This quantum computing specialist is a highly speculative investment.

IonQ (IONQ -0.74%) is one of the most popular pure-play quantum computing companies available for investment. The stock has risen an incredible 479% over the past year, but after its steep surge in the latter half of 2024, it stalled. It’s currently trading a few percentage points below the all-time high it reached at the start of 2025. However, IonQ is one announcement away from another surge that could lift the stock to new highs, which could make an investment today worthwhile.

On the flip side, IonQ doesn’t have a viable business model right now, so the stock is being valued based on what investors believe could happen in the future. This makes it a risky stock pick. But is the risk worth it for the potential reward?

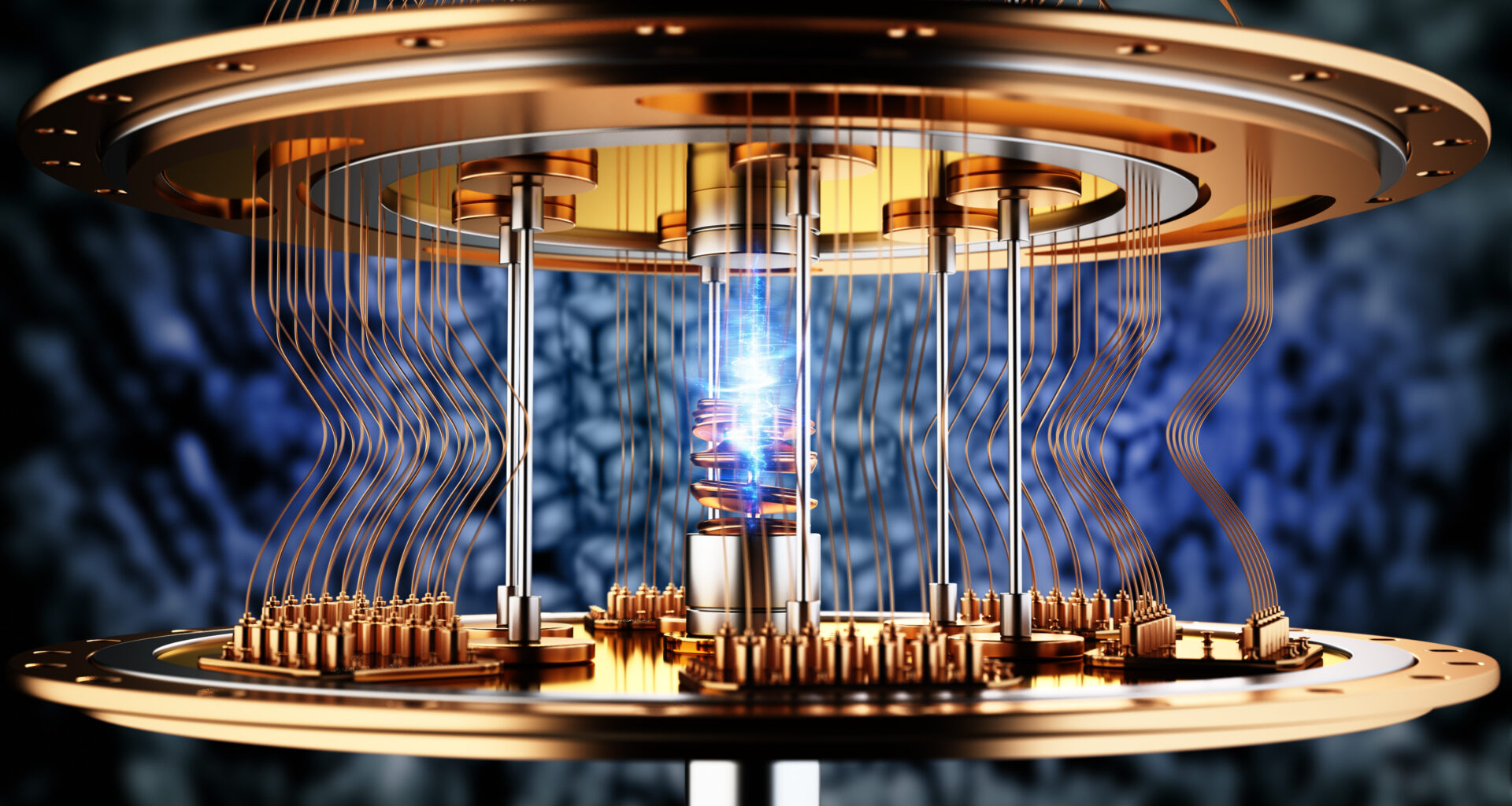

Image source: Getty Images.

The quantum computing market will look a lot different a decade from now

As a pure-play quantum computing company, IonQ has no other businesses that it can rely on to bring in funding for its operations. It must achieve a viable quantum computing product in the future, or its stock will become worthless. But after its 2025 run-up, are most of the potential rewards for success already baked into its stock price?

IonQ sports a market cap of approximately $12 billion, which is substantial considering that the company’s only revenues today come from research contracts. However, 2030 is expected to be a pivotal year for the quantum computing industry broadly, and IonQ’s CEO, Peter Chapman, believes that by that point, the company will be profitable, with sales approaching $1 billion. After 2030, the market opportunity is expected to explode: Based on a forecast by the market researchers at McKinsey, IonQ predicts that it will have an $87 billion market opportunity in 2035. And based on several third-party reports, IonQ asserts that by 20240, quantum computing could create up to $880 billion in economic value. Assuming that quantum computing does become a wide-reaching technology, IonQ could become a household name in the same way that artificial intelligence (AI) chip leader Nvidia has.

So, even though IonQ has a ton of expectations already baked into its stock price, it could still be a successful investment over a sufficiently long time frame — if its quantum computing technology proves successful. That’s a big “if,” though, because there’s no guarantee that IonQ’s approach will work well enough to be commercially viable.

IonQ’s approach to quantum computing differs from its peers’

The core of any quantum computing system is the qubit — the basic physical unit in which quantum information is stored and handled. But there are several approaches to creating qubits being pursued by the various players in the space. The most popular, by far, is superconducting, which involves cooling the qubit to near absolute zero. This is quite expensive, but the resulting circuits do provide extremely fast calculations.

IonQ doesn’t use this approach. Instead, it uses trapped ion qubits. These can be created at room temperature, and the technology delivers more accurate results than rival models. However, the gate processing speeds of IonQ’s quantum computers aren’t nearly as fast as those of its competitors. I think that the organizations and companies that will ultimately be the consumers of quantum computing technology will value accuracy and cost over greater speed, which makes me believe that IonQ could be successful in producing a commercially viable quantum computing product. But we’re still years away from finding out if it or any other quantum computing company will be up to the task.

Due to the high-risk, high-potential-reward nature of IonQ’s stock, if you’re going to buy it, you should keep your investment relatively small — no more than 1% of your portfolio. That way, if IonQ doesn’t pan out, it won’t be a major setback for your long-term returns. However, if IonQ turns out to be one of the major winners in the quantum computing race, a 1% position could easily grow into a much larger one. Just a decade ago, Nvidia also had a market cap of around $12 billion. Today, it’s the world’s largest company, valued at $4.2 trillion, as its formerly niche technology has become central to the AI revolution. Although it may be wishful thinking to imagine it, IonQ’s technology may achieve something similar.

Nobody knows just how useful quantum computing will be, but an investment in IonQ today could deliver the strong upside that many investors are looking for.