As U.S. stock indexes reach new all-time highs, driven by significant partnerships and strategic investments in the tech sector, investors are exploring diverse opportunities across the market spectrum. The term ‘penny stocks’ might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

Click here to see the full list of 370 stocks from our US Penny Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company in the healthcare sector with a market cap of $224.36 million.

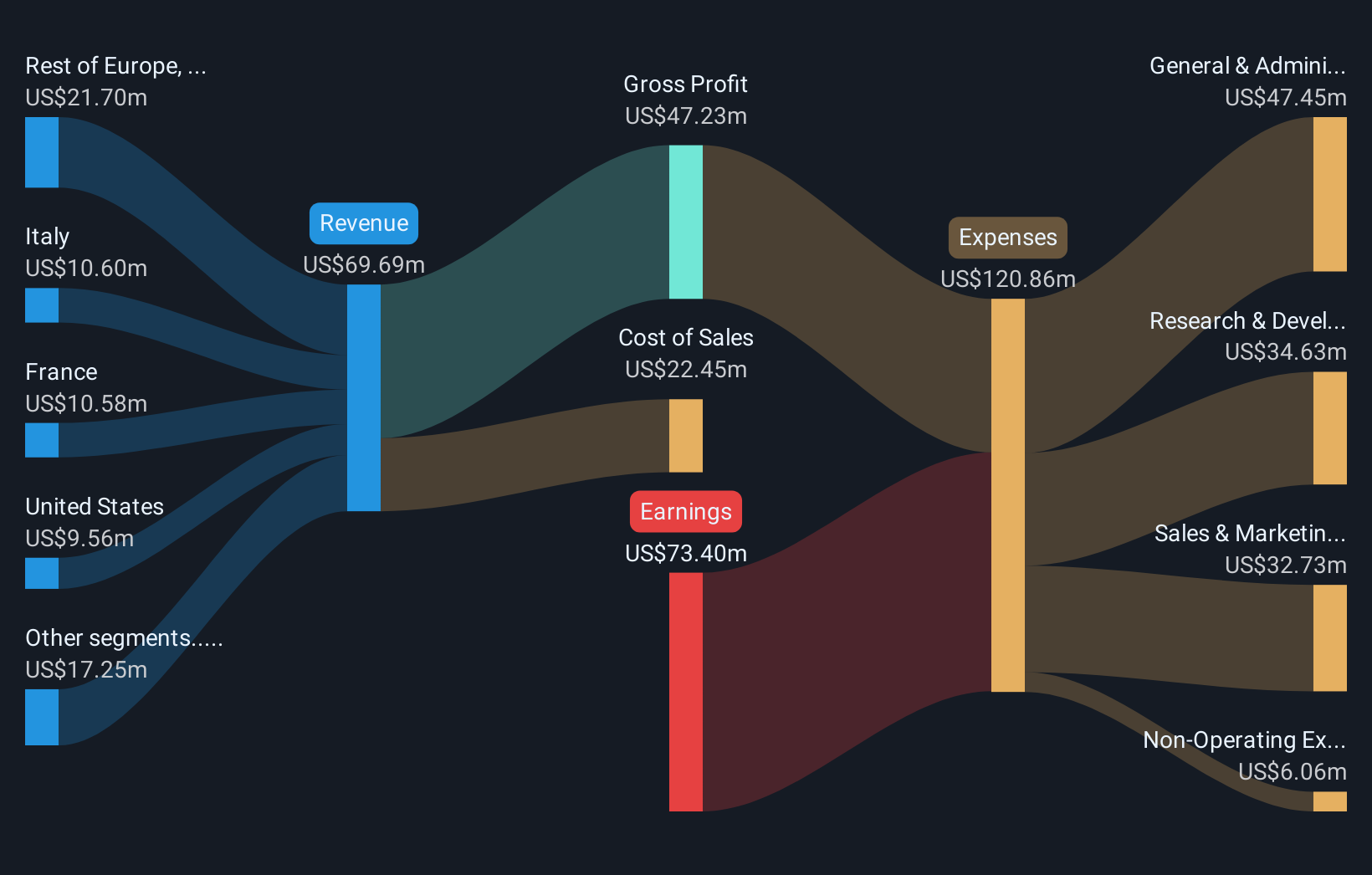

Operations: The company generates revenue from its healthcare software segment, totaling $69.69 million.

Market Cap: $224.36M

SOPHiA GENETICS, with a market cap of US$224.36 million, has been experiencing financial challenges despite its promising technology in the healthcare sector. The company reported revenues of US$69.69 million but remains unprofitable with increasing losses over the past five years. Recent developments include a significant collaboration with Jessa Ziekenhuis in Belgium to enhance molecular testing and oncology research, which could boost operational efficiency and scalability for both parties involved. Despite being dropped from the S&P Global BMI Index, SOPHiA GENETICS maintains a strong cash position exceeding its total debt, offering some financial stability amidst ongoing volatility.

