Unsurprisingly, when it comes to massive salaries in professional sports, Michael Jordan was the pacesetter.

Back in July 1996, fresh off the Chicago Bulls’ fourth NBA championship in six years, Jordan landed a then-unthinkable one-year, $30 million contract that blew everything else in the Big Four leagues out of the water.

At the time, athlete salaries were considerably lower than they are today. Larry Bird had set a high-water mark with the $7 million deal he signed in 1991-92 with the Boston Celtics, followed by Magic Johnson’s $14.6 million contract with the Los Angeles Lakers three years later.

And when Jordan signed for $30 million, the leading players in the other three major leagues were miles from that figure: Deion Sanders at $13.5 million in the NFL, Cecil Fielder at $9.2 million in MLB and Wayne Gretzky at $6.5 million in the NHL.

Among these Big Four leagues, Jordan’s contract was the first to break both the $20 million and $30 million barriers for annual athlete salaries. But he soon had company: Alex Rodriguez’s 10-year, $252 million deal with the Texas Rangers came four years later in December 2000, setting the table for some of the huge salaries that were to come in a cap-less MLB.

It wasn’t until 2012 that the New Orleans Saints’ Drew Brees became the first NFLer to net $20 million, signing for five years and $100 million to start a run of incredible salary growth for top quarterbacks. Thirteen years later, the top 11 players at the position are making north of $50 million this season, as some of the highest-paid athletes in the world.

The NHL, meanwhile, is still waiting for its first $20 million man.

The reasons hockey has lagged in paying its stars are myriad, but the No. 1 factor is simply that NHL revenues are much lower. The NFL reportedly earned more than $23 billion last season, followed by MLB at $12 billion and the NBA just shy of that figure. The NHL was well back of the pack, netting just $6.6 billion for 2024-25.

Other factors include the NHL’s hard cap and the way rosters are built and deployed, as no one hockey player can have the same impact as a generational QB or point guard. As the Florida Panthers have shown in winning back-to-back Stanley Cups, depth — including players with sizeable salaries on their third lines and second defense pairings — can be crucial to success in the playoffs.

But that doesn’t mean the NHL is far from a financial breakthrough, especially with the cap projected to skyrocket under a recently ratified collective bargaining agreement that runs until 2030.

Edmonton Oilers star Leon Draisaitl leads the way among NHL cap hits, with his new $14 million-a-season contract kicking in this year. Only three others have cleared $12 million so far — the Toronto Maple Leafs’ Auston Matthews ($13.25 million), the Colorado Avalanche’s Nathan MacKinnon ($12.6 million) and the Edmonton Oilers’ Connor McDavid ($12.5 million) — meaning the $20 million hurdle is still high, even for the sport’s best players.

The other barrier is that the current CBA doesn’t even allow players to make $20 million, as individual player compensation is capped at 20 percent of the $95.5 million ceiling — or $19.1 million.

That changes next year when the cap rises to a projected $104 million, raising the individual max to $20.8 million. Even then, it’s unlikely anyone signs for the limit. Since the salary cap was instituted in 2005, only Brad Richards has agreed to a contract with an AAV of 20 percent of the cap, and that was during a transitional period when the league’s ceiling was only $39 million and rapidly rising.

No NHL team has flirted with a 20-percent player since then, as general managers believe it would be too difficult to build a contender with so much salary allocated to a single player. The highest-salaried players on the most recent Stanley Cup-winning teams — including Sergei Bobrovsky and Aleksander Barkov this past spring with the Panthers — were making $10 million or less, which equates to only 11.3 percent of last season’s $88 million cap.

According to data provided by PuckPedia, the priciest superstar contracts over the past decade have been in the 14 percent to 15 percent range. Joe Thornton, Zdeno Chara and Alex Ovechkin signed deals for around 17 percent early in the cap era, but no one has come close since. McDavid’s second contract in 2018-19 leads the way today with a 15.7 percent share of the cap.

With his current eight-year deal set to expire next summer, McDavid will command a higher cap hit percentage against a much larger cap number than on his last deal. It feels unlikely it’ll be enough to clear the $20 million mark next season.

While some teams might be willing to pay that to the three-time Hart Trophy winner on the open market on July 1, 2026, McDavid’s top priority now is winning his first championship. He took less to stay in Edmonton seven years ago, negotiating down from a $13-plus million AAV, and he likely isn’t going to want to hamstring the team he signs with, whether it’s to stay with the Oilers or go elsewhere as an unrestricted free agent.

The more realistic scenario sees McDavid signing for around 17 percent of the cap, as Ovechkin did on his then-record-setting contract in 2008. On a $104 million cap for 2026-27, that would mean McDavid could earn more than $17.5 million a season, a sizeable jump over Draisaitl’s current mark.

