Report Overview

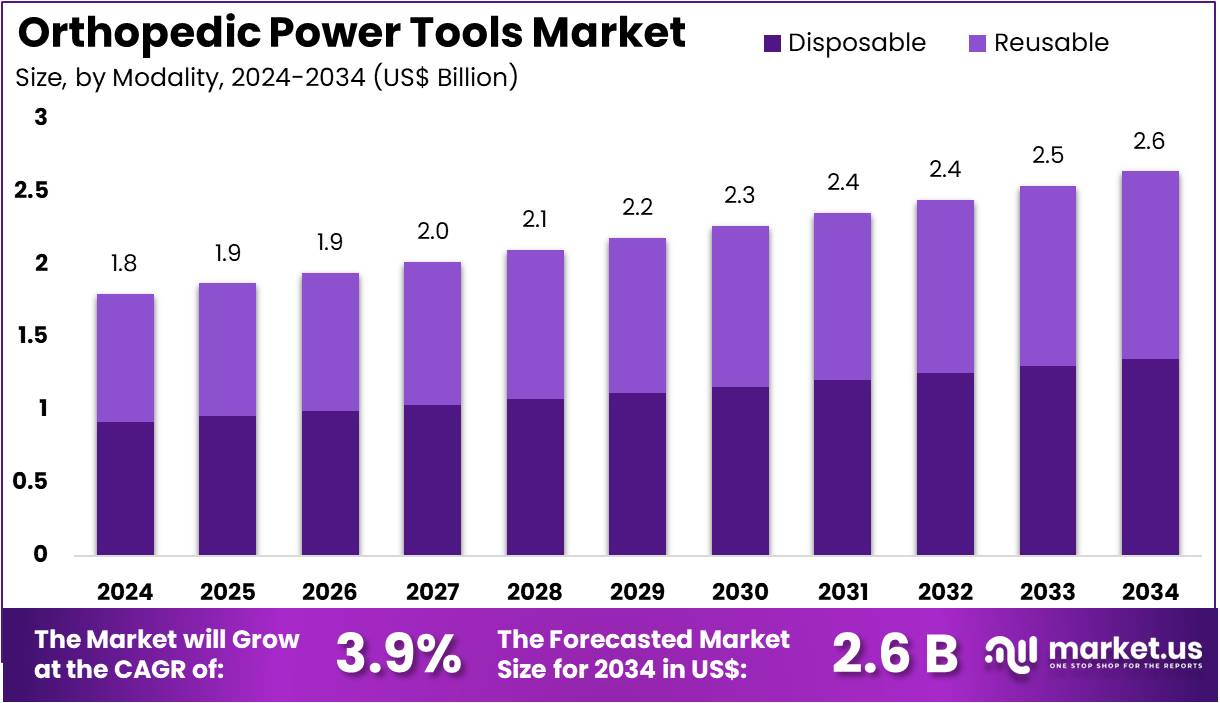

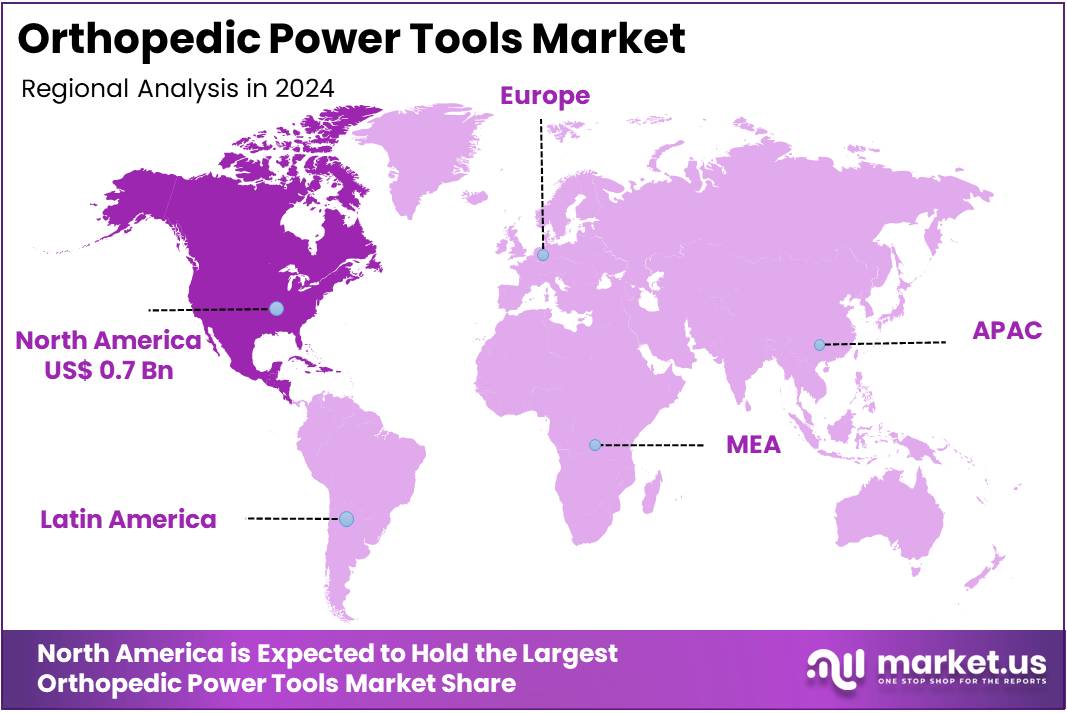

The Orthopedic Power Tools Market Size is expected to be worth around US$ 2.6 billion by 2034 from US$ 1.8 billion in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.7% share and holds US$ 0.7 Billion market value for the year.

Rising incidence of musculoskeletal disorders and the global aging population are primary drivers of the orthopedic power tools market. These tools are indispensable for a wide range of surgical procedures, including joint replacements, spinal fusions, and trauma surgery, as they enhance surgical precision and reduce operative time.

The National Institutes of Health (NIH) reports that musculoskeletal conditions affect over half of all adults in the US, with a significant portion requiring surgical intervention. This high prevalence, coupled with a continuously aging demographic, ensures a sustained and growing demand for advanced surgical equipment. Orthopedic power tools are fundamental to these procedures, enabling surgeons to drill, ream, and saw with the accuracy necessary for optimal patient outcomes.

Growing technological advancements and a strong focus on surgical efficiency are shaping key market trends. Manufacturers are moving towards designing more ergonomic, battery-powered, and intelligent instruments that offer greater mobility and reduce surgeon fatigue during long procedures. The development of cordless systems is a significant trend, as they eliminate the need for pneumatic hoses and power cords, improving the sterile field and overall workflow in the operating room. Furthermore, strategic acquisitions and consolidations are enhancing companies’ capabilities and market reach.