SOPH Revenue & Expenses Breakdown as at Sep 2025

SOPH Revenue & Expenses Breakdown as at Sep 2025

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ventyx Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing oral therapies for autoimmune, inflammatory, and neurodegenerative diseases, with a market cap of approximately $164 million.

Operations: Ventyx Biosciences, Inc. does not currently report any revenue segments.

Market Cap: $164.01M

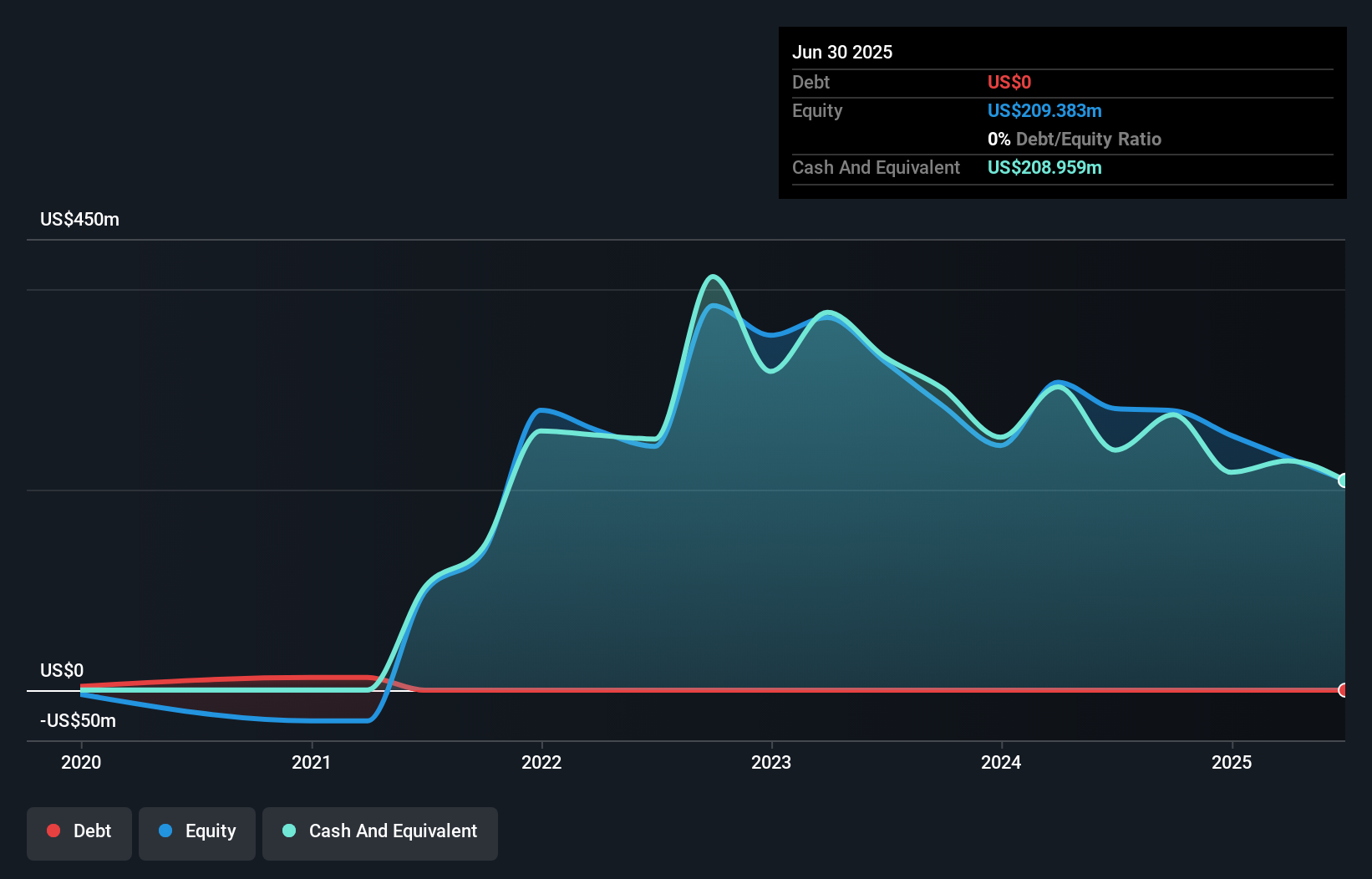

Ventyx Biosciences, with a market cap of approximately US$164 million, is a pre-revenue biopharmaceutical firm focused on developing oral therapies. The company has no debt and its short-term assets of US$219.3 million comfortably exceed both short and long-term liabilities. However, it remains unprofitable with a negative return on equity and increasing losses over the past five years. Recently, Ventyx was removed from several Russell indices, highlighting potential challenges in maintaining investor interest amid high share price volatility. Despite these hurdles, the company continues to present at major healthcare conferences to engage stakeholders and potentially attract new investment opportunities.

