Q3.25 – Market Outlook

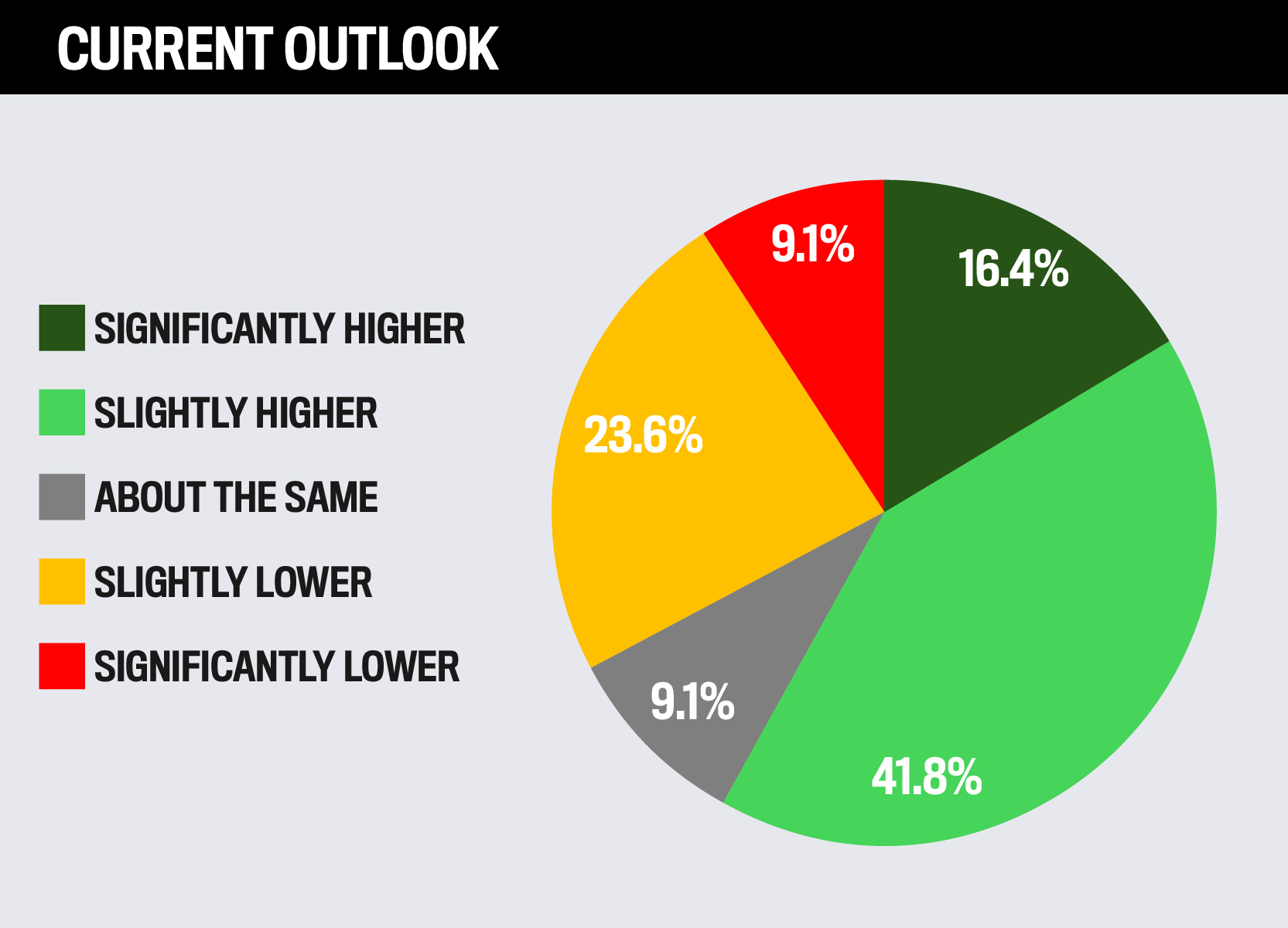

Where do you expect the S&P to be in 12 months, compared with today?

