Sunrise host Natalie Barr has launched a scathing attack on the federal government over its lack of action in the wake of a superannuation scandal which has seen 12,000 Australians lose $1.2b.

In an explosive on-air segment, Barr grilled Social Services Minister Tanya Plibersek, demanding to know why the government failed to act on a damning Senate report which warned more than a year ago Australia’s corporate watchdog ASIC was under-resourced.

Her comments came after it was revealed First Guardian and Shield Master super funds collapsed, wiping out retirement savings for thousands of people, including an Adelaide couple who lost their entire $240,000.

Plibersek insisted the government was treating the matter seriously, with assets frozen and travel bans in place for those allegedly responsible.

‘This is a devastating situation for the people who’ve lost their money,’ she said.

‘These people deserve to have the loss of their super investigated thoroughly.

‘Assistant treasurer Daniel Mulino is guiding this very closely to make sure that it is properly investigated and people are held to account.’

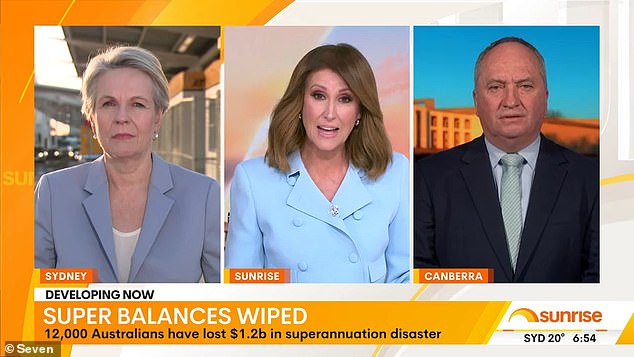

But Barr and Nationals MP Barnaby Joyce weren’t having it.

Sunrise host Natalie Barr (pictured) tears into the federal government over the First Guardian super scandal

Pictured is Canberra couple Simon and Annette Luck who lost $340,000 after First Guardian super collapsed

‘These weren’t some dodgy callers from Nigeria,’ said Barr.

‘These were platforms on Australian websites, some with names [of big bank] and Equity Trustees, and hard working Australians put their money in, often all of their super they put low risk, they didn’t want the high risk, and this is what’s happened to them.

‘They thought that their superannuation was guaranteed by the government.’

Plibersek said ASIC had more than 40 people investigating however Joyce said he lacked confidence the regulator was on top of it.

‘This is a tragedy for these people who have gone from living in their house, to living in Housing Commission homes,’ he said.

‘They’ve done absolutely the right thing, and this will be financially and personally devastating.

‘They might as well broken into a bank and stolen the money.’

The Senate inquiry in question, tabled 14 months ago, made 11 urgent recommendations, calling ASIC a ‘sick regulator’ and urging the government to urgently boost resources to prevent exactly this kind of financial disaster.

Tanya Plibersek (pictured left) said ASIC has 40 people on the case during a heated interview on Sunrise with host Natalie Barr (centre) and Nationals MP Barnaby Joyce (pictured right)

ASIC has sought leave from the Federal Court to expand its case against former financial adviser Ferras Merhi (pictured)

Earlier this week, ASIC sought leave from the Federal Court to expand its case against former financial adviser Ferras Merhi. The regulator alleges Mr Merhi engaged in ‘unconscionable conduct,’ failed to act in the best interests of clients, gave conflicted advice, and issued defective statements of advice, all while receiving millions of dollars, ASIC said in a media release.

According to ASIC, Mr Merhi used marketing companies to drive clients to his financial advice businesses, Venture Egg and Financial Services Group Australia (now in liquidation).

Between 2020 and 2024, Mr Merhi and advisers working for him allegedly directed clients to invest around $296 million of their superannuation into the First Guardian Master Fund and about $230 million into the Shield Master Fund, ASIC said.

In return, it is alleged Mr Merhi’s businesses received nearly $18 million in upfront advice fees, as well as more than $19 million from entities associated with First Guardian for marketing the fund to clients. Both funds have since collapsed.

ASIC deputy chair Sarah Court described the matter as ‘misconduct on an industrial scale’.

‘This type of conduct doesn’t just undermine the integrity of the financial advice and superannuation industries, it can have a devastating impact on people’s lives,’ she said.

ASIC also alleges Mr Merhi implied to clients that the fund was operated by Macquarie. His property assets have been frozen, and he is currently prevented from leaving the country.

Couple speak out after losing out to super fund collapse

A husband and wife close to retirement are now contemplating selling their mortgaged house and living in a caravan after losing $340,000 from the collapsed First Guardian Master Fund.

Canberra couple Simon Luck, 61, and Annette, 56, had been planning to use their super to pay off their house in coming years before visiting relatives in The Netherlands and the UK.

First Guardian Master Fund’s directors are accused of moving $242million in funds offshore, and splurging on a $9million Melbourne mansion and a $548,000 Lamborghini.

‘Absolutely gutted,’ Mr Luck told Daily Mail Australia. ‘We’ll be able to survive but it just means that all our plans for European travel and all that sort of stuff, we’ll just become homebodies I guess.

‘My wife’s Dutch heritage so we had plans to go to Holland and reunite with her extended family.’

Annette Luck said the couple, who married in 1993, had initially planned to pay off their house in Canberra’s northern suburbs when she was able to access her super, before travelling around Australia and overseas.

Annette Luck said the motorhome they had built for their retirement, with a separate $100,000 loan, could end up becoming their primary residence if they couldn’t pay off their house

‘We had plans to travel around Australia for two years and then do a tour of Europe then travel through Europe to England where Simon’s family is from, and Scotland and Ireland,’ she said. ‘We would then loved to have spent a year or two in New Zealand travelling around.’

‘We’d love to stay in Canberra but we simply won’t be able to afford to – we love where we are; just can’t afford to stay here now.

‘We’ll live out of the motorhome, we’ll become grey nomads and no fixed abode, I guess; it’s not what we envisaged.’