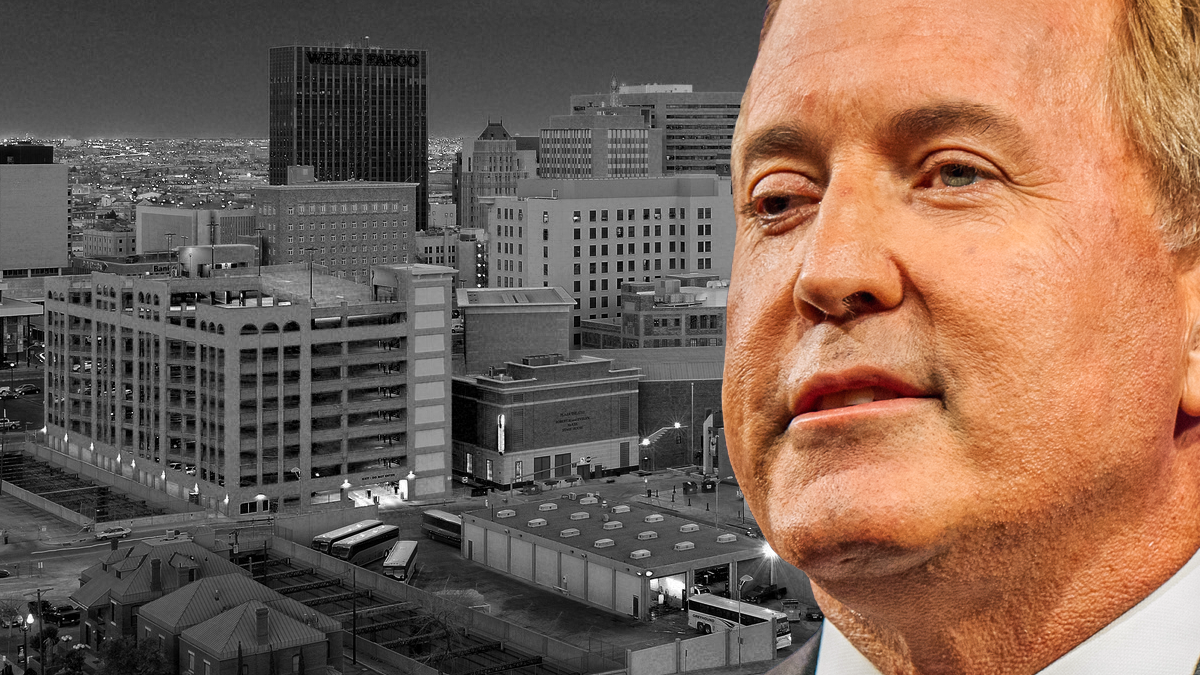

AUSTIN, Tx., December 10, 2025: Yesterday, Attorney General Ken Paxton issued a press release announcing that his office has launched an investigation into “unlawful tax increases.”

According to the press release, Paxton’s office will be reviewing the financial records of almost 1,000 Texas cities to ensure they are following the new state law, SB 1851, that requires government officials to transparently inform Texas property taxpayers about “raising taxes above the no-new-revenue rate.” The new state law that took effect on September 1 bars cities from raising taxes from the previous year if they have not published annual audited financial statements within 180 days after the city’s end of its fiscal year.

Joe Moody and Claudia Ordaz were excused as absent for the vote that included several items on May 10, 2025. Eddie Morales, Jr. voted in favor of the tax reporting requirements, while Vince Perez voted against it. Mary E. González did not cast a vote on the legislation although records she was present that day and voted on other legislation. However, she voted in favor of it on the Second Reading of the bill.

On April 16, César Blanco voted in favor of the bill as part of the uncontested State Senate calendar that included it.

Paxton stated that “local officials will not be allowed to ignore the law, coverup finances, and burden Texans with never-ending tax increases.” Among the Texas cities that Paxton has requested financial information from includes El Paso, according to his press release. El Pasoans pay one of the highest property taxes in the state.

However, according to The Texas Tribune, El Paso city officials have not received a request from Texas officials. Laura Cruz-Acosta told The Texas Tribune in an email yesterday that Paxton has not contacted city officials, but that the city “has always complied with all applicable laws, rules, and regulations” related to taxation.

Cruz-Acosta told Austin’s CBS affiliate that the city is not in violation of SB 1851 because when the adopted the city’s 2026 tax rate, “SB 1851 was not in effect.”

The City of El Paso adopted a lower tax rate on August 19, calling it the “lowest tax rate in ten years,” but many property owners will still see a tax increase because of rising property valuations.

However, as city spokesperson, Laura Cruz-Acosta told the Austin television station, the city’s tax rate was adopted a few days before SB 1851 came into effect on September 1 excluding the city from the law’s financial disclosure requirements.

Like Us and Follow Us On Our Social Media!

Visited 12 times, 12 visit(s) today