Middle East Anesthesia And Respiratory Devices Market Summary

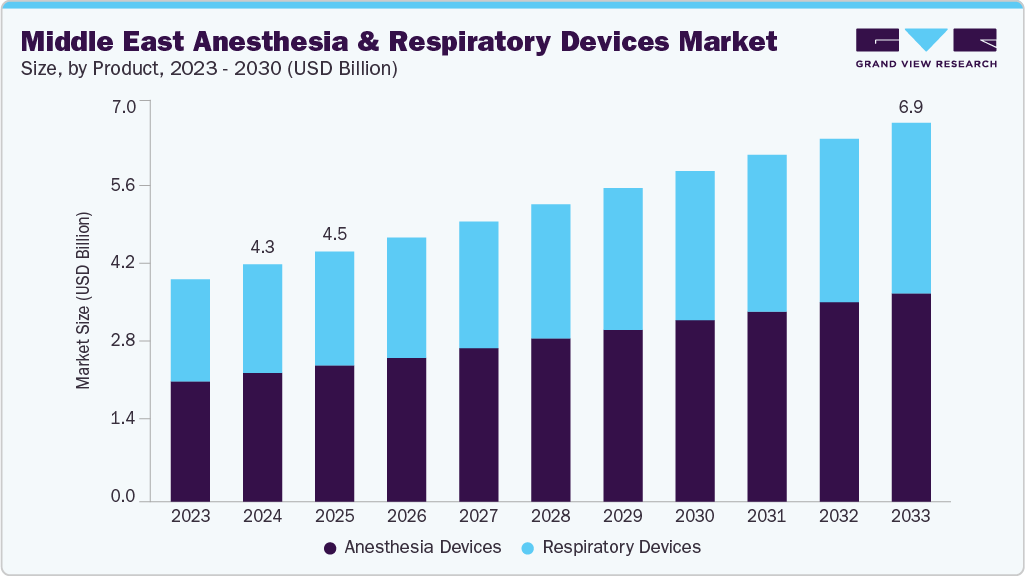

The Middle East anesthesia and respiratory devices market size was estimated at USD 4.32 billion in 2024 and is projected to reach USD 6.88 billion by 2033, growing at a CAGR of 5.34% from 2025 to 2033. This growth is attributed to factors such as the increasing prevalence of chronic respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD), growing technological advancements, and supportive initiatives by government and private organizations.

Key Market Trends & Insights

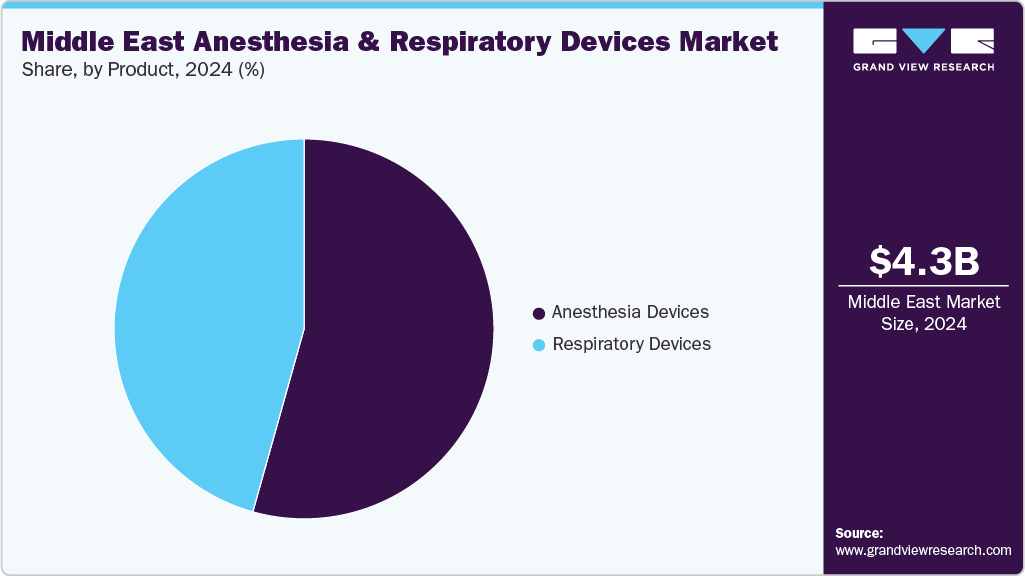

Saudi Arabia dominated the market and accounted for a 31.82% share in 2024.

By product, the anesthesia devices segment led the market with a share of over 54.00% in 2024.

