Texas. I don’t think that gets enough attention. It’s never been done before.”

Banks work to avoid being painted with the same ‘broad brush’

Banks work to avoid being painted with the same ‘broad brush’

Regional bank fears are throttling markets, but most institutions are doing fine, especially here in the D-FW.

Coinbase reincorporating in Texas from Delaware, small ‘Dexit’ movement grows

Coinbase reincorporating in Texas from Delaware, small ‘Dexit’ movement grows

A small wave of companies are moving their incorporations to Texas.