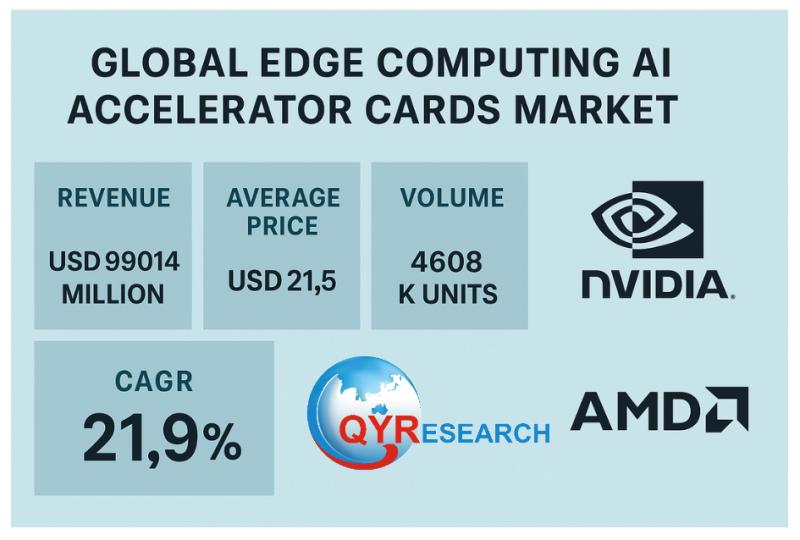

The Edge Computing AI Accelerator Cards market is entering a high-velocity growth phase. According to QYResearch Report Global Edge Computing AI Accelerator Cards Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031, the market reached US$ 26,805 million in 2024 and is projected to hit US$ 99,014 million by 2031 at a 21.9% CAGR (2025-2031). Momentum is reinforced by a series of 2024-2025 product launches that are pushing generative, vision, and robotics workloads to the edge while slashing latency and energy cost per inference. Nvidia introduced Jetson AGX Thor bringing Blackwell-class compute to robots, Hailo launched the Hailo-10H M.2 GenAI accelerator at single-digit watts, AMD rolled out Versal AI Edge Gen 2 doubling down on deterministic, safety-critical edge performance, Intel expanded its Data Center GPU Flex family for edge inference, and Huawei advanced its Atlas 300I Pro with improved Ascend architecture.

The Edge Computing AI Accelerator Cards market is entering a high-velocity growth phase. According to QYResearch Report Global Edge Computing AI Accelerator Cards Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031, the market reached US$ 26,805 million in 2024 and is projected to hit US$ 99,014 million by 2031 at a 21.9% CAGR (2025-2031). Momentum is reinforced by a series of 2024-2025 product launches that are pushing generative, vision, and robotics workloads to the edge while slashing latency and energy cost per inference. Nvidia introduced Jetson AGX Thor bringing Blackwell-class compute to robots, Hailo launched the Hailo-10H M.2 GenAI accelerator at single-digit watts, AMD rolled out Versal AI Edge Gen 2 doubling down on deterministic, safety-critical edge performance, Intel expanded its Data Center GPU Flex family for edge inference, and Huawei advanced its Atlas 300I Pro with improved Ascend architecture.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) https://www.qyresearch.com/sample/4937058

Latest Data

• Global Market Size 2024: US$ 26,805 million

• Forecast 2031: US$ 99,014 million

• CAGR 2025-2031: 21.9%

• Regions: North America, Europe, Asia Pacific, South America, Middle East & Africa

• Forecast Units: USD million (value)

• Coverage: Revenue & volume forecast, company share, competitive benchmarking, growth factors and restraints, regulation, and risk analysis

