Aug 26, 2025

IndexBox has just published a new report: U.S. – Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations – Market Analysis, Forecast, Size, Trends And Insights.

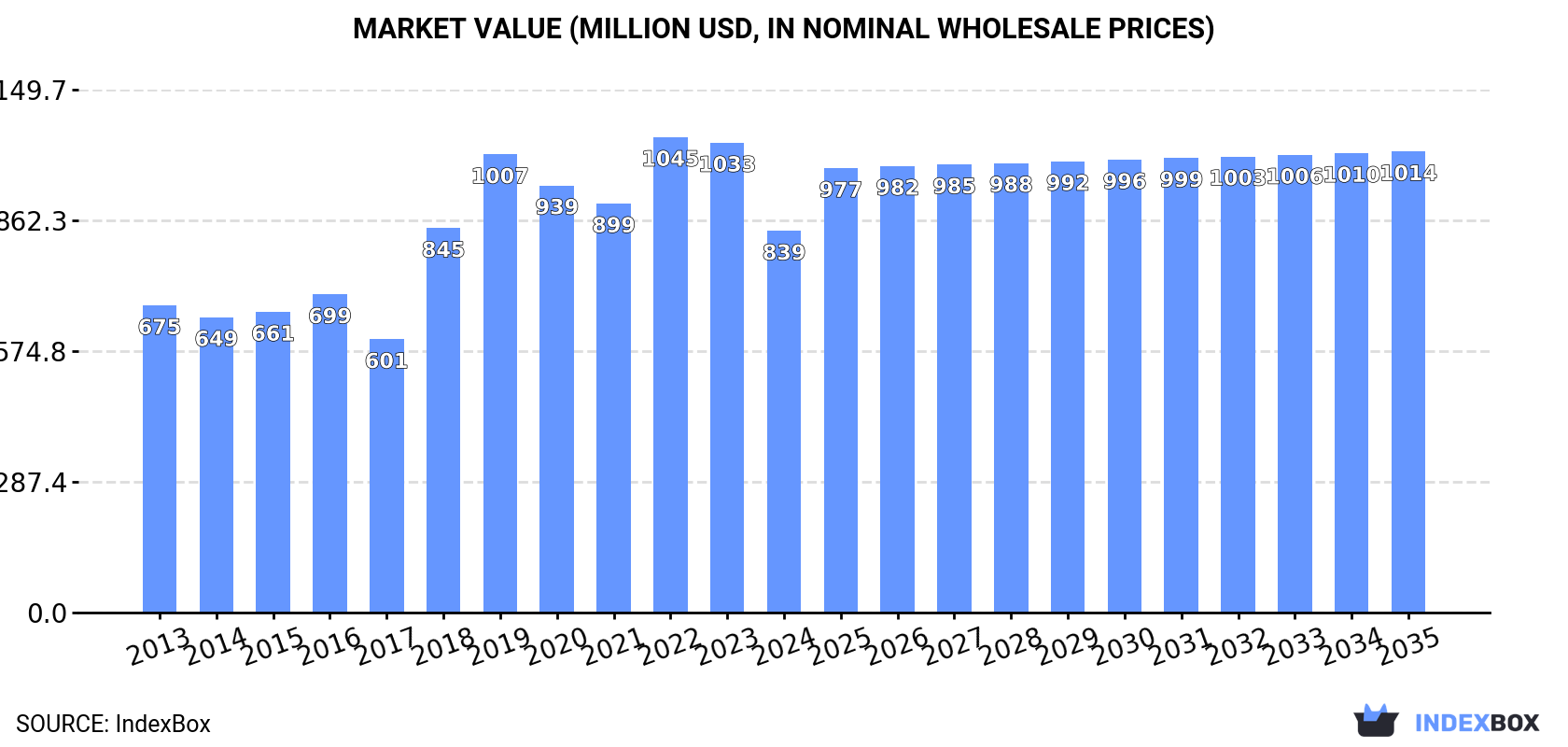

The United States market for artificial graphite and related products is expected to experience a steady increase in demand over the next decade. Forecasted to grow at a CAGR of +1.3% in volume and +1.7% in value from 2024 to 2035, the market is projected to reach 475K tons and $1B (in nominal wholesale prices) by the end of 2035. This growth trend is driven by the rising need for artificial graphite and related products in various industries within the United States.

Market Forecast

Driven by increasing demand for artificial graphite, colloidal, semi-colloidal graphite and preparations in the United States, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to retain its current trend pattern, expanding with an anticipated CAGR of +1.3% for the period from 2024 to 2035, which is projected to bring the market volume to 475K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +1.7% for the period from 2024 to 2035, which is projected to bring the market value to $1B (in nominal wholesale prices) by the end of 2035.

ConsumptionUnited States’s Consumption of Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations

ConsumptionUnited States’s Consumption of Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations

In 2024, after two years of growth, there was decline in consumption of artificial graphite, colloidal, semi-colloidal graphite and preparations, when its volume decreased by -1.9% to 413K tons. Overall, consumption, however, saw a relatively flat trend pattern. As a result, consumption reached the peak volume of 454K tons. From 2020 to 2024, the growth of the consumption remained at a lower figure.

