Report Overview

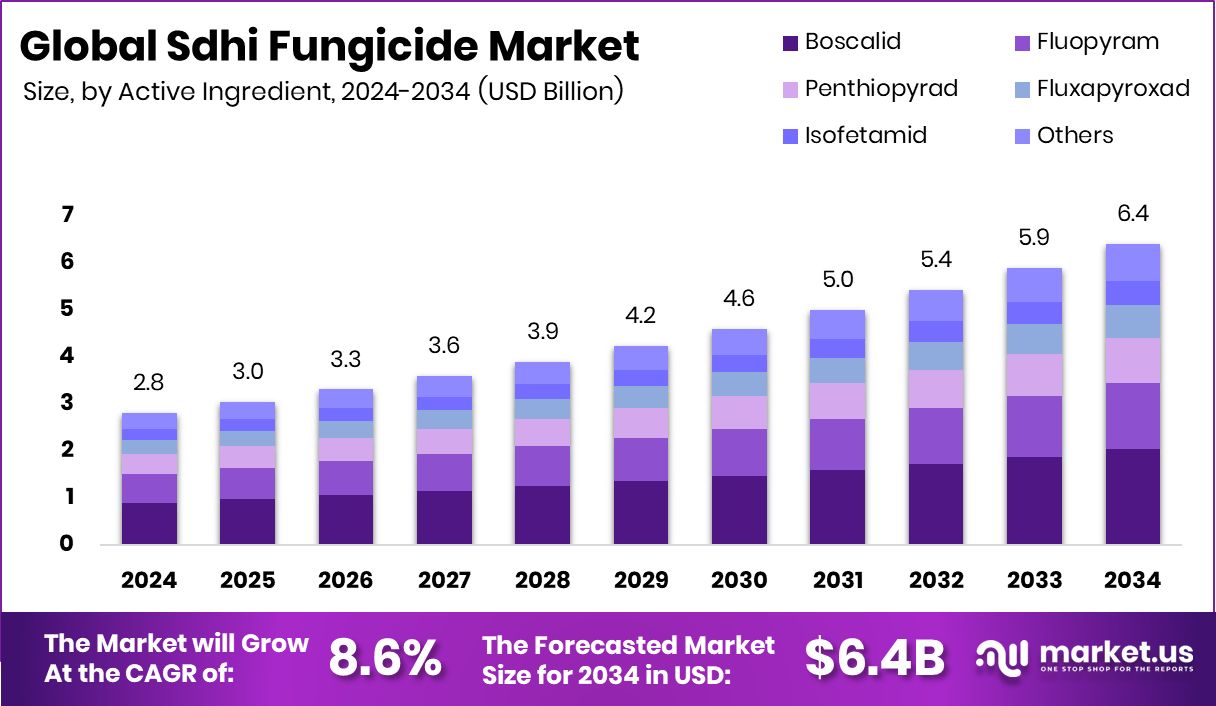

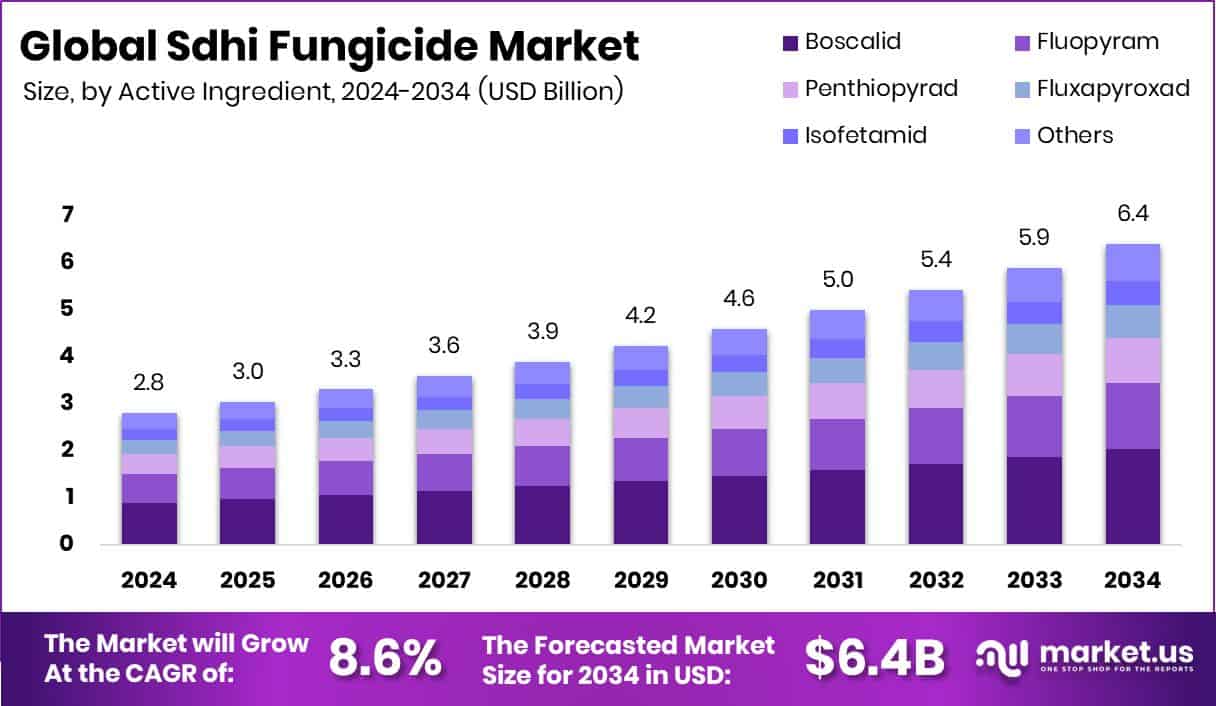

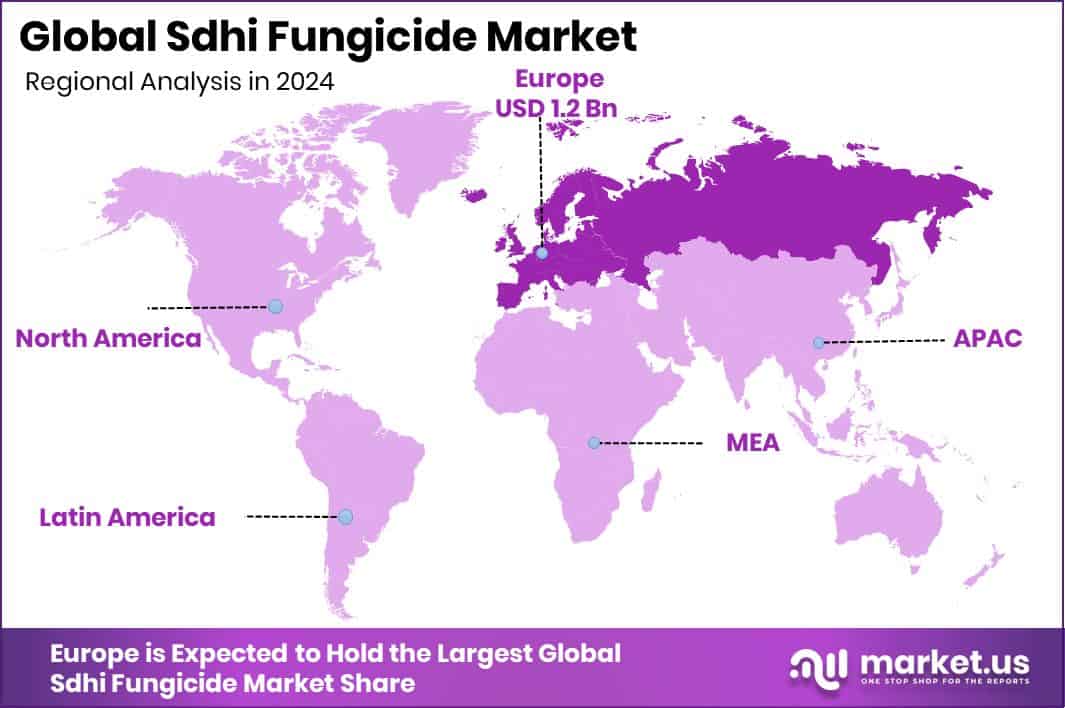

The Global Sdhi Fungicide Market is expected to be worth around USD 6.4 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034. With a USD 1.2 Bn value, Europe maintained dominance, accounting for 43.80%.

SDHI fungicides, also known as Succinate Dehydrogenase Inhibitors, are a class of crop protection chemicals that block the activity of the succinate dehydrogenase enzyme in fungal pathogens. By disrupting the fungal respiration process, these fungicides prevent the growth and spread of diseases such as leaf spots, blights, and molds that affect major crops like cereals, fruits, and vegetables. Their broad-spectrum activity, combined with their role in integrated pest management, has made them a widely adopted solution in modern agriculture.