Between July and September 2025, most advisors predicted the S&P to be higher in 12 months. Over half (58.2%) predicted a rise in the S&P, while 32.7% expected a decline.

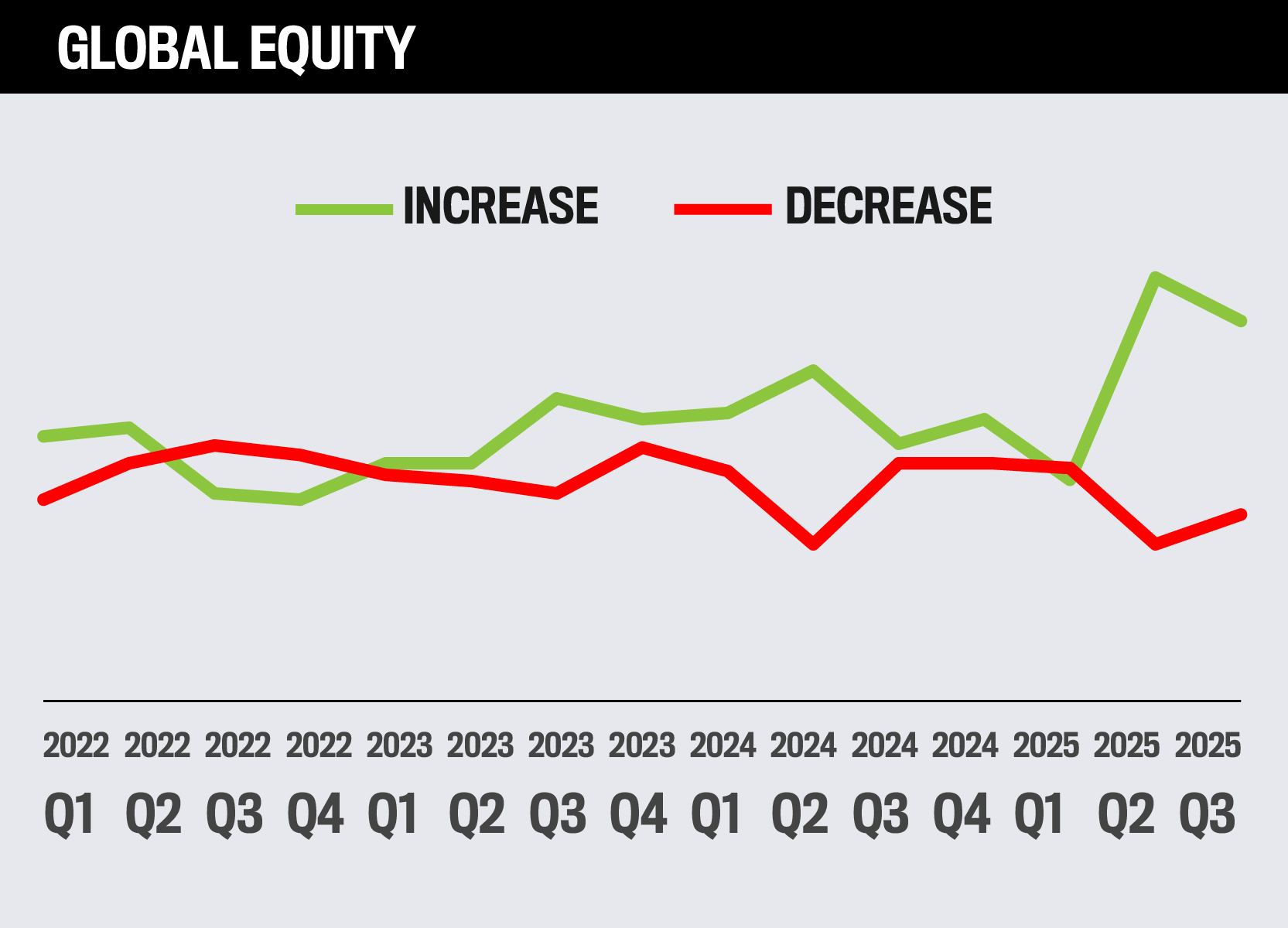