For instance, in May 2022, ConMed acquired In2Bones Global for US$245 million, a strategic move to broaden its global footprint in orthopedics, accelerate innovation, and reach more patients. This acquisition is set to strengthen ConMed’s product lineup and reinforce its position in the expanding orthopedic power tools sector.

Increasing emphasis on patient safety and the rise of ambulatory surgical centers are creating new opportunities for market expansion. The Agency for Healthcare Research and Quality (AHRQ) has documented the continuous rise in outpatient orthopedic procedures, with over 1.6 million arthroplasties performed annually in the United States, underscoring the high volume of surgical applications that rely on these advanced tools.

As a result, there is a growing demand for single-use, disposable attachments and handpieces that reduce the risk of cross-contamination and surgical site infections. These products offer a reliable and sterile solution for surgeons and are gaining favor in various settings, from large hospitals to smaller, outpatient clinics. The push for streamlined sterilization processes and improved infection control measures is a major force driving the adoption of these modern power tools.

Key Takeaways

In 2024, the market for orthopedic power tools generated a revenue of US$ 1.8 billion, with a CAGR of 3.9%, and is expected to reach US$ 2.6 billion by the year 2034.

The product type segment is divided into large bone orthopedic power tools, small bone orthopedic power tools, high-speed orthopedic power tools, and others, with large bone orthopedic power tools taking the lead in 2023 with a market share of 42.6%.

