(The Center Square) – The Association of Washington Business, the oldest and largest statewide organization of its kind, has set its priorities for next year’s legislative session at the group’s ongoing 2025 Policy Summit at the Davenport Grant Hotel in Spokane.

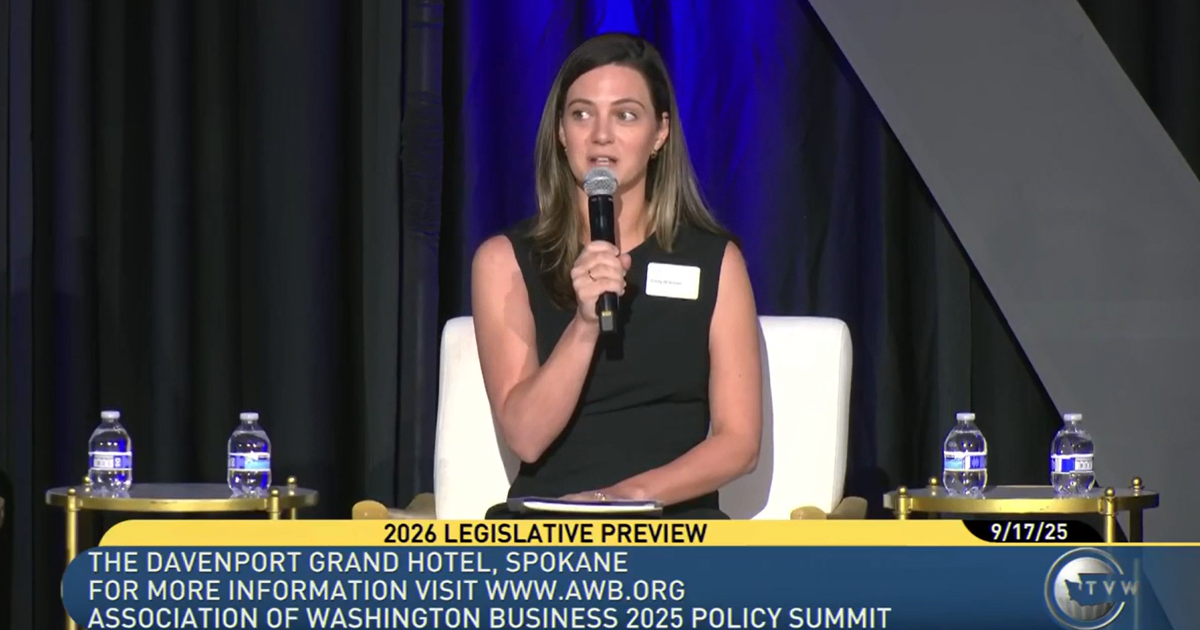

AWB Government Affairs Director Emily Wittman told those in attendance Wednesday – including AWB members, employers, business leaders, and lawmakers – that AWB will largely focus on health care policy in the upcoming session. She focuses on education, workforce, child care, health care, and federal affairs.

“I just can’t emphasize enough the financial crisis that our health care system is in, and especially our hospitals that are in Washington state,” she said. “We saw a significant tax increase with taxes applied to hospitals. “

According to Wittman, the new advanced computing charge that will take effect next year is another blow to the health care industry.

Beginning Jan. 1, 2026, Washington will increase its business and occupation advanced computing surcharge more than sixfold, from 1.22% to 7.5%. Passed as part of House Bill 2081 during this year’s legislative session, the new law also dramatically increases the annual tax cap and broadens the definition of affected businesses

“We’ve found out that a lot of folks in our system and healthcare pay the advanced computing surcharge,” Wittman said.

Wittman said rate increases in the individual healthcare market are hurting employees and their employers.

“The Office of the Insurance Commissioner approved a 21% increase in the individual health care market,” she said. “Seeing that the average increase for employer-sponsored healthcare is like 6.5%. You want to be providing these benefits for employees, but it’s getting pretty dire as far as what you’re paying out of pocket for your premiums and what employers are asked to pay.”

She said AWB will provide lawmakers with a list of burdensome regulations in hopes of decreasing the growth in health care costs.

Max Martin – AWB government affairs director for artificial intelligence, technology, and tax and fiscal policy – mentioned Comcast’s recently filed lawsuit, which aims to block a new law imposing a sales tax on digital advertising services.

Max Martin, Gov’t Affairs Director for the Association of Washington Business (AWB) at today’s AWB 2025 Policy Summit discussing 2026 legislative priorities

Source: TVW

“It was eye-opening, to say the least,” he said. “To see a nearly $9.4 billion revenue package come together so quickly and so late in session and include things like the single largest tax increase in state history. And it also includes one of the more significant shifts in sales tax policies that we’ve seen in decades.”

He suggested that Senate Bill 5814 will likely be amended during the 2026 session because of the lawsuit and other businesses’ opposition.

SB 5814, enacted this year, expands the state’s retail sales tax to cover many services, including information technology services, advertising, custom software, temporary staffing, and security services, effective Oct 1. It also extends the “other tobacco products tax” to include synthetic nicotine products starting Jan. 1, 2026.

“It’s been in the crosshairs recently with the lawsuit coming. I think it’s significant. It’s challenging this policy on the grounds of violating the Internet Tax Freedom Act by taxing digital advertising services while also carving out traditional offline media,” Martin added.

He added that Democratic budget writers relied heavily on taxes from SB 5814 to craft the 2025 budget.

“What’s really keeping me up at night right now, especially seeing what’s happening with this bill, is okay, say that portion comes out. What’s the financial hit going to look like? Department of Revenue has recently come out saying that that portion of the bill would generate $475 million over four years, and we used that money to build this most recent budget,” he said.

AWB’s summit concludes on Thursday.