Alumni of the University of Texas can expect a $244,000 return on investment 10 years after enrolling in a bachelor’s program. The public university places second among Texas’ nearly 80 public and private universities for 10-year ROI. It is second only to Rice University, a private college in Houston.

Though a private school claims the number one spot, data shows that public schools in Texas typically yield a higher ROI for in-state residents when compared to private schools within the state and universities in general across the nation.

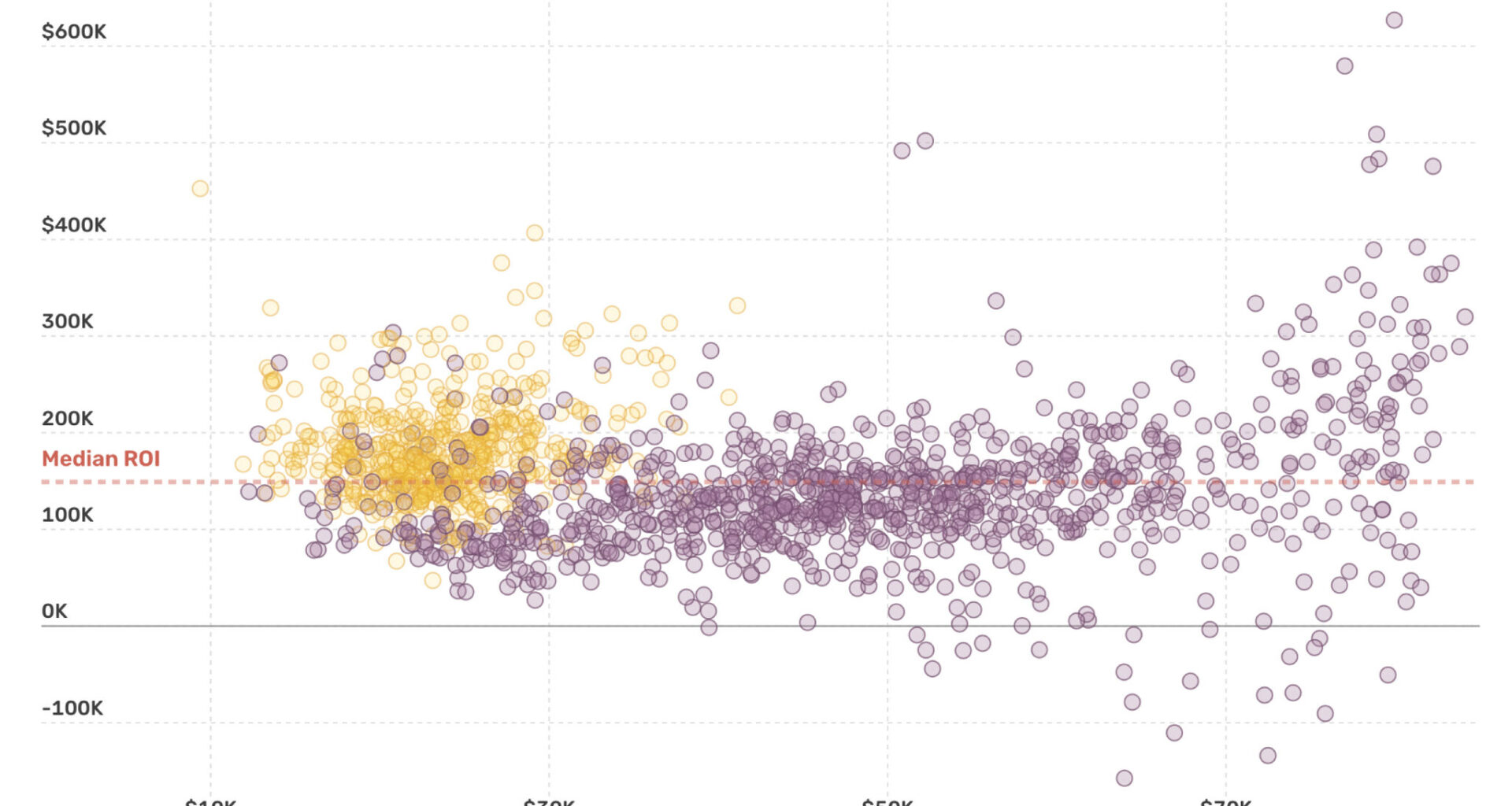

According to a 2025 analysis by Georgetown University’s Center on Education and the Workforce, after 10 years, attending a public school in Texas will yield a median ROI of $184,770 while private school attendees may only see a median of $127,000. The national median is $149,000.

