Report Overview

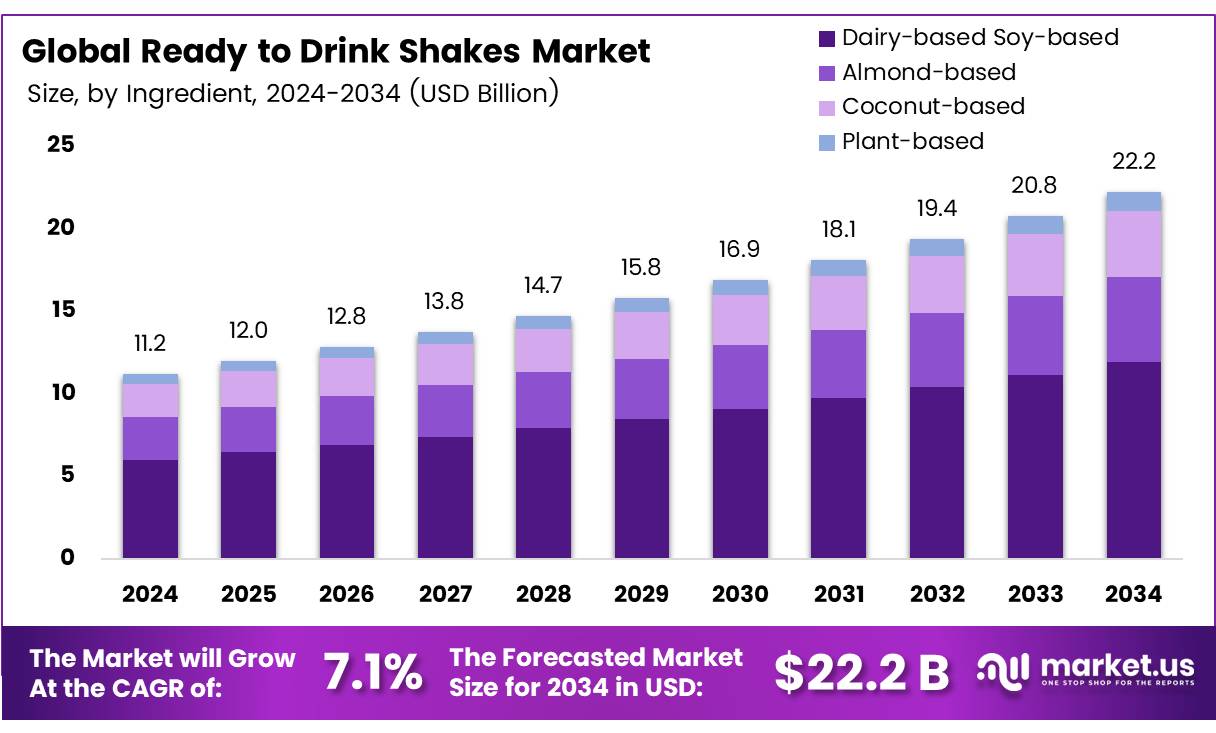

The Global Ready to Drink Shakes Market size is expected to be worth around USD 22.2 billion by 2034, from USD 11.2 billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

Dietary supplements, including animal, dairy, or plant-based protein formulations, are widely used by active individuals, athletes, bodybuilders, and certain patient groups. They are also employed in weight loss programs and to address protein-deficient diets. However, herbal and dietary supplements (HDS), such as protein-based products with or without added botanical ingredients, vitamins, minerals, amino acids, or other natural or synthetic compounds, are increasingly linked to hepatotoxicity, posing risks of liver injury, failure, and death.

Out of 36 protein supplement products examined, 20 were manufactured in India, while the remaining were produced by multinational companies. Among these, 9 products contained less than 40% protein, whereas the others had levels exceeding 60%. Overall, 25 products (69.4%) were found to be mislabeled, with the actual protein content per 100 g being lower than the advertised amount. The discrepancies ranged from deficits of under 10% to more than 50%.

