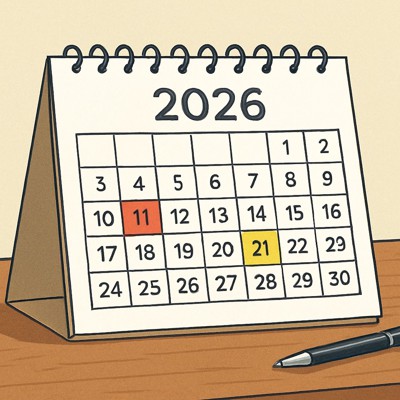

Download the Best Dates to Retire Calendar

Here is the calendar to go with last week’s guidance to help you plan your best date for retirement in 2026. The key below and the information provided in that column can be used to understand why some dates are better than others. The explanations are meant to help you understand when your CSRS, CSRS Offset or FERS retirement benefit will begin to accrue. There are 26 leave periods in 2026 for most federal employees, with the 2026 leave year beginning on Jan. 11, 2026, and ending on Jan. 9, 2027.

According to the Office of Personnel Management, although 2025 has been a year like none other, in most years, approximately 25% of all immediate, voluntary retirements are received at or near the end of the “leave year.” This allows a retiring employee to maximize the lump sum payment for annual leave. If you retire before the new leave year begins, you will be paid for the leave that was carried over from the previous year plus the leave accrued during the current year. The “use or lose” deadline isn’t until the first day of the new leave year. OPM has a fact sheet: Lump-Sum Payments For Annual Leave with more information.

The leave year begins on the first day of the first full biweekly pay period in a calendar year. A leave year ends on the day immediately before the first day of the first full biweekly pay period in the following calendar year. The beginning and ending dates of the leave years shown below apply to most employees. However, some agency payroll systems (such as the the U.S. Postal Service) use a different pay period schedule. Employees should contact their agencies to verify the beginning and ending dates of a particular leave year. OPM has another fact sheet showing the leave year beginning and ending dates for future years.

You may decide to begin taking TSP distributions and apply for Social Security retirement at a different time. For some of you, this retirement from federal service may mark the beginning of your second career. For others, you may be fully retiring and decide to have TSP and Social Security benefits begin around the same time as your retirement date under CSRS or FERS.

Be sure to notify your Human Resources specialist that you are retiring at least 30 to 90 days before you plan to stop working. This will allow time to complete the Online Retirement Application (ORA) that has portions for you, your Human Resources Office, and your Payroll Provider to complete before your application is forwarded to OPM. OPM will receive your completed application following your date of final separation. According to OPM, retirement processing can take several months to finalize if you have any of the following situations:

Court orders such as a divorce decree or property settlement. These require an additional step and are sent to the Court Order Benefits Branch for review.

Experience as a Law Enforcement Officer, Firefighter, Air Traffic Controller, Capitol Police, Supreme Court Police, or Nuclear Materials Courier, as these cases use a special annuity computation.

Past or active workers’ compensation claims.

Experience as a part-time or intermittent federal employee.

Federal service at multiple federal agencies.

Missing documents and forms, or incomplete or incorrect information in your retirement application.

Moving without updating your address with OPM.

Here is a calendar to help you plan your best date for retirement in 2026.