Zeolite 4A Market Size and Share Forecast Outlook 2025 to 2035

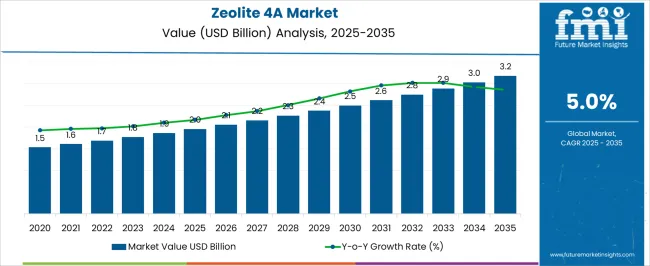

The zeolite 4A market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The initial phase from 2025 to 2028 represents a growth upswing, with stronger consumption in detergent applications as manufacturers continue to shift toward phosphate-free formulations. This stage reflects a peak in demand intensity, supported by favorable regulatory frameworks and expansion of production facilities in Asia Pacific. Between 2029 and 2032, the market may experience a relative trough as growth rates moderate due to raw material cost fluctuations, competitive pressures from alternative adsorbents, and slower industrial activity in certain regions.

However, trough phases are not absolute declines but periods of reduced momentum, where growth stabilizes at a lower rate. From 2032 onward, another peak cycle emerges as technological advancements, rising demand in gas separation, and greater emphasis on water purification reinvigorate expansion. By 2035, the market achieves 3.2 billion, underscoring that while cyclical peaks and troughs occur, long-term progression remains positive, supported by regulatory alignment, diversification of applications, and ongoing innovation in zeolite-based solutions.

Quick Stats for Zeolite 4A Market

Zeolite 4A Market Value (2025): USD 2.0 billion

Zeolite 4A Market Forecast Value (2035): USD 3.2 billion

Zeolite 4A Market Forecast CAGR: 5.0%

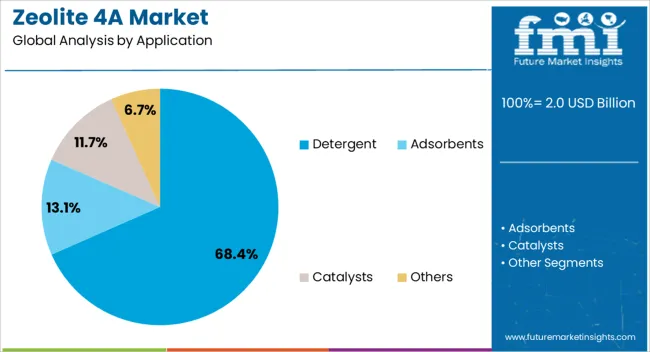

Leading Segment in Zeolite 4A Market in 2025: Detergent (68.4%)

Key Growth Regions in Zeolite 4A Market: North America, Asia-Pacific, Europe

Key Players in Zeolite 4A Market: BASF SE, Interra Global Corporation, KNT Group, Anhui Mingmei MinChem Co., Ltd., Dalian Haixin Chemical Industrial Co., Zeolite (India) Pvt. Ltd., Silkem Ltd., Anten Chemical Co., Ltd., Dinesh Chandra Industries, National Aluminum Company Limited, Zeolites and Allied Products Pvt. Ltd., PQ Corporation, Clariant International Ltd., Tosoh Corporation

Zeolite 4A Market Key Takeaways

Metric

Value

Zeolite 4A Market Estimated Value in (2025 E)

USD 2.0 billion

Zeolite 4A Market Forecast Value in (2035 F)

USD 3.2 billion

Forecast CAGR (2025 to 2035)

5.0%

The market is influenced by several upstream industries. Detergent and cleaning product manufacturers account for approximately 42%, as Zeolite 4A is widely used as a phosphate-free builder in laundry and dishwashing powders. Chemical and catalyst producers represent about 25%, using Zeolite 4A for ion exchange and adsorption in petrochemicals and gas treatment. Water treatment companies contribute nearly 14%, applying Zeolite 4A in softening processes to replace conventional phosphates. Plastic and polymer additives hold around 11%, enhancing stability and performance in packaging and industrial products. Construction material suppliers cover the remaining 8%, incorporating Zeolite 4A in lightweight aggregates and specialty applications.

