The Ferrum Capital collapse costing hundreds of people millions of dollars is a long way from being resolved.

But new court records and a forensic accountant’s report obtained by LubbockLights.com reveal details of what happened to the money.

“It was a scam from the get-go,” said Lubbock attorney Ed Price who represents people trying to get their money back.

And Price, plus another attorney trying to recover money for investors believe another person should face criminal charges in the case.

“Walt Collins, I would certainly suggest,” said San Antonio attorney Matthew King.

Price had the same answer.

“The guy who really causes all of this is the guy who comes in and wines and dines the Josh Allens and the Michael Coxes and says, ‘Look, I got a great idea here where we can all make millions.’ And he’s the bad guy. Collins is the bad guy, or one of the bad guys – but maybe the worst of the bad guys because he knows better,” Price said.

King added, “This is part of what a scheme would do … create these intermediaries. And as you’re handing a bag of money from one party to another, what you’re doing is creating obstacles to recovery. You’re also giving a party, like Walt Collins himself, some deniability by saying, ‘Well, I don’t know what happened to it.’”

Price said of Collins, “He’s the one that has done it a couple of times before in other states in different formats. But that was his position at the deposition: ‘It’s not mine, it’s not my company. They’ve got it. They’re the bad guys. Leave me alone.’ And we’re not going to leave him alone.”

What you’ll find in this story:

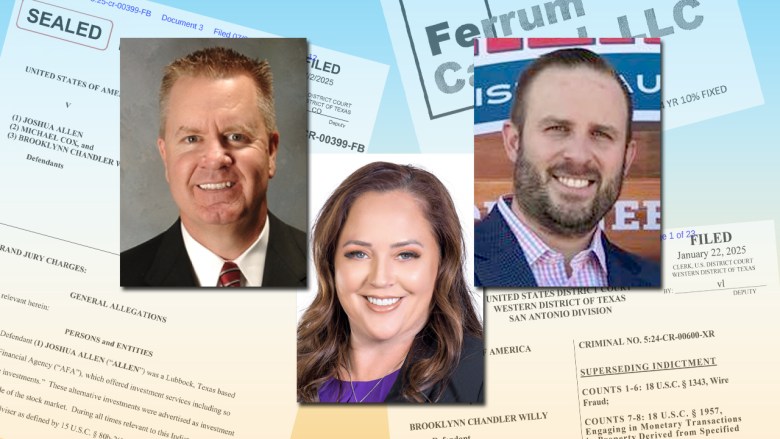

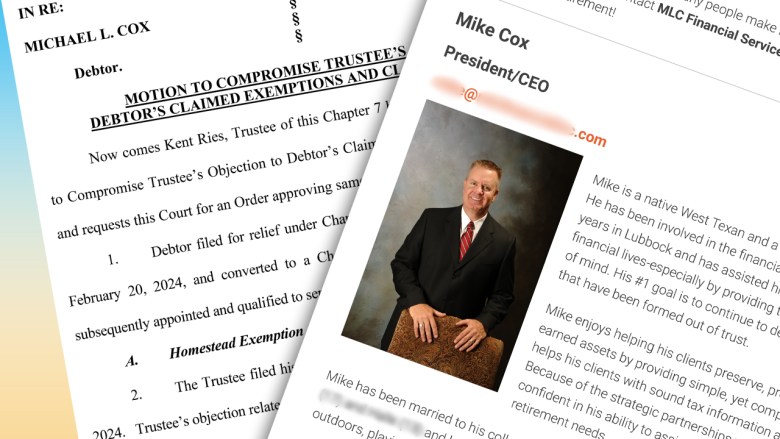

Details from the forensic report showing how much Joshua Allen, his Lubbock business partner Mike Cox and their San Antonio business affiliate – Brooklyn Chandler Willy – are accused of taking from Ferrum

How Allen moved money from Ferrum in and out of Walk-On’s restaurant ventures, according to the report.

A demonstration of how Ferrum’s business plan was “defective.”

