August 22, 2025

Earlier this year, precarity emerged as the defining mindset across Canada. At a time when housing pressures were mounting, healthcare strains were deepening, and job insecurity lingered, Canadians began to question not just whether they could afford what they needed today, but whether the systems they rely on – housing, healthcare, stable work, even national security – would hold up tomorrow. Pressures from the U.S., including tariff threats and questions of sovereignty, only amplified this sense of instability and cast doubt on the resilience of the country itself.

This anxiety played out directly in the federal election. Canadians most attuned to these pressures gravitated toward Carney and the Liberals, seeking calm and reassurance in a period of turbulence. Others, frustrated by years of economic strain and institutional drift, turned to Poilievre and the Conservatives, whose promise of bold change and disruption appealed to those who saw the status quo as part of the problem. In the end, Carney’s message of stability won out, resonating with a country craving certainty in a time where there was little of it.

But since April, that reassurance has been difficult to sustain. The threat of U.S. tariffs has not gone away. Carney has yet to secure a trade deal with the Trump administration. Housing pressures remain relentless. And the cost of living continues to dominate Canadians’ concerns. The question now is whether the Liberals have delivered the security voters were looking for, or whether the country has slipped further into a heightened state of precarity.

The Shifting Distribution of Precarity

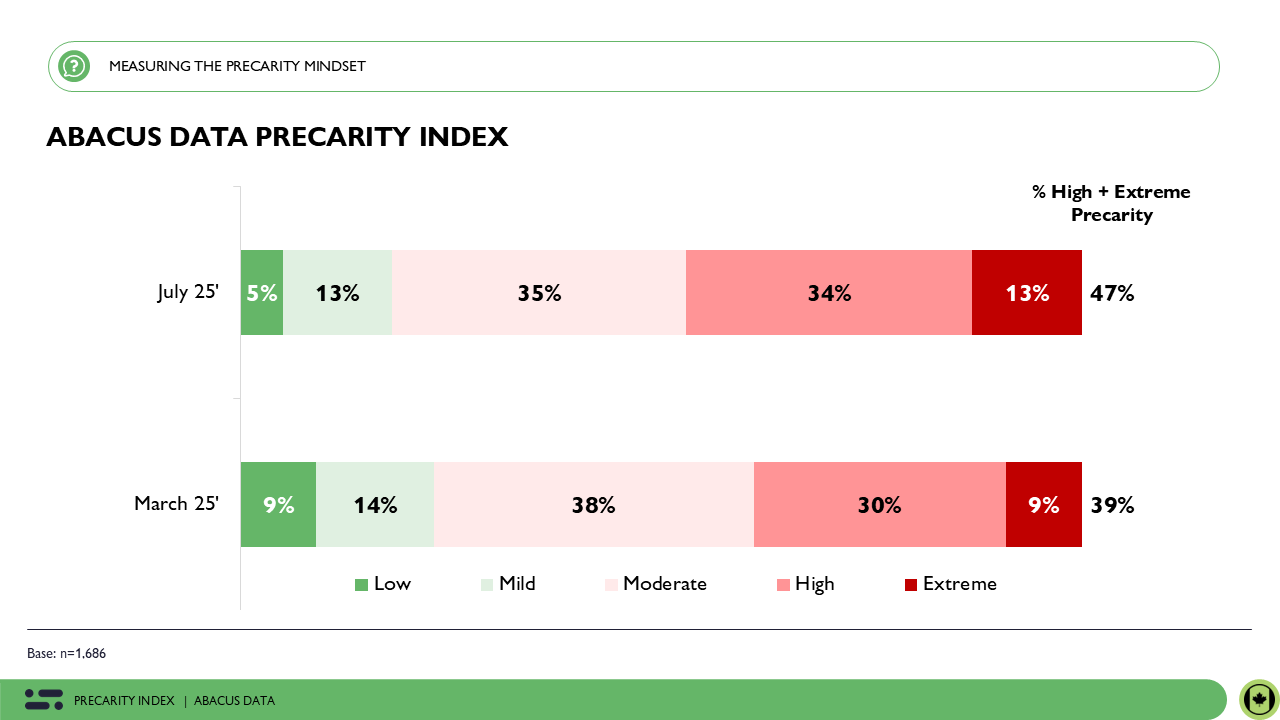

Since March 2025, the distribution of Canadians across the Abacus Data Precarity Index has shifted in ways that highlight a growing polarization. The middle ground is eroding, with fewer Canadians feeling secure and more clustering at the high and extreme ends of precarity.

