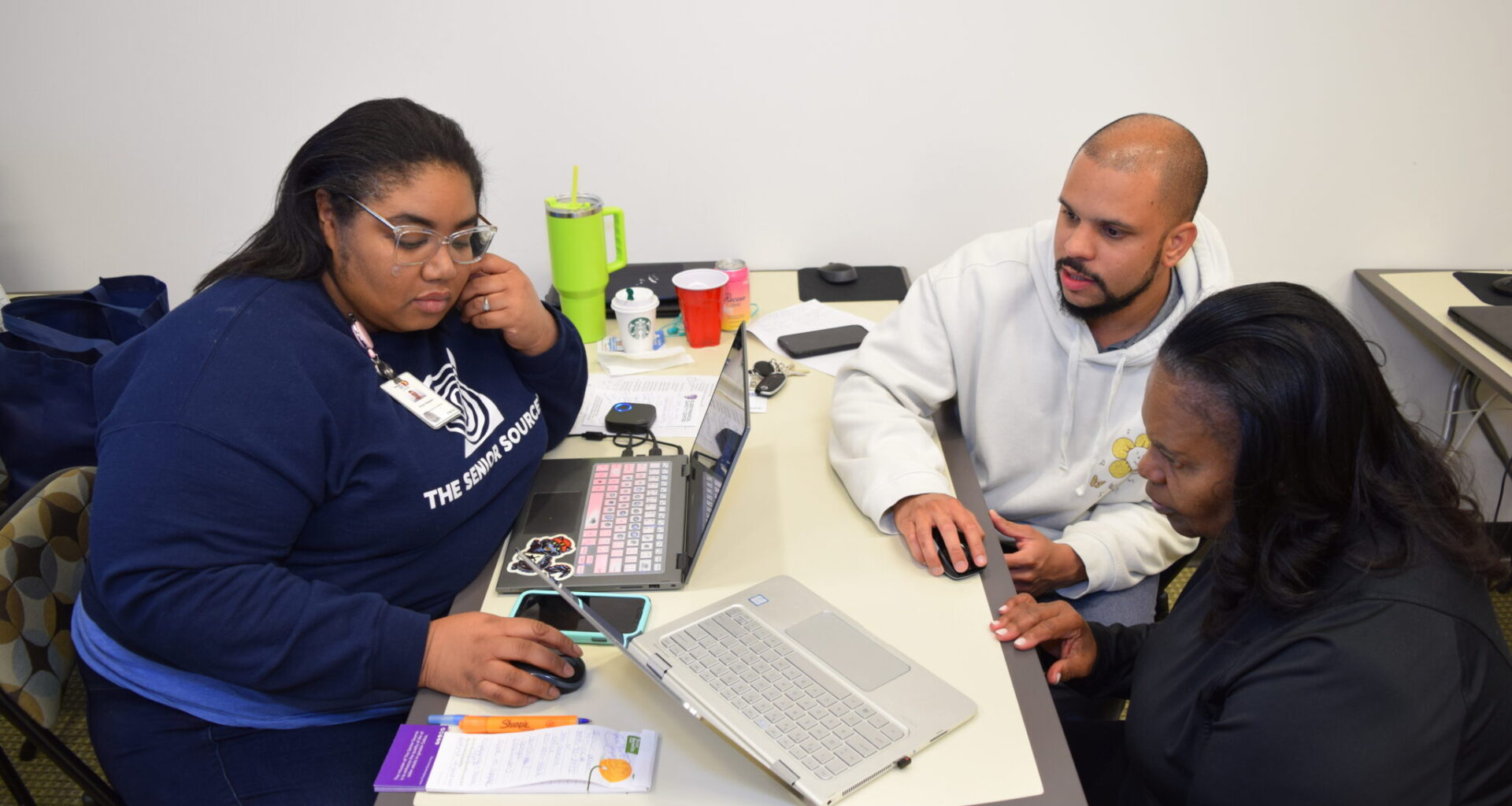

Medicare counseling to help older adults find the right plan. Photo courtesy of The Senior Source.

Medicare open enrollment began Oct. 15, a process that can often be confusing and time-consuming. Whether you’re over 65 or helping a parent or grandparent navigate it, there are a few new additions to the services compared to last year.

“Family dynamics, that always can be a cloudy situation. I think for that conversation to exist or to happen, and if not, maybe it’s about finding that person, finding whoever is trustworthy, or who can that person trust to talk and listen,” senior insurance counselor Carl Burlbaw said.

Burlbaw works for The Senior Source, a resource hub for older adults and caregivers that breaks down the Medicare process. The organization has an in-person location, but can also help answer questions by phone.

He said there are many aspects to keep in mind when enrolling, but specifically not to rush the selection even though marketing during this time can portray a sense of urgency to enroll.

The four parts to Medicare are “like an alphabet soup.”

Part A covers individuals who go into a hospital, rehab, or skilled nursing facility for overnight stays. It also covers hospice and some aspects of health care.

Part B, which pairs with Part A known as Original Medicare, covers doctor visits, outpatient services, procedures, and durable medical equipment. This part also requires a cost that everybody on Medicare is responsible for, which changes every year.

This year’s cost is $185 and the increase coincides with cost of living adjustments for Social Security beneficiaries that were made by Congress earlier this year, Burlbaw said.

With Part C and Part D, they are added aspects to Medicare. Part C allows for additional private insurance that’s approved by Medicare and can offer additional benefits, such as dental, vision, and fitness that are not covered by A and B.

The final Part D is prescription drug coverage. This is an addition that covers pharmaceuticals for those without plans that already come with that prescription coverage.

People already enrolled in Medicare have the opportunity to review their coverage and evaluate what changes are coming with the next year.

“Overall, the average premium has gone up for Part D plans. I think that’s going to have the biggest impact as far as any changes for Medicare,” he said.

The Senior Source has three changes to keep in mind for next year including more than 15 common procedures for seniors will now require prior authorization, a decrease in Part D options and the increase in cases of scammers misleading older adults.

These changes could lead to delayed care or costs up to thousands of dollars, which can be stressful on a fixed income that many seniors use.

“I don’t recommend you go through every single plan and look at every single benefit,” Burlbaw said. “I think you focus on which plans your doctors accept, what plans cover your prescriptions, and to what extent meaning, what are your expected out of pocket costs, and then look at what the benefits might be.”

Enrollment is now open for those reviewing prior coverage with the deadline to select a new plan or remain on the same plan by December 7.