Payments to a New York attorney who’s been suspended from practicing law.

An explanation of how the tables are turning and Ferrum is suing its own “Ferrum Capital insiders.”

Why a company connected to Ferrum is claiming it might owe Ferrum $559 million as it seeks bankruptcy protection.

How we got here

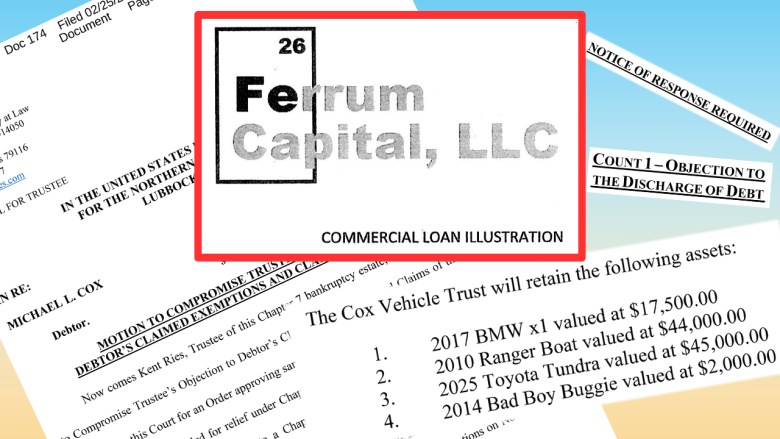

Allen and Cox started Ferrum Capital in 2017 and began to solicit investors, according to their indictment.

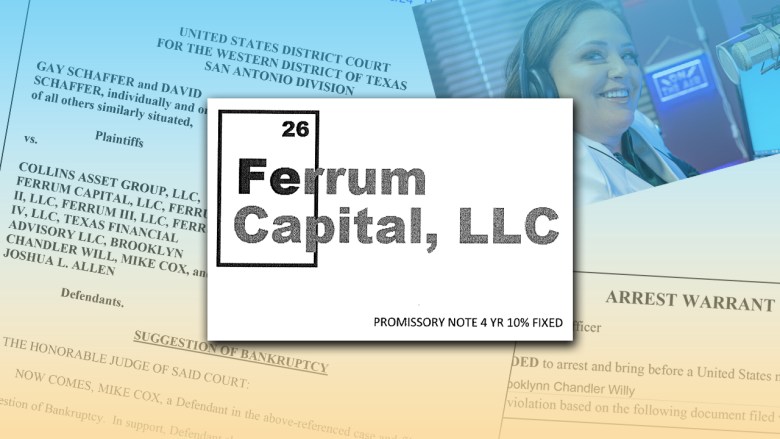

“Allen, Cox, and … Willy used Ferrum Capital, Ferrum II, Ferrum III, and Ferrum IV (collectively ‘Ferrum Entities’) to steal millions of dollars from hundreds of victims,” said federal indictments that have the trio facing an April 2026 trial date in federal court.

The victims put up $67 million, according to the indictment. The numbers in other legal documents differ.

“Most of the investors lost some or all of their investment.” the indictment said.

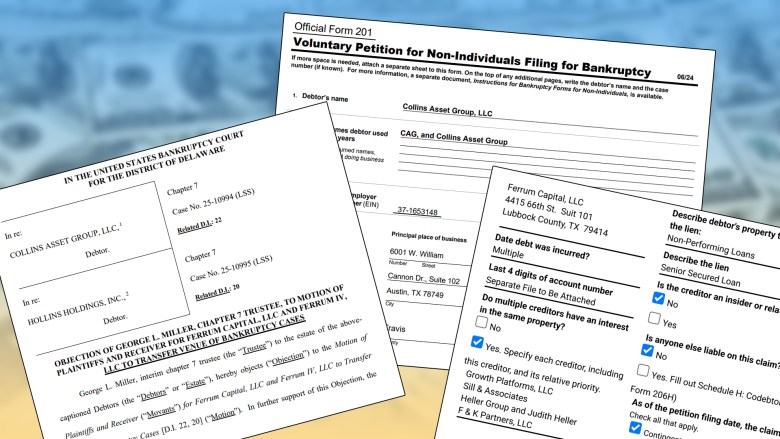

Ferrum transferred money to Collins Asset Group (CAG), a debt collection company. Participants were told CAG would purchase debts for pennies on the dollar and would make a lot of money if the debts were collected. But according to various lawsuits, the debts were not collectible and Ferrum was a “Ponzi scheme.”