Low Precarity has dropped nearly in half (5% vs. 9% in March 25’), showing that fewer Canadians feel shielded from disruption or confident in their ability to navigate uncertainty.

Mild Precarity remains virtually unchanged (13% vs. 14%), but this stability masks the broader hollowing out of the middle ground.

Moderate Precarity, still the single largest group, fell slightly to 35% from 38%, reflecting a shrinking share of Canadians who balance anxiety with cautious optimism.

High Precarity rose notably (34% vs. 30%), indicating that stress about finances, climate change, and technology is increasingly shaping everyday decisions.

Extreme Precarity surged to 13% from 9% – a sharp rise that reflects how persistent global tensions, economic volatility, and uncertainty about the future are feeding a sense that sudden or long-term shocks could fundamentally upend people’s lives.

All told, Canada is experiencing a hollowing out of the middle ground, with fewer Canadians sitting in relative comfort and more pushed toward higher levels of vulnerability. This polarization creates an increasingly fractured social and political landscape where experiences of stability and instability are moving further apart.

Demographic Drivers: Rising Anxiety Across the Board

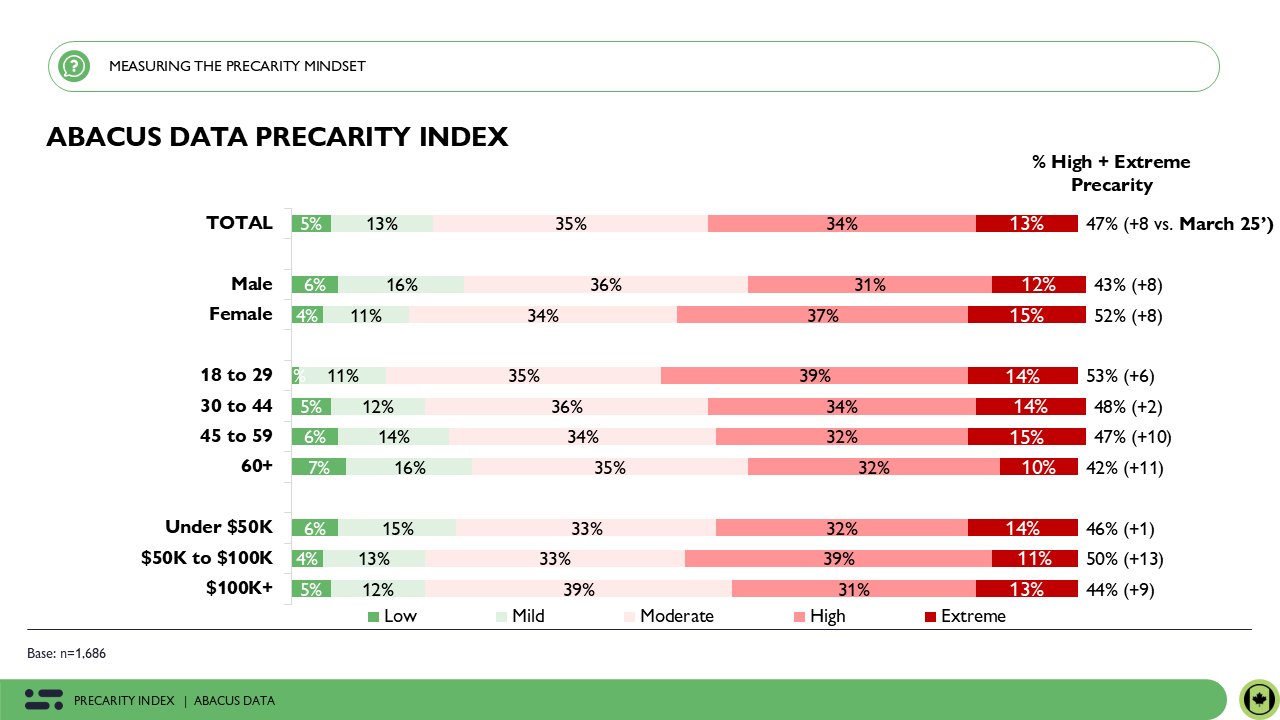

The results show that, since March 2025, precarity has spread well beyond the groups traditionally most exposed to risk. While youth, women, and lower-income households remain the most likely to have high levels of precarity overall, older and higher-income Canadians – once more buffered from volatility – are now experiencing significant increases in perceived precarity.