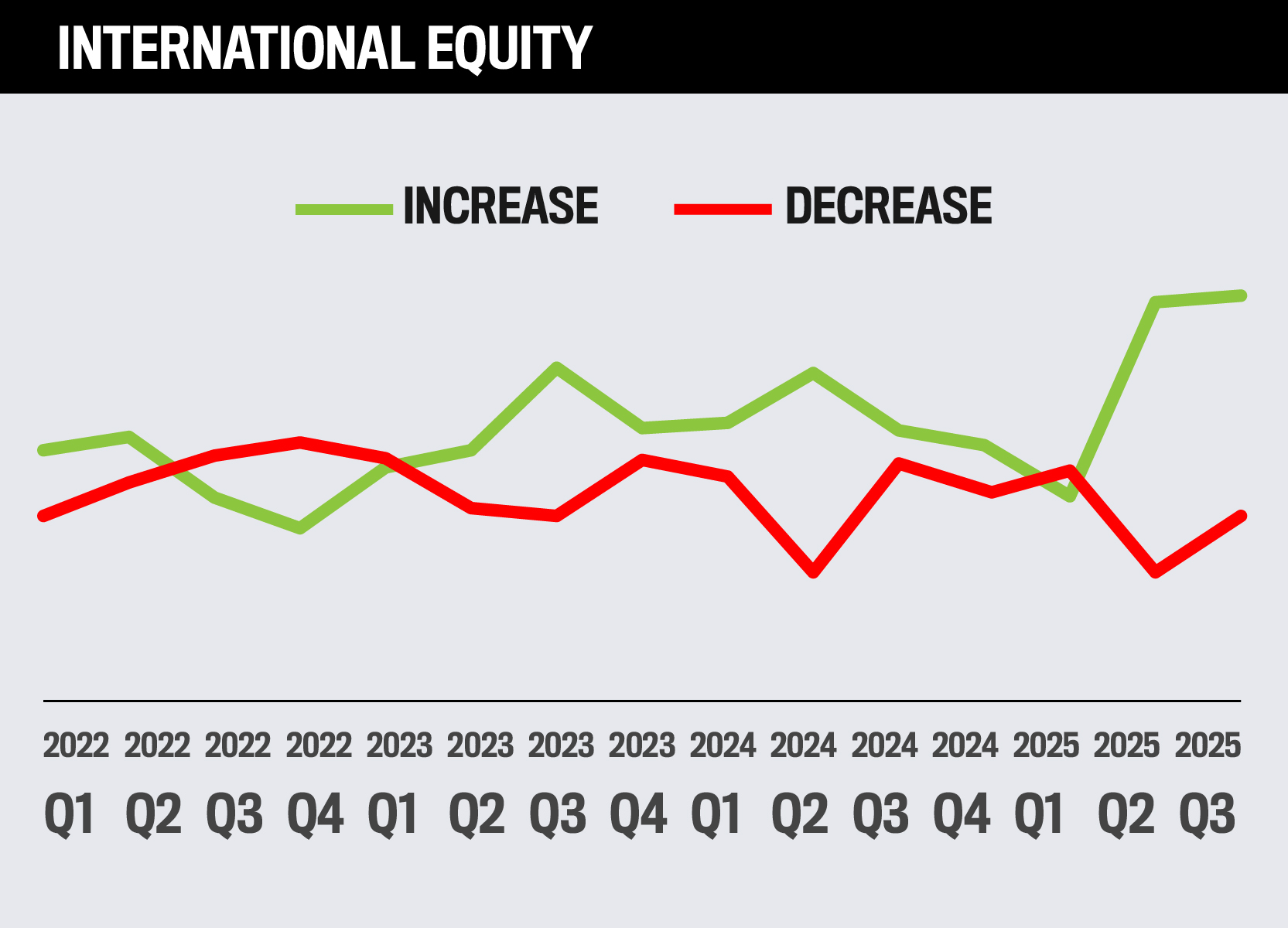

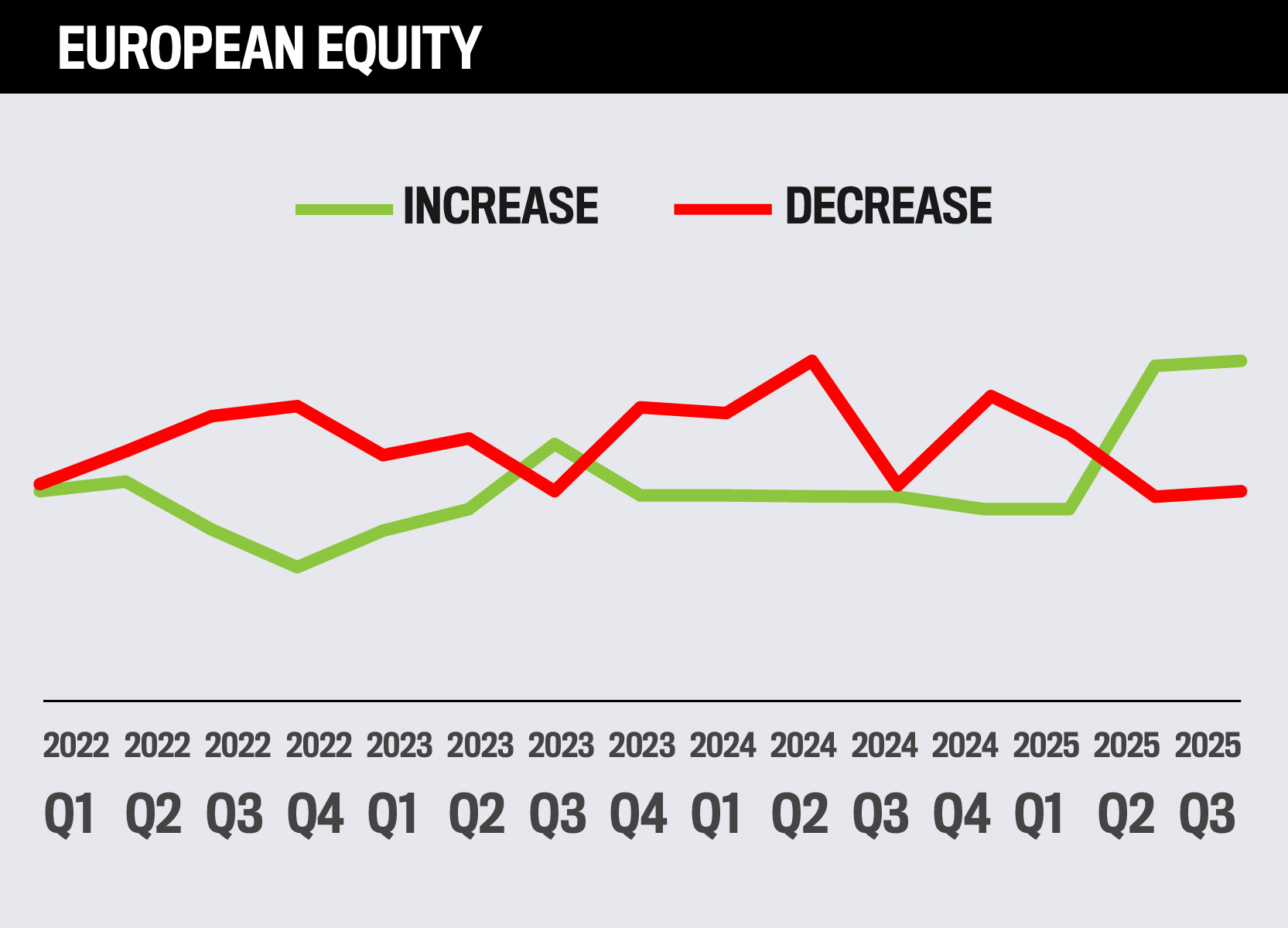

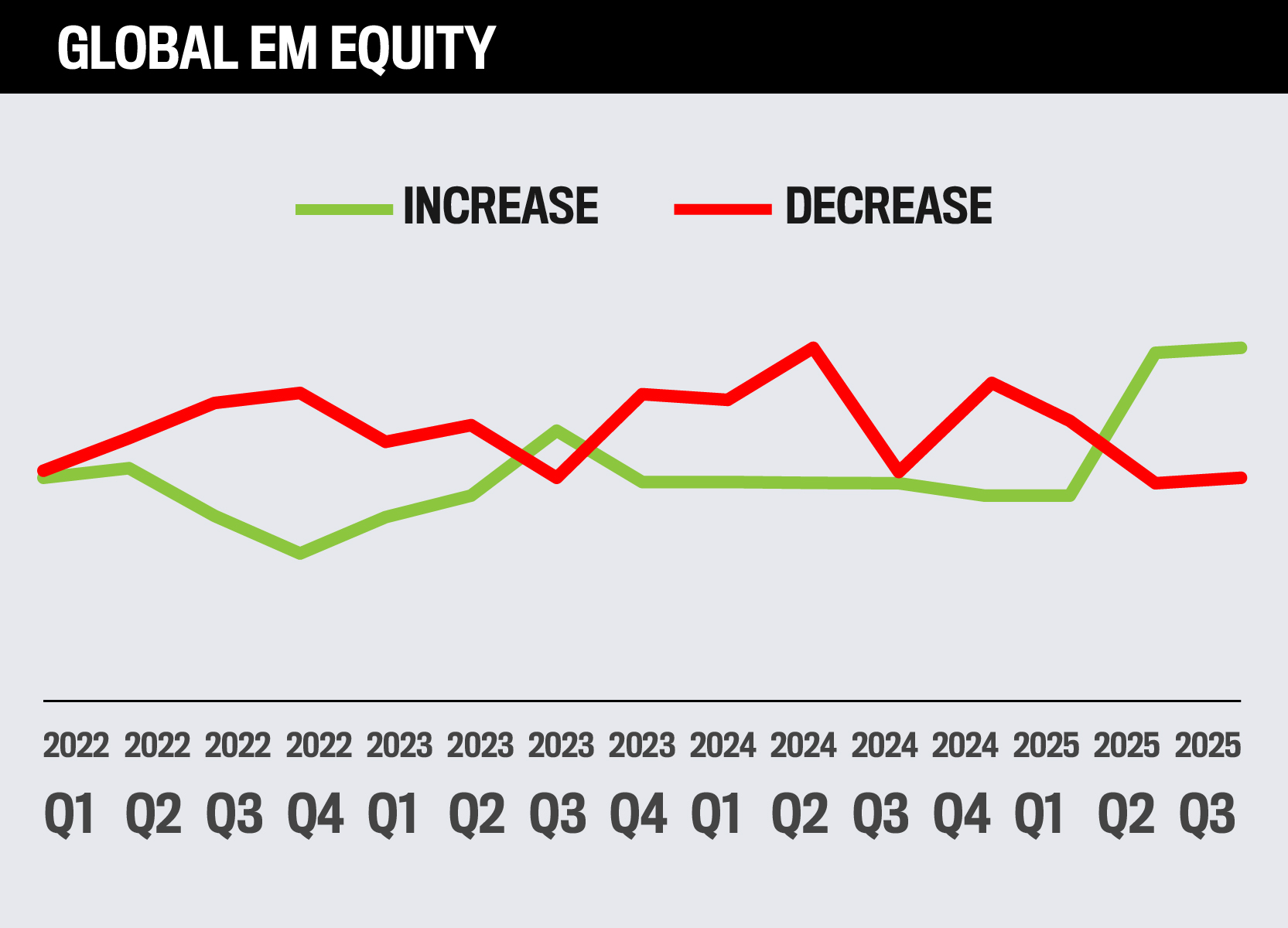