CAG defaulted to Ferrum in late 2023, with Ferrum in turn defaulting to its participants. Legal actions followed.

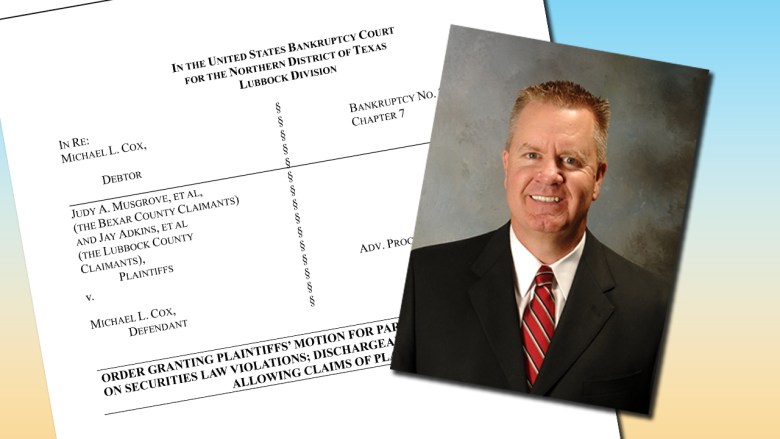

Cox filed for bankruptcy in early 2024 revealing nearly 400 people or businesses that stood to lose money in Ferrum.

Cox’s bankruptcy judge, Mark X. Mullin, ruled “The Ferrum Entities were operated as a Ponzi scheme in that new investor money and funds pledged to other investors were used to pay early investors.”

For that reason, Cox was not allowed to discharge more than $30 million of debt.

CAG and its parent company, Hollins Holdings, filed for bankruptcy in June.

LubbockLights.com reached out to attorneys for Allen, Cox, Willy, CAG, Hollins Holdings, Walt Collins and a spokesperson for Walk-On’s. We did not receive responses.

The forensic report

People sued Ferrum in numerous lawsuits across Texas, and in one, attorneys hired Greg T. Murray, a San Antonio forensic accountant.

Murray introduced his findings this way: “Ferrum Capital LLC and Ferrum IV LLC were established to receive investor funds. They promised high rates of return to attract investor funds. Those funds were disbursed to other entities as loans and commissions. The loans appear to have been very high-risk investments and have proved to be uncollectible.”

“We met with Mike Cox back in November or December of 2017. … He said he had an investment that was guaranteed to be risk free – said if you’re tired of the ups and downs of the stock market this would be an interest-paying note.”

dwain strait

Michael Cox

Michael Cox

That’s not what Dwain Strait and others were told. He spoke to LubbockLights.com in January about the money he and his wife lost in Ferrum.

“We met with Mike Cox back in November or December of 2017. … He said he had an investment … guaranteed to be risk free – said if you’re tired of the ups and downs of the stock market this would be an interest-paying note.”

Strait liked the idea of “risk free.” According to Strait, Cox offered him 8 percent interest with quarterly payments. Cox was told Ferrum would work with CAG to collect distressed debt and make a lot of money.

“The Collins Group was supposed to be fantastic. They just touted them as been doing this for decades,” Strait said.

Murray’s forensic report put CAG right in the middle of everything. Ferrum sent more than $47.6 million to CAG and got back more than $19 million in repayments and interest.

