Two El Paso school districts are seeking voter approval to increase the operations portion of their tax rates beyond the state’s limit, hoping to generate new revenue and improve their financial standing.

Early voting for the Socorro and Tornillo independent school districts’ voter approval tax ratification elections — or VATREs — begins Monday and runs through Oct. 31. Election Day is Tuesday, Nov. 4.

Both will appear on the ballots of voters living within the districts’ boundaries as Proposition A. Also on the ballot will be 17 state propositions, including property tax relief that will offset most if not all of the tax increases being proposed by the school districts.

The district elections were triggered after their respective school boards adopted tax rates higher than the voter-approval rate — the highest they could have adopted without going to voters under state law.

The language on the ballots in both districts states “this is a tax increase” – legally required language for any tax referendum that increases the district’s overall maintenance and operations tax revenue compared to the previous year. However, most homeowners will likely see a reduction in the school district portion of their tax bill if the state tax relief is approved.

Alfredo Aguero asks questions about Socorro ISD’s proposed change to tax rates during a meeting at Americas High School, Oct. 14, 2025. (Corrie Boudreaux/El Paso Matters)

Alfredo Aguero asks questions about Socorro ISD’s proposed change to tax rates during a meeting at Americas High School, Oct. 14, 2025. (Corrie Boudreaux/El Paso Matters)

Alfredo Aguero, 67, a community organizer, SISD resident and taxpayer, said he supports the proposition, but doesn’t support the language on the ballot.

“I think that’s going to confuse a lot of people who won’t understand it,” Aguerro said during a recent SISD community meeting on the tax rate election at Americas High School.

The Socorro ISD board in August adopted a tax rate of $1.06 per $100 valuation for the 2025 tax year. This includes a tax rate of 27 cents per $100 valuation to repay its debt and a rate of 79 cents per $100 valuation for operations.

The district’s voter-approval rate is 94 cents per $100 valuation.

If the proposition is approved, SISD will shift 12 cents from its interest and sinking rate, used to pay its debt, to its maintenance and operations rate, which is used to pay for salaries, programs, utility bills and to run the district. Added together, the two rates create the total school district rate.

The move, known as a “penny swap,” allows the district to generate new revenue while maintaining the same tax rate as last year.

If approved by voters, Socorro ISD, which has 45,900 students, expects to generate up to $49.2 million a year.

The Tornillo ISD school board adopted a tax rate of $1.21 per $100 valuation, with a voter-approval rate of $1.13 per $100 valuation. The rural district on the southeastern corner of the county with just under 700 students expects over $237,000 in additional revenue a year.

Homeowners in both districts will likely see a decrease in the school portion of their tax bill, or have it eliminated, if Texas voters approve a constitutional amendment on the ballot to raise the homestead exemption from $100,000 to $140,000.

Socorro ISD homeowners may see a reduction in those savings if they approve the tax rate proposition. If it passes, homeowners can expect to see the school portion of their property tax bills reduced by about $345 a year on the average-valued $232,700 home. Without it, Socorro ISD homeowners would see an additional $110 in savings.

Tornillo High School, home of the Coyotes, celebrates its 100th anniversary this year. (Corrie Boudreaux/El Paso Matters)

Tornillo High School, home of the Coyotes, celebrates its 100th anniversary this year. (Corrie Boudreaux/El Paso Matters)

Tornillo ISD’s finance director, Luis Guerra, said most homeowners in the district won’t pay anything on the school portion of their property tax bill on the average home valued at $119,000 as long as the state constitutional amendment passes.

While property tax bills generally go out in October, any propositions approved by voters in November will apply retroactively to that tax bill. Taxpayers will receive an adjusted tax bill or refund for overpayment.

How will the new funds be used?

Socorro ISD Superintendent James Vasquez said the district plans to use the funds generated by the new tax rate to rebuild its reserves, which were depleted after years of overspending, to pay for air conditioner repairs and to give employees retention stipends.

Vasquez said the district has not decided the dollar amount of the stipends, which ranged from $750 to $1,000 in the past.

He noted the fund won’t be used to hire additional teachers or to provide raises, since the district provided salary increases to all its employees at the start of the school year.