The SDHI fungicide market has been expanding steadily due to the growing demand for higher crop yields, food security, and resistance management strategies. Farmers are increasingly using them in rotation or combination with other fungicides to safeguard crops against resistant fungal strains. With rising population pressures, this market has gained attention as part of global efforts to ensure a consistent food supply and reduce post-harvest losses. Additionally, funding initiatives like Plant Impact, raising $5 million on the LSE to launch new chemical crop enhancers, highlight the growing investment in advanced crop protection technologies.

One of the major growth factors driving this market is the rising prevalence of fungal diseases that significantly impact crop productivity. Climate change and shifting weather patterns are increasing the risk of pathogen outbreaks, making reliable protection essential. At the same time, biological innovations such as Ascribe Bioscience securing $2.5 million to fight crop loss with soil signaling molecules show how chemical and biological tools are being developed in parallel to strengthen crop resilience.

On the demand side, expanding global agriculture and the pressure to feed a population expected to surpass 9.7 billion by 2050 are pushing farmers to adopt more effective solutions. The use of SDHI fungicides in cereals, fruits, and vegetables aligns with the demand for quality produce and reduced spoilage, offering farmers economic security. Investments such as Promise Bio raising $8.3 million (Seed) to transform immune-mediated disease treatment reflect how broader biotech innovations are spilling into agriculture, encouraging similar breakthroughs in crop protection.

Key Takeaways

The Global Sdhi Fungicide Market is expected to be worth around USD 6.4 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034.

Boscalid dominates the SDHI fungicide market, holding a 31.8% share due to strong disease resistance control.

Foliar spray remains the preferred mode, accounting for 59.3% of SDHI fungicide applications worldwide.

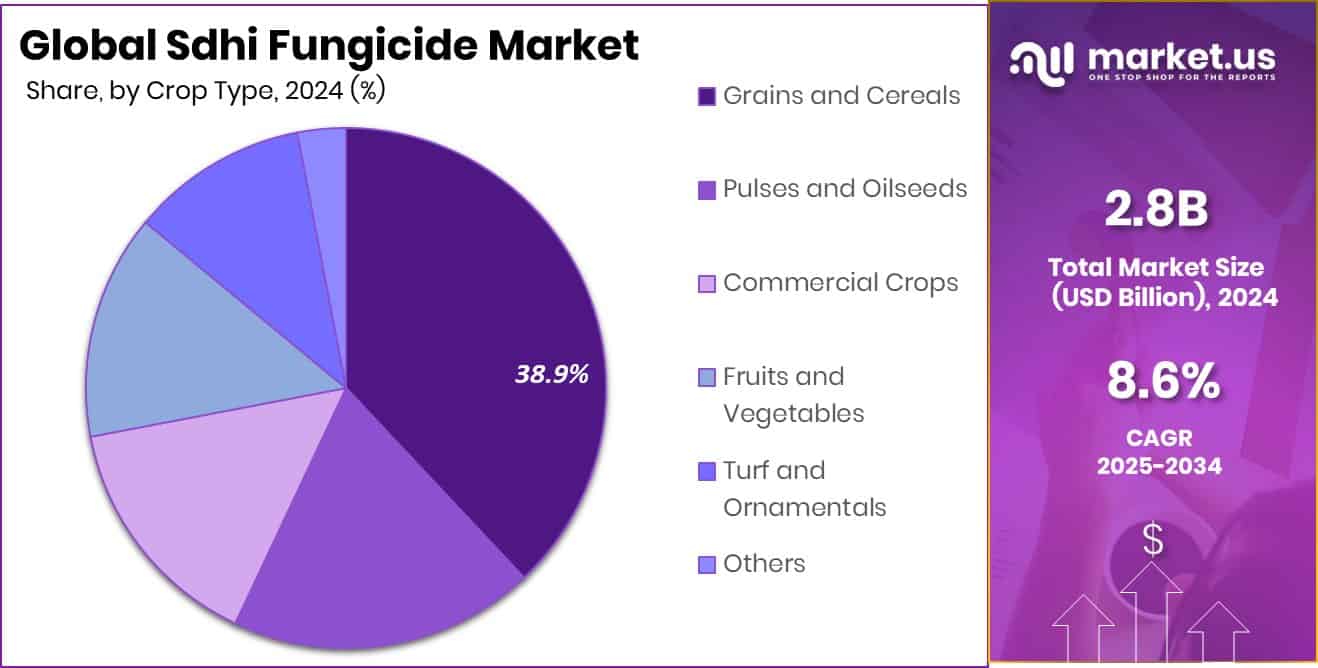

Grains and cereals lead usage, with a 38.9% share, highlighting farmers’ reliance on SDHI fungicides.

