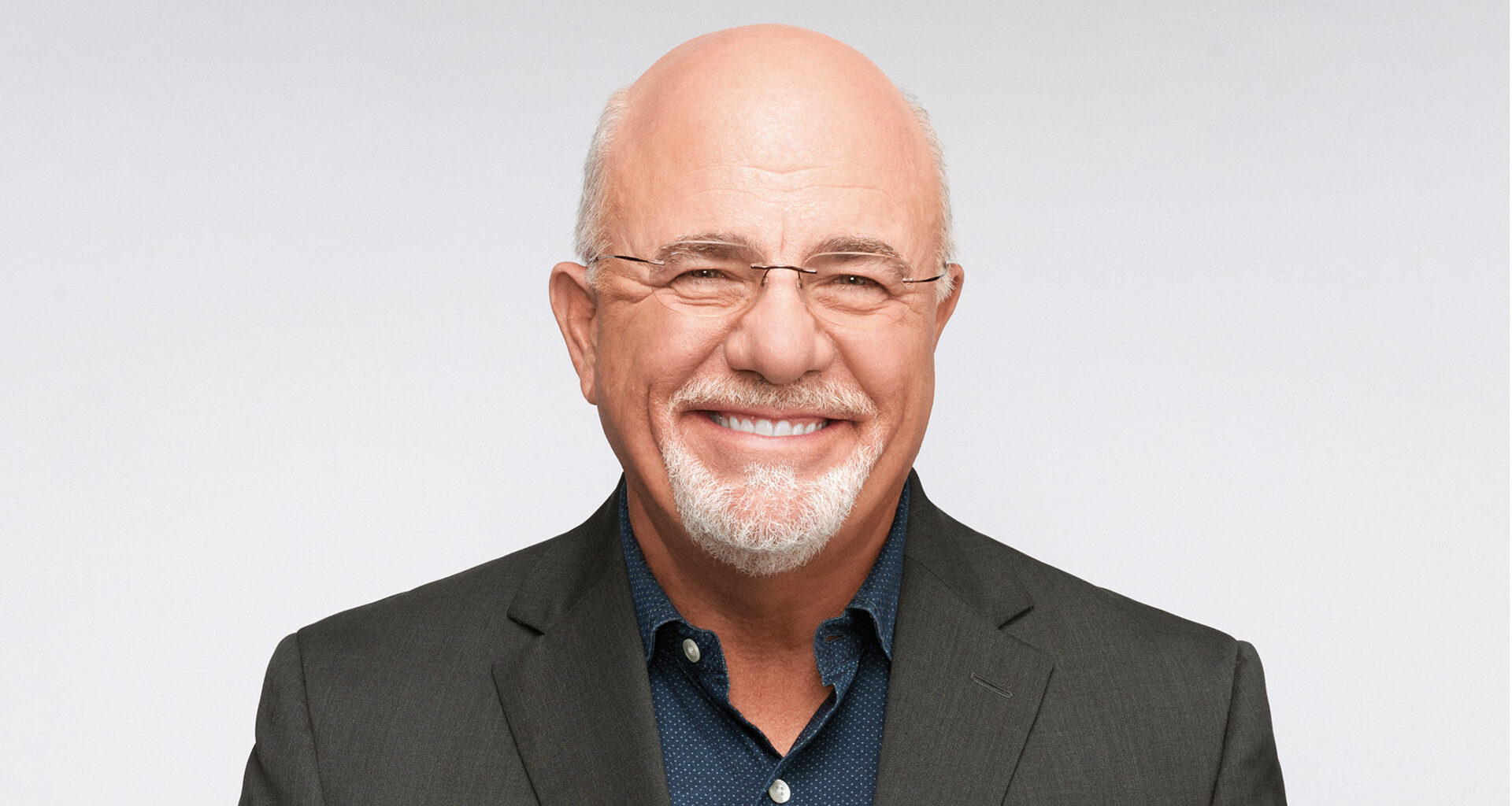

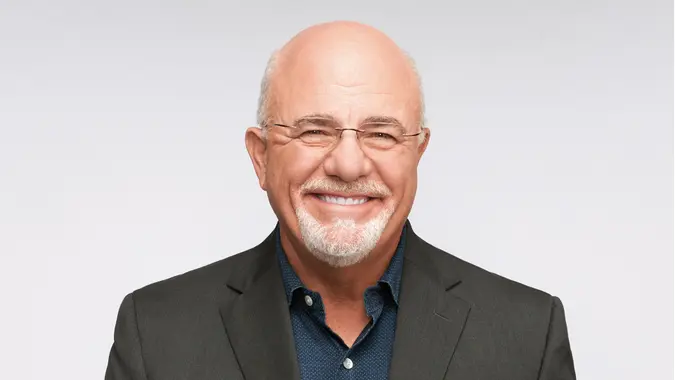

©Dave Ramsey

Commitment to Our Readers

GOBankingRates’ editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services – our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Trusted by