“This money would be used to support our fund balance and get us in a better financial situation. But there are other needs as well. Our schools look beautiful and amazing, but they’re aging. So, there’s going to be some maintenance and operations upgrades that would need to be addressed,” he said.

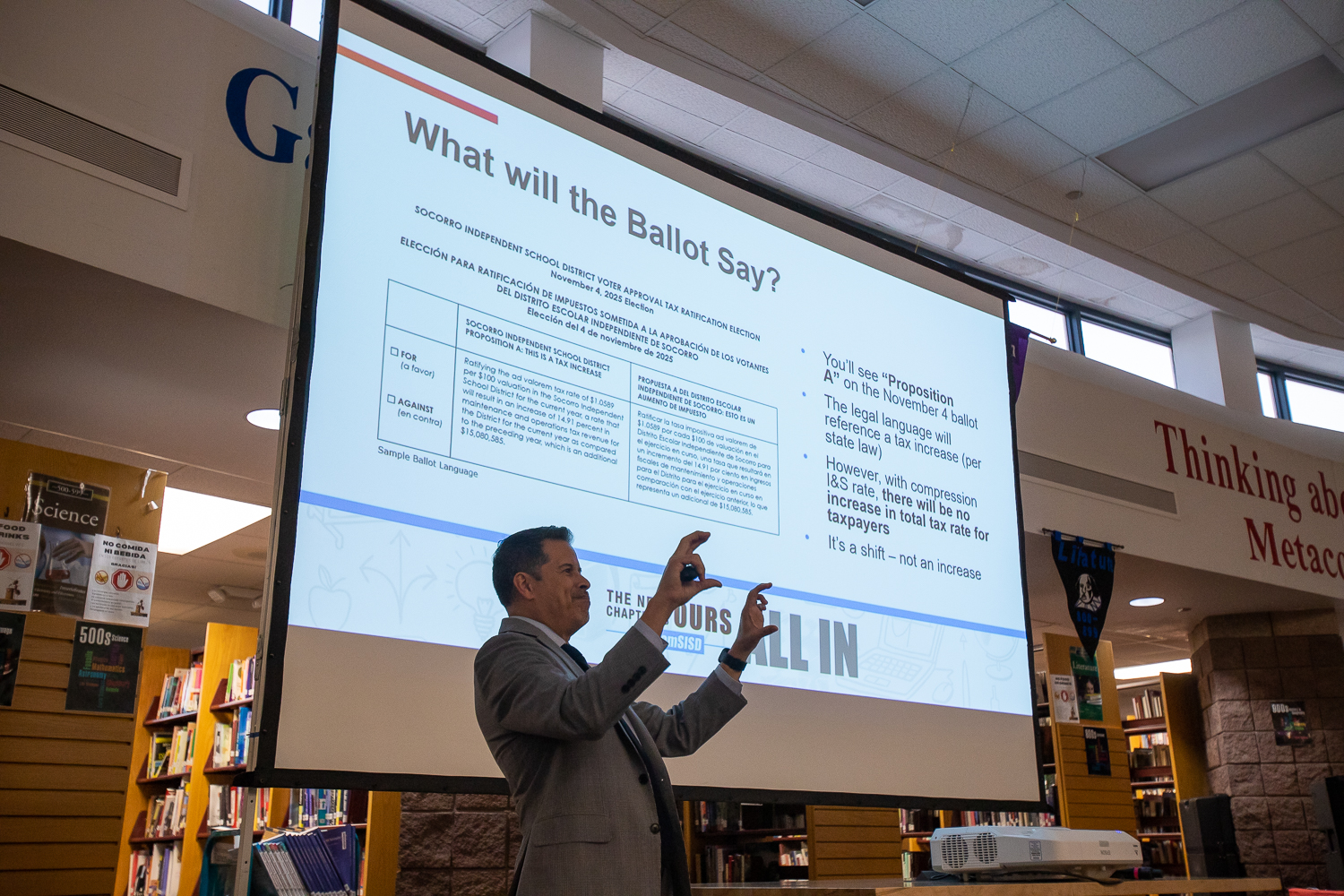

Socorro ISD Superintendent James Vasquez greets the attendees of a meeting at Americas High School to explain the proposed tax rate change that will be on the November ballot, Oct. 14, 2025. (Corrie Boudreaux/El Paso Matters)

Socorro ISD Superintendent James Vasquez greets the attendees of a meeting at Americas High School to explain the proposed tax rate change that will be on the November ballot, Oct. 14, 2025. (Corrie Boudreaux/El Paso Matters)

Vasquez said a portion of the funds would also be used to replace broken and outdated student laptops that were purchased in 2020 using COVID-19 relief funds, but did not have an estimate on how much it would cost.