Age: Younger adults remain the most precarious, with the highest concentration in the high and extreme categories. But the most dramatic increases came from older cohorts: those aged 45–59 reported a 10-point rise in high or extreme precarity, while those 60+ jumped by 11 points. This signals that precarity is now reaching groups once buffered by retirement savings, pensions, and homeownership.

Gender: Women continue to show higher levels of precarity than men, especially at the high and extreme ends. Yet both groups experienced an 8-point increase, underscoring that while women remain most vulnerable, men are also feeling more exposed than in the past.

Income: Lower-income households still face the highest levels of precarity overall, but the steepest increases are now coming from middle- and higher-income Canadians. Those earning $50–100k reported a 13-point rise in high or extreme precarity, while households earning $100k+ climbed 9 points. What was once a relatively secure middle- and upper-income cushion is showing signs of strain.

The groups historically most vulnerable – youth, women, and lower-income Canadians – remain the most likely to feel precarity, but anxiety and uncertainty is spreading quickly among those who once felt stable. This broadening of precarity across demographics signals that insecurity is becoming a shared Canadian experience, not a marginal one.

Political Implications: Precarity and Vote Intentions

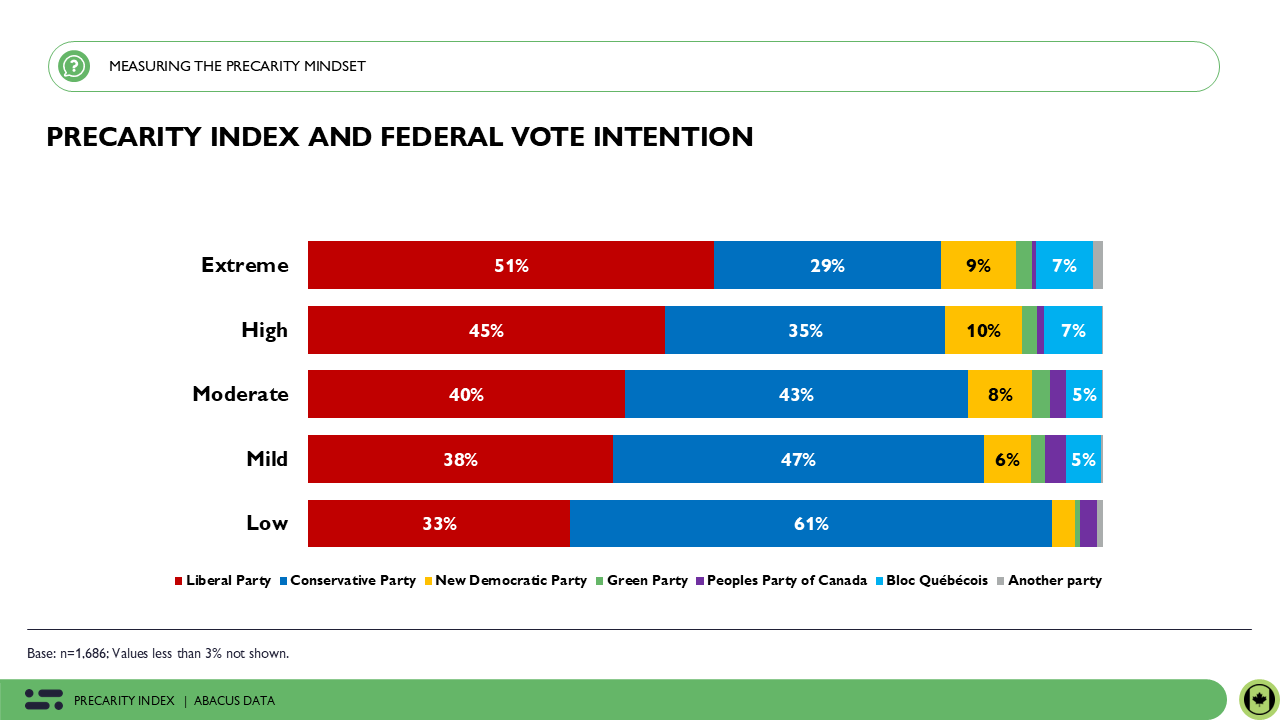

Political preferences are increasingly shaped by the lens of precarity. Among Canadians in extreme precarity, 51% say they would vote Liberal, compared to just 33% in low precarity. Conversely, Conservative support dominates among those with low precarity (61%), underscoring a stark divide.

