In Lubbock, Max Tarbox is trying to figure out how many companies Joshua Allen owns to collect a lawsuit judgment against Allen breaching his duty to other investors in the Amarillo Walk-On’s restaurant.

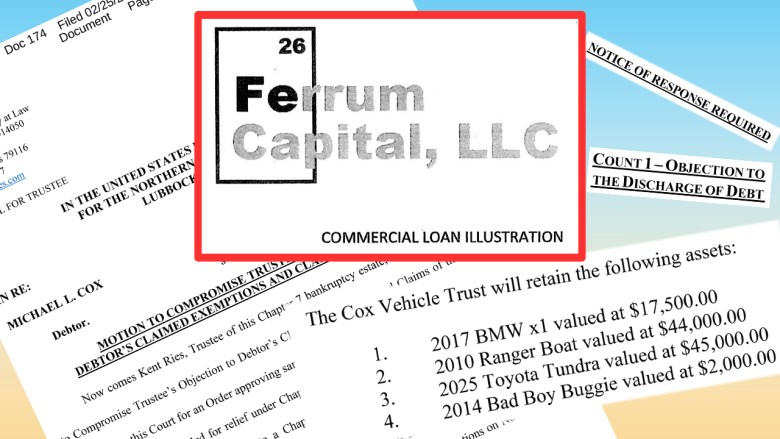

In San Antonio, attorneys believe a $1.175 million payment is just the first to help hundreds of Ferrum Capital victims recover some of their millions in investments.

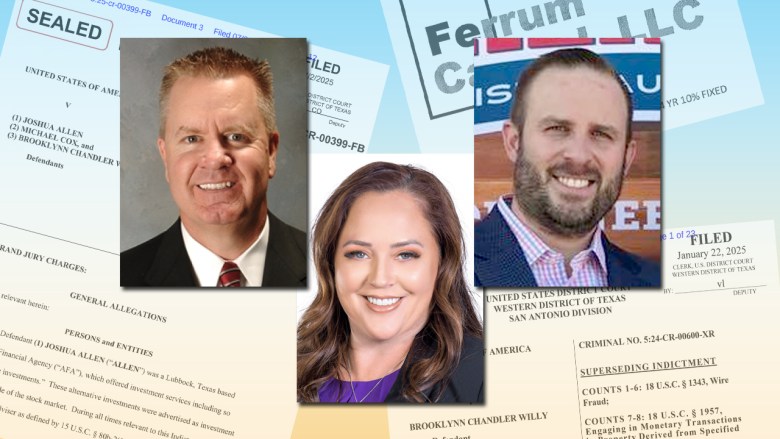

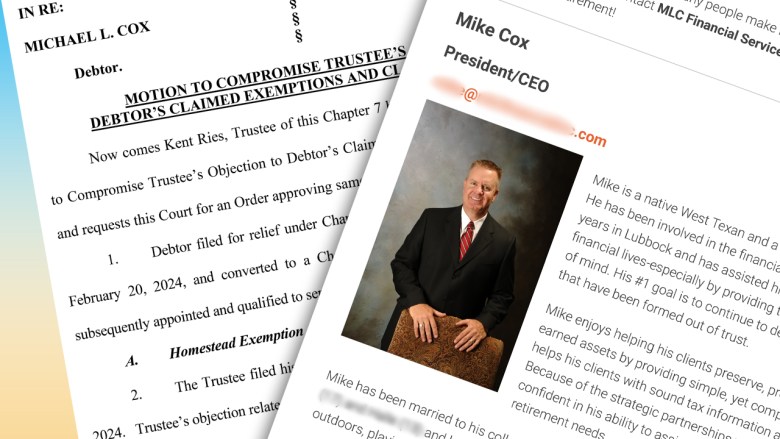

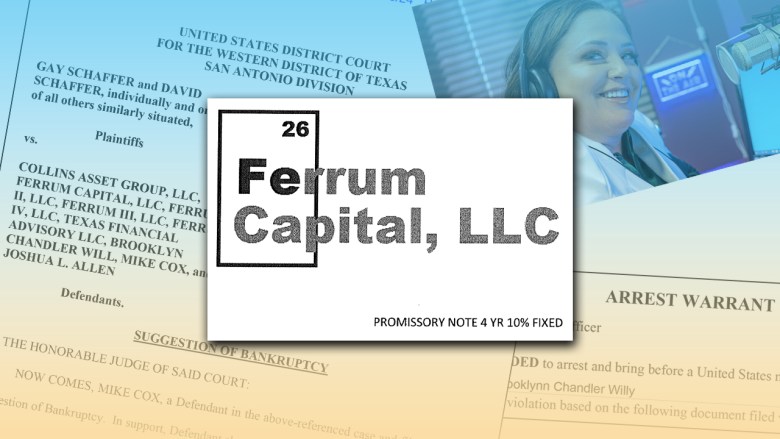

Allen and his fellow Ferrum cofounder Michael Cox – both of Lubbock – are under federal indictment for securities fraud by a San Antonio grand jury. So is their affiliate Brooklyn Chandler Willy. They face an April 2026 trial date.

