Report Overview

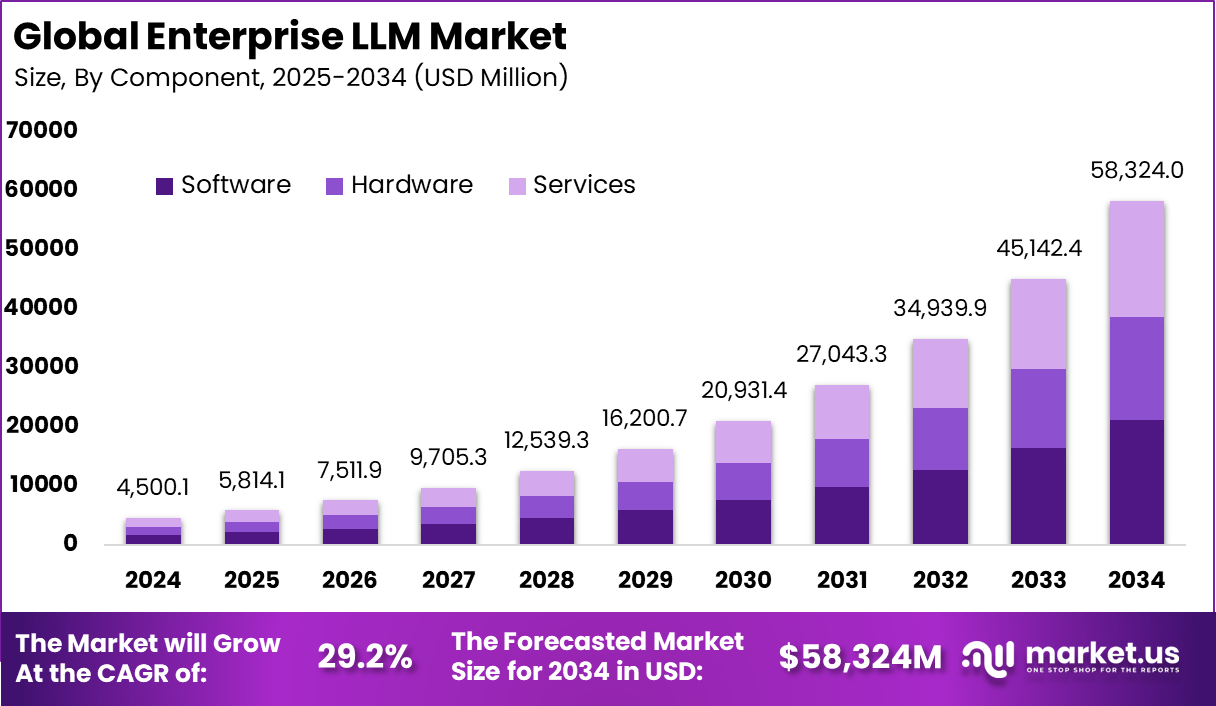

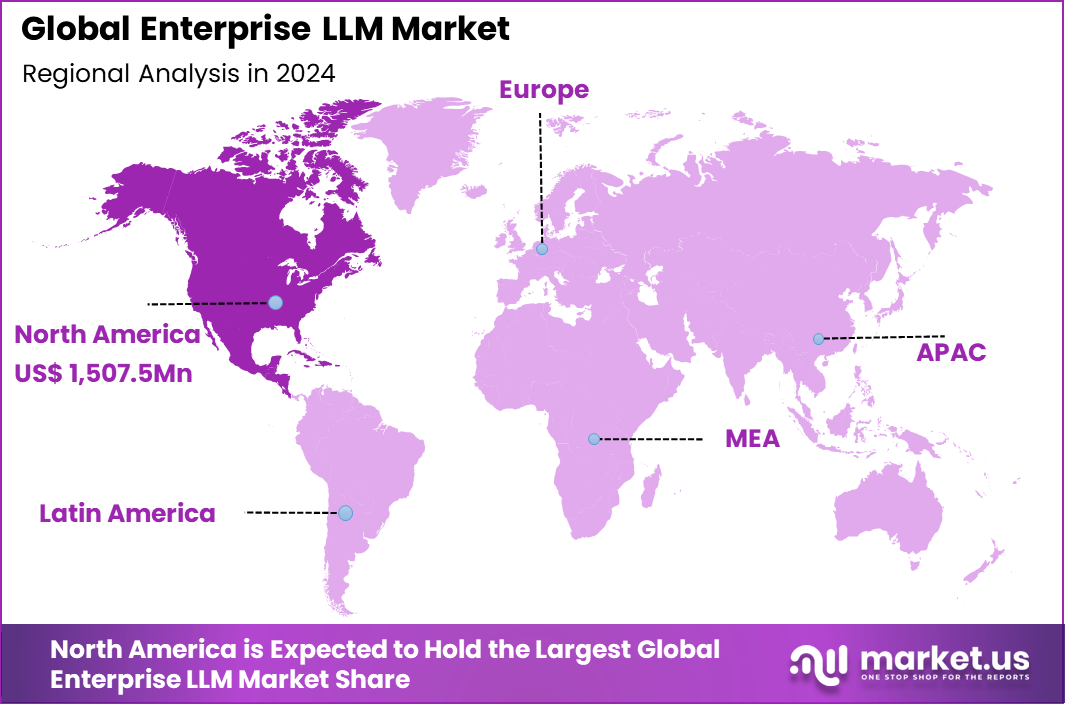

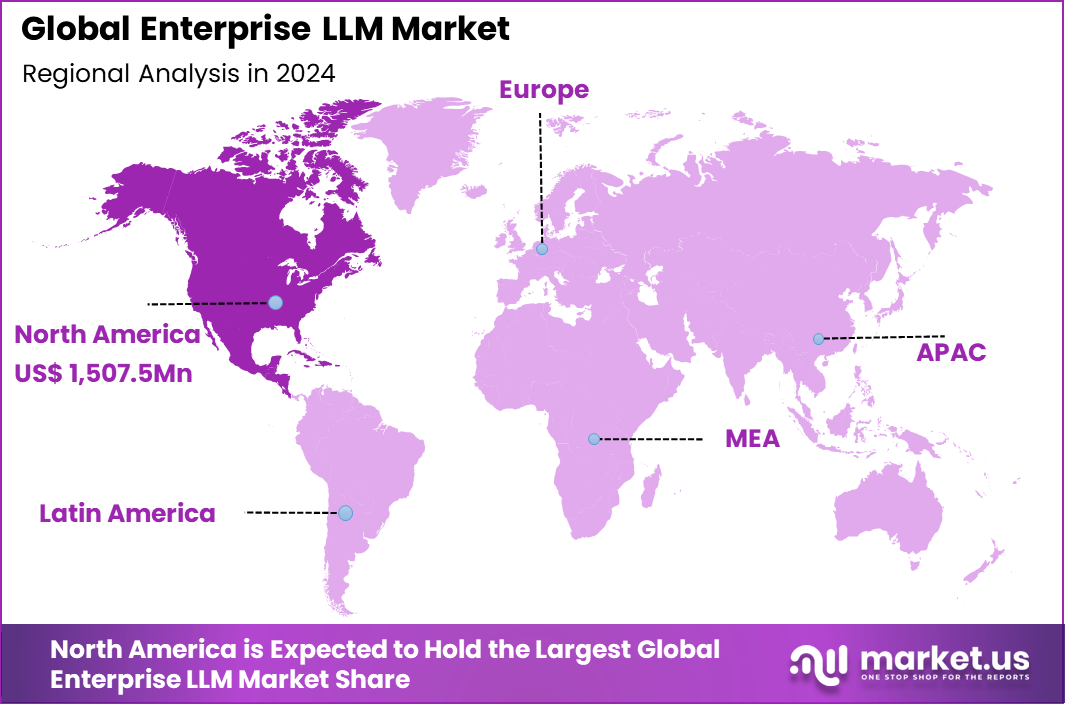

The Global Enterprise LLM Market size is expected to be worth around USD 58,324 Million By 2034, from USD 4,500.1 Million in 2024, growing at a CAGR of 29.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 33.5% share, holding USD 1,507.5 Million revenue.

The Enterprise Large Language Model (LLM) market refers to the adoption and integration of advanced language models specifically designed for business and organizational use. These models help enterprises automate workflows, enhance decision-making, enrich customer interactions, and unlock value from large volumes of unstructured data.

Enterprise LLMs are tailored for scalability, security, and compliance with industry regulations, enabling businesses to improve operational efficiency and innovate faster by leveraging AI-driven natural language understanding across domains such as finance, healthcare, retail, and more.