These results suggest that Canadians most unsettled by economic, environmental, and social turbulence gravitate toward the Carney-led Liberals, viewing them as the safer option to provide protection and stability. Those who feel more shielded from disruption, however, align more strongly with the Conservatives. The Abacus Data Precarity Index thus provides a powerful lens for understanding not just individual anxieties, but also the political polarization that flows from them.

How Canadians See the Next Five Years: Optimism is Very Limited

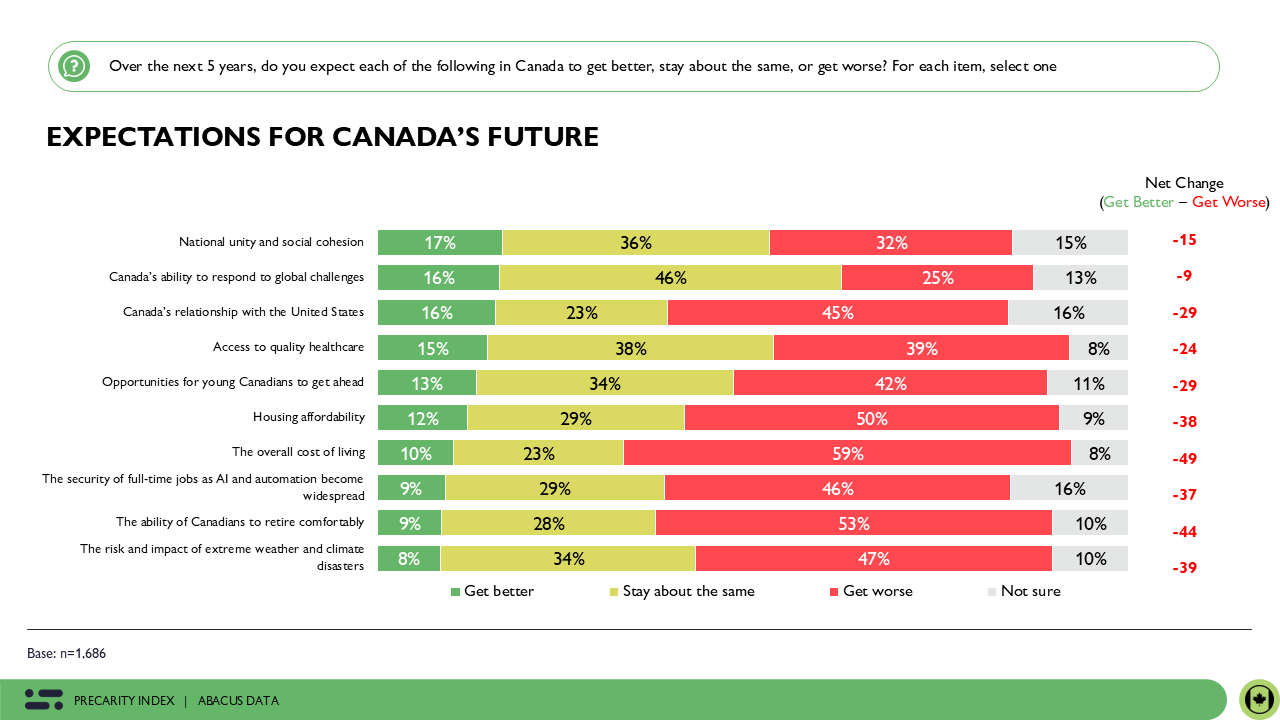

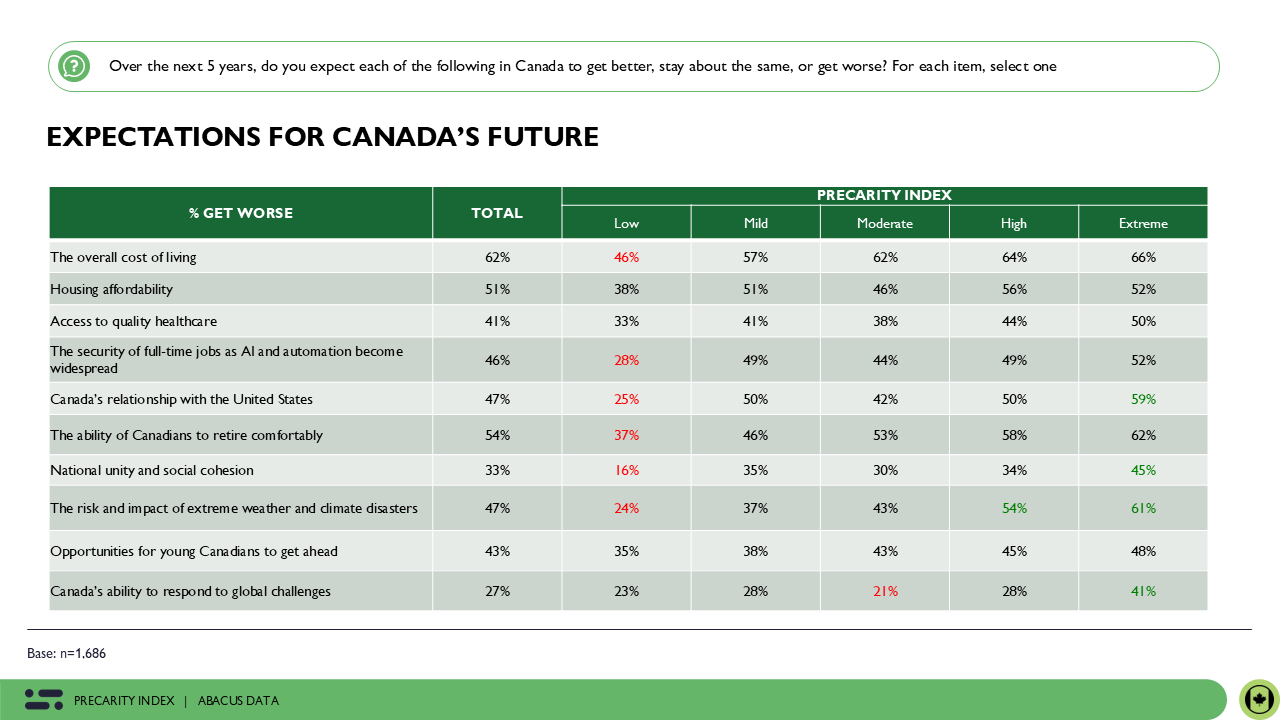

Looking ahead, Canadians see little relief on the horizon. Most believe that the very pressures driving today’s precarity will not only persist but intensify over the next five years.

Cost of living: 59% expect conditions to worsen, compared to just 10% who see improvement, reinforcing the sense that financial strain is becoming a permanent feature of Canadian life.

Housing affordability: Half (50%) anticipate further decline, while only 12% foresee progress, signaling little confidence that current policies will bring relief to one of the country’s most pressing crises.

Climate risks: Nearly half (47%) believe extreme weather and climate disasters will worsen, with just 8% expecting improvements, pointing to mounting anxieties about environmental resilience.

Job security: 46% predict stable, full-time work will erode, compared to 8% who expect gains, as fears of automation and AI disrupting employment intensify.

Canada–U.S. relations: 45% foresee a deterioration in ties with Canada’s closest ally, against 16% who expect improvement, amplifying uncertainty about the country’s geopolitical footing.