Murray’s report also tracks the flow of money into and out of certain companies Allen created which are related to Walk-On’s including the Amarillo location. From the report:

Ferrum transferred just short of $3 million to companies under Allen’s control or partial control including WO Metro and Waco WO – companies Allen set up as he pursued Walk-On’s franchise locations in Texas.

WO Colony transferred more than $530,000 into Ferrum.

Ferrum transferred $821,000 to QuBall Holdings which, according to a lawsuit filed in Lubbock, was the general partner of the Amarillo location of Walk-On’s.

Ferrum transferred nearly $1.3 million to Landzacha LLC, which (according to the same lawsuit) was a limited partner in the Amarillo Walk-On’s.

Ferrum transferred nearly $1.3 million to WO Metroplex.

WO Metroplex got a nearly $2.2 million dollar loan “facilitated” by QuBall and Allen, according to the Amarillo Walk-On’s lawsuit. WO Metroplex then deposited the money into an account related to the Amarillo location. “[The] account was used to commingle funds of various entities,” court records said.

Price said Allen did not treat each entity like a company but more like a bank account – describing Allen’s behavior as, “‘Wherever I need money, I’ll just get it.’ Money was coming in and out, and here and there, and whatever. … He just kind of treated it all as his little kingdom.”

Murray’s report indicates the Ferrum companies (Ferrum Capital and Ferrum IV) paid:

Allen Financial $11.8 million (with roughly $3.8 million of that amount getting moved to other places).

Willy’s company, Chandler Capital, $1.26 million.

Two of Cox’s companies MCKC and MLC Inc. just less than $700,000 and $628,000 respectively.

New York attorney Aaron Etra $3.14 million, the report said. Other court records indicated Etra was to act as an escrow attorney in a joint venture between Ferrum and Ryan Project Funding. Ryan was to put the money into investment grade securities and return it with a 20 percent profit. Etra was suspended this year from practicing law in New York according to nycourts.gov for violations of professional conduct rules. Murray’s report indicated Etra owes the money back.

Payments to “insiders and control persons” totaled more than $18.7 million, according to Murray.

“Funds are commingled and used for personal and authorized expenses by insiders or control persons,” Murray wrote.

Part of Murray’s mission was to conclude if Ferrum operated as a Ponzi scheme. His answer was yes:

Part of Murray’s conclusion

“Whether the program would have been profitable is another key consideration. Exhibit #4 details loan advancements to Collins Asset Group totaling $52,455,273.43. 40 percent interest for 4 years would be $20,982.109.37. Total repayment after 4 years would be $73,437,382.80. Exhibit #20 computes investor funds received totaling $82,829,057.16. The promised investor return computed at 40 percent is $33,131,622.82. Total required investor payments would be $115,960,679.88. The business plan is defective.”

Joshua Allen

Joshua Allen

Ferrum, to keep its promises, would need to pay its investors nearly $116 million. Ferrum was always going to run tens of millions of dollars short, he concluded.

“Ferrum and Ferrum IV business models exhibit all the court-identified badges of a Ponzi scheme,” Murray wrote.

Another document, filed in September in one of the lawsuits, had different dollar figures but the exact same conclusion.

“Using simple math, Ferrum Capital’s only source of available revenue was the origination and service fees. So, if those monies were paid out in commissions to Cox and Allen or other sales agents such as Willy, Ferrum Capital would never be able to repay its investors,” one of the lawsuits said.

“From the inception of Ferrum Capital and the first transfer of monies from Ferrum Capital to Cox and Allen, its ultimate failure was assured and inevitable,” the lawsuit also said.