The market is expanding due to environmental regulations promoting phosphate-free formulations in detergents. More than 60% of new detergent products introduced in 2024 integrated Zeolite 4A as a substitute, strengthening demand from household and industrial cleaning sectors. Production facilities are upgrading with energy-efficient processes, lowering operational costs by 8–10% per ton. In water treatment, usage has grown by 12% year-on-year, supported by stricter standards for hardness reduction. Petrochemical players are adopting Zeolite 4A for gas purification, particularly in natural gas dehydration. Companies are also investing in regional production plants to reduce supply chain costs and ensure consistent availability in high-demand markets.

Why is the Zeolite 4A Market Growing?

The zeolite 4A market is expanding steadily, driven by its widespread use as a phosphate-free builder in cleaning and water treatment applications. Industry announcements and chemical sector reports have underscored the shift toward eco-friendly cleaning products, particularly in regions with stringent environmental regulations limiting phosphate usage in detergents. Zeolite 4A’s ion-exchange capabilities, ability to soften water, and compatibility with surfactants have positioned it as a preferred additive in detergent formulations.

Rising demand for household and industrial cleaning products in emerging markets, coupled with increasing consumer awareness of sustainable ingredients, has further fueled market growth. Additionally, advances in zeolite manufacturing processes have improved product quality and reduced costs, enabling wider adoption.

Strategic investments in production capacity, particularly in Asia-Pacific and Europe, have supported consistent supply. Looking ahead, the market is expected to benefit from continued regulatory support for phosphate alternatives and growing detergent production, reinforcing the prominence of zeolite 4A as an essential functional ingredient.

Segmental Analysis

The zeolite 4a market is segmented by application, and geographic regions. By application, zeolite 4a market is divided into detergent, adsorbents, catalysts, and others. Regionally, the zeolite 4a industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Application Segment: Detergent

The detergent segment is projected to hold 68.4% of the zeolite 4A market revenue in 2025, cementing its position as the dominant application category. This leadership has been supported by zeolite 4A’s efficiency in replacing phosphates as a water-softening and cleaning-enhancing agent. Its ability to remove calcium and magnesium ions during washing improves detergent performance, especially in hard water conditions. Manufacturers have increasingly favored zeolite 4A due to its environmental safety, non-toxicity, and stability under various storage and usage conditions. Reports from detergent producers and chemical manufacturers have highlighted that zeolite 4A’s granular and powder forms integrate seamlessly into both powdered and liquid formulations, ensuring broad applicability. The rising production of household and commercial detergents in fast-growing economies, combined with the global trend toward sustainable cleaning products, has strengthened demand for this material. With regulatory bans on phosphate detergents becoming more widespread, the detergent segment is expected to maintain its market dominance, underpinned by environmental compliance and consistent cleaning performance.

What are the Drivers, Restraints, and Key Trends of the Zeolite 4A Market?

Demand is primarily concentrated in detergents as a phosphate substitute, while applications in wastewater treatment, petrochemicals, and gas separation are expanding. Asia Pacific leads consumption with over 45% share, backed by large-scale detergent manufacturing, while Europe and North America focus on eco-friendly and industrial-grade applications. Environmental regulations limiting phosphate use strengthen demand for zeolite-based builders.

Driving Force Rising Demand in Detergent Manufacturing

Zeolite 4A continues to replace phosphate-based builders in detergents due to its ion-exchange properties, enhancing cleaning efficiency in hard water conditions. Expanding urban populations and increased laundry frequency drive higher detergent use, particularly in Asia and Africa. Producers benefit from cost savings and compliance with environmental restrictions, ensuring widespread adoption across both household and industrial formulations. I believe the global detergent industry will remain the anchor of Zeolite 4A demand in the coming decade.