In other areas, Canadians anticipate more stagnation than progress. Nearly half (46%) expect Canada’s ability to respond to global challenges to remain unchanged, while significant numbers believe access to healthcare (38%) and national unity (36%) will hold steady.

Taken together, these views paint a sobering picture: Canadians are bracing for decline in the areas that matter most to their day-to-day lives like costs, housing, jobs, climate, and international stability, while expecting little positive momentum elsewhere. The mood is not one of collapse, but of stagnation layered with fragility, where the future feels less like a source of opportunity and more like a continuation of the pressures already weighing heavily on the country today.

At the same time, there’s a striking gap between what Canadians expect and what may plausibly unfold. Few anticipate worsening strains on national unity or the disruptive impact of AI, yet the evidence points in the opposite direction. The likely election of the Parti Québécois in Quebec next year will inevitably stoke renewed talk of independence, testing Canada’s political cohesion in ways not seen for a generation. Similarly, while only a minority foresee AI-driven instability, the technology is almost certain to upend large swaths of the labour market, especially in white-collar sectors where Canadians may feel least vulnerable. This disconnect matters – when pressures materialize that the public is not braced for, the resulting shock can deepen precarity and sour the national mood even further. History suggests that disappointment hits hardest when expectations are misaligned with reality. If Canadians are already girding themselves for stagnation, but then face unanticipated political and economic jolts, the sense of fragility could quickly harden into disillusionment.

