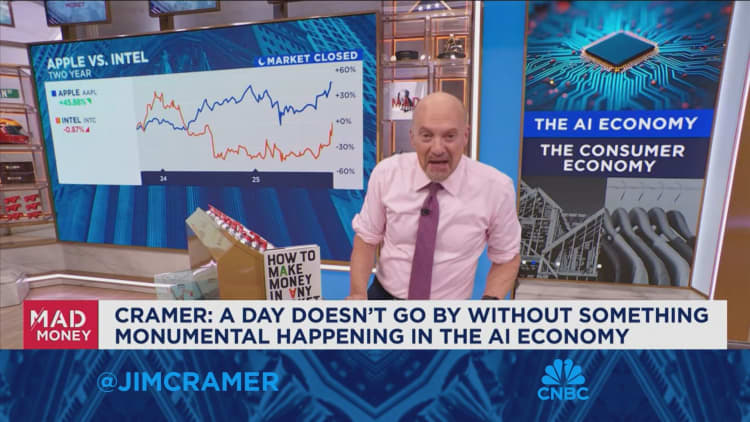

CNBC’s Jim Cramer on Thursday suggested the current economy is divided into two parts — a strong segment spurred on by the artificial intelligence boom and a weaker consumer portion that needs a boost from interest rate cuts.

“The writing is on the wall for a big chunk of the economy if we don’t get more rate cuts, things are going to keep sinking,” Cramer said. “The other part, the AI part, is totally indifferent to rates — most of these companies will never need to raise money, and even if they do, it seems like they just sell equity to their deep-pocketed business partners.”

The contrast is clear even though the averages don’t necessarily show it, he said, because the AI economy can be all encompassing as it’s connected to the Big Tech megacaps that dominate market action.

Frequent major events propel the AI-centric economy, Cramer said, like CoreWeave‘s Thursday announcement that it had expanded its investment with OpenAI. The cloud infrastructure giant inked a $6.5 billion deal with OpenAI — which brings its total contracts with the company to $22.4 billion. Cramer also noted that Meta is building a $10 billion data center that requires so much energy it could threaten the state’s grid.

But while the AI giants are playing with billions, Cramer suggested that consumer-oriented companies broadly are struggling to meet estimates. He cited recent earnings reports from car dealer CarMax and homebuilder KB Home that disappointed Wall Street. Cramer also pointed out that Starbucks announced Thursday it would shrink its store count by 1% and fire approximately 900 nonretail employees.

To Cramer, autos, housing and retail are the foundations of the economy. He said one might expect these sectors to be doing well because the GDPP is strong. However, Cramer suggested that AI-related companies represent an enormous part of those gains.

“I know it sounds crazy to suggest that we need rate cuts when prices are still elevated, often in a self-inflicted way — think tariffs — and we have a very strong 3.8% GDP growth,” he said. “But the strength is in tech ,and there’s just not much intersection between tech and the day-to-day life of our workforce.”

Jim Cramer’s Guide to Investing

Jim Cramer’s Guide to Investing

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club owns shares of Starbucks.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com