2h agoThu 17 Jul 2025 at 2:31amMarket snapshotASX 200: +0.8% at 8,628 points (live values below)Australian dollar: -0.7% to 64.80 US centsS&P 500: +0.3% to 6,263 pointsNasdaq: +0.3 to 20,730 pointsFTSE 100: -0.1% to 8,926 pointsEuroStoxx 600: -0.6% to 541 pointsSpot gold: -0.2% to $US3,339/ounceBrent crude: +0.4% to $US68.79/barrelIron ore: +0.1% to $US98.05/tonneBitcoin: -1.3% at $US118,443

Prices current around 12:30pm AEST

Live updates from major ASX indices:

18m agoThu 17 Jul 2025 at 4:18am

Jobs data suggests weaking in labour market: AMP

Economist My Bui from AMP says the the jobs figures don’t paint the rosiest picture and show a potential broad weakening in the labour market.

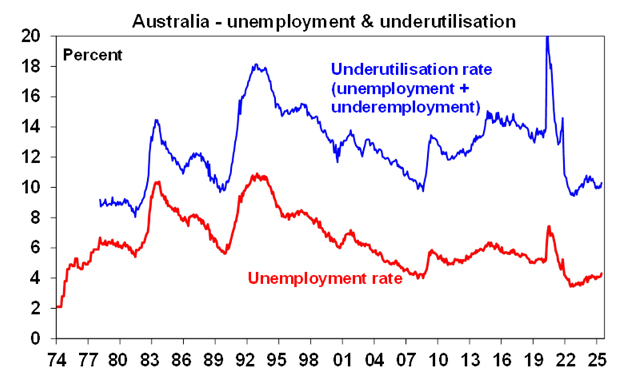

“First, the disappointing jobs figure followed an outright 1k drop in May, translating to a 2% annual growth in employment. Similarly, hours worked increased by only up 1.8% over the year — both lagging behind the 2.3% growth in the labour force. Finally, measures of underemployment (which accounts for people who would like to work more hours but couldn’t) have ticked up: the underutilisation rate increased to 10.3% from 10% last month.”

She noted:

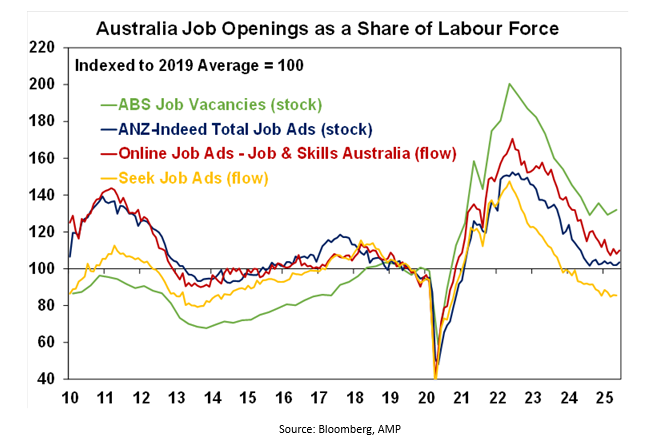

“We continue to see clear downside risks for the labour market. While “stock” measures of job openings seemed stable, “flow” indicators such as new job ads have continued to trend down”

39m agoThu 17 Jul 2025 at 3:57am

The mechanics of the labour force survey

Can I ask two questions please? 1. If the unemployment rate is being carefully watched by the RBA , why on earth would the ABS change the calculation basis ? 2. Do we actually know if the unemployment rate went up if the methodology is different?

– Phillip

Hi Phillip,

We’re sorry for the confusion. That post you’re referring to was talking about the mechanics of the labour force survey.

Here’s how the labour force survey works.

To calculate the unemployment rate, the Bureau of Statistics surveys around 52,000 people every month (26,000 households) and extrapolates its national estimates from there.

And to get a representative sample of the population, it surveys a certain number of people in every state and territory, and those people are located evenly in city centres and regional areas, and comprise a realistic combination of men and women and age groups and everything else.

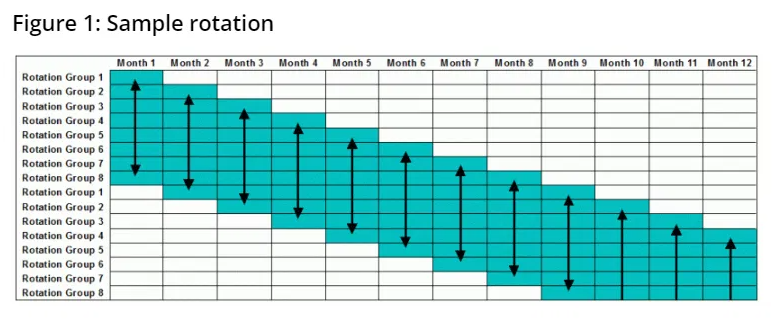

The ABS maintains consistency in the labour force survey by tracking the fortunes of the same group of people for eight months.