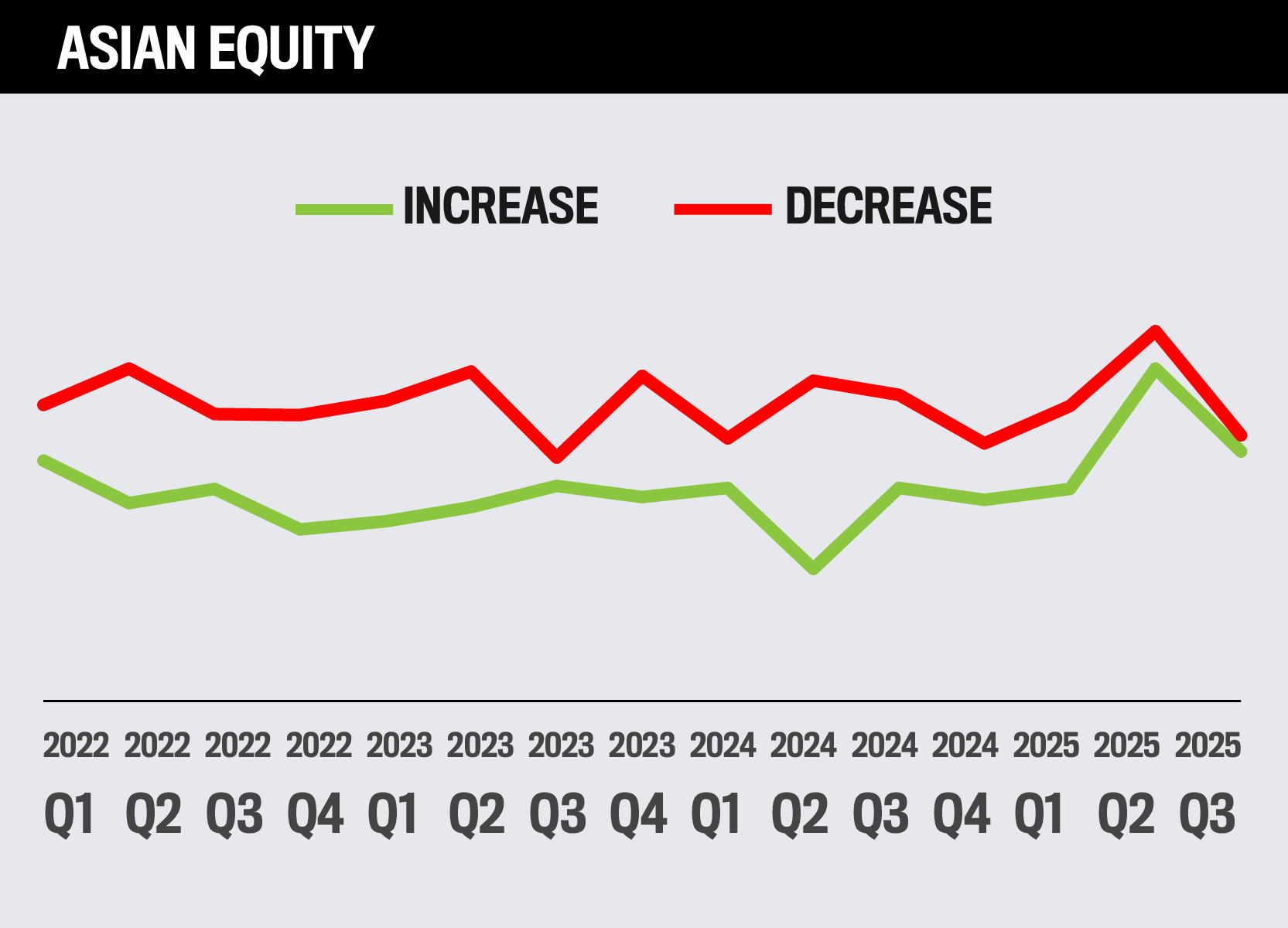

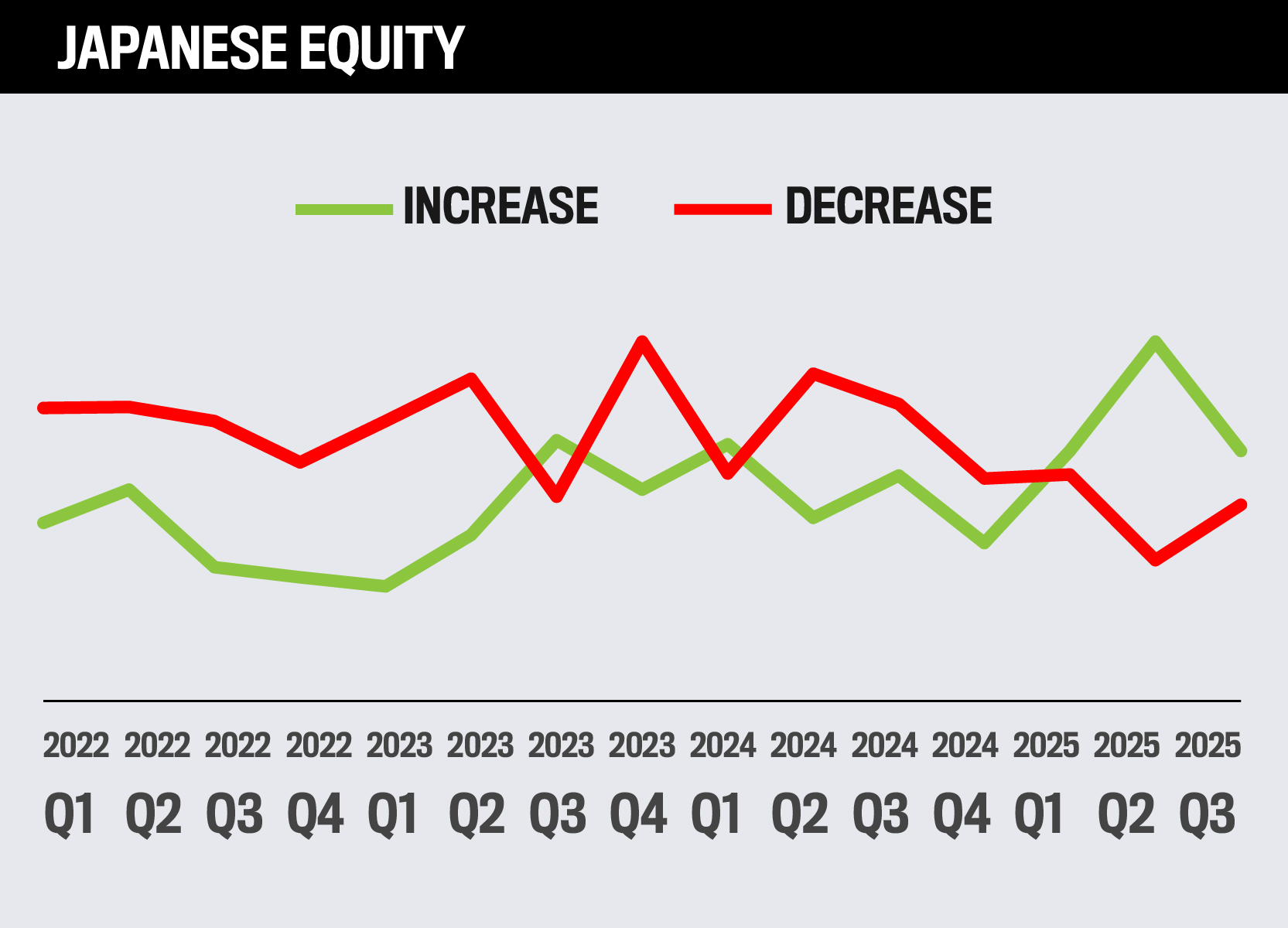

Equities