VTYX Debt to Equity History and Analysis as at Sep 2025

VTYX Debt to Equity History and Analysis as at Sep 2025

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $824.29 million.

Operations: The company generates revenue of $230.50 million from its Internet Software & Services segment.

Market Cap: $824.29M

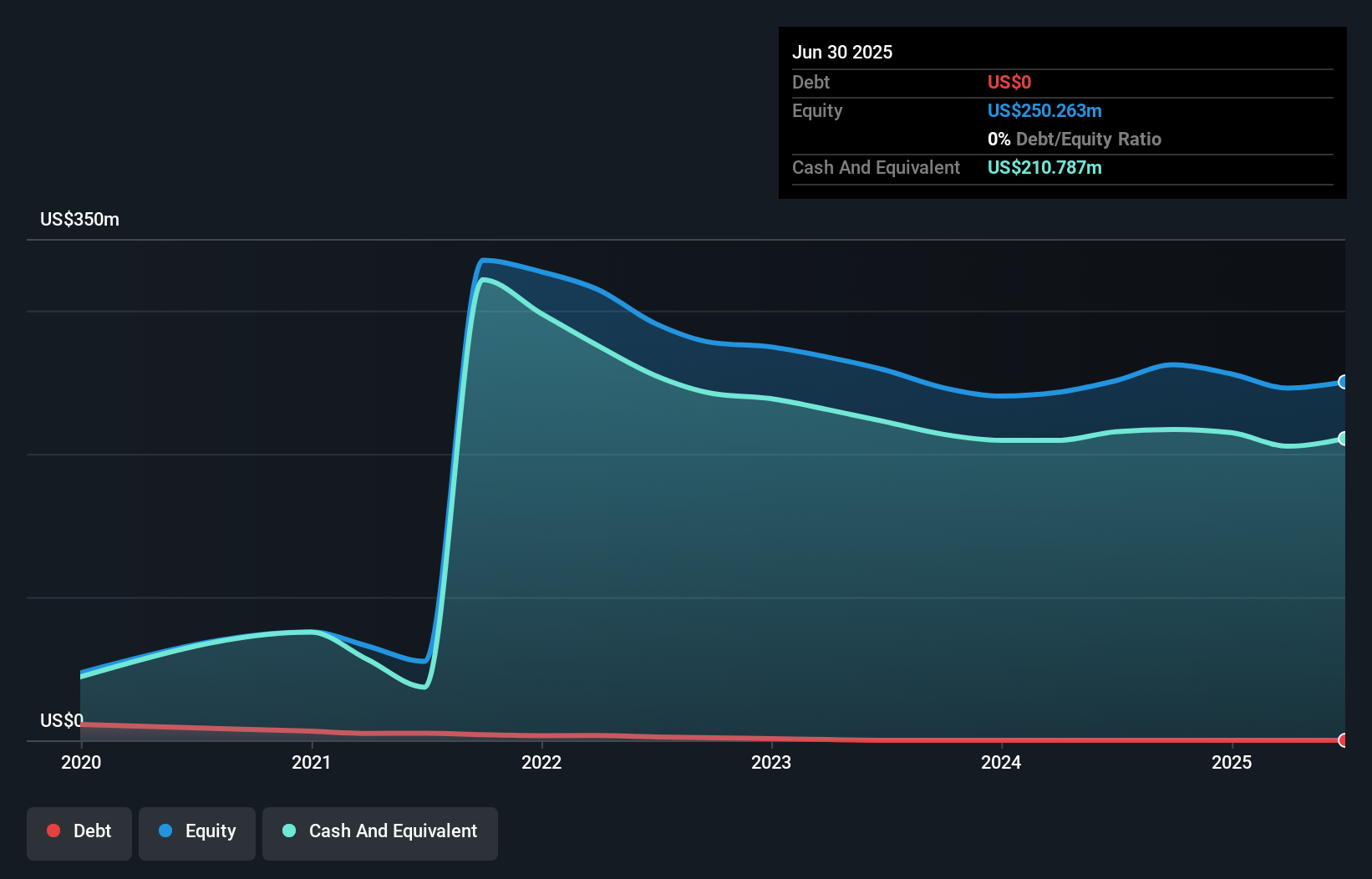

VTEX, with a market cap of US$824.29 million, is debt-free and has experienced significant earnings growth, outpacing the IT industry. Its recent innovations in B2B commerce and AI-driven solutions enhance its digital commerce platform’s capabilities. Despite a decline in net income to US$2.99 million for Q2 2025 compared to the previous year, VTEX maintains robust short-term assets of US$283.8 million exceeding liabilities. The company is executing a share repurchase program worth US$40 million and was recently added to multiple Russell indices, signaling positive investor sentiment despite some challenges in profit margins and earnings per share reductions.

VTEX Debt to Equity History and Analysis as at Sep 2025Seize The Opportunity

VTEX Debt to Equity History and Analysis as at Sep 2025Seize The Opportunity

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com