Meanwhile, “receivers” – court-appointed managers – are busy.

Allen stands to lose control over a series of companies he owns, partially owns or controls.

“I’m still trying to locate and identify all of his property interests,” Tarbox told LubbockLights.com Monday.

Tarbox asked permission from a judge last week to take control of Allen’s ownership interests in various companies.

John Patrick Lowe, the San Antonio receiver, is working to get millions of dollars back for hundreds of victims in the Ferrum case, which the FBI described in October as “characteristic of Ponzi fraud schemes.”

Royal Lea, an attorney working with Lowe, said, “It’s not like the $1.175 million is all there’s ever going to be. I expect more. But as an interim payment, the court ordered the trustee to pay the receiver the $1.175 million.”

That money will eventually go back to Ferrum victims – not just the ones who sued in San Antonio, Lea said.

“There are about 87 plaintiffs in that one particular piece of litigation, but there are a number of other Ferrum investors who never filed a lawsuit. They’re all part of the receivership,” Lea said.

LubbockLights.com reached out to attorneys for Allen, Cox and Willy on previous occasions. So far they have declined to comment. LubbockLights.com found a cell phone number for Allen and left a message. He did not call back.

The Ferrum case

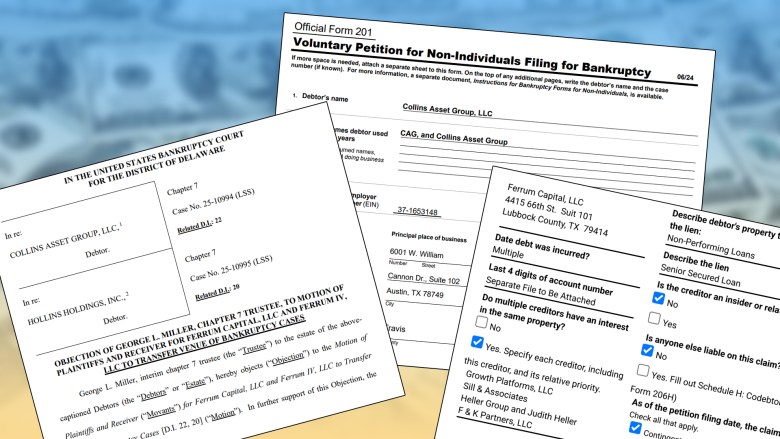

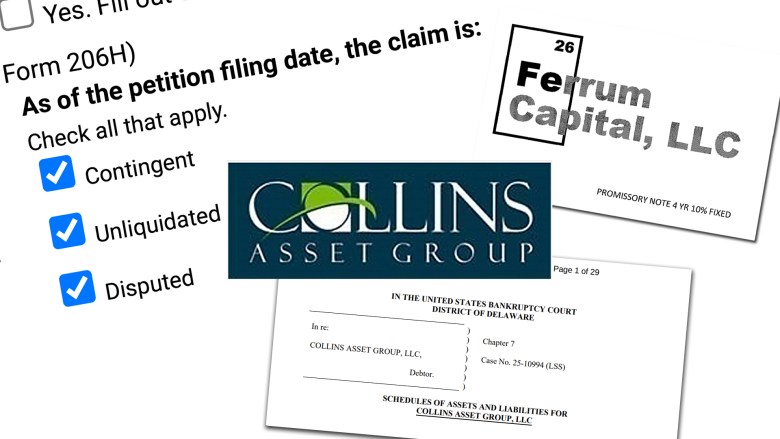

LubbockLights.com reported a victory for Lowe last week in the bankruptcy of Collins Asset Group. Collins borrowed more than $47 million from Ferrum between 2017 through most of 2023.

A judge ordered a bankruptcy trustee to pay the Ferrum receivership more than $1 million.

Lea does not have a timetable of when victims may see money.

“I don’t have a time estimate for you. … I think there will be additional litigation against affiliates of Collins in the bankruptcy court. And that’s a potential source of recovery,” Lea said.

“The receiver [Lowe] has his pending litigation against Allen and Cox and Willy in the state court. We’ll be proceeding with that, and that’s set for trial in October next year,” Lea said.

Ferrum Capital, previous coverage

November 21, 2025

November 7, 2025

October 8, 2025

Ferrum criminal trial – Allen, Cox and Willy – pushed back until next year

September 5, 2025

Ferrum detour to Delaware ends; what that means for victims in Lubbock, San Antonio

July 29, 2025

July 24, 2025

July 16, 2025

‘Finally … in shackles’ – Ferrum victims ‘ecstatic’ about criminal charges against Allen and Cox

July 10, 2025

July 9, 2025

June 19, 2025

Attorneys trying to recover money in Ferrum cases concerned about legal processes moving to Delaware