“We have not received any additional funds for that, and those computers are five years old now, so they’ve gone beyond their lifespan. We are replacing them as we can, but it’s not nearly what we need for a full refresh. Now, if this passes, we can start looking at a replacement plan,” Vasquez said.

Guerra said Tornillo plans to use its funds to give raises to employees who did not qualify for a pay increase under the state’s school funding bill, approved by the Legislature earlier this year.

“It’s not much, however, (House Bill 2) gave teachers a big increase in their salaries while the rest of our employees are going without,” Guerra said. “We need to remain competitive with the bigger districts in El Paso, so we usually pay a little bit more.”

Guerra said the district has not given its employees a raise in three years. Most live in El Paso and make a 30- to 40-minute commute to get to work in Tornillo.

HB 2 gave teachers who work in districts with 5,000 or fewer students, like Tornillo ISD, a $4,000 raise if they have three to four years of experience, while those with five or more years of teaching will receive $8,000.

Teachers working in districts with over 5,000 students received $2,500 and $5,000 raises, respectively.

Teachers with less than three years of experience and other staff did not get pay increases under the bill.

Tornillo ISD has just under 150 employees, over 40 of whom qualified for a raise under HB 2.

The additional revenue may also be key to keeping both districts afloat financially as they face declining enrollment.

Socorro ISD adopted a balanced budget in June, after years of operating under a budget deficit.

Last year, the district had $50.4 million in reserves, or enough to keep the district running for 33 days. As of April 30, it had about $26 million in reserves.

Texas school districts need to have enough reserve funds to keep running for at least 75 days to get an A in the Financial Integrity Rating System of Texas, which could affect a district’s accreditation if they fail multiple years in a row.

Vasquez said the district already took out two loans – in November and May – because it did not have enough cash on hand to cover its expenses.

If Socorro ISD’s Proposition A doesn’t pass, the district may need to take out additional loans in the future, and could lead to staffing and program cuts. The district already experienced layoffs earlier this as part of a plan to cut $38 million from the district’s budget. The district initially estimated it would lay off about 300 employees, but cut that number down to 43 after making budget cuts and eliminating vacant positions.

“It’s very likely that we would need to take out another loan in the spring to get us through those months where we do not receive funding from the state,” Vasquez said. “There could be it could impact the programs that we currently provide. We would have to look to see if we can continue to provide the same types of programs, and it could impact staff as well down the road.”

Guerra said Tornillo ISD currently has enough reserves to keep the district running for 119 days, but expects that to dip to 100 days by next year.

“We have a good fund balance, but it’s coming to the few months where the reserves need to be there,” Guerra said.

PAC forms to support Socorro ISD VATRE

Members of Socorro ISD’s Finance and Operations Advisory Committee, a group of parents, staff and community members who recommended the tax rate election, formed a political action committee to encourage voters to approve Proposition A.

Tom Laign, a committee member and treasurer of the Support Socorro ISD Schools PAC, said members of the advisory committee wanted to help “get Proposition A across the finish line.”