In the context of shelf-stable high-protein dairy beverages, beverages with a water activity (aw) >0.85 and a finished equilibrium pH >4.6 are classified as low-acid. Beverages with added acids or acidic ingredients, resulting in a finished equilibrium pH ≤4.6 and aw >0.85, are classified as acidified foods. The Food and Drink Federation welcomed the opportunity to participate in the consultation, noting significant progress in reformulation efforts.

It highlighted that research and development investments have led to a 46% sugar reduction in soft drinks over the past five years and a 30% sugar reduction in pre-packed milk-based beverages. The RTD shakes industry is positioned for robust growth, powered by lifestyle changes, nutritional needs, and innovation. The interplay of consumer demand for health-centric products, sustainable practices, and digital retail expansion ensures that the market will continue to evolve and thrive in the coming decade.

Key Takeaways

The Global Ready-to-Drink Shakes Market is projected to grow from USD 11.2 billion in 2024 to USD 22.2 billion by 2034, at a CAGR of 7.1%.

Dairy-based and Soy-based shakes dominated in 2024, holding a 53.7% market share due to consumer preference for dairy and plant-based proteins.

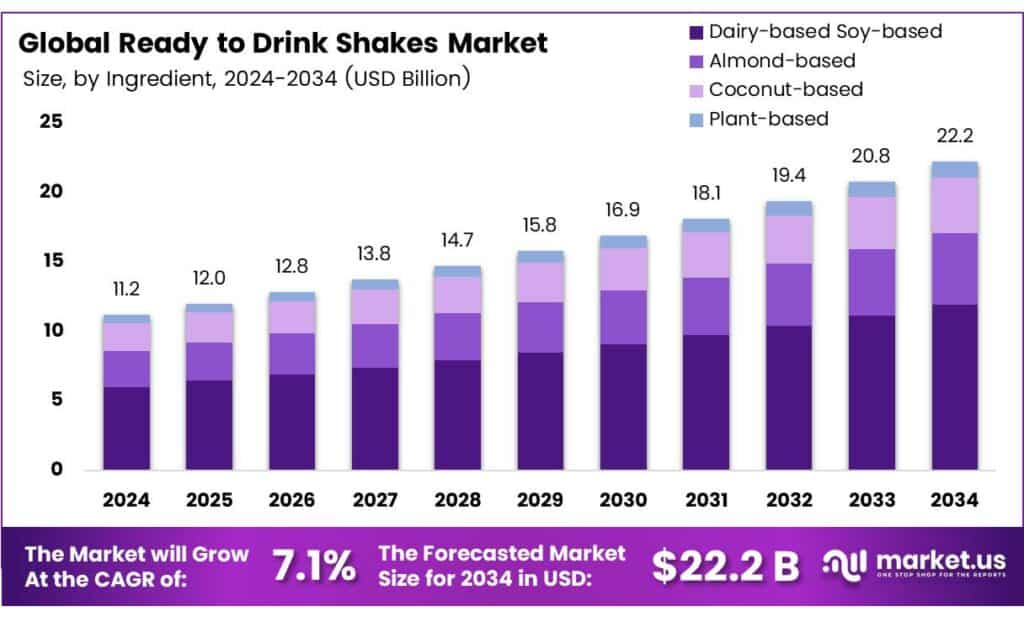

Chocolate flavor led the market in 2024 with a 44.3% share, driven by its universal appeal and nutritional value.

The High-Protein shakes captured a 41.7% market share in 2024, fueled by demand for fitness and weight management solutions.

Supermarkets and Hypermarkets accounted for a 37.8% share in 2024, favored for their product variety and competitive pricing.

North America held a 43.7% share of the global market in 2024, valued at USD 4.8 billion, driven by fitness trends and strong retail infrastructure.

Analyst Viewpoint

The Ready-to-Drink (RTD) shakes market is buzzing with potential for investors, driven by a growing consumer appetite for convenient, health-focused beverages. With people leading busier lives, RTD shakes packed with protein, vitamins, or functional ingredients are becoming go-to options for on-the-go nutrition.

