TYLER, Texas (KLTV) – Eight school districts in East Texas will hold elections in November on their tax rate.

Some East Texas school districts are asking voters to approve new property tax rate increases.

The districts holding what’s called Voter Approval Tax Rate Elections or VATRE are listed below with a brief description on how these increases impact residents.

Eustace ISD‘s Proposition A would keep the overall tax rate the same. The district is seeking voter approval to increase the maintenance and operations rate by 5 cents. The district is reducing the interest and sinking rate by 5 cents. The district states it will be forced to reduce staff if the measure fails.

Groveton ISD‘s Proposition A calls for an increase of $0.7819 per $100 taxable property. The district is looking to generate an estimated $954,035 in additional funds.

Hawkins ISD is seeking a three-cent tax increase to generate approximately $600,000 in additional funding. This will cost a property owner $18 per year on a $200,000 home.

Hemphill ISD‘s Proposition A calls for a seven-cent tax hike to $0.7369 per $100 valuation. The district states the increase will generate $851,826 in additional revenue that will be used to increase all staff salaries, repair infrastructure, install an elementary playground and purchase school buses.

Kilgore ISD‘s Proposition A calls for an increase in the maintenance and operations tax rate of 5 cents after the school board has restructured the interest and sinking tax rate by the same amount. The district states on its website that the proposition will keep the same overall tax rate for the district at $1.551.

Spring Hill ISD‘s Proposition A calls for an increase of $0.0321 per $100 of taxable property value. The district states the change would generate about $304,590 in additional annual funding.

Rains ISD‘s Proposition A calls for a nine-cent tax hike per $100 of taxable property. The district states this would provide $338,756 per year.

Whitehouse ISD states that although the district proposes a four-cent tax rate increase, the average homeowner will still see a reduction to their property tax bill if Proposition A passes. Because the Texas Legislature increased the homestead exemption, the average homeowner would see a $246.81 decrease in their property tax bill compared to last year. If the proposition fails, the average homeowner would see a decrease of $415.82.

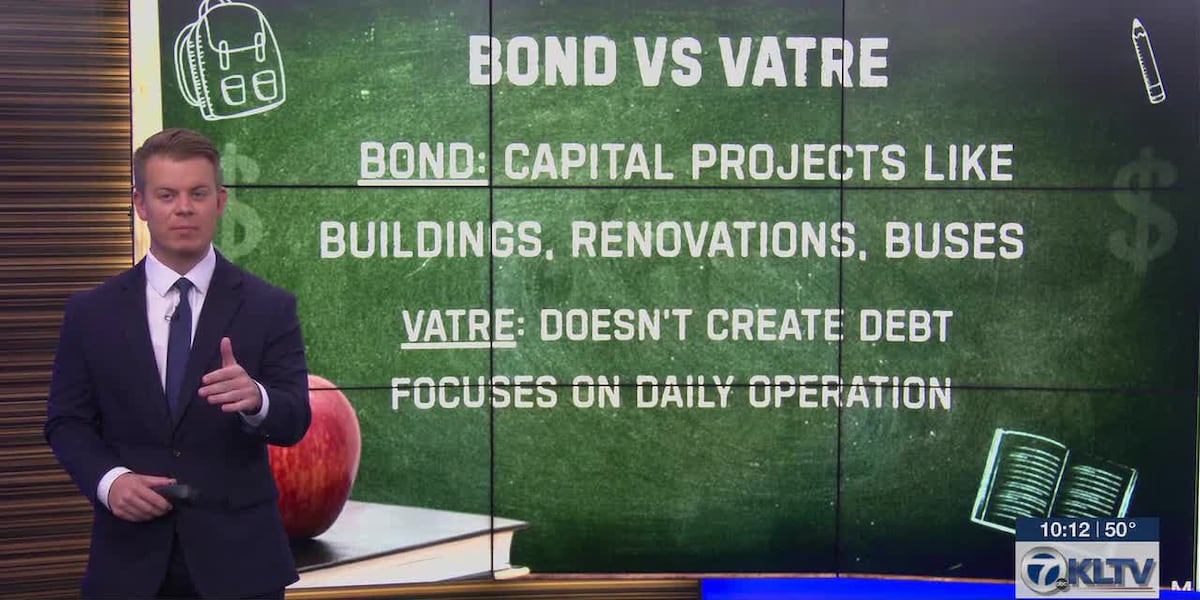

What is a VATRE?

A Voter-Approval Tax Rate Election is a local school finance election that asks voters to consider allowing the district to access additional pennies on the Maintenance & Operations tax rate. Voters will be asked whether they are FOR or AGAINST the 3 to 7 cent total tax rate change. The 2025 VATRE proposal carries a tax impact that is 66% less than last year’s proposal, while still generating significant new local revenue for Rockwall ISD classrooms and programs.

For Jeff Hutchins this will be his first election as the superintendent at Hawkins ISD. He and the districts school board are asking residents to approve a 3-cent tax increase to accomplish three things.

“When I got here in January there were a few obstacles that I wanted to address those include teacher raises, security and improving certain areas on campus,” said Hutchins.

Back in June, the city of Hawkins decided to fire its lone officer leaving no police force for the town.

“Right now, we don’t have police in Hawkins, so we contracted a constable to protect students and staff. We are also in the guardian program. With this tax rate increase we could add a second officer on campus or if we can get approval to create our own police force that would be ideal. We would have officers only working for the district,” said Hutchins.

For Spring Hill ISD, the district has four different propositions it is hoping to pass. Spring Hill ISD is asking voters to consider two ballot items in the upcoming election: A Voter-Approval Tax Rate Election (VATRE) for district operations. A Bond Proposal for facility maintenance and improvements.

Both measures are designed to address current and future needs of students, staff, and the community.

According to Spring Hill ISD’s website this is a breakdown of each proposition.

Proposition B – Cost: $17,222,744Renovations to the Junior High School – updates to classrooms, band hall, gym, cafeteria, including paint, flooring, lighting, student furniture, etc. as well as drainage improvementsHVAC system replacements across the districtReplacement of busesUpdates to the baseball/softball complex – including future turf replacement as warranted by safety protocolsProposition C – Cost: $1,975,000Updates to Panther Stadium – including future turf replacement as warranted by safety protocols, lighting upgrades, etc.Proposition D – Cost: $802,256Improvements to the tennis complex – including future restroom updates

Voters will have the opportunity to vote on each proposition separately. Those who are over the age of 65 will not have their tax rates impacted by the results of each district election.

Copyright 2025 KLTV. All rights reserved.