Considering technology, the market is divided into battery-powered systems, pneumatic-powered systems, and electric-powered systems. Among these, battery-powered systems held a significant share of 37.5%.

Furthermore, concerning the modality segment, the market is segregated into disposable and reusable. The disposable sector stands out as the dominant player, holding the largest revenue share of 51.3% in the orthopedic power tools market.

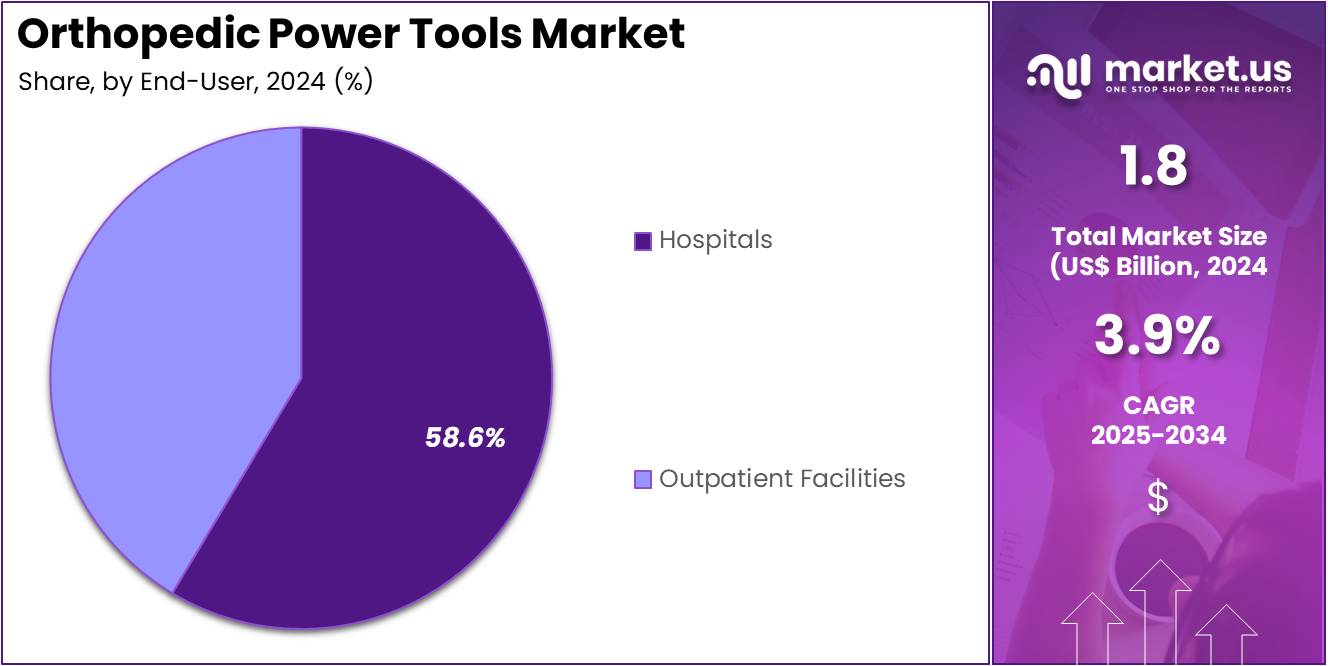

The end-user segment is segregated into hospitals and outpatient facilities, with the hospitals segment leading the market, holding a revenue share of 58.6%.

North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

Large bone orthopedic power tools account for 42.6% of the market share, making them the largest segment. The growing prevalence of bone fractures, orthopedic surgeries, and joint replacements drives demand for these tools. Large bone orthopedic procedures, such as hip and knee replacements, are expected to remain a primary application, supported by the aging population and increasing incidence of degenerative bone diseases. Technological advancements, including improved ergonomics, enhanced precision, and better battery life, are anticipated to increase adoption.

