Company Logo

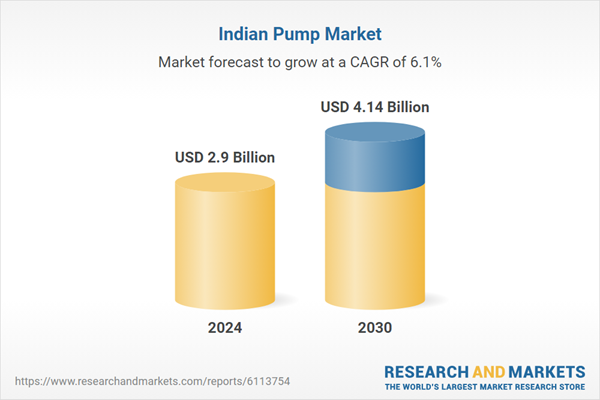

The India Pump Market, valued at USD 2.90 billion in 2024, is set to reach USD 4.14 billion by 2030, with a CAGR of 6.11%. This growth is influenced by the US-China trade war, increasing raw material costs, and sourcing challenges. However, India benefits from a diversified supply chain, IoT integration, solar solutions, and government-backed initiatives like Jal Jeevan Mission. Major players like Kirloskar Brothers and CRI Pumps dominate, adapting to trends in energy efficiency and digital innovation. The market sees strong demand from the industrial sector, with Western India leading, and Eastern regions expected to grow rapidly.

Indian Pump Market

Indian Pump Market

Dublin, Sept. 03, 2025 (GLOBE NEWSWIRE) — The “India Pump Market Research Report 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

The India Pump Market was valued at USD 2.90 Billion in 2024, and is projected to reach USD 4.14 Billion by 2030, rising at a CAGR of 6.11%.

The India pump market consists of major domestic manufacturers Kirloskar Brothers, CRI Pumps, and Texmo Industries, together with smaller regional companies that serve agriculture, water supply, wastewater treatment, industrial applications, and building services. The market experiences growth from investments in irrigation systems and smart city development, and rural electrification initiatives.

Local manufacturers such as Shakti Pumps, KSB India, and Jyoti Ltd are adopting smart pump technologies. These include remote monitoring and automation to meet the need for water efficiency, energy savings, and digital infrastructure in rural and urban areas. Furthermore, companies like V-Guard benefit from strong dealer and distributor networks, extensive service systems, and local manufacturing. This gives them an edge, especially in the agricultural and municipal pump markets.

The government maintains its support for the industry, which enables manufacturers like Solar Pump India Pvt Ltd to offer solar-powered and energy-efficient pump solutions. Also, larger firms such as Grundfos India focus on innovation and research and development for energy-efficient and IoT-enabled pumps. In the meantime, local manufacturers such as Falcon Pumps, Lubi Industries, and Roto Pumps compete based on price and customization, especially in agriculture and in the borewell pump business.

INDIA PUMP MARKET GEOGRAPHICAL ANALYSIS

In 2024, the Western region accounted for approximately 33% of the India pump market, establishing itself as the largest market share, driven by strong industrial demand. This dominance is largely attributed to industrial activities in key states like Maharashtra and Gujarat, which are critical manufacturing hubs contributing significantly to India’s industrial output. According to Invest India, Maharashtra alone accounts for 13.8% of India’s overall industrial output and attracts 30% of the nation’s total Foreign Direct Investment (FDI) inflows from April 2000 to March 2023

The Eastern region is projected to be the fastest-growing region in the Indian pump market, with a CAGR of 7.77%, driven by a strong government focus on rural infrastructure development. This growth is further supported by the emergence of new industrial corridors in states like Bihar, Odisha, and West Bengal. In June 2025, Odisha approved eight mega industrial projects with a combined investment of approximately USD 17.76 billion, significantly contributing to the demand for pumps in the region.

Story Continues

INDIA PUMP MARKET TRENDS & ENABLERS

The increasing adoption of smart and IoT-enabled pump systems is allowing end-users to track performance, detect faults, and reduce maintenance costs through remote diagnostics and predictive analytics. Solar-powered and energy-efficient pump solutions are becoming more popular in the India pump market, especially in agriculture and rural water projects. This trend is driven by rising electricity costs and strong government backing for renewable energy programs.

Municipal and industrial pumping systems are adding the capabilities of automation and centralized control systems. This improves system responsiveness and cuts operational costs. Investments from the Jal Jeevan Mission and AMRUT schemes are significantly boosting pump deployment for rural water supply, sanitation, and sewage treatment infrastructure across different states.

The industrial and construction boom, supported by the Make in India and Smart Cities programs, is driving demand for pumps in HVAC systems, material handling, and utility services; hence, supporting the India pump market growth during the forecast period. The government and industrial sectors have a vast array of aging pump systems that pose prospects for retrofitting and replacing them with energy-efficient and digitally regulated systems.

INDUSTRY RESTRAINTS

High initial costs of modern pump systems and control units keep small farmers and MSMEs from adopting them. Price-sensitive buyers select models that are low-priced with few features. This limits the reach of energy-efficient and IoT-enabled options. Furthermore, volatility in raw material prices, particularly for copper, cast iron, and stainless steel, leads to unstable pump pricing and tighter profit margins for manufacturers. This makes long-term procurement planning difficult for buyers and OEMs.

The India pump market is very fragmented, with many small and regional players that focus on low-cost, low-quality products. This erodes customer trust, limits product standardization, and creates challenges for organized manufacturers trying to scale. Moreover, a lack of awareness and inadequate training among end-users and field technicians about optimal pump usage, energy-saving methods, and preventive maintenance results in frequent failures, shorter lifespans, and poor performance of advanced systems.