Top driving factors in this market include the growing need for intelligent automation in business processes, the demand for 24/7 personalized customer service, and the ability to extract actionable insights from complex data. Advances in model accuracy, multi-turn conversation capabilities, and domain-specific customization also push adoption.

According to Forbes, enterprises are rapidly increasing investments in large language models, with 72% expecting higher spending this year. Nearly 40% already allocate over $250,000 annually, showing strong financial commitment. Google leads adoption, with 69% of respondents using its models in early 2025, compared to 55% for OpenAI. A clear preference for professional solutions is evident, as 63% of organizations choose paid enterprise-grade models over free tiers.

Security and privacy remain key obstacles, with 44% citing them as barriers to wider use. Despite these concerns, international providers are gaining ground. DeepSeek, for example, is used by 17% of enterprises, while 80% of respondents expressed comfort with deploying its models. This reflects a major shift in traditionally cautious markets and signals disruption in the global LLM landscape.

Moreover, enterprises seek to reduce operational costs and improve workflow efficiency by deploying LLM-driven chatbots, virtual assistants, and content automation tools. The rising interest in domain-focused LLMs further accelerates growth, as these models address specific industry regulations and terminology with higher accuracy.

Key Insight Summary

General-Purpose LLMs led by model type, holding 42.5% share of the market.

By component, Software accounted for the largest share at 36.2%.

Cloud deployment dominated with a strong 55% share.

Large Enterprises were the primary adopters, representing 60% share of the market.

By industry vertical, Healthcare emerged as the leading sector, contributing 20% share.

Analysts’ Viewpoint

The increasing adoption of technologies supporting enterprise LLM includes cloud computing platforms that enable scalable deployment and specialized frameworks like Retrieval-Augmented Generation (RAG) that improve response accuracy by integrating enterprise-specific data in real time. Enterprises favor hybrid approaches combining proprietary, open-source, and industry-tuned models to balance control, customization, and performance.

Investment opportunities within the enterprise LLM market are abundant, driven by enterprises increasing budget allocations and venture capital interest in scalable, customizable AI solutions. Organizations often invest in LLM development internally or partner with AI vendors to tailor models for domain-specific tasks. The growing demand for secure, compliant, and explainable AI solutions opens avenues in areas such as healthcare, finance, legal compliance, and customer experience management.

Business benefits of enterprise LLMs include improved real-time analytics, risk management, and operational scalability, which collectively boost productivity and reduce manual errors. Automated content generation and intelligent virtual assistants help enterprises serve customers better and faster. Enhanced security features ensure sensitive enterprise data remains protected, mitigating risks associated with AI adoption.

Region Insight

In 2024, North America held a dominant market position, capturing more than 33.5% share and generating USD 1,507 million revenue in the enterprise LLM market. The region’s leadership is largely driven by the strong presence of enterprises that are early adopters of AI technologies, particularly large language models.

Businesses across sectors such as finance, healthcare, retail, and IT have integrated LLM-powered solutions to automate workflows, enhance customer support, and improve decision-making processes. High digital maturity, coupled with significant investment in AI infrastructure, has allowed North America to lead in scaling enterprise-grade LLM applications at a faster pace than other regions.

The dominance of North America is also explained by its advanced ecosystem of technology providers, research institutions, and venture capital investments that continuously push innovation in large language model applications. Enterprises in the region are leveraging LLMs for tasks such as document processing, code generation, and compliance automation, which has boosted efficiency and reduced operational costs.

By Model Type

In 2024, General-purpose Large Language Models (LLMs) held the largest share of 42.5% in the enterprise LLM market in 2024. These models are designed to perform a wide range of natural language processing tasks across diverse applications without being specialized for a particular industry or function.

Their flexibility and broad applicability make them attractive for enterprises seeking scalable AI solutions capable of handling multiple automated tasks such as content creation, customer support, and internal knowledge management. General-purpose LLMs benefit from continuous advances in training data scale, model architecture, and computational power, enabling them to generate coherent and contextually aware responses.

Enterprises leverage these models’ versatility to reduce costs and improve operational efficiency by deploying them for multiple use cases within a single platform. This widespread applicability supports rapid AI adoption in business environments aiming to enhance communication, decision-making, and customer engagement.

By Component

In 2024, Software components accounted for 36.2% of the enterprise LLM market in 2024. This includes AI frameworks, model APIs, development platforms, and software tools that facilitate the integration, customization, and deployment of LLMs.