Its survey has eight sub-samples (called ‘rotation groups’), and each sub-sample stays in the survey for eight months, with one group “rotating out” each month and being replaced by a new group “rotating in.”

That means seven-eighths of the sample are common from one month to the next, and changes in the estimates reflect real changes in the labour market.

Here’s what that rotation system looks like:

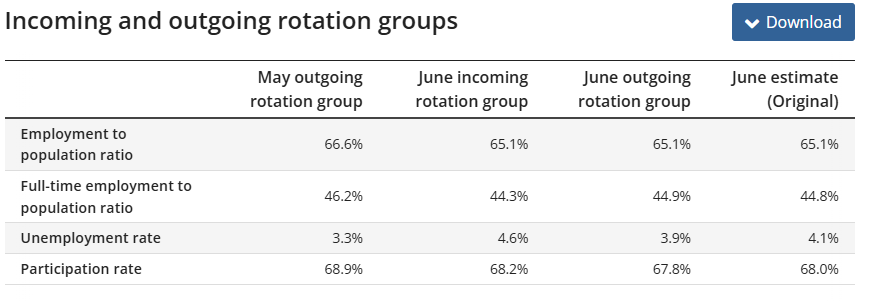

And here’s what June’s incoming rotation group and outgoing rotation group looked like.

The incoming group had an unemployment rate of 4.6%, compared to the outgoing group’s unemployment rate of 3.9%.

Here’s what ANZ’s economic team said about that:

“Within the details, it appears the group rotating into the labour force sample had a higher propensity for being unemployed than the group it replaced, which helps explain the jump in the unemployment rate this month. That is, there is both statistical noise and signal in the June labour force survey.”

58m agoThu 17 Jul 2025 at 3:38am

Matcha shortage causing a *stir*

From traditional Japanese origin, matcha has become a global sensation, thanks in part to social media. Influencers tout it as a cleaner, calmer caffeine hit that comes with a dose of antioxidants, but the matcha craze has pushed supply chains to the brink, and the lovers of this trendy drink could soon be paying more, as my colleague Samuel Yang reports

Loading…

1h agoThu 17 Jul 2025 at 3:32am

Update

Sharp rise makes RBA July hold look like ‘policy error’ is a polite way of putting it.

It proves it was wrong and completely flawed.

– Robert

Lots of opinions coming in on the jobs data today. Thanks for sharing yours

1h agoThu 17 Jul 2025 at 3:16amQantas gets court order to block data release

Qantas has been granted a court order in an attempt to pre-emptively block the release of customers’ personal data.

The airline says there’s “no evidence that any personal data stolen from Qantas has been released” but that it continues to actively monitor the situation with the support of cyber security experts.

Last week the airline confirmed 5.7 million customer records had been exposed in a cyber attack.

“In an effort to further protect affected customers, the airline has today obtained an interim injunction in the NSW Supreme Court to prevent the stolen data from being accessed, viewed, released, used, transmitted or published by anyone, including by any third parties,” a statement read.

“We want to do all we can to protect our customers’ personal information and believe this was an important next course of action.”

1h agoThu 17 Jul 2025 at 2:58am

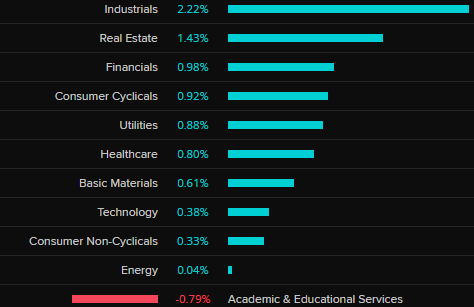

ASX keeps momentum with broad-based rise

The local share market has maintained its gains and the ASX 200 is 0.7 per cent higher at lunchtime.

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

The major banks are on the rise, led by ANZ (+1.1pc) and CBA (+1pc).

BHP (+0.4pc) and Rio Tinto (+0.8pc) are also helping lift the broader index, while gold miners have fallen.

Car Group shares remain lower (-2.1pc) on news its long-standing chief executive will leave the firm.

1h agoThu 17 Jul 2025 at 2:54am

Next RBA rates decision looking a ‘slam dunk’ for rate cut, economist says

Betashares chief economist, David Bassanese, was one of a handful of economists to correctly predict the Reserve Bank would keep interest rates on hold in July.

He sees the latest jobs data today as evidence the RBA can confidently cut interest rates next month.

“On that score, the rise in the unemployment rate to 4.3% is disappointing, and may suggest the economy is finally losing the ability to find jobs for a labour force still growing strongly at a rate of around 30k per month.”

And that’s a key point.

There’s been many new job applicants entering the labour force each month, and the demand for labour has been strong enough to absorb them, but has that now changed?