What Canadians Believe Could Happen

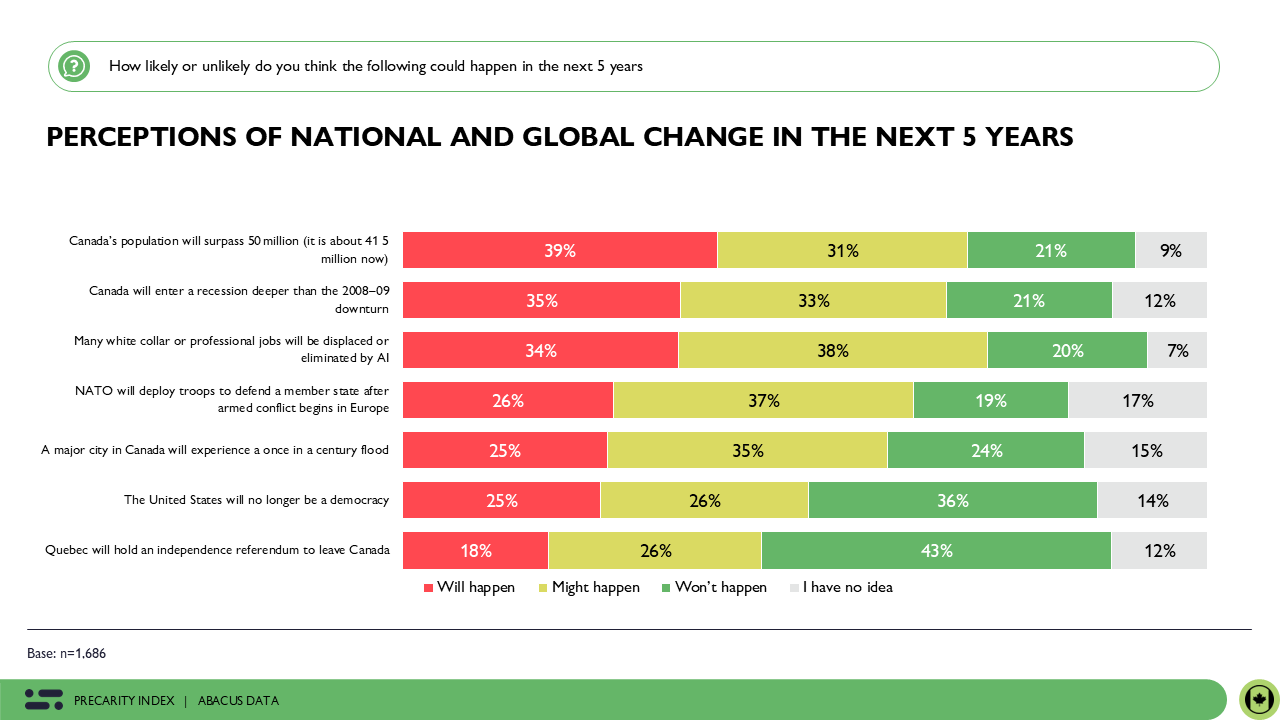

When asked about major events that may unfold over the next five years, Canadians reveal a mix of skepticism and inevitability. Many expect transformative or destabilizing changes, while dismissing others as unlikely.

39% believe Canada’s population will surpass 50 million.

35% expect a recession deeper than the 2008–09 downturn.

34% believe many white-collar and professional jobs will be displaced by AI.

By contrast, few Canadians see other disruptive events as likely: 43% believe Quebec will not hold an independence referendum, and 36% believe the U.S. will not cease to function as a democracy.