Hospitals and outpatient facilities are likely to invest in these tools for efficient and less invasive surgeries, reducing recovery times. Additionally, the growing demand for minimally invasive procedures is projected to boost the use of these tools in joint replacement surgeries. Strategic partnerships between orthopedic tool manufacturers and hospitals are expected to expand the market reach. Market expansion in emerging economies, due to improving healthcare infrastructure, will likely drive further growth. Cost-efficiency and high performance will continue to make large bone orthopedic power tools the preferred choice in orthopedic procedures.

Technology Analysis

Battery-powered systems dominate with 37.5% of the technology segment. This growth is expected to continue due to the increasing preference for lightweight, portable, and flexible tools in orthopedic surgeries. Battery-powered systems provide the advantage of eliminating the need for air or electric connections, offering better mobility and reducing surgical limitations. They are particularly beneficial for surgeries in remote or field settings, where access to power sources may be limited.

The growing trend of minimally invasive surgeries, which require high precision and flexibility, is likely to increase the demand for battery-powered tools. Furthermore, battery technology advancements, including longer battery life and faster charging, are anticipated to improve the efficiency of these devices. The convenience and reliability of battery-powered systems are projected to drive their adoption in hospitals and outpatient facilities. Increased patient awareness about the advantages of these systems in enhancing surgical outcomes is expected to contribute to their widespread usage. R&D efforts to develop more powerful and energy-efficient batteries are likely to further expand the segment’s market share.

Modality Analysis

The disposable segment, with 51.3% market share, is likely to experience strong growth due to the increasing demand for hygiene and infection control in orthopedic procedures. Disposable orthopedic tools offer the advantage of reducing the risk of cross-contamination between patients, a critical factor in preventing healthcare-associated infections (HAIs). Hospitals and outpatient facilities are increasingly adopting disposable tools to enhance patient safety and ensure regulatory compliance with sterilization standards.

The growing trend of minimally invasive and outpatient surgeries further supports the demand for disposable tools, as they offer convenience and ease of use. The cost-effectiveness of disposable products, particularly in terms of sterilization and maintenance costs, makes them an attractive option for healthcare facilities. Additionally, the rising number of surgical procedures and increased patient throughput in hospitals are expected to contribute to higher consumption of disposable orthopedic power tools. Manufacturers are likely to develop improved, eco-friendly, and cost-effective disposable tools to meet growing market demands.

End-User Analysis

Hospitals account for 58.6% of the end-user segment in the orthopedic power tools market. The growth of this segment is expected to be driven by the increasing volume of orthopedic surgeries and the growing focus on advanced technologies to improve patient outcomes. Hospitals invest heavily in high-quality orthopedic tools to provide optimal treatment for a wide range of musculoskeletal disorders, including fractures, arthritis, and joint replacements. The rising incidence of conditions such as osteoarthritis and the aging population requiring joint replacement surgeries are likely to fuel demand.

Hospitals prioritize the use of state-of-the-art orthopedic tools that enhance the precision and speed of surgeries, improving patient recovery times. Furthermore, advancements in technology, including real-time tracking, navigation, and better ergonomics, will contribute to further growth.

Healthcare providers are expected to continue adopting cutting-edge orthopedic tools to meet rising patient expectations and regulatory requirements. As hospitals move toward digitalization and robotic surgeries, the demand for high-performance power tools is anticipated to grow. Additionally, hospitals are likely to drive market growth by increasing investments in equipment upgrades and replacements.

Key Market Segments

By Product Type

Large Bone Orthopedic Power Tools

Small Bone Orthopedic Power Tools

High-speed Orthopedic Power Tools

Others

By Technology

Battery-powered Systems

Pneumatic-powered Systems

Electric-powered Systems

By Modality

By End-user

Hospitals

Outpatient Facilities

Drivers

The rising prevalence of orthopedic conditions and an aging population is driving the market

The market for these specialized surgical instruments is experiencing significant growth, primarily driven by a worldwide increase in orthopedic conditions such as arthritis, osteoporosis, and sports-related injuries. As the global population ages, the incidence of degenerative joint diseases and other musculoskeletal disorders rises, creating a sustained and increasing demand for surgical interventions. Procedures like total joint replacement are becoming more common as a result.