Consumer insights reveal a shift toward personalization and sustainability. People want shakes tailored to their dietary needs—think vegan, keto, or high-protein options while also demanding eco-friendly packaging. Brands that use AI to analyze consumer preferences or offer customizable blends are gaining traction, as seen with companies experimenting with digital platforms for personalized nutrition.

Technological advancements, like AI-driven production or blockchain for supply chain transparency, are helping companies stay agile, but adopting these comes with upfront investment risks. Investors should weigh the high growth potential against these operational and regulatory challenges, focusing on brands that innovate while keeping consumer trust at heart.

By Ingredient

Dairy-based & Soy-based Segment Leads with 53.7% Share

In 2024, Dairy-based Soy-based held a dominant market position, capturing more than a 53.7% share in the Ready-to-Drink (RTD) Shakes Market. This strong performance reflects consumers’ trust in traditional dairy proteins, such as whey and casein, combined with the rising popularity of soy as a plant-based protein alternative.

Dairy-based shakes continue to attract athletes, fitness enthusiasts, and health-conscious individuals due to their complete amino acid profile, quick absorption, and proven role in muscle recovery. Meanwhile, soy-based formulations are expanding the consumer base by appealing to lactose-intolerant buyers and those following vegan or vegetarian diets.

Dairy proteins remain a go-to choice for their superior digestibility and taste, while soy-based shakes benefit from being cholesterol-free and offering additional health benefits such as heart support. This dual advantage strengthens the segment’s appeal across diverse demographics, ensuring sustained growth.

By Flavor

Chocolate Flavor Dominates with 44.3% Share

In 2024, Chocolate held a dominant market position, capturing more than a 44.3% share in the Ready-to-Drink (RTD) Shakes Market. The popularity of chocolate as a universally preferred flavor has made it the top choice among consumers seeking both taste and nutrition.

Its rich and indulgent profile appeals to a wide range of age groups, from young adults looking for a quick energy boost to older consumers who prefer a familiar and comforting taste in their daily diets. The strong preference for chocolate also comes from its versatility, as it pairs well with both dairy-based and plant-based formulations, ensuring broader acceptance.

The chocolate segment is expected to sustain its dominance, supported by growing demand for protein-rich shakes that do not compromise on flavor. Manufacturers continue to innovate within this category, offering low-sugar, high-protein, and functional variants infused with vitamins or added nutrients, while keeping chocolate as the central flavor.

By Functional Benefits

High Protein Leads with 41.7% Market Share

In 2024, High Protein held a dominant market position, capturing more than a 41.7% share in the Ready-to-Drink (RTD) Shakes Market. This dominance reflects the rising consumer focus on fitness, muscle recovery, and weight management, as protein continues to be the most sought-after nutrient in functional beverages.

High protein shakes are especially popular among gym-goers, athletes, and young professionals who seek convenient nutrition on the go. With growing awareness about the role of protein in maintaining overall health, including satiety and metabolism support, this segment has become the primary growth engine of the RTD shakes category.

By 2025, the high protein segment is expected to strengthen its position further, driven by the global trend toward preventive health and active lifestyles. Increasing demand for clean-label products with added functional benefits, such as low sugar, fiber enrichment, and vitamin fortification, is adding momentum to this category.

By Distribution Channel

Supermarkets and Hypermarkets Lead with 37.8% Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 37.8% share in the Ready-to-Drink (RTD) Shakes Market. These large-scale retail outlets remain the most trusted shopping destinations for consumers due to their wide product variety, competitive pricing, and promotional offers.

The ability to compare different brands side by side and access both premium and mass-market RTD shakes gives supermarkets and hypermarkets a clear edge. Additionally, the availability of in-store discounts and bundled deals often encourages bulk purchases, further boosting sales in this channel.