Detergent applications account for around 60% of Zeolite 4A consumption

Asia Pacific dominates detergent-grade Zeolite 4A with over 45% market share

Formulators reduce costs by 10–15% by substituting phosphates with Zeolite 4A

Growth Opportunity Expansion in Water and Wastewater Treatment

Water and wastewater treatment create a robust opportunity for Zeolite 4A adoption. Its ability to capture ammonium and heavy metals makes it vital in municipal and industrial purification systems. Growing investments in water infrastructure and stricter discharge regulations are accelerating its role as a preferred filtration medium. In my opinion, this segment will emerge as a stable revenue stream beyond detergents, driven by urban infrastructure upgrades in developing regions.

Global wastewater treatment investments projected to exceed USD 500 billion by 2035

Zeolite 4A reduces ammonium concentration in treated water by more than 70%

Industrial wastewater treatment represents about 25% of new applications

Emerging Trend Use in Gas Separation and Petrochemicals

Zeolite 4A is gaining traction in petrochemical refining and gas separation processes due to its molecular sieve properties. Its role in adsorption systems helps optimize oxygen-nitrogen separation and moisture removal. Refinery and chemical plant expansions across Asia and the Middle East are reinforcing demand. From my view, Zeolite 4A’s ability to handle purification processes efficiently positions it well in the broader energy and chemicals sector.

Market Challenge Volatile Raw Material Prices and Competition

The market faces cost pressures due to fluctuations in alumina and silica, which directly impact margins. Producers also face intense competition from low-cost suppliers that dominate commodity-grade supply. At the same time, maintaining high-purity standards for industrial and environmental use requires additional investments. In my opinion, resilience in supply chains and efficiency-driven production models will determine long-term success in this competitive environment.