According to data from the American College of Rheumatology, approximately 790,000 total knee replacements and 544,000 hip replacements are performed annually in the US alone, numbers that continue to climb as our population ages. These procedures rely heavily on high-precision power tools for bone cutting, drilling, and reaming, making them a cornerstone of modern orthopedic surgery. The continuous evolution of surgical techniques and the growing patient pool requiring joint restoration and other bone-related procedures provide a powerful impetus for the market.

Restraints

The high cost of sophisticated surgical equipment and stringent sterilization requirements are restraining the market

A significant restraint on the market is the substantial capital investment required to acquire advanced surgical equipment and the ongoing costs associated with its maintenance and sterilization. Modern surgical instruments are highly engineered, with sophisticated designs that allow for greater precision and efficiency, but they also come with a high price tag.

The procurement cost of a single reusable battery drill, for example, can be in the range of $6,000 to $6,700, making a complete set of tools a major financial commitment for hospitals and surgical centers. Furthermore, these tools must undergo rigorous cleaning and sterilization protocols to prevent hospital-acquired infections (HAIs).

A 2023 report from the US Centers for Disease Control and Prevention (CDC) highlighted that while overall HAIs were down, surgical site infections (SSIs) for specific procedures like abdominal hysterectomies actually increased by 8%, underscoring the persistent challenges with proper instrument sterilization. The high cost of equipment, combined with the expensive and labor-intensive sterilization processes, can be a deterrent to hospitals, particularly in resource-constrained environments.

Opportunities

The increasing adoption of robotic and navigation-assisted surgery is creating growth opportunities

The market is presented with significant opportunities from the accelerating trend toward robotic and computer-assisted surgery. These advanced surgical platforms utilize specialized instruments to enhance a surgeon’s precision, accuracy, and control during complex procedures. The demand for these systems is growing as they demonstrate the potential to improve patient outcomes, reduce recovery times, and lower the risk of complications. For instance, robotic systems are increasingly used in total joint replacement to ensure precise bone cuts and optimal implant placement, leading to better long-term function.

A 2023 survey report on advancements in robotic orthopedic surgery highlighted that the global market for these systems continues to expand. The specialized tools and consumables required for these systems are a key component of this growth. As more surgeons and institutions invest in these platforms, the demand for compatible surgical instruments will continue to rise, creating a new and highly lucrative segment for the market.

Impact of Macroeconomic / Geopolitical Factors

The orthopedic power tools market faces significant macroeconomic and geopolitical challenges that impact its global supply chain and end-user costs. The prices of essential raw materials, including medical-grade titanium and stainless steel, have experienced fluctuations due to global inflation and trade disruptions. According to a 2024 analysis of US trade policies, medical device imports from the European Union now face a 20% tariff, a notable increase from previous rates.

In addition, imports from China are subject to duties that can reach 54% due to existing and new trade measures, directly raising procurement costs for hospitals and surgical centers. Despite these hurdles, the market’s fundamental drivers remain strong.

The World Health Organization (WHO) and other organizations report that the demand for orthopedic procedures continues to grow, with millions of surgeries performed annually worldwide, driven by an aging global population. This consistent demand encourages manufacturers to invest in new production strategies, such as diversifying their supplier networks and increasing domestic output to build a more resilient and secure supply chain.

Latest Trends

The development of lightweight and battery-powered instruments is a recent trend

A significant trend in 2024 is the shift toward developing more ergonomic, lightweight, and battery-powered surgical instruments. Traditional pneumatic or corded tools can be heavy, cumbersome, and tethered to a power source, limiting a surgeon’s mobility and contributing to hand fatigue during lengthy procedures. The newer generation of battery-powered systems addresses these challenges by offering greater freedom of movement, a more balanced feel, and reduced noise levels in the operating room.