The SDHI Fungicide Market in Europe stood strong at 43.80% share.

By Active Ingredient Analysis

The SDHI fungicide market sees Boscalid leading with a 31.8% share.

In 2024, Boscalid held a dominant market position in the By Active Ingredient segment of the SDHI Fungicide Market, with a 31.8% share. This leadership reflects its wide acceptance across multiple crop categories due to its reliable performance in managing a broad spectrum of fungal diseases.

Boscalid’s mode of action, targeting the succinate dehydrogenase enzyme, provides consistent disease control, which is crucial for protecting high-value crops such as cereals, fruits, and vegetables. Its established role in integrated pest management strategies and compatibility with other fungicide classes further strengthen its market presence. The 31.8% share underscores Boscalid’s importance as a core solution in modern agriculture, driving stable adoption among growers seeking both yield protection and resistance management.

By Mode of Application Analysis

Foliar spray dominates SDHI fungicide applications, accounting for 59.3% usage.

In 2024, Foliar Spray held a dominant market position in the By Mode of Application segment of the SDHI Fungicide Market, with a 59.3% share. This strong presence is driven by the effectiveness of foliar applications in delivering quick and uniform protection against fungal pathogens directly on the plant surface.

Farmers prefer this method as it ensures higher absorption, immediate action, and better coverage across leaves and stems, which are the primary infection sites for many crop diseases. The 59.3% share highlights the reliability and practicality of foliar spraying as a preferred choice in large-scale and intensive farming practices, reinforcing its role as a leading application mode in sustaining crop health and yield protection.

By Crop Type Analysis

Grains and cereals drive demand strongly, representing 38.9% market share.

In 2024, Grains and Cereals held a dominant market position in the By Crop Type segment of the SDHI Fungicide Market, with a 38.9% share. This dominance reflects the critical role of fungicide applications in safeguarding staple crops such as wheat, rice, and maize from fungal infections that can cause significant yield losses.

Farmers rely heavily on SDHI fungicides to protect against common diseases like leaf spots, rusts, and blights, which directly affect productivity and food security. The 38.9% share demonstrates the importance of grains and cereals as the backbone of global agriculture, where consistent disease management is essential to maintaining supply chains and meeting the growing demand for staple food products worldwide.

Key Market Segments

By Active Ingredient

Boscalid

Fluopyram

Penthiopyrad

Fluxapyroxad

Isofetamid

Others

By Mode of Application

By Crop Type

Grains and Cereals

Pulses and Oilseeds

Commercial Crops

Fruits and Vegetables

Turf and Ornamentals

Others

Driving Factors

Rising Crop Disease Pressure Boosting Fungicide Adoption

One of the biggest driving factors for the SDHI Fungicide Market is the rising pressure from crop diseases that threaten global food security. Farmers across different regions face increasing challenges from fungal infections such as leaf spots, blights, and molds, which can cut yields significantly if not managed effectively.

With changing weather patterns and more humid conditions, the risk of fungal outbreaks has grown, making reliable fungicides essential for protecting staple crops like wheat, rice, and maize. This rising demand reflects the urgent need to safeguard both farmer income and food supplies. Recent investments, such as Gene

Control Startup Concinnity securing £3M seed funding to advance gene therapy safety and Alveron Pharma closing €5 million seed extension financing to accelerate breakthrough ICH therapy, further emphasize the momentum in agricultural and life sciences innovation, reinforcing confidence in sustainable solutions like SDHI fungicides.

Restraining Factors

Rising Resistance Risk Limiting Fungicide Effectiveness

A key restraining factor for the SDHI Fungicide Market is the growing risk of resistance development in fungal pathogens. Continuous and repeated use of the same active ingredient can reduce effectiveness over time, as fungi adapt and survive treatment. This resistance not only diminishes crop protection but also raises concerns for farmers who depend on consistent disease control to secure yields.

Managing resistance requires careful rotation with other fungicide classes and integrated pest management practices, which can be costly and complex for small-scale farmers. If resistance spreads widely, it could limit the long-term reliability of SDHI fungicides, making this a significant challenge that slows down adoption and creates uncertainty in market growth.