Analysis of Zeolite 4A Market By Key Countries

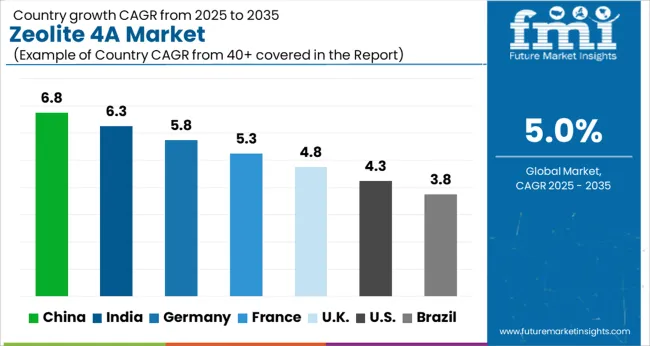

Country

CAGR

China

6.8%

India

6.3%

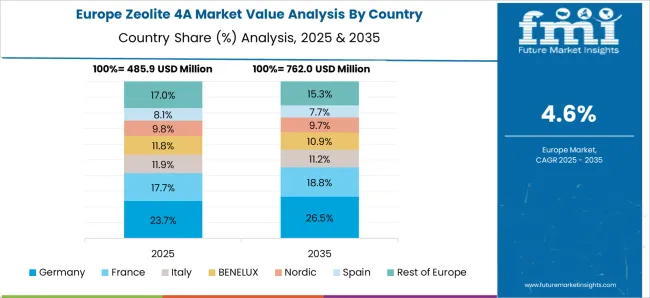

Germany

5.8%

France

5.3%

UK

4.8%

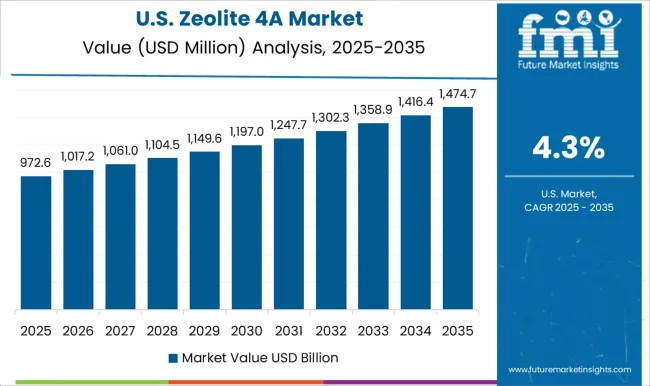

USA

4.3%

Brazil

3.8%

The market is growing at a global CAGR of 5% between 2025 and 2035, supported by rising demand in detergents, wastewater treatment, and industrial applications. China leads with a CAGR of 6.8%, +36% above the global average, driven by BRICS-led expansion in chemical manufacturing and high detergent consumption. India follows at 6.3%, +26% over the global benchmark, reflecting strong growth in domestic cleaning product demand and increased adoption of zeolite-based water treatment solutions. Germany records 5.8%, +16% above global performance, shaped by OECD-driven industrial use in environmental applications and tightening regulations on phosphate alternatives. The United Kingdom posts 4.8%, slightly below the global rate, reflecting moderate growth from detergent producers and selective industrial adoption. The United States stands at 4.3%, −14% under the global CAGR, influenced by slower growth in consumer detergents but supported by applications in petrochemicals and environmental remediation. BRICS economies are driving higher consumption, while OECD markets emphasize regulation-driven applications and technological refinement. The analysis includes over 40+ countries, with the leading markets detailed below.

Market Expansion of Zeolite 4A in China

China is witnessing steady progress in the Zeolite 4A market with a CAGR of 6.8%. Rising detergent usage across urban and semi-urban households is driving bulk demand. Manufacturing bases in Shandong and Jiangsu are expanding capacity with automated processes to reduce costs and meet higher consumption levels. Industrial applications, particularly in chemical processing and wastewater treatment, are also adding to growth. Government-backed initiatives for clean water treatment are supporting greater use of Zeolite 4A as an ion-exchange substitute. China is also strengthening its role as an exporter, with rising shipments to Southeast Asia and Africa. Competitive pricing and efficient raw material sourcing provide Chinese producers with a strong advantage in both domestic and overseas markets.

Detergent-grade Zeolite 4A forming over 60% of domestic demand

Automation in facilities cutting production costs by 12% annually

Exports to Southeast Asia rising by 9% year-on-year

Growth Outlook on Zeolite 4A Market in India

India is recording a 6.3% CAGR in the Zeolite 4A market, driven by detergent penetration and higher washing machine ownership. Rising middle-income consumption is translating into stronger demand for premium detergent formulations containing Zeolite 4A. Local manufacturers are increasing investments in new plants across Gujarat and Maharashtra to strengthen supply. Industrial adoption in water treatment and plastic additives is also growing, with Zeolite 4A emerging as a cost-efficient substitute. Government-backed chemical clusters are improving logistics, which in turn supports export potential. With both multinational and domestic detergent companies sourcing locally, India is becoming a competitive supplier while meeting rising internal consumption.

Growth Analysis of Zeolite 4A Market in the United States

The United States market is recording a 4.3% CAGR, with steady demand from both household detergents and industrial users. Production facilities are upgrading to advanced chemical processes that improve energy efficiency by over 10%. Wastewater management plants are using Zeolite 4A as an ion-exchange medium, expanding applications beyond household detergents. Oil refining and plastic processing industries are also showing growing adoption, diversifying the market base. Environmental regulations continue to drive phosphate replacement, where Zeolite 4A remains a strong candidate. Producers are entering partnerships with distribution networks to ensure timely supply, while research facilities are focusing on developing high-performance variants for industrial operations.

Market Assessment of Zeolite 4A in Germany

Germany is advancing its Zeolite 4A sector at a CAGR of 5.8%, supported by its established chemical industry. Demand is rising as phosphate bans in detergents accelerate substitution with Zeolite 4A. Producers are scaling investments in high-purity grades for both household and industrial cleaning. German wastewater treatment facilities are also incorporating Zeolite 4A, further lifting consumption. With strong trade routes across Europe, Germany is becoming a supply hub for surrounding countries. Local producers are focusing on technology upgrades to enhance efficiency, while consumers are steadily adopting eco-compatible detergent solutions. The combination of strict regulatory enforcement and rising export volumes is reinforcing Germany’s role in the European Zeolite 4A market.

Future Outlook on Zeolite 4A Market in the United Kingdom

The United Kingdom Zeolite 4A market is expanding at a CAGR of 4.8%, shaped by regulatory requirements and evolving detergent formulations. Companies are forming collaborations with cleaning product manufacturers to supply specialized grades of Zeolite 4A. Demand for imported raw material is rising, as local production is limited, creating reliance on European and Asian suppliers. Household cleaning demand accounts for the largest share, though water treatment and niche industrial uses are gradually expanding. Ongoing research into alternatives for phosphate-based compounds is also supporting Zeolite 4A adoption. Market players are focusing on long-term contracts and efficient logistics networks to address import dependency and ensure steady supply across the country.