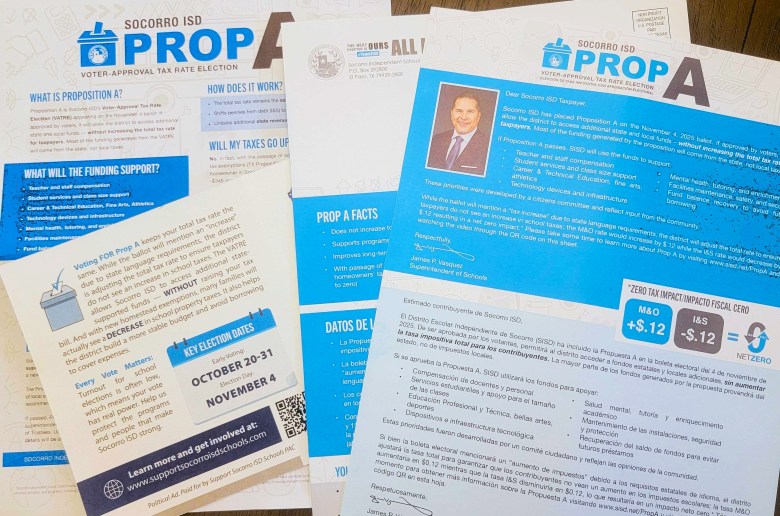

Mailers from the Support Socorro ISD Schools PAC ask district voters to support a tax rate ratification proposition that will bring SISD additional revenue. (Cindy Ramirez / El Paso Matters)

Mailers from the Support Socorro ISD Schools PAC ask district voters to support a tax rate ratification proposition that will bring SISD additional revenue. (Cindy Ramirez / El Paso Matters)

Laign said this means Socorro ISD can share factual information about the election, but can not encourage people to vote in favor of the tax ratification.

“What we can do that the district cannot is we can make a recommendation to vote for Proposition A. The district can’t tell people to vote for or against it, but we’re telling voters to vote for it,” said Laign, a retired district employee.

As of Oct. 3, the PAC had raised just under $10,400 in political contributions and has spent nearly $2,100 on campaign mailers and to access voter information, campaign finance reports show.

Some of the contributions include $2,500 from Banes General Contractors and $1,000 each from JMJ Home Health Care, Protech Roofing Systems, Texas Electrical Contractors, APCO Building Specialties and Diversified Interiors of El Paso. A $500 donation came from BTC Builds, a Fort Worth contractor that specializes in school construction and has previously worked for SISD.

Vendors – including contractors and developers – are generally the largest donors to political action committees formed to support school district tax or bond proposals.

The PACs are common as state law prohibits school districts from using public funds and internal mailing systems for political advertising. While district employees and trustees cannot campaign for a tax ratification in a professional capacity, they can encourage people to vote for or against it as private citizens using their own time and resources.

ON THE BALLOT: NOV. 4, 2025, ELECTION

Socorro Independent School District VATRE

Ballot language:

PROPOSITION A: THIS IS A TAX INCREASE

Ratifying the ad valorem tax rate of $1.0589 per $100 valuation in the Socorro Independent School District for the current year, a rate that will result in an increase of 14.91 percent in maintenance and operations tax revenue for the District for the current year as compared to the preceding year, which is an additional $15,080,585.

Adopted tax rate: $1.06 per $100 valuation

Last year’s tax rate: $1.06 per $100 valuation

Voter approval rate: 94 cents per $100 valuation

Expected revenue generation: $49.2 million a year

Upcoming Community meetings:

6 p.m. Monday, Oct. 20: Montwood High School cafeteria, 12000 Montwood Drive

6 p.m. Tuesday, Oct. 21: El Dorado High School library, 12401 Edgemere Blvd.

Tornillo Independent School District VATRE

Ballot language:

PROPOSITION A: THIS IS A TAX INCREASE

Ratifying the ad valorem tax rate of $1.207800 per $100 valuation in the Tornillo Independent School District for the current year, a rate that will result in an increase of 29.88 percent in maintenance and operations tax revenue for the District for the current year as compared to the preceding year, which is an additional $237,252.

Adopted tax rate: $1.21 per $100 valuation

Last year’s tax rate: $1.14 per $100 valuation

Voter approval rate: $1.13 per $100 valuation

Expected revenue generation: $237,252 a year

KEY ELECTION DATES

Monday, Oct. 20: First day of early voting; last day to apply for ballot by mail

Friday, Oct. 31: Last day of early voting

Tuesday, Nov. 4: Election Day; last day to receive ballot by mail

VOTER GUIDE

For more information on the Nov. 4 election, including where to find sample ballots and voting sites, visit El Paso Matters’ Voter Guide.

Related

LISTEN: EL PASO MATTERS PODCAST