In large part, the discrepancy is a result of the costs of attending a private school. Typically, attending a private school costs about 50% more than attending a public school in the state.

The Georgetown researchers used data on attendance costs and post-college earnings to estimate the financial return of attending each higher education institution in the country. Specifically, they estimated the typical total income 10 years after college enrollment and subtracted the total attendance cost, assuming a student attends college for five years, the national average for a bachelor’s degree.

Attendance cost includes tuition, fees and living expenses and accounts for federal financial aid. The tuition data reflects in-state tuition for public universities, though out-of-state students often pay thousands more. The data in this story reflects the income and cost experience of students who began school between 2010 and 2014.

Look up cost and earnings data for U.S. colleges

Select the arrow next to each name to search for another four-year college

The chart includes data on nonprofit colleges that offer four-year degrees. The ROI calculations assume no earnings increases after 10 years and should therefore be considered low estimates. Values shown in 2023 dollars.

The ROI estimates were calculated using data from the U.S. Department of Education on the earnings of college attendees six, eight and 10 years after enrollment. The researchers at Georgetown inferred the earnings for every other year and summed those numbers to determine total earnings at 10 years after enrollment.

The earnings data are sourced from tax documents and includes only students who received federal financial aid at the time of enrollment. Nationally, 55% of undergraduates receive federal financial aid in the form of loans or Pell Grants.

Jeff Strohl, a research professor and the director of the Center on Education and the Workforce, says that thinking about college in terms of a long-term investment is key.

“If you go to a private school with a huge amount of cost, then it takes a little while to pay it off,” Strohl said. “But if the earnings are higher or even just in a longer time period you see that it pays for the cost.”

In recent years, lawmakers and members of the Texas Higher Education Coordinating Board have placed greater emphasis on encouraging enrollment in degree programs that result in a higher return on investment.

The state’s higher education agency aims to have 550,000 students complete postsecondary “credentials of value” each year at a Texas institution. Students must be able to earn enough within 10 years of obtaining the credential to pay for their initial cost of education and surpass the earnings of a typical high school graduate for a program to be deemed “of value.”

Public schools often have a higher initial return on investment because they are more affordable than private schools. Only four of the top 20 schools in Texas ranked by 10-year ROI are private universities.

School10yr ROI1.Rice University$333.8K2.The University of Texas at Austin$244.0K3.The University of Texas at Arlington$235.7K4.The University of Texas at Dallas$230.6K5.Texas A & M University-College Station$227.4K6.The University of Texas Permian Basin$223.5K7.University of Houston$221.9K8.Texas Woman’s University$208.6K9.Midwestern State University$206.9K10.Trinity University$201.4KSchool10yr ROI11.The University of Texas at Tyler$195.9K12.The University of Texas at San Antonio$195.7K13.University of Houston-Victoria$194.0K14.Texas A & M International University$193.4K15.University of Houston-Clear Lake$192.0K16.Abilene Christian University-Undergraduate Online$190.8K17.Texas State University$186.8K18.Texas Tech University$186.1K19.Texas A & M University-Kingsville$185.8K20.University of St Thomas$185.6K

When viewed on a longer timeline, private schools in Texas start to edge closer to the returns offered by public schools. Private universities make up just over half of the list of top 20 schools ranked by 40-year ROI.

School40yr ROI1.Rice University$3.1M2.Southern Methodist University$2.6M3.The University of Texas at Austin$2.5M4.Texas A & M University-College Station$2.5M5.Trinity University$2.3M6.The University of Texas at Dallas$2.3M7.Texas Christian University$2.1M8.University of Houston$2.1M9.Baylor University$2.1M10.Texas Tech University$2.1MSchool40yr ROI11.The University of Texas at Arlington$2.1M12.Austin College$2.0M13.Southwestern University$2.0M14.The University of Texas Permian Basin$2.0M15.University of Houston-Clear Lake$2.0M16.University of Dallas$1.9M17.St. Mary’s University$1.9M18.Saint Edward’s University$1.9M19.The University of Texas at San Antonio$1.9M20.LeTourneau University$1.9MCreditsReporting by Alexandra Kanik. Data & graphics by Nami Sumida and Darryl Laiu. Reporting, data & graphics by Hanna Zakharenko. Editing by Emily Donaldson and Dan Kopf.