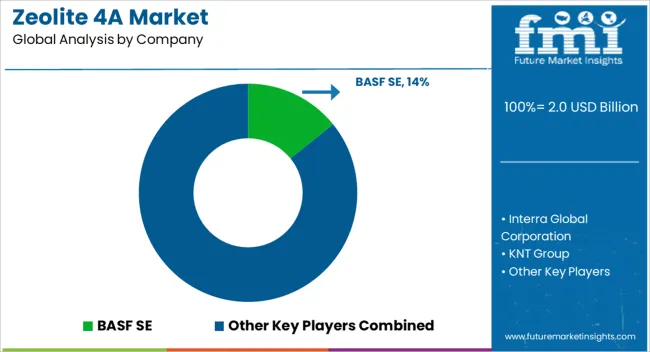

Competitive Landscape of Zeolite 4A Market

The Zeolite 4A market is shaped by large-scale chemical producers and specialized suppliers providing high-performance materials primarily for detergents, water treatment, and industrial applications. BASF SE is assumed to be the leading player, supported by its broad production capabilities, advanced formulations, and extensive distribution network across Europe, North America, and Asia. Interra Global Corporation and PQ Corporation compete strongly by offering tailored zeolite products designed for bulk detergent manufacturing and filtration processes, while Clariant International Ltd. and Tosoh Corporation strengthen their market presence with diversified product portfolios and close collaboration with industrial end-users. Anhui Mingmei MinChem Co., Ltd., Dalian Haixin Chemical Industrial Co., and Zeolite (India) Pvt. Ltd. enhance competitiveness by providing cost-efficient alternatives with consistent quality for regional markets. Strategic focus across these companies remains on securing long-term supply agreements with detergent producers, expanding manufacturing capacity, and investing in process efficiency to meet rising demand for synthetic zeolites in multiple industries.

Product brochures emphasize the use of Zeolite 4A as an effective ion exchanger in detergents, highlighting superior calcium-binding properties, non-toxic characteristics, and environmentally safe performance. Manufacturers present the product in both powder and granular forms, promoting its compatibility with automated detergent production lines and water softening systems. Industrial applications, including wastewater treatment and specialty chemical processes, are also featured, with emphasis on consistency, purity, and high absorption capacity. Marketing materials underscore benefits such as stability under varying pH levels, high thermal resistance, and adaptability for customized formulations. Lifecycle support, technical guidance, and regional distribution channels are positioned as key advantages, ensuring reliable supply and strong customer engagement across both global and regional markets.

Key Players in the Zeolite 4A Market

BASF SE

Interra Global Corporation

KNT Group

Anhui Mingmei MinChem Co., Ltd.

Dalian Haixin Chemical Industrial Co.

Zeolite (India) Pvt. Ltd.

Silkem Ltd.

Anten Chemical Co., Ltd.

Dinesh Chandra Industries

National Aluminum Company Limited

Zeolites and Allied Products Pvt. Ltd.

Clariant International Ltd.

Tosoh Corporation

Scope of the Report

Item

Value

Quantitative Units

USD 2.0 billion

Application

Detergent, Adsorbents, Catalysts, and Others

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

BASF SE, Interra Global Corporation, KNT Group, Anhui Mingmei MinChem Co., Ltd., Dalian Haixin Chemical Industrial Co., Zeolite (India) Pvt. Ltd., Silkem Ltd., Anten Chemical Co., Ltd., Dinesh Chandra Industries, National Aluminum Company Limited, Zeolites and Allied Products Pvt. Ltd., Clariant International Ltd., and Tosoh Corporation

Additional Attributes

Dollar sales by grade and application segment, demand dynamics across detergents, water treatment, and industrial uses, regional trends across Asia-Pacific, Europe, and North America, innovation in high-absorption capacity and eco-friendly formulations, environmental impact of wastewater management and reduced phosphate use, and emerging applications in gas separation, agriculture, and specialty chemicals.