The segment is expected to maintain its leading position, supported by the growing consumer trend of one-stop shopping and the rising penetration of organized retail across emerging markets. Supermarkets and hypermarkets not only offer convenience but also provide visibility to newer product launches, flavor innovations, and functional shake varieties.

Key Market Segments

By Ingredient

Dairy-based Soy-based

Almond-based

Coconut-based

Plant-based

By Flavor

Chocolate

Vanilla

Strawberry

Mixed Berry

Tropical

By Functional Benefits

High Protein

Low Fat

No Sugar Added

Gluten-Free

Lactose-Free

Others

By Distribution Channel

Supermarkets and Hypermarkets

Convenience Stores

Online Retailers

Health Food Stores

Specialty Stores

Others

Drivers

Addressing Protein Deficiency Through Ready-to-Drink Shakes

In India today, a major engine behind the growth of Ready‑to‑Drink (RTD) shakes is simply this: they help fill a real and pressing nutritional gap. Nearly 73% of the population is estimated to be protein‑deficient—this isn’t minor; it’s huge, affecting overall health and energy levels nationwide.

Governments, dairy giants, startups, and even sports stars are responding. Amul, for example, is turning thousands of litres of surplus whey into protein‑fortified products that include shakes and other everyday favorites. All this to get more protein onto the plates of urban and rural Indians alike. This shortage has sparked a hunger not just for protein, but for convenient, trusted sources of it.

RTD shakes meet that need perfectly. They are easy to grab, often taste good, and are seen as a safer way to deliver protein than powders or supplements that may have misleading labels. The Food Safety and Standards Authority of India (FSSAI) has tightened regulations over protein products to curb misleading claims and protect consumers.

Restraints

High Sugar Content: A Major Restraint for Ready-to-Drink Shakes

One key hurdle holding back the growth of the Ready‑to‑Drink (RTD) shakes market is their typically high sugar content, which is increasingly at odds with public health goals and government guidelines. Across India, daily sugar intake is already alarming. Children aged 4 to 10 are getting around 13% of their daily energy from sugar, and those aged 11 to 18 are getting 15%, both well above the 10% limit recommended by the World Health Organization (WHO).

This equates to about 20–25 teaspoons of sugar per day, far beyond the advisable five to seven teaspoons. Recognizing this health concern, the Indian government has initiated school-level interventions. The Central Board of Secondary Education (CBSE) now mandates ‘sugar boards’ in schools to visually educate children about sugar’s hidden dangers, and over 40,000 pediatricians from the Indian Academy of Pediatrics (IAP) are supporting this effort through school visits

Opportunity

Urbanisation and Busy Lifestyles Fuel Demand for Ready-to-Drink Shakes

India’s rapid urbanisation and the increasing pace of life are key engines propelling the ready‑to‑drink (RTD) shakes market. More and more people, especially in tier‑II and III cities, are seeking quick, nutritious options that fit their fast‑moving routines, and RTD shakes tick that box wonderfully. This reflects how consumers increasingly prioritise convenience without compromising on nutrition.

In urban households, where time is a premium, shakes act as a lifesaver, whether as a breakfast substitute, a quick post-workout refuel, or a mid-day energy boost. The Food Safety and Standards Authority of India (FSSAI), which operates under the Ministry of Health and Family Welfare, plays a vital role by ensuring food safety standards for RTD beverages.

Its regulations foster trust among consumers, especially when trying new formats. Plus, the government’s focus on boosting the food processing sector with ambitions to double its GDP contribution by 2030 and a projected 15% CAGR reaching USD 535 billion by 2025/26, lays fertile ground for innovation in ready‑to‑drink nutrition like shakes.

Trends

Rise of High-Protein, Functional RTD Shakes for Health Awareness

The surge in health consciousness is emerging as a powerful new wave shaping the ready‑to‑drink (RTD) shake market. More people are looking not just for quick nutrition, but for shakes that actively support their wellness, especially those rich in protein and functional ingredients.

