The New York Times recently published an opinion piece, “The Stock Market Is Getting Scary. Here’s What You Should Do.” Its author is legendary economist Burton Malkiel, author of the classic book on index investing, “A Random Walk Down Wall Street.”

One of the premises of the article is that the recent gains in the stock market may be overdone. Many financial pundits have similarly warned that we may be approaching bubble territory, with recent gains in AI-focused stocks particularly worrisome. I get questions daily from investors concerned about whether the market is overheated.

While the takeaway from Malkiel’s article is that investors should stay in their seats and avoid trying to time market highs and lows (good advice), I’d like to challenge the premise that the current market is somehow detached from reality. I’m not predicting where the market is headed from here — short-term moves in the stock market are erratic and I don’t pretend to know what will happen next. But I would like to point out that current stock prices are not unhinged.

I always remind myself that investing in the stock market means that you get to own a little piece of lots of successful companies. Ownership, or equity, is a tremendous opportunity to grow wealth. Think about the wealthiest people you know — they are likely business owners. In the Berkshires, these might be the owners of landscaping companies or builders who have grown their businesses from scratch.

Having an opportunity to invest in these businesses and share in their growth over time would have been a great way to build wealth. Investing in the stock market offers equity on a much larger scale and with the most successful businesses of all time. The S&P 500 is like the all-star team of businesses.

Investing in the S&P 500 means that you get to share in the current profits and future growth of behemoths like Apple, Microsoft, Nvidia, JP Morgan, and other household names.

But that brings us back to the question at hand — are the current stock prices of these companies irrational? Have they become detached from reality?

While current companies may be more “expensive” than companies in the past, they are not detached from reality. The most fundamental gauge of a company’s success is its earnings, reported each quarter. (Think of earnings as net income after expenses and taxes).

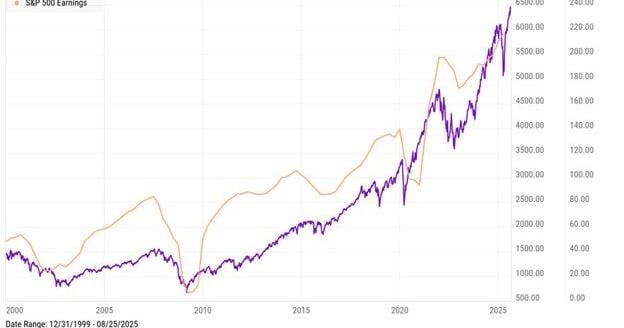

The chart below adds up the profits of all the companies in the S&P 500 and compares that to the current level of the index. Looking at the chart, we see an obvious correlation between the two.

As earnings rise over time, so too does the value of the stock market. When earnings collapsed in the financial crisis in 2008, so did the stock market. Earnings fell in 2020 during the COVID-19 outbreak and again in 2022 during peak inflation. Each of these periods also saw the stock market decline significantly. The timing wasn’t exact, but the general trend stayed intact.

As of the most recent report, S&P 500 earnings are at an all-time high. In other words, the companies in the index have never been more profitable. And the stock market has never been higher. It’s an oversimplification of how the stock market is valued, but it is instructive.

TABLEAUX WEALTH

Not only are current earnings at an all-time high, but future expectations are high as well. The current AI revolution may have a profound impact on publicly traded companies and their earnings. While companies like chipmaker Nvidia and other tech companies are the most obvious beneficiaries of AI, there are countless other examples across industries.

For example, what if JP Morgan replaces analysts with technology and significantly reduces the cost of its labor? What if Walmart uses AI for better supply chain logistics to reduce inventory costs? What if John Deere sells AI-powered tractors to increase farm productivity? What if FedEx uses AI to optimize routes to reduce fuel costs and delays? What if Eli Lilly can implement AI to reduce R&D timelines on new drugs by years?

The examples are endless. All signs point to potentially more efficient companies with higher profits and increased earnings.

The stock market is a group of companies that have never seen higher earnings. And now we have an expectation of increased earnings in the future due to productivity gains from AI. Current earnings combined with future expectations means that there is nothing irrational about the stock market being at all-time highs.

This isn’t to say that the stock market isn’t scary. The stock market is always scary because volatility can materialize in a flash. In the earliest days of 2020 no one could have foreseen that a global pandemic would shut down the economy and lead to such a drastic decrease in earnings. We are always one black swan event from a market meltdown.

But there is nothing about the current stock market that makes it particularly scary, except that it has gone up and people are afraid of all-time highs. Rather than fear all-time highs, investors should remember that strong earnings and future innovation are exactly what drive the market upward over time.