“Given the inherent volatility in labour market data, today’s results need to be taken with a grain of salt,” Bassanese said.

“We’ll need more consistent signs of weakness in both employment and hiring indicators before we can conclude the labour market is turning.

“That said, today’s result clearly adds to the case for a RBA rate cut at the August policy meeting, provided next week’s Q2 CPI report [inflation data] is not a shocker,” he said.

For those who love to keep it simple … Bassanese says, based on this jobs data, a second quarter ABS CPI figure of 2.7 per cent of below would allow the RBA to cut interest rates next month.

A figure of 2.8 per cent, “would make the RBA’s decision more agonising.”

Imagine that. Thousands of dollars in potential savings for mortgage borrowers coming down to a statistical difference of 0.1 per cent.

2h agoThu 17 Jul 2025 at 2:33amMarkets see 84pc chance of August rate cut

A quick check in on how market pricing for the August Reserve Bank meeting is sitting after the jobs figures.

According to LSEG, there is an 84 per cent chance of a 0.25 percentage point cut — just before the labour force data was released, it was around 77 per cent.

2h agoThu 17 Jul 2025 at 2:30am

Not happy, Jan!

The National Australia Bank does a big survey every three months, interviewing hundreds of businesses across the economy.

The results of its survey are read by the Reserve Bank.

The June quarter survey shows business conditions are not great … at all.

“Business conditions eased to their lowest level since Q3 2020.”

“Falls in the trading and employment components were the drivers, while the profitability component remained weak.

So operating a business in Australia now seems pretty challenging, according to this survey.

But maybe there’s a silver lining, especially with further potential interest rate cuts?

Here’s what the survey showed:

“Business confidence trends are more positive, with another gain, but it is still below its long-run average.”

“Forward-looking indicators saw some modest gains, but remain on the soft side.”

This survey, combined with the latest jobs data, showing a jump in the unemployment rate, may explain why the Australian dollar has taken a bit of a tumble against the greenback today.

It’s 64.8 US cents at 12:30 AEST.

2h agoThu 17 Jul 2025 at 2:18am

Sample survey change may have skewed the jobs data: ANZ

Today’s ABS unemployment data for June has come as a surprise, but there may be an explanation for that surprise.

ANZ senior economist Adelaide Timbrell says it’s entirely possible more unemployed people, and less full-time employed people, were included in this latest survey.

“So there was a change in the sample groups of people who were asked about their labour force status.”

“In the latest survey, we have to remember, like most economic data, the labour force data is not perfect, and what happened was the people who were being surveyed this month versus last month were more likely to be unemployed before that survey began,” Adelaide Timbrell said.

Notwithstanding this though, there does seem to be some loosening in the jobs market.

“So although the data does seem to show some loosening in the labour market, we need to temper that with the idea that part of this increase in the unemployment rate may be because of who was asked.”

2h agoThu 17 Jul 2025 at 2:11amSharp rise makes RBA July hold look like ‘policy error’: Capital Economics

We’re starting to get some initial economist notes coming through after the unexpected rise in the unemployment rate.

Abhijit Surya, senior economist at Capital Economics, said the result was “markedly weaker” than he had anticipated.

“The sharp rise in unemployment in June makes the RBA’s decision to leave rates on hold earlier this month look like a policy error,” he wrote.

“We’re increasingly convinced that the incoming data flow will prompt the Bank to cut rates further than most are currently anticipating.”

Mr Surya did note that over the quarter, the labour force isn’t materially weaker than the RBA had been forecasting, with annual employment growth in the second quarter slightly above the central bank’s expectations, while the unemployment rate was in line.

“Even so, the dramatic shift in the sequential momentum evidenced in the monthly data is certain to give the RBA cause for concern.

“After all, it did note in its July monetary policy announcement that there was a risk that weak private demand could lead to a ‘sharper deterioration in the labour market than currently expected.’ And today’s labour force release suggests that that very risk is closer to materialising.”

He noted there were other indicators of spare capacity in the labour market in today’s figures, including the underemployment rate and underutilisation rates rising, and hours worked dropping.

2h agoThu 17 Jul 2025 at 2:01am4.3pc is highest unemployment rate since late 2021

The last time the unemployment rate was higher than this was in November 2021, so more than 3.5 years ago, when it was 4.6 per cent.

Since then, it reached a low of 3.4 per cent in late 2022 and since early 2024 it has been fairly steady between 3.9 and 4.2 per cent.

The participation rate edged up in June, to 67.1 per cent, meaning a greater portion of the population was in a job or looking for work.

The increased size of the labour force meant there were more officially unemployed people, as well as more employed people.

2h agoThu 17 Jul 2025 at 1:49am

How has the unemployment rate tracked?

