Voters in the East Central Independent School District rejected a property tax increase Tuesday that would’ve helped the fast-growing district address a budget deficit and cover basic costs.

Results show that more than 55% of voters opposed the proposition, known as a voter approved tax rate election or VATRE.

The tax rate increase would’ve unlocked an extra $7.6 million annually under the maintenance and operations rate for the district to spend on the day-to-day costs of running schools. Homeowners would’ve seen their rate go from 88 cents to slightly more than 98 cents per $100 of taxable value.

East Central ISD officials planned to use the extra funds for school safety and security, employee benefits, student programs and pay raises for teachers and other employees who didn’t qualify for mandated raises from the state earlier this year.

Officials also say the money would have “helped maintain financial stability and transparency.”

East Central is currently facing a $4.6 million structural deficit and has reduced the budget by 10% for the last two school years, and will probably do so this year.

East Central’s financial struggles are not unique.

Most school districts in Texas face budget deficits, citing rising costs, inflation and no significant increase to the base amount that public schools receive per student since 2019.

Earlier this year, state lawmakers passed $8.5 billion for public schools, but districts are required to use most of their state funding on pay raises for teachers with more than two years of experience, leaving out newer teachers and other employees who work with students like librarians and counselors.

School districts are also on the hook for covering the cost of implementing those raises, keeping several districts in financial shortfalls.

Putting more limits on school districts’ revenue collecting power, the November ballot also included state propositions to increase homestead exemptions that apply to school district tax rates.

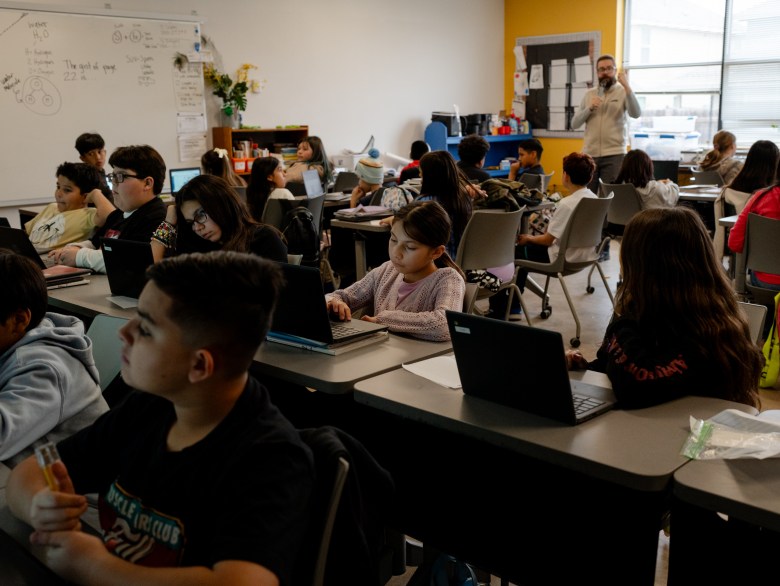

School districts in the San Antonio area, like the overcrowded East Central ISD, want voters to approve tax increases to cover the day-to-day costs of running schools. Credit: Brenda Bazán / San Antonio Report

School districts in the San Antonio area, like the overcrowded East Central ISD, want voters to approve tax increases to cover the day-to-day costs of running schools. Credit: Brenda Bazán / San Antonio Report

Voter-approved tax rate elections are also a way for districts to pull down more dollars from the state. Nearly half of the annual $7.6 million East Central will get will come from the state through the “golden penny” mechanism, in which the state matches what taxpayers contribute based on a district’s property values.

Of the proposed 5-cent increase, East Central would’ve claimed three golden pennies, and the state would’ve paid the district $1.35 for every dollar the taxpayers contribute.

Unlike most school districts in San Antonio, East Central’s enrollment grows every year, increasing need for services, teachers and school buildings. In May, voters approved a $309 million bond measure to build three new schools, giving way for the district to increase the tax rate by 8 cents under the interest and sinking rate.

Voters rejecting the tax measure could negatively affect the district’s ability to pass future bonds, even though they’re two completely different rates.

During an Oct. 17 public school funding panel, East Central’s superintendent Roland Toscano said the district would have to keep passing budget deficits and dipping into its general fund balance if the tax rate increase didn’t pass.

“And tapping into our fund balance over time affects our bond rating, which within a community like ours, is developing rapidly in our future. And so it’s going to have a sustained negative effect on our taxpayer,” Toscano said.

Reporter Gisell Campos contributed to this article.