Classification

• Cloud Deployment

• Device Deployment

Applications

• Smart Grid

• Smart Manufacturing

• Smart Rail Transit

• Smart Finance

• Other

Leading Companies

NVIDIA

AMD

Intel

Huawei

Qualcomm

IBM

Hailo

Denglin Technology

Haiguang Information Technology

Achronix Semiconductor

Graphcore

Suyuan

Kunlun Core

Cambricon

DeepX

Advantech

Five Product Snapshots

NVIDIA – Jetson AGX Thor

• Blackwell-based edge module for robotics and physical AI

• Up to 7.5× AI compute compared with Jetson Orin

• Up to 3.5× higher energy efficiency

• Supports up to 128 GB LPDDR5X memory

• Developer kit listed at US$ 3,499; production modules US$ 2,999

AMD – Versal AI Edge Series Gen 2

• Up to 3× TOPS per Watt vs. previous generation

• Up to 10× more scalar compute

• Designed for deterministic real-time control and functional safety

• Targeting industrial automation, medical imaging, aerospace, and defense

Intel – Data Center GPU Flex 170

• 32 Xe cores with 512 XMX engines

• 16 GB GDDR6, 576 GB/s bandwidth, 150 W power envelope

• PCIe Gen4 x16 interface

• Optimized for video analytics and media-rich pipelines at the edge

Huawei – Atlas 300I Pro Inference Card

• Ascend 310 series processor with 8 AI cores and 8 CPU cores

• 24 GB LPDDR4X memory with ~204.8 GB/s bandwidth

• Half-height, half-length PCIe card for industrial deployment

• Capable of approximately 140 INT8 TOPS

Hailo – Hailo-10H

• Around 40 TOPS (INT4) or 20 TOPS (INT8) performance at 2.5 W

• M.2 form factor (2242/2280) with PCIe Gen3 x4

• Equipped with 4-8 GB LPDDR4/4X memory

• Focused on running GenAI workloads locally on PCs and embedded systems

Verified Downstream Users

Amazon Robotics

Caterpillar

Figure AI

Meta Platforms

Siemens

John Deere

Apptronik

Foxconn

H3C Technologies

ZTE

Lenovo

Dell Technologies

Hewlett Packard Enterprise

Supermicro

Cisco Systems

Market Trend

Physical AI goes mainstream in robotics

Robotics vendors are moving LLM and VLM reasoning from the cloud to on-device compute for lower latency, privacy, and resilience. NVIDIA’s Jetson AGX Thor brings a 7.5× performance uplift over Orin with 3.5× better efficiency, enabling robots to handle multi-modal perception and interaction directly at the edge. Early adopters include Amazon Robotics, Caterpillar, Meta, and Figure AI, with agriculture, logistics, and manufacturing poised to expand adoption.

Low-power GenAI with quantized inference

Edge accelerators are adopting INT4 and INT8 quantization to allow transformer models and diffusion networks to run on small devices. Hailo-10H exemplifies this with 40 TOPS INT4 performance at just 2.5 W. This trend makes on-device copilots and real-time inspections feasible without relying on high-power GPUs or cloud servers.

Adaptive SoCs for safety-critical applications

Industrial, medical, and rail environments require deterministic performance and functional safety. AMD’s Versal AI Edge Gen 2 delivers up to 3× TOPS per Watt with stronger real-time control and safety features. These adaptive SoCs and FPGA solutions are gaining traction in regulated industries that demand consistent latency and certified safety standards.

Memory-rich edge accelerators for GenAI

Accelerator cards are increasingly equipped with larger onboard memory to support bigger models and reduce round-trips to the cloud. Qualcomm’s Cloud AI 100 Ultra with 128 GB on-card memory achieves lower latency on generative workloads like Stable Diffusion, and scales throughput by multi-device scheduling, proving that high-memory PCIe cards are now vital for edge GenAI.

Industrial adoption through platform partnerships

Industrial ecosystems are expanding by integrating accelerator cards with complete software platforms. Siemens has strengthened its partnership with NVIDIA, embedding GPU-powered AI into industrial PCs for predictive maintenance and inspection. Such partnerships are accelerating adoption in smart manufacturing and smart grid sectors.

Regional ecosystems and localized supply chains

In China, accelerator providers like Cambricon and Baidu Kunlunxin have secured large orders from H3C and ZTE for edge deployments, driven by national priorities for domestic AI hardware. Local supply chains are fostering CUDA-compatible alternatives and new PCIe-based edge cards tailored for surveillance, transport, and utilities.

Open-source enablement

Firmware and drivers for AI accelerators are being upstreamed into major Linux distributions, cutting deployment time and easing fleet management. Qualcomm’s AIC100 firmware inclusion in linux-firmware in 2024 exemplifies how open-source contributions accelerate adoption across enterprise edge systems.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4937058

Diversified form factors and power envelopes

The product spectrum is widening from 2.5 W M.2 modules to 150 W PCIe cards, allowing customers to right-size AI acceleration for their application. PCIe Gen4 and Gen5 adoption is expanding, with device-level accelerators serving mobile robots and cameras, while server-class cards address retail, utilities, and transportation back-ends.

Strategic Takeaways

• Robotics and industrial AI will be the strongest growth engines through 2025, powered by Blackwell-class modules and low-power GenAI at the edge.

• Quantization and memory-centric designs will define leadership, with INT4/INT8 compute and high onboard memory emerging as critical metrics.

• Adaptive SoCs and FPGA-based accelerators are set to dominate regulated industries requiring functional safety and deterministic performance.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Details

Tel: +1 626 2952 442 ; +41 765899438(Tel & Whatsapp); +86-1082945717

Email: john@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world’s largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.