Here’s a chart of how we got to here, with the unemployment rate increasing to 4.3 per cent in June, after several months steady at 4.1 per cent:

Business reporter Gareth Hutchens will have a comprehensive write-up here, which he’s updating as we speak:

2h agoThu 17 Jul 2025 at 1:43amAussie dollar takes a hit, ASX adds to gains

We saw a swift market reaction to those jobs numbers — looks like currency analysts got the material surprise they had said would be needed to shift the Aussie, which is now down half a per cent against the greenback:

AUDUSD (LSEG Refinitiv)

AUDUSD (LSEG Refinitiv)

And the Australian share market has added to its gains — the benchmark index is now up 0.6 per cent.

3h agoThu 17 Jul 2025 at 1:36amSlight increase in employment all down to part-time positions

According to the ABS, overall employment only increased by 2,000 people, while the number of officially unemployed people increased by 33,600.

Part-time employment grew by 40,000 people, offset by a 38,000-person fall in full-time employment.

3h agoThu 17 Jul 2025 at 1:32amBreaking: Unemployment rate rises to 4.3%

The unemployment rate has risen to 4.3 per cent in June, according to the ABS.

That’s a worse outcome than expected — it had been tipped to stay steady at 4.1 per cent.

Employment rose by just 2,000 people in the month, also below estimates.

3h agoThu 17 Jul 2025 at 1:23am

Aussie dollar around 65.2 US cents ahead of jobs data

Currency analysts aren’t expecting too much reaction from the Aussie dollar to the jobs data due out shortly, unless there’s a material surprise.

Here’s where we’re currently sitting:

AUDUSD (LSEG Refinitiv)

AUDUSD (LSEG Refinitiv)

According to LSEG, market pricing currently puts the chance of an interest rate cut by the Reserve Bank in August at 77 per cent.

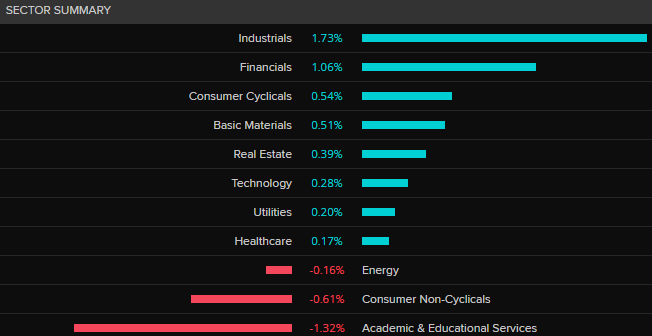

3h agoThu 17 Jul 2025 at 1:00amBroad bounce for ASX as banks and miners rise

The Australian share market is holding onto its gains around an hour into the session — with 16 of the top 20 stocks on the rise, some of the biggest companies are doing heavy lifting, including the banks and miners.

Here’s how the sectors are faring:

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

The best performing stocks:

Block +4.4%Auckland Intl Airport +6.7%Nuix +3.1%Hub24 +2.8%Monadelphous Group +2.6%

And the worst:

Pilbara Mineral -4.1%Lifestyle Communities -3.8%Lynas -2.9%IGO -2.9%Liontown Resources -2.4%

4h agoThu 17 Jul 2025 at 12:32am

Market snapshotASX 200: +0.5% at 8,607 points (live values below)Australian dollar: -0.1% to 65.17 US centsS&P 500: +0.3% to 6,263 pointsNasdaq: +0.3 to 20,730 pointsFTSE 100: -0.1% to 8,926 pointsEuroStoxx 600: -0.6% to 541 pointsSpot gold: -0.1% to $US3,344/ounceBrent crude: +0.5 to $US68.88/barrelIron ore: +0.1% to $US98.05/tonneBitcoin: -0.9% at $US118,945

Prices current around 10:30am AEST

Live updates from major ASX indices:

ASX 200: +0.8% at 8,628 points (live values below)Australian dollar: -0.7% to 64.80 US centsS&P 500: +0.3% to 6,263 pointsNasdaq: +0.3 to 20,730 pointsFTSE 100: -0.1% to 8,926 pointsEuroStoxx 600: -0.6% to 541 pointsSpot gold: -0.2% to $US3,339/ounceBrent crude: +0.4% to $US68.79/barrelIron ore: +0.1% to $US98.05/tonneBitcoin: -1.3% at $US118,443

ASX 200: +0.8% at 8,628 points (live values below)Australian dollar: -0.7% to 64.80 US centsS&P 500: +0.3% to 6,263 pointsNasdaq: +0.3 to 20,730 pointsFTSE 100: -0.1% to 8,926 pointsEuroStoxx 600: -0.6% to 541 pointsSpot gold: -0.2% to $US3,339/ounceBrent crude: +0.4% to $US68.79/barrelIron ore: +0.1% to $US98.05/tonneBitcoin: -1.3% at $US118,443