Even governments and trusted organizations are nudging this trend forward. For instance, public health campaigns often emphasize adequate protein intake, especially for the elderly and those on weight‑loss medications, to preserve muscle and overall health. While not always targeting RTD shakes specifically, these messages build consumer trust in protein‑fortified, convenient nutrition.

Consider Danone’s recent launch under the Oikos yogurt brand: a protein‑packed shake aimed at Americans using GLP‑1 weight‑loss drugs, who need more protein to prevent muscle loss. Priced at USD 3.69 and offering 5 g of fiber for digestive health, this product responds directly to evolving health needs and growing consumer demand.

Regional Analysis

North America Dominates with 43.7%, USD 4.8 Billion Market Share

North America leads the Ready‑to‑Drink (RTD) shakes market, commanding approximately 43.7% of the global share in 2024, equating to around USD 4.8 billion, making it the dominant regional segment. This leadership reflects the region’s strong demand for convenient, nutrition‑focused meal replacements, spurred by widespread fitness and weight‑control trends, and advanced retail infrastructure.

Europe trails behind North America but remains a solid second, buoyed by growing health and nutrition awareness alongside expanding product portfolios. Innovation in flavors and clean‑label offerings in markets like the UK are key growth drivers. The rise in health consciousness and demand for functional beverages supports regional expansion.

APAC is the fastest‑growing region, benefiting from rapid urbanization, surging disposable income, and evolving consumer preferences for on‑the‑go nutrition. The market in India, in particular, is expected to grow significantly given rising incomes and demand for convenient, premium RTD shakes. Japan also shows increasing uptake due to busy lifestyles and nutritional needs.

While data is more limited for these regions, they are recognized for their emerging potential. Increased urbanization and adoption of packaged nutritional products suggest a gradual uptick in RTD shake consumption, although affordability and consumer awareness remain challenges.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Kellogg’s leverages its powerful cereal brand equity, particularly with Special K and Nutri-Grain shakes, to capture health-conscious consumers. Its extensive global distribution network in retail and foodservice ensures wide product accessibility. The company focuses on convenience and weight management positioning, appealing to a broad demographic.

Kraft Heinz targets the convenient nutrition segment for children and families. Its key strength lies in established brand recognition and trust, driving sales in retail channels. The strategy focuses on portability and combining shakes with snacks for a complete, on-the-go meal solution. While not as diversified in adult nutrition, its stronghold in the family and kids’ market secures its position as a significant and recognizable player in the RTD shake sector.

Danone is a key player through its market-leading Ensure and Orgain brands, heavily focused on clinical and wellness nutrition. It dominates the medically-tailored segment for older adults and those with specific dietary needs. Its strategy emphasizes scientific backing, protein content, and vitamin fortification. With a strong presence in pharmacies and healthcare channels, Danone holds a specialized, premium position that is less reliant on traditional retail competition, ensuring loyal demand from a dedicated consumer base.

Top Key Players in the Market

Kellogg’s

Kraft Heinz

Danone

General Mills

Unilever

Abbott Laboratories

Campbell Soup Company

Mead Johnson Nutrition

FrieslandCampina

Nestle

PepsiCo

Recent Developments

In 2024, Kellogg’s collaborated with Nestlé S.A. to launch two breakfast-inspired ready-to-drink (RTD) beverages under the Frosted Flakes and Eggo brands. The Nestlé Sensations Frosted Flakes cereal-flavored milk mimics the taste of frosted cornflakes with a creamy dairy finish. At the same time, the Nestlé Sensations Eggo offers a maple waffle-flavored milk with hints of toasty waffles, butter, and maple syrup.

In 2024, Kraft Heinz will be reformulating its product portfolio to meet global nutrition targets, aiming to reduce saturated fat, total sugars, and sodium across its entire range of offerings. While not specific to RTD shakes, this includes beverages under its portfolio, such as Capri Sun, which could extend to RTD shake development to align with consumer demand for healthier options.

Report Scope