Growth Opportunity

Expanding Role in Sustainable Farming Practices Worldwide

A major growth opportunity for the SDHI Fungicide Market lies in its integration with sustainable and eco-friendly farming practices. As consumers and governments push for reduced chemical residues and safer food production, SDHI fungicides offer targeted action with lower application volumes compared to many traditional options. Their ability to work effectively in resistance management programs also makes them valuable in long-term crop protection strategies.

This opens opportunities for developing next-generation formulations that pair well with biological solutions, precision farming tools, and digital agriculture. Recent funding highlights this momentum, with Reverb Therapeutics raising $17 million in seed funding and Andes raising USD 15 million in Series A funding co-led by Leaps by Bayer and Cavallo Ventures, signaling growing investor confidence in agricultural innovation.

Latest Trends

Integration of SDHI Fungicides with Soil Health

One of the latest trends in the SDHI Fungicide Market is the growing focus on combining fungicide use with soil health management. Farmers are increasingly aware that healthy soil not only boosts crop productivity but also supports the effectiveness of crop protection products. By integrating SDHI fungicides with precision soil testing and better residue management, growers can achieve more targeted applications and reduce environmental impact. This shift aligns with broader sustainability goals and the protection of natural resources.

Supporting this direction, a soil testing company based in the Prairies raised $5 million in seed funding, Wyandotte County is set to remove 65,000 tons of contaminated soil near Kaw Point, and The Nature Conservancy leads $1.2 million collaboration to protect water in Central Ohio, highlighting the link between crop protection and ecosystem stewardship.

Regional Analysis

In 2024, Europe captured a 43.80% share, valuing around USD 1.2 Bn.

The SDHI Fungicide Market is segmented across major regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, each reflecting diverse adoption trends.

In 2024, Europe emerged as the dominant region with a 43.80% market share, valued at USD 1.2 billion, underscoring its strong reliance on advanced crop protection practices and well-established agricultural frameworks.

North America continues to represent a significant region where SDHI fungicides are used extensively to safeguard cereals, fruits, and vegetable crops against yield-threatening fungal infections, supported by large-scale mechanized farming.

Asia Pacific, with its vast agricultural base and rising population, demonstrates steady adoption of fungicides as farmers aim to increase productivity and protect staple crops, reflecting a strong growth trajectory.

Meanwhile, the Middle East & Africa region shows rising uptake, driven by the need to protect limited arable land against diseases, while Latin America leverages fungicides primarily in large-scale commercial agriculture, particularly grains and export-oriented crops.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

BASF SE maintains a strong foothold through its extensive portfolio of SDHI fungicides designed to deliver broad-spectrum disease control across cereals, fruits, and vegetables. The company’s emphasis on combining crop protection with sustainability ensures its solutions remain relevant to evolving farmer needs. BASF’s investments in research strengthen its ability to address resistance management, a growing concern in the fungicide sector.

Bayer AG also plays a pivotal role, leveraging its strong agricultural science background and global reach. The company focuses on integrating SDHI fungicides with modern agronomic practices, ensuring improved yields and reduced losses. Bayer’s continued development of formulations tailored to regional cropping conditions allows it to align effectively with global farming trends. Its balanced approach to crop protection and innovation positions it as a critical partner for farmers worldwide.

Nufarm Limited, while smaller compared to the global giants, contributes significantly through practical and cost-effective solutions. By focusing on reliability and accessibility, Nufarm enables farmers in diverse markets to adopt SDHI fungicides as part of their disease management strategies. Its role in providing efficient solutions to mid-scale and regional growers strengthens the overall market adoption.

Top Key Players in the Market

BASF SE

Bayer AG

Nufarm Limited

FMC Corporation

Corteva Agriscience

Adama Ltd

Syngenta

UPL Limited

Valent U.S.A. Corporation

Nissan Chemical Corporation

Recent Developments

In November 2024, BASF introduced Endura PRO fungicide for the 2025 crop year. This new product combines boscalid with Revysol® to give enhanced disease protection for potatoes, targeting tough pathogens like early blight and white mold.

In July 2024, Bayer launched Valpura in Brazil, a fungicide with bixafen as the active ingredient. It is systemic and works by inhibiting the SDHI enzyme, targeting diseases in potato, tomato, grape, and apple crops.

Report Scope