This focus on ergonomics is crucial for surgeons, as it can reduce the risk of musculoskeletal disorders associated with repetitive tasks. The US Patent and Trademark Office’s patent database has seen a rise in filings for ergonomic and portable surgical devices, with a new patent for a device to improve ergonomics of an endoscopic handle being issued in 2025. This focus on user-centric design is driving product innovation, as manufacturers seek to create tools that not only perform well but also enhance the surgeon’s comfort and control, thereby improving the overall surgical experience and outcomes.

Regional Analysis

North America is leading the Orthopedic Power Tools Market

The North American market for orthopedic power tools held a substantial 39.7% share of the global market in 2024. This leadership is a direct result of several key factors, including an advanced healthcare infrastructure, the increasing prevalence of orthopedic injuries and diseases, and a strong focus on surgical innovation. The US has a particularly high burden of chronic musculoskeletal conditions.

The Centers for Disease Control and Prevention (CDC) reported that in 2022, the age-adjusted prevalence of diagnosed arthritis in adults was 18.9%, a condition that often leads to surgical intervention. Furthermore, the American Joint Replacement Registry’s 2024 Annual Report provides specific procedural data, noting a significant number of hip and knee arthroplasties are performed annually. This high volume of orthopedic procedures across the region drives a consistent demand for advanced surgical instruments that improve precision and efficiency.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific orthopedic power tools market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly aging population, increasing disposable incomes, and the expansion of healthcare infrastructure in emerging economies. The World Health Organization (WHO) highlights that the proportion of individuals aged 60 and above is projected to grow faster in the Asia Pacific region than in any other part of the world.

This demographic shift is likely to create a significant and sustained demand for joint replacement and other orthopedic surgeries. The market’s expansion is further supported by government initiatives aimed at improving healthcare access and quality. For instance, in China, a focus on upgrading medical facilities and increasing domestic manufacturing capacity is likely to spur the adoption of advanced surgical equipment.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherland

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

New Zealand

Singapore

Thailand

Vietnam

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Key Players Analysis

Leading players in the orthopedic power tools market employ several key strategies for growth. They are heavily investing in research and development to create more precise, ergonomic, and lightweight instruments, often with a focus on battery-powered and cordless systems that enhance surgical efficiency.

Companies are also pursuing strategic acquisitions and partnerships to expand their product portfolios and gain access to new technologies, such as robotic-assisted surgery platforms and single-use, disposable tools for improved infection control. Furthermore, they are broadening their market reach by targeting emerging economies with a growing demand for advanced medical devices due to improving healthcare infrastructure.

DePuy Synthes, the orthopedic arm of Johnson & Johnson, holds a significant position in the market. The company offers a comprehensive portfolio spanning joint reconstruction, trauma, spine, sports medicine, and craniomaxillofacial specialties. Their growth is driven by a deep commitment to innovation, exemplified by their VELYS Digital Surgery platform. This system integrates robotics and enabling technologies to enhance surgical precision and streamline workflows.

DePuy Synthes consistently leverages its extensive research and development capabilities and a global distribution network to provide a wide range of solutions that address the evolving needs of surgeons and patients worldwide.

Top Key Players in the Orthopedic Power Tools Market

Zimmer Biomet

Stryker

Shanghai Bojin Medical Instrument Co.,Ltd

Richard Wolf GmbH

NSK / Nakanishi inc

Medtronic

Kaiser Medical Technology Ltd

DepuySynthes

CONMED Corporation

Braun SE

Arthrex, Inc

Recent Developments

In January 2024: Arthrex rolled out NanoExperience.com, a dedicated online resource designed to explain the benefits and applications of Nano arthroscopy. The platform focuses on educating patients and healthcare professionals about this minimally invasive orthopedic procedure, which employs nanotechnology to allow smaller surgical incisions, reduce tissue trauma, and accelerate recovery times compared with traditional arthroscopic methods.

In October 2023: DePuy Synthes introduced the VELYS Robotic-Assisted Solution for total knee replacements in the European market. This robotic system is engineered to streamline surgical procedures, improve precision, and standardize outcomes. By removing the need for pre-operative CT imaging, the solution simplifies the workflow, enhances procedural accuracy, and supports faster patient recovery while optimizing the use of clinical resources.

Report Scope