Where things get interesting is if McDavid decides to sign a short-term agreement. In theory, his next deal could be for two or three years, setting him up for an even bigger haul in 2029 or 2030 when the NHL’s salary cap may have risen to $125 million to $130 million.

At that point, even at age 32 or 33, McDavid would easily be able to command more than $20 million on his fourth (and potentially final) contract.

But could anyone potentially beat him to that number?

With Minnesota Wild winger Kirill Kaprizov and Vegas Golden Knights center Jack Eichel on expiring contracts, they will soon push the envelope past Draisaitl’s $14 million: A report surfaced on Wednesday that Kaprizov rejected a $16 million-a-season offer from the Wild. But neither will reach the same stratosphere as McDavid.

Top defensemen Cale Makar and Quinn Hughes, whose contracts expire in 2027, and Matthews, who is up in 2028, would be better candidates for the NHL’s first $20 million man, especially if they’re willing to go to the open market. It’s worth noting that contracts for defensemen have tended to lag, with Erik Karlsson’s $11.5 million deal as the position’s highest AAV and only four blueliners leaguewide earning more than $9.6 million a season. In contrast, 15 forwards have a cap hit higher than that this season.

Two or three years from now, it’s quite possible that the superstar contract landscape has shifted to a point where NHL front offices are willing to dedicate higher cap percentages to singular talents. With so many teams re-signing their best players and a corresponding scarcity of free agent talent every year — including an anemic UFA class this past July — executives could face pressure to rethink just how high they’re willing to go to pry a top player from a rival roster.

If the NHL’s best players begin to routinely command more than 15 percent of the cap, and if the cap continues on its trajectory to sniff $125 million by 2028-29, a $20 million average annual value may become relatively routine.

And it would be fitting if McDavid — like another all-time talent in Jordan 30 years earlier — becomes the first to get there.

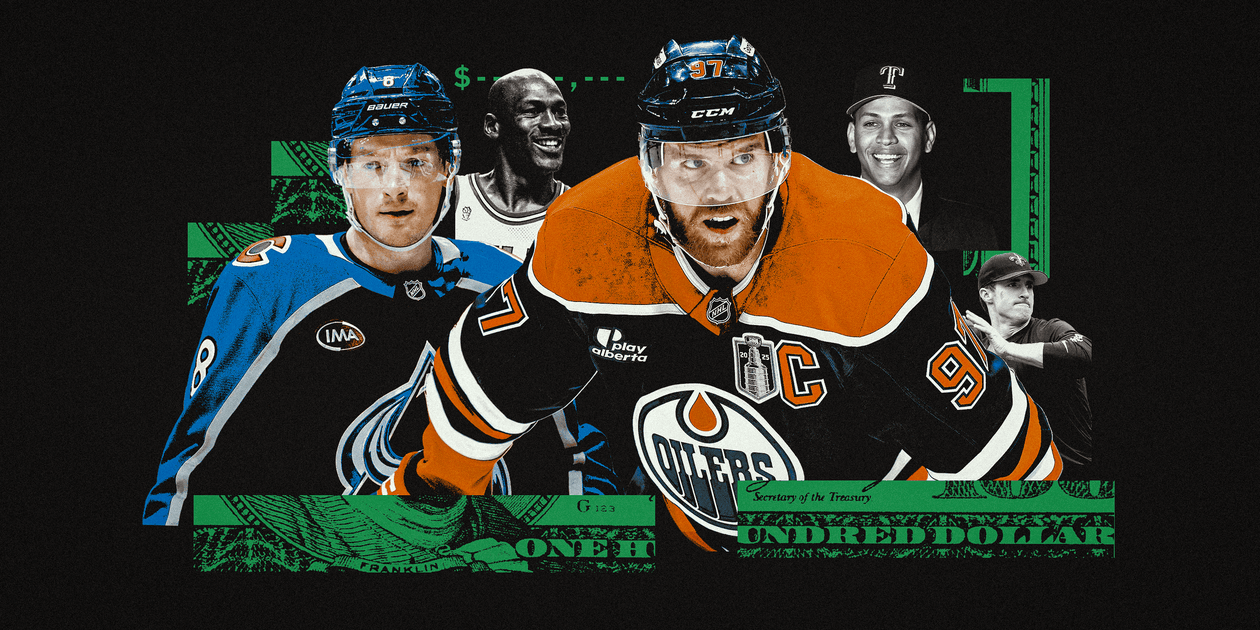

(Illustration: Demetrius Robinson / The Athletic; Top photos: Steph Chambers, C. Morgan Engel, Grant Halverson/Getty Images, Jeff Haynes/AFP via Getty Images, Gary Barber/Allsport)