Software investments focus on providing comprehensive capabilities such as prompt engineering, fine-tuning, workflow automation, and safety filters to ensure effective and controlled AI outputs. The software segment’s growth is driven by demand for user-friendly, scalable AI infrastructure that enables enterprises to build and manage large language models without requiring extensive expertise in deep learning.

Providers continuously enhance software to comply with enterprise security, privacy, and governance requirements, addressing data handling concerns. These software solutions form the backbone of enterprise LLM adoption, allowing seamless integration with existing IT ecosystems and business processes.

By Deployment Mode

In 2024, Cloud deployment dominated the enterprise LLM market in 2024 with 55% share due to its scalability, flexibility, and cost efficiency benefits. Cloud platforms provide the computational resources necessary for training and running LLMs on demand, eliminating the need for enterprises to invest heavily in on-premises infrastructure.

Cloud-based LLMs also enable easier access to updates, model improvements, and support services, fostering agility in AI adoption. The cloud environment’s elastic resource allocation allows enterprises to handle fluctuating workloads efficiently while supporting collaboration across distributed teams.

Security and compliance features offered by cloud providers, including encryption and identity management, further enhance the market’s attractiveness. The growing availability of cloud AI platforms from major providers accelerates adoption by simplifying deployment and management, helping businesses focus on leveraging AI for innovation and competitive advantage.

By Enterprise Size

Large enterprises led the market with a 60% share in 2024, reflecting their early adoption of enterprise-scale AI solutions. These organizations have significant IT budgets and complex data environments that benefit from the productivity, automation, and insight generation provided by LLM technologies.

Large-scale deployments often target customer experience improvements, operational digitization, and advanced analytics. Large enterprises also prioritize stringent security, compliance, and integration capabilities, driving demand for LLM offerings that meet such enterprise-grade requirements.

Their leadership drives market innovation and sets adoption trends for medium and smaller businesses. Investments in LLM-powered tools enable these firms to sustain digital transformation efforts and unlock new business value through AI-driven automation and decision-making.

By Industry Vertical

In 2024, Healthcare accounted for 20% of the enterprise LLM market in 2024, reflecting the sector’s growing reliance on AI for clinical decision support, patient engagement, and medical research. LLMs assist in interpreting vast amounts of unstructured healthcare data, including medical records, research papers, and patient interactions, enabling faster and more accurate insights.

Healthcare organizations demand highly specialized and secure LLM solutions to comply with patient privacy regulations such as HIPAA. AI-powered models improve diagnostic accuracy, personalize patient care, and accelerate drug discovery efforts. The complex nature of healthcare data and critical need for reliability underscore the increasing adoption of LLM technologies within the sector to enhance outcomes and operational efficiency.

Key Market Segments

By Enterprise LLM Model Type

General-Purpose LLMs

Domain-Specific LLMs

Custom/Proprietary LLMs

By Component

Software

Hardware

Services

By Deployment Mode

By Enterprise Size

Small & Medium size

Large Enterprises

By Industry Vertical

BFSI

Healthcare

Retail and e-commerce – Retail and E-commerce

Legal and Compliance

Manufacturing

Others

Regional Analysis and Coverage

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherlands

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Singapore

Thailand

Vietnam

Rest of Latin America

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Driver Analysis

Growing Demand for Intelligent Automation in Enterprises

The rapid expansion of the enterprise large language model (LLM) market is heavily driven by the rising demand for intelligent automation in business processes. Organizations are increasingly adopting LLM-powered tools such as chatbots, virtual assistants, and content creation systems to enhance customer service and optimize operations.

These models allow enterprises to deliver personalized and multilingual support 24/7, handling large volumes of interactions efficiently. This automation significantly reduces operational costs and frees up resources for more strategic, value-added activities, making LLMs an attractive investment for improving business efficiency.

Additionally, LLMs offer advanced capabilities to extract insights from vast amounts of unstructured data stored within organizations. By providing real-time analytics, sentiment analysis, and risk evaluation from sources like customer feedback and market data, LLMs help speed up decision-making and give businesses a competitive edge. Improvements in model accuracy, scalability, and multi-turn contextual understanding further increase their usefulness in enterprise environments, supporting continuous growth in adoption.