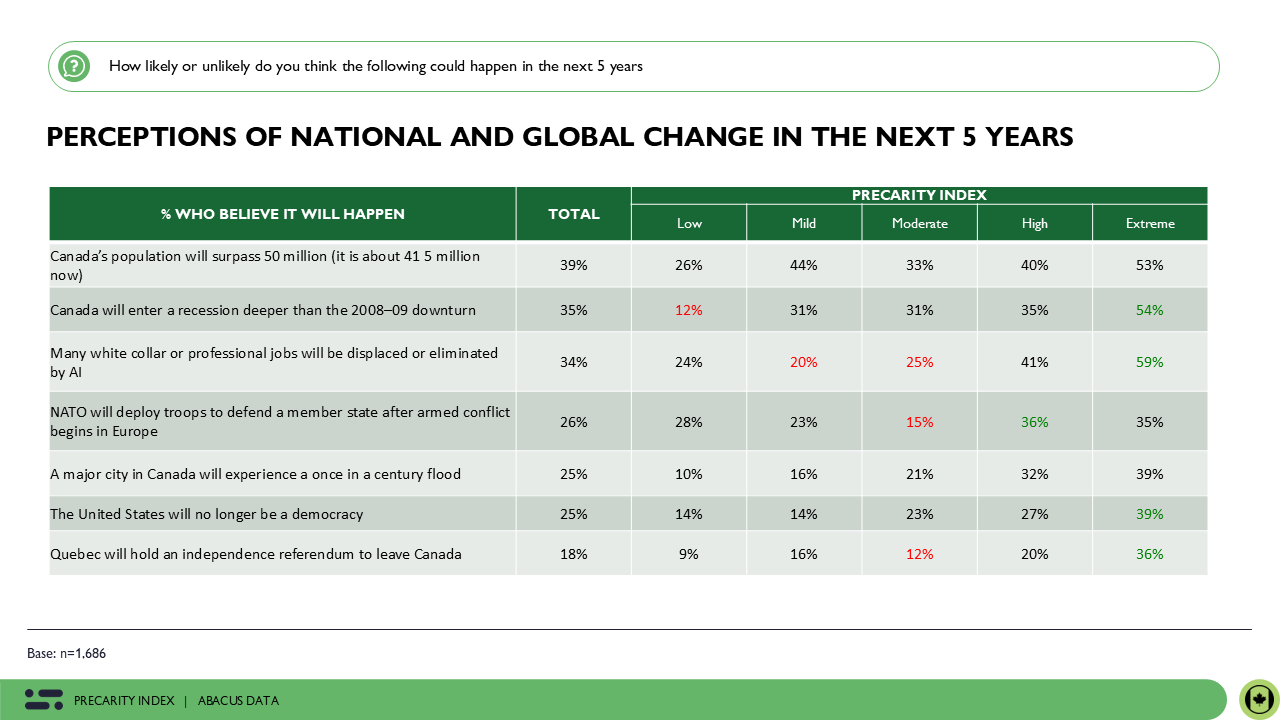

Here again, precarity is a key dividing line. Those in high or extreme precarity are significantly more likely to expect major disruptions. Among those in extreme precarity, 54% predict a severe recession, 59% expect widespread job losses from AI, 39% believe the U.S. will no longer function as a democracy, and 36% anticipate Quebec holding an independence referendum.

These results underline a central insight: Canadians who feel most vulnerable are also the most likely to expect disruption – both economic and political – on the horizon. For them, precarity is not just a description of the present, but a lens through which they view the future.

THE UPSHOT

Since March 2025, the most striking shift in the Abacus Data Precarity Index is the surge in Canadians experiencing high or extreme precarity. Nearly half the country now sits in these categories – a sharp rise in just a few months – showing that anxiety and vulnerability are no longer fleeting pressures but structural realities. The middle ground is eroding, with fewer Canadians feeling insulated from disruption and more being pulled to the precarious extremes.

While everyday conversations remain focused on the micro-level pressures – affordability, housing, healthcare access – many Canadians are less aware of the macro-level risks that could reshape the country in even more disruptive ways. Issues like the aging population and its strain on healthcare, the unresolved question of Quebec’s place in Confederation, and the durability of Canada’s relationship with the United States remain largely in the background of public attention. Yet as these larger structural risks become clearer, they could amplify the very sense of vulnerability already gripping households.

The result is a dangerous feedback loop: micro anxieties fuel macro concerns, and macro threats reinforce micro insecurities. Canadians who already feel precarious today are also the most likely to expect major disruptions tomorrow – whether from AI reshaping the workforce, a severe recession, or even the weakening of democratic institutions abroad.

This means Canada may only be at the beginning of a longer arc: a period where extreme precarity expands, where fewer Canadians see stability as achievable, and where social and political polarization hardens. The question is no longer whether Canadians can weather temporary shocks, but whether they believe the systems and institutions underpinning the country are resilient enough to endure the next wave of challenges.

METHODOLOGY

The survey was conducted with 1,686 Canadian adults from July 31 to August 7, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.39%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/ck on schedule. It’s whether people believe their government acted fairly, reluctantly, and transparently when faced with a hard choice.

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.