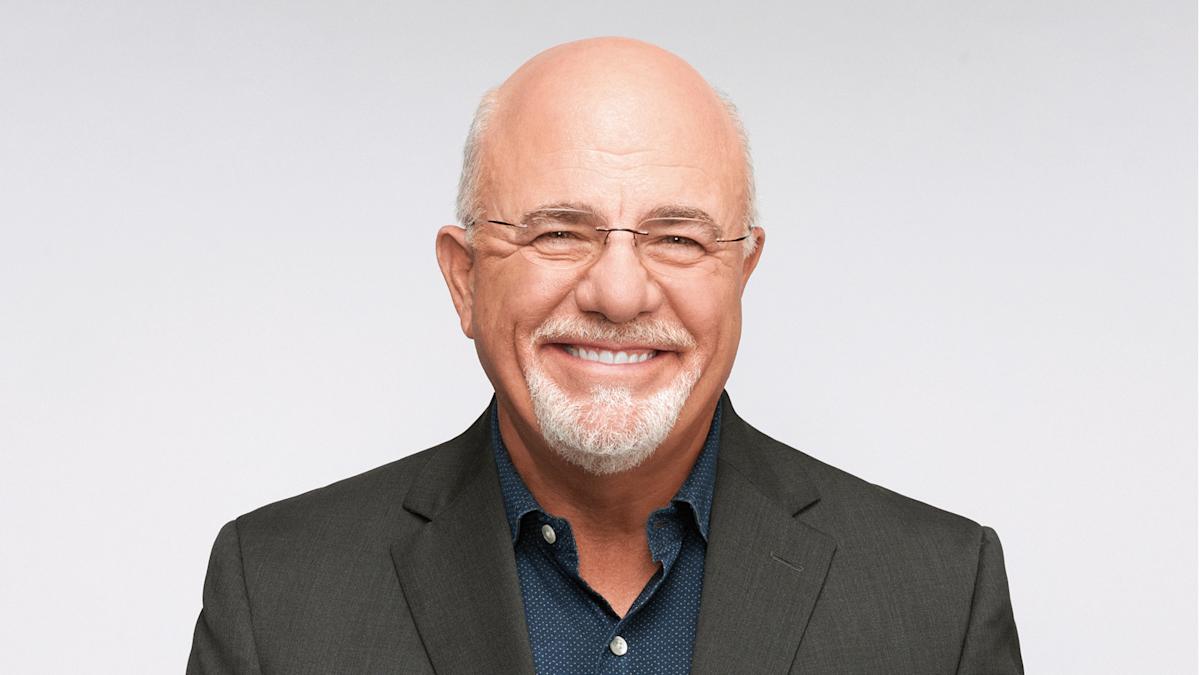

We all make mistakes when it comes to personal finance and leading financial expert and best-selling author Dave Ramsey highlights several of them in a YouTube video.

While the name of the video may be a little off-putting, it’s important to note that Ramsey frequently talks about his own “dumb” money mistakes from his younger years, including declaring bankruptcy.

For that reason, he has dedicated his career to helping as many people as possible overcome debt and achieve financial wealth. Here are Ramsey’s top money mistakes mentioned in this video.

Read Next: Dave Ramsey Says This Is the Best Way To Pay Off Debt

Check Out: These Cars May Seem Expensive, but They Rarely Need Repairs

Ramsey explained that, in his experience, it’s a significant financial risk for people to purchase a house with someone they are not married to. He explained that it becomes very complicated and costly if couples break up and own such a significant asset together. Ramsey said that he has had collars in this exact situation and the outcome is typically expensive and stressful.

Instead, he recommended purchasing a house with a spouse after the wedding.

For You: I Made $10,000 Using One of Dave Ramsey’s Best Passive Income Ideas

Ramsey said another mistake many people make is upgrading their car after an accident, especially when they can’t afford it. Ramsey explained that if someone were driving a $6,000 car, for example, then that means a $6,000 car works for them. If they are involved in an accident and receive a check for the car’s value, many people end up upgrading their car, which can lead to financial stress.

Instead, he recommended that people try to find a car with a price close to the one they were recently driving and save up cash if they want to upgrade their car in the future.

Lastly, Ramsey advises being mindful of the career paths associated with a chosen degree. He said too many students borrow a significant amount of student loans for careers that don’t enable them to earn enough to live and pay them back simultaneously. He strongly suggested that students consider their earning potential before borrowing money for college.

Currently, there is $1.8 trillion in outstanding student loan debt in the United States, according to the Education Data Initiative. Remember, there are many ways to make college tuition more affordable, including attending a community college first or finding a workplace that offers tuition reimbursements.