June 13, 2025

Two companies tied to Ferrum and securities fraud FBI investigation go bankrupt

June 9, 2025

May 20, 2025

May 2, 2025

Cox deal to keep his house approved but some of his bankruptcy protections lost

April 30, 2025

April 29, 2025

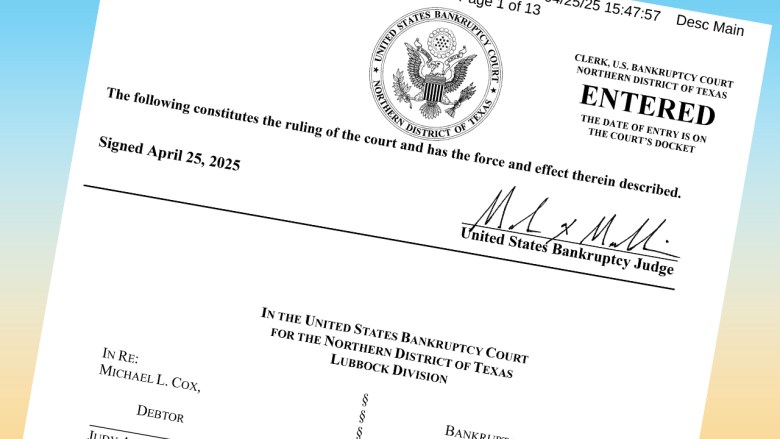

April 25, 2025

New bankruptcy judge appointed in Lubbock – to oversee cases across much of West Texas

April 15, 2025

‘They robbed people blind,’ says upset Lubbock attorney representing dozens in Ferrum Capital case

March 28, 2025

March 28, 2025

March 10, 2025

March 4, 2025

January 27, 2025

December 23, 2024

The Walk-On’s case

In March, LubbockLights.com did a paid search of official state records and found Allen owned or was an officer in 43 companies registered with the Texas Secretary of State. At that time, 33 were still in existence.

Some of the more prominent ones based on court records were: Allen Financial Agency, Inc.; Ferrum Capital, LLC; Ferrum II, LLC; Ferrum III, LLC; Ferrum IV, LLC; Landzacha, LLC; QUBALL Holdings, LLC; RaiderLand Property Management; Slam-Dunk Food, LLC; WO Amarillo, LLC; and WO McKinney, LLC.

Even though Tarbox is an attorney, he asked District Court Judge John Grace for permission to hire Ed Price as the receivership attorney. Price has been involved in the Ferrum case too through one of many lawsuits. On November 4, Grace granted the request.

Is something like that common?

“It’s very common. In fact, sometimes it’s hard for a receiver to hire himself as an attorney,” Tarbox said.

For example, Tarbox might be called as a witness in a court hearing.

“The receiver can hire all sorts of professionals – such as accountants and real estate people, real estate agents, Realtors – whatever tools he needs to do his job,” Tarbox said.

Price, on behalf of Tarbox, filed a motion to take away Allen’s companies.

The motion said, “Preliminary investigation reveals that Allen has placed most of his ill-gotten gains into a network of limited liability companies. … Allen is the sole or controlling member of most of these entities and uses them to conceal and control property obtained through fraudulent means.”

Motion to take control

A portion of the November 17 request to take control of Allen’s companies said:

On August 7, 2025, this Court entered its Order Appointing Receiver (the “Receivership Order”), appointing Max Tarbox as Receiver over all non-exempt property of Joshua Allen for the purpose of locating, securing, managing, and liquidating such property for the benefit of creditors and victims of Allen’s fraudulent schemes.

Since his appointment, the Receiver has undertaken substantial efforts to identify Allen’s property and assets. Preliminary investigation reveals that Allen has placed most of his ill-gotten gains into a network of limited liability companies formed under the laws of Texas and other jurisdictions.

These LLCs appear to hold title to real estate and/or serve as holding companies that own membership interests in other entities which, in turn, own real property or other valuable assets. Upon information and belief, Allen is the sole or controlling member of most of these entities and uses them to conceal and control property obtained through fraudulent means.

… The Receiver respectfully requests that the Court enter an order:

Authorizing the Receiver to take immediate possession, custody, and control of any and all membership or ownership interests in limited liability companies, corporations, partnerships, or similar entities in which Joshua Allen holds, directly or indirectly, any legal, equitable, or beneficial interest;

Empowering the Receiver to exercise all management, voting, and ownership rights associated with such interests, including the authority to change registered agents, amend organizational documents, access bank and financial records, and act as managing member or officer of the entities as necessary;

Authorizing the Receiver to obtain and review all records, books, ledgers, and accounts of such entities, whether held by accountants, agents, or third parties;

Authorizing the Receiver to take such steps as may be necessary to preserve, manage, or liquidate the assets of those entities, subject to further Court approval prior to sale or distribution of proceeds; and

Granting such other and further relief, both at law and in equity, to which the Receiver may be justly entitled.

Tarbox was uncertain of the timetable on getting a ruling from Grace, but it would be “at the judge’s convenience.”

When asked how much money might be in Allen’s companies, Tarbox answered, “I don’t know yet.”

“I would be taking over his interest in the company, which is a different thing than the company itself,” Tarbox said.

There are circumstances when a receiver might end up with 100 percent of a company and need to manage the company’s affairs.

However, Tarbox does not think he’ll be required to do any company management.

Tarbox added it makes no difference if Allen is convicted and goes to prison. The receivership continues either way.

Related

Related posts