Market Size & Forecast

2024 Market Size: USD 4.32 Billion

2033 Projected Market Size: USD 6.88 Billion

CAGR (2025-2033): 5.34%

The rising prevalence of obesity and other chronic diseases is expected to drive demand for respiratory and anesthesia devices in the region. For instance, according to a study published in the PubMed Central Journal in February 2022, the prevalence of obesity and overweight in the Middle East was 21.17 and 33.14, respectively. A similar study was carried out between January 2018 and August 2023. The result of this study, published in July 2025, revealed that out of 440,590 participants, 63.4% of the population were living with overweight and obesity (OAO). Obesity leads to chronic disease prevalence, thus increasing the need for hospital admissions and might lead to surgical procedures, thereby requiring anesthesia and respiratory devices. Such factors are expected to drive market growth.

Furthermore, initiatives like Arab Health 2025, which celebrated its 50th edition in January 2025 in Dubai, have emerged as leading global platforms for showcasing AI-driven healthcare solutions, smart hospital systems, digital health innovations, and sustainable advancements. Several respiratory device providers participated in the exhibition, presenting their latest technologies to expand their international reach. For instance:

Respircare displayed its complete line of respiratory therapy products at Arab Health 2025, including homecare and hospital respiratory devices along with related consumables. These products are known for their high accuracy, stability, and ease of use, earning praise from healthcare professionals.

Penlon showcased its advanced anesthetic machines, patient monitors, and accessories. Notably, the Penlon Prima 451 MRI anaesthetic system was highlighted. It is designed for compatibility with various MRI scanner strengths (0.55, 1.5, 3, and 7 tesla) and offers advanced patient support modes. The exhibited devices focus primarily on anaesthesia delivery and monitoring

Air Liquide Medical Systems showcased several innovative medical devices, focusing on critical care and respiratory support. Key devices included the Monnal TEO, a new ICU ventilator designed for critical care patients, and the Bag CPAP, a non-invasive ventilation device for treating de novo acute respiratory failure. The company also displayed a range of masks, airway management devices, and medical gas distribution equipment.

Such active participation and product demonstrations highlight the increasing demand for advanced respiratory solutions, driving growth of the anesthesia and respiratory devices market across the Middle East

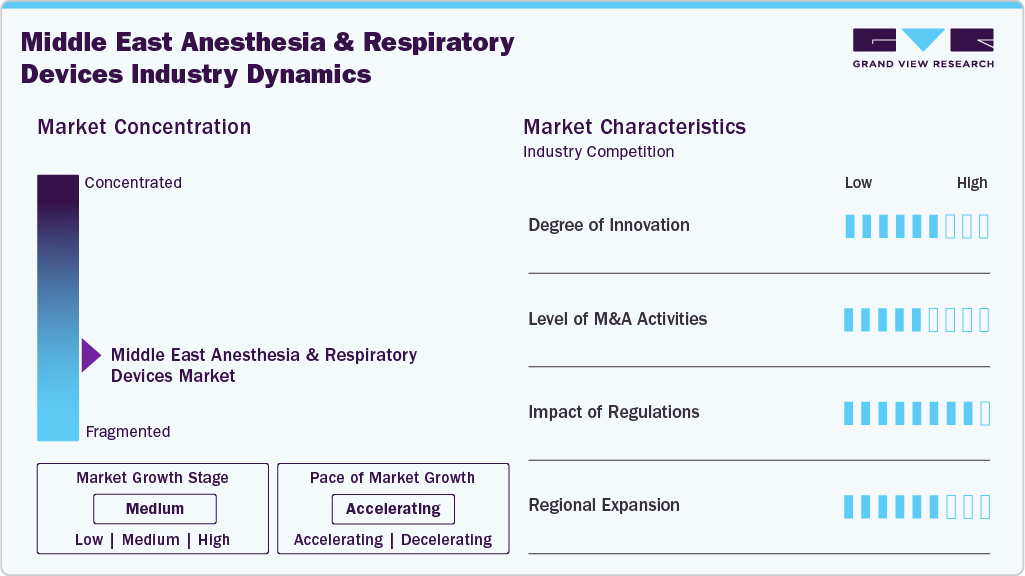

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the Middle East anesthesia and respiratory devices market is highly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the Middle East anesthesia and respiratory devices market is moderate to high, driven by expanding healthcare infrastructure, strong government support, and the rising prevalence of respiratory diseases and surgical procedures. Healthcare providers in the region are increasingly focusing on providing advanced anesthesia and respiratory devices to enhance treatment precision, patient safety, and clinical efficiency. For instance, in January 2024, Sanrai and Drive DeVilbiss Healthcare launched the Pulmo2 10-liter oxygen concentrator at Arab Health in Dubai. The device features an energy-efficient design and advanced performance for clinical settings.

The level of partnerships and collaboration activities in the Middle East anesthesia and respiratory devices market is moderate, reflecting the region’s efforts to enhance critical care and surgical outcomes through advanced technologies. Healthcare providers are increasingly working with global medical device manufacturers and regional distributors to expand access to ventilators, anesthesia delivery systems, and respiratory support devices.