Restraint Analysis

High Computational Costs and Data Privacy Concerns

One major restraint facing the enterprise LLM market is the high computational cost linked to training and deploying these large AI models. Substantial computing power is required, resulting in expensive infrastructure needs that can be prohibitive for smaller and mid-sized companies.

This makes the initial investment and ongoing operational cost a significant barrier to broader adoption, particularly for enterprises with limited budgets. Data privacy and security concerns also limit market growth. Since LLMs rely on vast datasets for training and operation, handling sensitive or regulated data (e.g., in healthcare or finance) raises compliance risks.

Organizations must ensure they meet stringent regulations around data protection, which can slow down implementation. The shortage of skilled AI professionals who understand both technology and regulatory requirements further compounds this restraint.

Opportunity Analysis

Expansion into Non-English and Industry-Specific Models

There is a significant opportunity for growth in enterprise LLMs by developing models that support non-English languages and specific industries. Most current LLMs are optimized primarily for English, but growing global business and diverse user bases drive demand for models that handle additional languages, unlocking markets that are otherwise underserved.

Enterprises operating in multilingual environments stand to benefit greatly from this expansion. Furthermore, tailoring LLMs for specialized industry needs presents substantial potential. Sectors like healthcare, legal, and scientific research generate large volumes of complex text data that can be better leveraged through domain-specific LLMs.

Customized models improve accuracy and relevance in tasks such as medical diagnosis support or legal document analysis. These advances create new revenue streams by enabling more sophisticated AI applications and improving enterprise workflows.

Challenge Analysis

Integration and Accuracy for Specific Enterprise Needs

A key challenge is aligning general-purpose LLMs with the specific requirements of enterprise applications. Models trained on broad datasets may lack precision or fail to grasp the nuances necessary for specialized tasks, such as technical product support or regulatory document analysis. This misalignment can result in inefficiencies, errors, or reduced trust in AI outputs.

Moreover, integrating LLMs into existing complex enterprise IT environments is difficult. Enterprises need to ensure that LLM systems work seamlessly with legacy software, comply with internal security policies, and maintain high accuracy levels. Continuous tuning, updating, and monitoring of the models require ongoing investment and skills.

Competitive Analysis

In the Enterprise LLM Market, Microsoft, Google, and IBM remain at the forefront, leveraging their established cloud and AI ecosystems. Microsoft is strengthening its integration of LLMs across enterprise software and productivity tools. Google is advancing its foundation models with a focus on enterprise-grade AI solutions. IBM continues to drive adoption through hybrid cloud and trusted AI frameworks.

NVIDIA, Oracle, and Meta play a strategic role by combining hardware, cloud infrastructure, and AI platforms. NVIDIA dominates the GPU ecosystem, enabling faster model training and deployment. Oracle enhances its enterprise cloud services with AI-driven capabilities, targeting data-intensive industries. Meta invests heavily in advancing open-source LLM research, aiming to expand its influence beyond social media.

Apple, Anthropic, H2O.ai, and Alibaba Cloud represent an evolving competitive layer in the market. Apple is aligning its LLM advancements with device ecosystems, ensuring enterprise-ready AI tools. Anthropic is gaining traction by promoting safety-first LLM design, appealing to regulated industries. H2O.ai is expanding adoption with its open-source frameworks and enterprise AI platforms. Alibaba Cloud leverages its dominance in Asia, delivering regionally optimized LLM services.

Top Key Players in the Market

Microsoft

Google Inc.

IBM Corporation

NVIDIA Corporation

Oracle

Meta

H2O.ai

Apple Inc.

Anthropic PBC

Alibaba Cloud

Recent Developments

In March 2025, H2O.ai launched Enterprise LLM Studio, a Fine-Tuning-as-a-Service platform on Dell infrastructure. It enables organizations to securely customize large language models with private datasets, streamlining the entire workflow from data preparation to deployment for domain-specific AI applications.

In April 2025, Alibaba introduced Qwen3, an open-source LLM family with six dense models and two Mixture-of-Experts models. Qwen3 supports 119 languages, offers hybrid reasoning for deeper analysis with faster responses, and is designed for diverse applications, from mobile devices to robotics.

IBM’s enterprise LLM focus is anchored in its Granite AI family. In October 2024, Granite 3.0 launched with a flagship 8B parameter instruction-tuned model emphasizing low-cost, practical deployment with high safety and industry-grade performance.

Report Scope