The value of the artificial and colloidal graphite market in the United States shrank remarkably to $839M in 2024, reducing by -18.8% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Over the period under review, the total consumption indicated a tangible expansion from 2013 to 2024: its value increased at an average annual rate of +2.0% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, consumption decreased by -19.7% against 2022 indices. Artificial and colloidal graphite consumption peaked at $1B in 2022; however, from 2023 to 2024, consumption remained at a lower figure.

ProductionUnited States’s Production of Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations

In 2024, the amount of artificial graphite, colloidal, semi-colloidal graphite and preparations produced in the United States shrank to 317K tons, reducing by -2.5% compared with 2023. In general, production, however, recorded a relatively flat trend pattern. The most prominent rate of growth was recorded in 2014 when the production volume increased by 18%. Over the period under review, production reached the peak volume at 370K tons in 2020; however, from 2021 to 2024, production stood at a somewhat lower figure.

In value terms, artificial and colloidal graphite production skyrocketed to $2.1B in 2024. The total output value increased at an average annual rate of +1.9% over the period from 2013 to 2024; the trend pattern remained consistent, with only minor fluctuations throughout the analyzed period. As a result, production attained the peak level and is likely to continue growth in the immediate term.

ImportsUnited States’s Imports of Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations

In 2024, purchases abroad of artificial graphite, colloidal, semi-colloidal graphite and preparations decreased by -4.8% to 128K tons, falling for the second consecutive year after two years of growth. In general, imports recorded a relatively flat trend pattern. The most prominent rate of growth was recorded in 2018 with an increase of 62% against the previous year. Over the period under review, imports hit record highs at 168K tons in 2022; however, from 2023 to 2024, imports failed to regain momentum.

In value terms, artificial and colloidal graphite imports plummeted to $467M in 2024. Overall, imports, however, posted a remarkable increase. The pace of growth appeared the most rapid in 2018 when imports increased by 137%. Over the period under review, imports hit record highs at $627M in 2022; however, from 2023 to 2024, imports stood at a somewhat lower figure.

Imports By Country

In 2024, China (87K tons) constituted the largest supplier of artificial and colloidal graphite to the United States, accounting for a 68% share of total imports. Moreover, artificial and colloidal graphite imports from China exceeded the figures recorded by the second-largest supplier, Mexico (7.6K tons), more than tenfold. The third position in this ranking was held by South Korea (5.2K tons), with a 4% share.

From 2013 to 2024, the average annual rate of growth in terms of volume from China totaled +8.0%. The remaining supplying countries recorded the following average annual rates of imports growth: Mexico (+4.4% per year) and South Korea (+50.5% per year).

In value terms, China ($279M) constituted the largest supplier of artificial graphite, colloidal, semi-colloidal graphite and preparations to the United States, comprising 60% of total imports. The second position in the ranking was taken by South Korea ($44M), with a 9.4% share of total imports. It was followed by Mexico, with a 7.6% share.

From 2013 to 2024, the average annual growth rate of value from China totaled +18.1%. The remaining supplying countries recorded the following average annual rates of imports growth: South Korea (+52.0% per year) and Mexico (+16.4% per year).

Imports By Type

In 2024, artificial graphite (111K tons) constituted the largest type of artificial graphite, colloidal, semi-colloidal graphite and preparations supplied to the United States, with a 87% share of total imports. Moreover, artificial graphite exceeded the figures recorded for the second-largest type, carbonaceous pastes for electrodes and furnace linings (9.3K tons), more than tenfold. Graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (6.7K tons) ranked third in terms of total imports with a 5.2% share.

From 2013 to 2024, the average annual growth rate of the volume of artificial graphite imports amounted to +7.2%. With regard to the other supplied products, the following average annual rates of growth were recorded: carbonaceous pastes for electrodes and furnace linings (-17.7% per year) and graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (+4.0% per year).

In value terms, artificial graphite ($421M) constituted the largest type of artificial graphite, colloidal, semi-colloidal graphite and preparations supplied to the United States, comprising 90% of total imports. The second position in the ranking was taken by graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures ($26M), with a 5.5% share of total imports. It was followed by carbonaceous pastes for electrodes and furnace linings, with a 2.8% share.

From 2013 to 2024, the average annual rate of growth in terms of the value of artificial graphite imports stood at +13.3%. With regard to the other supplied products, the following average annual rates of growth were recorded: graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (+5.7% per year) and carbonaceous pastes for electrodes and furnace linings (-12.4% per year).

Import Prices By Type

The average artificial and colloidal graphite import price stood at $3,641 per ton in 2024, shrinking by -12.9% against the previous year. In general, the import price, however, continues to indicate a prominent expansion. The most prominent rate of growth was recorded in 2018 an increase of 46% against the previous year. Over the period under review, average import prices reached the maximum at $4,180 per ton in 2023, and then contracted in the following year.

There were significant differences in the average prices amongst the major supplied products. In 2024, the product with the highest price was colloidal or semi-colloidal graphite ($7,999 per ton), while the price for carbonaceous pastes for electrodes and furnace linings ($1,413 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by carbonaceous pastes for electrodes and furnace linings (+6.4%), while the prices for the other products experienced more modest paces of growth.