Murray’s forensic summary of Ferrum Capital

(Numbers are rounded off)

Funds received:

Funds received from investors

$31.8 million

Funds received from Goldstar Trust Company

$36.5 million

Collins Asset Group principal, interest and fees

$19.4 million

Total cash receipts

$87.8 million

Funds expended:

Loans to Collins Asset Group

$47.6 million

Net transfers to other Ferrum funds

$1.074 million

Payments to related parties

$2.3 million

Origination fees and other Allen Financial payments

$6.6 million

Transfers to Allen Financial related accounts

$2.9 million

Transfers to Allen Financial related accounts

$2.9 million

Transfers to Allen Financial for distributions

$66,769

Transfers to Goldstar Trust Company

$18.1 million

Distributions directly to Investors

$8.2 million

Operating expenses

$778,690

Total disbursements

$87.8 million

What CAG owes Ferrum

Separate from the forensic report, CAG updated bankruptcy schedules said the company owes roughly $36.3 million in principal and nearly $12.7 million of interest. Those two numbers add up to nearly $49 million that CAG owes to Ferrum in principal and interest.

Ferrum: Four-year 10 percent

$21.5 million

Accrued interest on Ferrum 10 percent

$9.4 million

Ferrum: Four-year 8 percent

$14.8 million

Accrued interest on Ferrum 8 percent

$3.2 million

Is it $67 million or $87 million?

A federal indictment said, “Hundreds of victims invested approximately $67 million into Ferrum Capital.”

Civil court records said, “Ferrum Capital took in approximately $67.7 million from retail investors …”

And Murray’s forensic report said Ferrum took in $87.7 million. But Murray was counting both investor money and partial repayments from CAG.

Murray’s accounting included, for example, $19.4 million repayment from CAG to Ferrum. His method was to examine the checking accounts for all money coming in and going out.

“I created a QuickBooks accounting system file for Ferrum. My staff posted all the checking account transactions,” Murray said.

Trying to get money for victims

Separate from Murray’s report, the court-appointed receiver over Ferrum, John Patrick Lowe, recently filed an updated document in state court.

“Ferrum insiders took or received approximately $13.6 million for themselves or entitles they controlled and delivered about $47.6 million to Collins Asset Group, LLC,” Lowe said.

Brooklynn Willy

Brooklynn Willy

Lowe’s list of “Ferrum insiders” is shorter compared to Murray’s “potentially related companies” and so the two come to different dollar figures ($13.6 million compared to $18.7 million).

They also had different goals. Murray’s task was to prove whether Ferrum was a Ponzi scheme. Lowe is trying to get money back for Ferrum’s victims.

Lowe originally filed a complaint against CAG in 2024, but CAG has since gone into bankruptcy. Just recently Lowe documented a $66.1 million claim against CAG in the bankruptcy – saying approximately $10 million of it is a secured claim.

In state court, Lowe filed updated complaints in June and September seeking judgements against Allen and Willy. Cox filed for bankruptcy so he’s not on the list.

Lowe also seeks money back from these companies: MLC, MCKC, MKMH, Allen Financial, and Landzacha.

“Since some time in 2022, [CAG] has been a zombie entirely under the control of the Oliphant parties.”

john patrick lowe’s claim in bankruptcy court

CAG is tied to a company called Oliphant by common ownership. Lowe filed a claim against CAG in the bankruptcy case – claiming some of the Ferrum money ended up with Oliphant.

“The Receiver [Lowe] contends that the Oliphant Parties took or converted some or all of the money due the Receiver from collections on the Ferrum Capital collateral,” Lowe claimed.

Lowe contended Oliphant is responsible, saying CAG and Oliphant collected at least $56 million of debt on accounts serving as collateral for Ferrum. But Ferrum was only paid back $19.4 million, according to Murray’s report.

“Since some time in 2022, [CAG] has been a zombie entirely under the control of the Oliphant parties,” Lowe’s claim in bankruptcy court stated.