IMPACT OF US & CHINA TRADE WAR

In April 2025, India imposed safeguard tariffs of up to 15% on Chinese steel and alloy imports. This significantly increased the cost of raw materials among home pump manufacturers in irrigation systems, municipalities, and industries.

Between late 2023 and Q1 2025, Indian steel prices rose by over 20%, forcing OEMs to delay public utility pump tenders and cut margins on infrastructure-driven projects.

Indian pump manufacturers are now sourcing from Vietnam, Thailand, and Eastern Europe. However, lead times have increased to 8 to 14 weeks, disrupting the delivery of pump systems under Engineering, Procurement, and Construction (EPC) and export contracts.

Slow global demand from the U.S. and China in FY2024 led to a decrease in Indian pump exports for oil, gas, and water infrastructure projects linked to both markets.

As part of the China +1 sourcing strategy, global buyers are seeking to diversify their supply chains by looking beyond China for manufacturing options. This shift has led to a rise in inquiries for Indian pumps from regions such as the GCC (Gulf Cooperation Council), ASEAN (Association of Southeast Asian Nations), and East Africa. However, domestic capacity constraints limit short-term volume growth.

To reduce the impact of tariffs, major Indian OEMs are localizing IoT integration and forming regional supply partnerships. Their goal is to stabilize component availability and reduce delays in obtaining international approvals.

INDIA PUMP MARKET NEWS

In February 2025, Grundfos introduced the MIXIT HVAC solution and IE5 pump systems and enhanced LSV technology at ACREX India. The company implemented this strategy to enhance energy efficiency in data centers and district cooling systems.

In April 2025, Havells India announced a USD 70.49 million investment to acquire up to a 9.24% stake in Goldi Solar, which operates as a leading solar module manufacturer. The acquisition strategy aimed to establish a reliable solar module and cell supply while expanding its renewable energy market position.

In July 2025, Shakti Pumps Limited approved an approximately USD 1.4 million equity investment in its subsidiary, Shakti Energy Solutions. This investment is aimed at bolstering the company’s expansion into DCR-compliant solar cell and module manufacturing at a new facility in Pithampur, Madhya Pradesh, India, strengthening its position in the rapidly growing solar pump segment.

KEY QUESTIONS ANSWERED

How big is the India pump market?

What is the growth rate of the India pump market?

Who are the key players in the India pump market?

Which region dominates the Indian pump market share?

What are the significant trends in the India pump market?

Key Attributes:

Report Attribute

Details

No. of Pages

247

Forecast Period

2024 – 2030

Estimated Market Value (USD) in 2024

$2.9 Billion

Forecasted Market Value (USD) by 2030

$4.14 Billion

Compound Annual Growth Rate

6.1%

Regions Covered

India

Key Company Profiles

Crompton Greaves Consumer Electricals Limited

WPIL Limited

Flowserve Corporation

Jyoti Ltd.

Roto Pumps Limited

Kirloskar Brothers Limited

KSB Limited

Shakti Pumps (India) Ltd.

Oswal Pumps Limited

Lubi Industries LLP

C.R.I. Pumps Private Limited

Other Prominent Vendors

AQUA Group

Angel Pumps (P) Limited

Best Pumps (India) Pvt. Ltd.

CNP Pumps India Pvt. Ltd.

Deccan Industries

Dover India Private Limited

Duke Pumping Solutions Private Limited

EKKI Water Technologies

Ellen Group

Endura Pumps

Falcon Pumps Pvt. Ltd.

Grundfos Holding A/S

Havells India Ltd.

Jasco Pump Pvt. Ltd.

Kishor Pumps Pvt. Ltd.

KIRLOSKAR EBARA PUMPS LIMITED

Mahendra Pumps Pvt. Ltd.

MAK Pump Industries

Maxwell Engineering Solutions

MBH Pumps (Guj) Pvt. Ltd.

Protecto Engineering Pvt. Ltd.

PSP Pumps Pvt. Ltd.

Sabar Hydrotech LLP

SAM Turbo Industry Private Ltd.

Swastik Engineering

Suguna Pumps

Sintech Precision Products Ltd.

Latteys Industries Limited

Texmo Industries

V-Guard Industries Ltd.

Waterman Industries Pvt. Ltd.

Xylem Inc.

Yathi Pumps

La-Gajjar Machineries Pvt. Ltd.

SEGMENTATION ANALYSIS

Segmentation by Operation

Segmentation by Power Output

Low Power

Medium Power

High Power

Segmentation by Product

Centrifugal

Reciprocating

Rotary

Segmentation by Centrifugal Pump

Single-stage

Multi-stage

Submersible

Turbine

Others

Segmentation by Reciprocating Pump

Segmentation by Rotary Pump

Gear

Lobe

Peristaltic

Vane

Others

Segmentation by Distribution Channel

Segmentation by End-user

Industrial

Agricultural

Commercial

Residential

Segmentation by Industrial

Water & Wastewater

Oil & Gas

Power

Chemical

Food & Beverage

Mining

Pharmaceutical

Others

Segmentation by Commercial

Public Utilities

Office Complexes

Hospitality

Others

Segmentation by Agricultural End-users

Segmentation by Geography

Western

Maharashtra

Gujarat

Madhya Pradesh

Rajasthan

Southern

Tamil Nadu

Karnataka

Andhra Pradesh

Telangana

Northern

Uttar Pradesh

Punjab

Haryana

Delhi

Eastern

West Bengal

Odisha

Bihar

Assam

For more information about this report visit https://www.researchandmarkets.com/r/ygo8i5

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900