Import Prices By Country

In 2024, the average artificial and colloidal graphite import price amounted to $3,641 per ton, declining by -12.9% against the previous year. Overall, the import price, however, saw a prominent expansion. The pace of growth was the most pronounced in 2018 when the average import price increased by 46% against the previous year. The import price peaked at $4,180 per ton in 2023, and then reduced in the following year.

Prices varied noticeably by country of origin: amid the top importers, the country with the highest price was Japan ($10,010 per ton), while the price for Norway ($1,466 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Canada (+13.3%), while the prices for the other major suppliers experienced more modest paces of growth.

ExportsUnited States’s Exports of Artificial Graphite, Colloidal, Semi-Colloidal Graphite and Preparations

In 2024, overseas shipments of artificial graphite, colloidal, semi-colloidal graphite and preparations decreased by -17.4% to 32K tons, falling for the second consecutive year after two years of growth. Over the period under review, exports recorded a perceptible setback. The most prominent rate of growth was recorded in 2018 when exports increased by 32% against the previous year. As a result, the exports reached the peak of 52K tons. From 2019 to 2024, the growth of the exports remained at a lower figure.

In value terms, artificial and colloidal graphite exports reached $210M in 2024. Overall, exports recorded a noticeable reduction. The pace of growth appeared the most rapid in 2022 when exports increased by 27% against the previous year. Over the period under review, the exports hit record highs at $289M in 2013; however, from 2014 to 2024, the exports remained at a lower figure.

Exports By Country

Mexico (11K tons) was the main destination for artificial and colloidal graphite exports from the United States, accounting for a 33% share of total exports. Moreover, artificial and colloidal graphite exports to Mexico exceeded the volume sent to the second major destination, Canada (4.5K tons), twofold. The third position in this ranking was taken by the UK (2.7K tons), with an 8.2% share.

From 2013 to 2024, the average annual growth rate of volume to Mexico stood at +2.1%. Exports to the other major destinations recorded the following average annual rates of exports growth: Canada (+2.0% per year) and the UK (+5.4% per year).

In value terms, Mexico ($33M), China ($30M) and South Korea ($28M) were the largest markets for artificial and colloidal graphite exported from the United States worldwide, with a combined 43% share of total exports. Canada, France, Japan, Taiwan (Chinese), Germany, Brazil, Italy, the UK, Saudi Arabia and the Czech Republic lagged somewhat behind, together comprising a further 40%.

The Czech Republic, with a CAGR of +18.6%, recorded the highest rates of growth with regard to the value of exports, in terms of the main countries of destination over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Exports By Type

Artificial graphite (26K tons) was the largest type of artificial graphite, colloidal, semi-colloidal graphite and preparations exported from the United States, accounting for a 80% share of total exports. Moreover, artificial graphite exceeded the volume of the second product type, graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (3.2K tons), eightfold. Colloidal or semi-colloidal graphite (3.1K tons) ranked third in terms of total exports with a 9.6% share.

From 2013 to 2024, the average annual rate of growth in terms of the volume of artificial graphite exports totaled -4.1%. With regard to the other exported products, the following average annual rates of growth were recorded: graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (-4.5% per year) and colloidal or semi-colloidal graphite (+1.6% per year).

In value terms, artificial graphite ($162M) remains the largest type of artificial graphite, colloidal, semi-colloidal graphite and preparations exported from the United States, comprising 77% of total exports. The second position in the ranking was taken by graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures ($29M), with a 14% share of total exports. It was followed by colloidal or semi-colloidal graphite, with an 8.2% share.

From 2013 to 2024, the average annual rate of growth in terms of the value of artificial graphite exports amounted to -1.8%. With regard to the other exported products, the following average annual rates of growth were recorded: graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures (-8.2% per year) and colloidal or semi-colloidal graphite (+2.9% per year).

Export Prices By Type

In 2024, the average artificial and colloidal graphite export price amounted to $6,489 per ton, surging by 26% against the previous year. In general, the export price saw mild growth. As a result, the export price attained the peak level and is likely to continue growth in the immediate term.

There were significant differences in the average prices for the major types of exported product. In 2024, the product with the highest price was graphite or other carbon based preparations in the form of pastes, blocks, plates or other semi-manufactures ($9,321 per ton), while the average price for exports of carbonaceous pastes for electrodes and furnace linings ($3,241 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for the following types: artificial graphite (+2.4%), while the prices for the other products experienced mixed trend patterns.

Export Prices By Country

In 2024, the average artificial and colloidal graphite export price amounted to $6,489 per ton, rising by 26% against the previous year. Overall, the export price saw a mild increase. As a result, the export price reached the peak level and is likely to continue growth in the immediate term.

There were significant differences in the average prices for the major export markets. In 2024, amid the top suppliers, the country with the highest price was South Korea ($20,546 per ton), while the average price for exports to the UK ($1,550 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to South Korea (+11.8%), while the prices for the other major destinations experienced more modest paces of growth.