The impact of regulations on the Middle East anesthesia and respiratory devices market is high, as governments across the region enforce stringent standards to ensure patient safety, device efficacy, and quality of care. Regulatory authorities such as the UAE’s Ministry of Health and Prevention (MOHAP) and the Saudi Food and Drug Authority (SFDA) mandate compliance with international benchmarks, including ISO, CE, and FDA approvals for anesthesia and respiratory equipment. These frameworks safeguard clinical outcomes and drive manufacturers to adopt advanced technologies and adhere to rigorous quality controls, thereby shaping market dynamics across the region.

The level of regional expansion in the Middle East anesthesia and respiratory devices market is moderate, supported by rising healthcare digitization initiatives and strong government investments across the Gulf Cooperation Council (GCC) countries.

Product Insights

The aesthesia devices segment holds the largest revenue share of 54.35% in 2024, driven by the increasing number of surgical procedures, both elective and emergency. This rise has increased demand for advanced anesthesia workstations and delivery systems in hospitals and ambulatory surgical centers. In addition, the prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions, particularly among the aging population, is contributing to a greater volume of surgeries, which in turn boosts the adoption of anesthesia devices.

The respiratory devices segment is expected to experience significant growth driven by the rising prevalence of chronic respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea, which require continuous respiratory support through devices such as inhalers, nebulizers, CPAP machines, and ventilators. In addition, the rapidly expanding aging population, which is more susceptible to respiratory complications, is increasing demand for hospital-based and homecare respiratory equipment.

Country Insights

UAE Anesthesia and Respiratory Devices Market Trends

The anesthesia and respiratory devices market in UAE is gaining momentum due to rising respiratory disease prevalence (such as COPD and asthma), increased demand from surgical and critical-care settings, growing geriatric population, and rapid advancement of private and public healthcare infrastructure, particularly in Abu Dhabi and Dubai. For instance, according to the United Nations Population Fund, the number of persons over 60 is estimated to reach 2 million in 2050 from about 311,000 in 2020. The government’s focus on modernizing healthcare under Vision 2030 and significant investment in hospitals and ICU capabilities are driving the adoption of advanced airway tools. In addition, the UAE’s focus on innovation and technology adoption in healthcare drives market growth.

Saudi Arabia Anesthesia and Respiratory Devices Market Trends

The growth of the Saudi Arabia anesthesia and respiratory devices market is driven by the rapidly increasing population and the rising prevalence of lifestyle-related risk factors for sleep apnea, such as obesity and sedentary lifestyles, which contribute to the rising rates of sleep disorders in Saudi Arabia. According to the Saudi National Health Survey (SNHS), in 2023, 23.9% of people were found to be obese (with a BMI of ≥30). These factors are expected to fuel market growth.

Kuwait Anesthesia and Respiratory Devices Market Trends

The anesthesia and respiratory devices market in Kuwait is driven by several key factors such as increasing prevalence of respiratory illnesses such as COPD, asthma, and post-COVID complications; significant government investments in healthcare infrastructure under Kuwait Vision 2035, including the opening of Sheikh Jaber Al-Ahmad Hospital; expanding ICU and hospital capacity across public and private sectors; rising demand for advanced critical-care technologies and ventilator support.

Key Middle East Anesthesia And Respiratory Devices Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Middle East Anesthesia And Respiratory Devices Companies:

GE Healthcare

Medtronic

Teleflex Incorporated

Drägerwerk AG & Co. KGaA

ICU Medical, Inc.

B. Braun SE

Resmed

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Masimo

Fisher & Paykel Healthcare

Air Liquide

Kafou Medical

Saudi Mais CO

Recent Developments

In January 2024, Northern Meditec showcased advanced respiratory, anesthesia, and monitoring devices, including V1-V8 ventilators and the Atlas N7 anesthesia machine, at Arab Health 2024, receiving strong international acclaim.

In May 2025, Huma UK-based healthtech company expanded its global healthcare impact, including in Saudi Arabia, by acquiring US respiratory health startup Aluna and partnering with Eckuity Capital. This move enhances Huma’s AI-powered respiratory monitoring and chronic disease management platform, strengthening its role in national healthcare initiatives across Saudi Arabia and other countries.

Middle East Anesthesia and Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.54 million

Revenue forecast in 2033

USD 6.88 million

Growth rate

CAGR of 5.34% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

GE Healthcare; Medtronic; Teleflex Incorporated; Drägerwerk AG & Co. KGaA; ICU Medical, Inc.; B. Braun SE; ResMed; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Masimo; Fisher & Paykel Healthcare; Air Liquide; Kafou Medical; Saudi Mais Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Anesthesia And Respiratory Devices Market Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East anesthesia and respiratory devices report based product and country:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Respiratory Devices

Anesthesia Devices

Anesthesia Machines

Anesthesia Disposables

Anesthesia Masks

Anesthesia Accessories

Country Outlook (Revenue, USD Million, 2021 – 2033)

Saudi Arabia

UAE

Kuwait

Qatar

Oman