Millions of Readers

Remember the tale of Hansel and Gretel — the duo lured into an evil witch’s cabin with the promise of candy? They learned about not falling into the trap of chasing sweet, shiny things at the expense of your common sense. As a grown-up in the real world, you’re probably not chasing chocolate bars into a cauldron, but to hear Dave Ramsey tell it, you might be succumbing to some gnarly financial traps.

Ramsey is well-acquainted with some of the most common ways people waste their money through money traps and schemes — many of which give credence to the old saying that if something sounds too good to be true, it likely is. Unsurprisingly, he’s got a list of things he really wants you to stop doing with your money.

Getting an Adjustable-Rate Mortgage

Ramsey has a lot to say about adjustable-rate mortgages (ARMs) — and none of it is good. He even calls getting an ARM “playing with fire,” arguing that if your interest rate is adjustable (as in, it’s not locked in forever) that means it’s probably going to go up over time.

On the Ramsey Solutions website, he breaks down why ARMs are such a bad money trap: “With ARMs, you lock in a low interest rate for a short period of time, and after that, your rate can go up yearly (or every few years) at the market rate,” he said. “And if that rate is sky-high, your mortgage payments will be too … potentially leaving you unable to pay your mortgage.”

What should you do instead? Ramsey would much prefer that you invest in a 15-year fixed-rate mortgage, which is pretty much exactly what it sounds like — a mortgage loan that charges a consistent interest rate through the 15-year term of the loan. Since the interest rate stays the same throughout the duration of the loan, your monthly payment (sans taxes and insurance, of course) will stay the same.

Going In on a Timeshare

What’s so bad about going in on a timeshare, anyway? Sounds kind of nice to have a vacation property arrangement where you share the property costs with other people, while guaranteeing your family’s time at the property.

However, Ramsey cautions you against succumbing to the siren song of the timeshare. In a piece expressly about timeshares, he calls them a “big, expensive headache” that comes from yearly maintenance fees, incidental costs, dues and interest. And oh yeah, you’ve still got the hassle of booking your vacation dates before one of your fellow timeshare owners does.

Instead, plan your own vacation on your own terms. He recommends using a sinking fund to set aside money for a vacation that you can pay for upfront.

Getting a Car Lease

Ramsey isn’t made of stone; he understands the appeal of a sleek new BMW when you’re cruising down the road in an otherwise reliable but still less-than-visually appealing used car. But if you’re tempted to trade in that used car and take on monthly payments for a flashier, pricier model, he warns you that you’re falling into a money trap.

According to Ramsey, leasing is “the most expensive way to drive a car,” because you don’t actually own your car — technically, the bank or your lender does. “They just let you drive it around — as long as you make your monthly payment, that is,” he said.

You’re better off buying a new — or even new-to-you — car outright, with cash. He encourages you to develop a car budget while you research the right models for you. Look into factors like insurance payments and car inspections. And be sure to brush up on your negotiating skills.

Using No Money Down Plans

The phrase “no money down” may sound like music to your ears, but Ramsey warns that it can strike a sour note. He gives the example of using a no money down plan to pay for a brand-new couch.

“Look, putting 0% down might sound like a no-brainer, but the no-money-down trap is just another way to get you locked into making long-term payments on stuff you need to pay for up front,” he said. “Never mind the fact that you’re financing something you sit on — but now you don’t actually own that couch either.”

He’d rather you save up and put all the money down on an item. It may take some time to save up, but you won’t be on the hook for payments down the line.

Playing the Lottery

Everyone has the dream of what they’d do if they hit the mega millions. But the reality is stark: You probably won’t win, and you’re wasting your money on multiple scratch-off purchases.

Time to buckle down and dedicate yourself to a more grounded approach of growing your wealth. Ramsey advocates for hard work and following his famed Baby Steps plan.