Complete Ferrum Capital coverage

Ferrum criminal trial – Allen, Cox and Willy – pushed back until next year

Ferrum detour to Delaware ends; what that means for victims in Lubbock, San Antonio

‘Finally … in shackles’ – Ferrum victims ‘ecstatic’ about criminal charges against Allen and Cox

Attorneys trying to recover money in Ferrum cases concerned about legal processes moving to Delaware

Two companies tied to Ferrum and securities fraud FBI investigation go bankrupt

Cox deal to keep his house approved but some of his bankruptcy protections lost

New bankruptcy judge appointed in Lubbock – to oversee cases across much of West Texas

‘They robbed people blind,’ says upset Lubbock attorney representing dozens in Ferrum Capital case

Another lawsuit

One of the lawsuits in San Antonio, under the direction of attorney Randall Pulman, was updated in September.

“Ferrum Capital, LLC was formed for the sole and exclusive purpose of financing CAG. Ferrum Capital had no borrowers other than CAG. CAG’s prior source of funding, Soniqui, used the same sales, marketing and financing structure—it too was a Ponzi scheme,” the suit said.

LubbockLights.com in late 2024 pointed to Soniqui in our original overage. CAG settled its lawsuit related to Soniqui for less than $16 million as we previously reported.

Pulman’s lawsuit said Ferrum simply picked up where Soniqui left off. CAG then sold off to Oliphant, according to lawsuits.

“The Oliphant Entities, through a series of corporate machinations looted CAG of its assets and the monies which were raised by Ferrum Capital from the Plaintiffs,” Pulman’s lawsuit said.

Attorney King thinks the next step will be getting Oliphant (Oliphant, Inc., Oliphant Financial and Oliphant USA) involved.

“From 2017 through 2023, Ferrum Capital raised approximately $60,000,000 from investors and turned over to CAG approximately $50,000,000 in investor funds from approximately 250 investors,” the lawsuit said.

“Not satisfied with just taking an undisclosed commission, Cox and Allen also … simply stole investor monies from Ferrum Capital for their own benefit,” the lawsuit said.

They “skimmed” $12 million out of Ferrum, according to the lawsuit.

“Nor did Cox or Allen disclose to the investors that they owned 100 percent of Ferrum Capital, and later that one or both of them had acquired an interest in Oliphant, Inc.—the ultimate owner of CAG.”

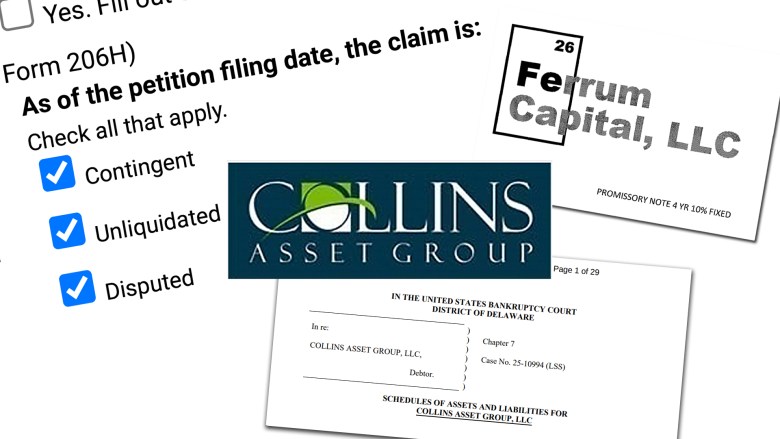

$559 million?

In its September bankruptcy filing, CAG claimed it might owe Ferrum $559 million. The figure comes from CAG’s updated bankruptcy schedules and represents an amount claimed as “contingent, unliquidated, and disputed” – not one that is settled or admitted.

Price had not seen the $559 million figure before.

“We think the number is over 50 [million], but we don’t know for sure, because again, we’re having to reconstruct all this stuff,” Price said.

Why $559 million instead of something closer to $50 million?

King said realistically CAG does not owe Ferrum $559 million, but instead, “That’s a fairly common thing that you’ll see sometimes in lawsuits. … What they’re doing there is listing every possible claim … to provide a maximum figure.”

To emphasize this point, CAG’s lawyers are not admitting $559 million is the amount owed. They’re saying in court records that’s the maximum amount that might be claimed by the time all the dust settles on various lawsuits.

Related

Related posts