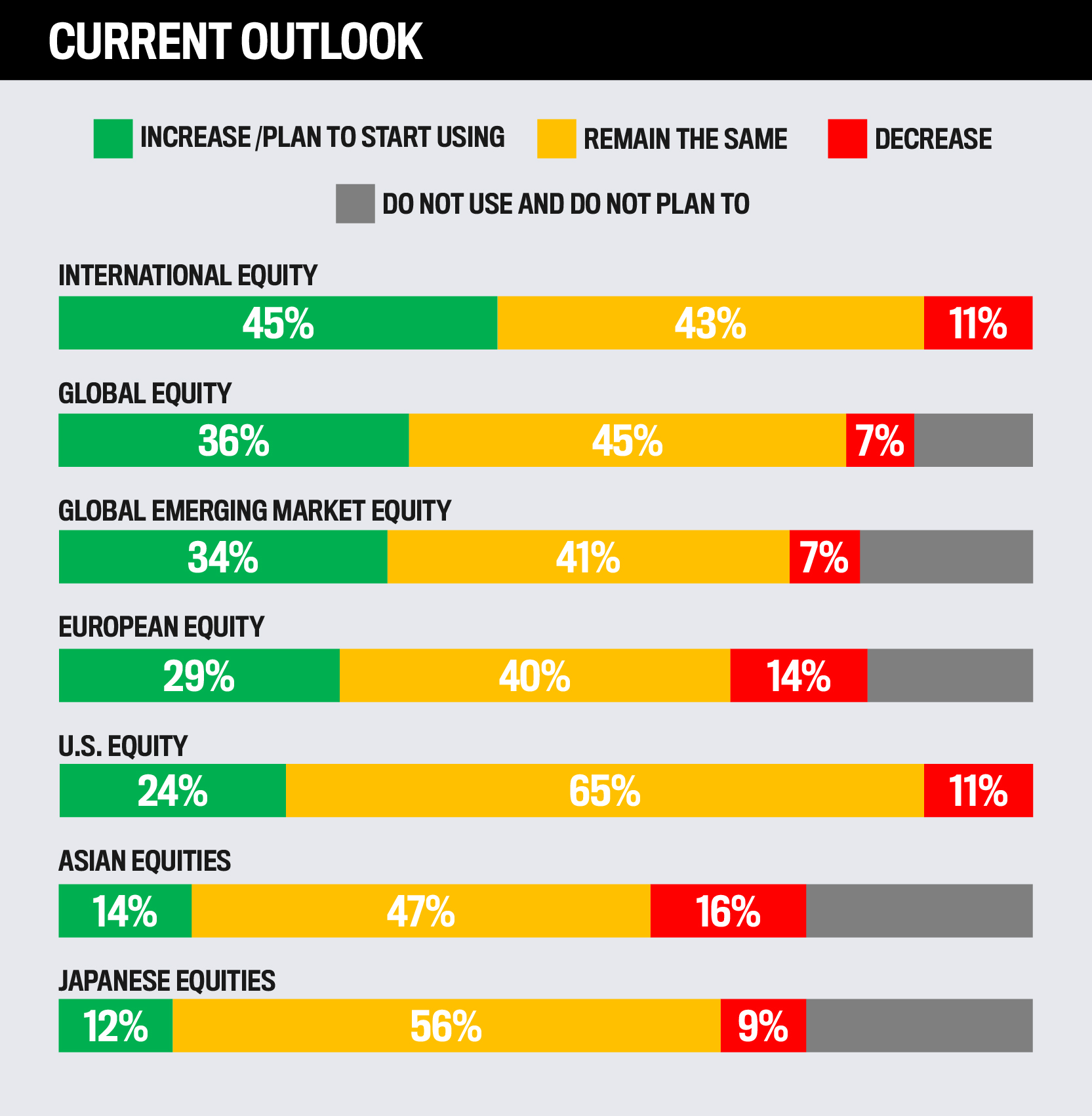

How advisors plan to allocate assets to equities over the next year

Within equity markets, over the next year financial professionals plan to invest the most in International (45%) and Global (36%) equities, and the least in Japanese equities, with only 12% planning to increase exposure.

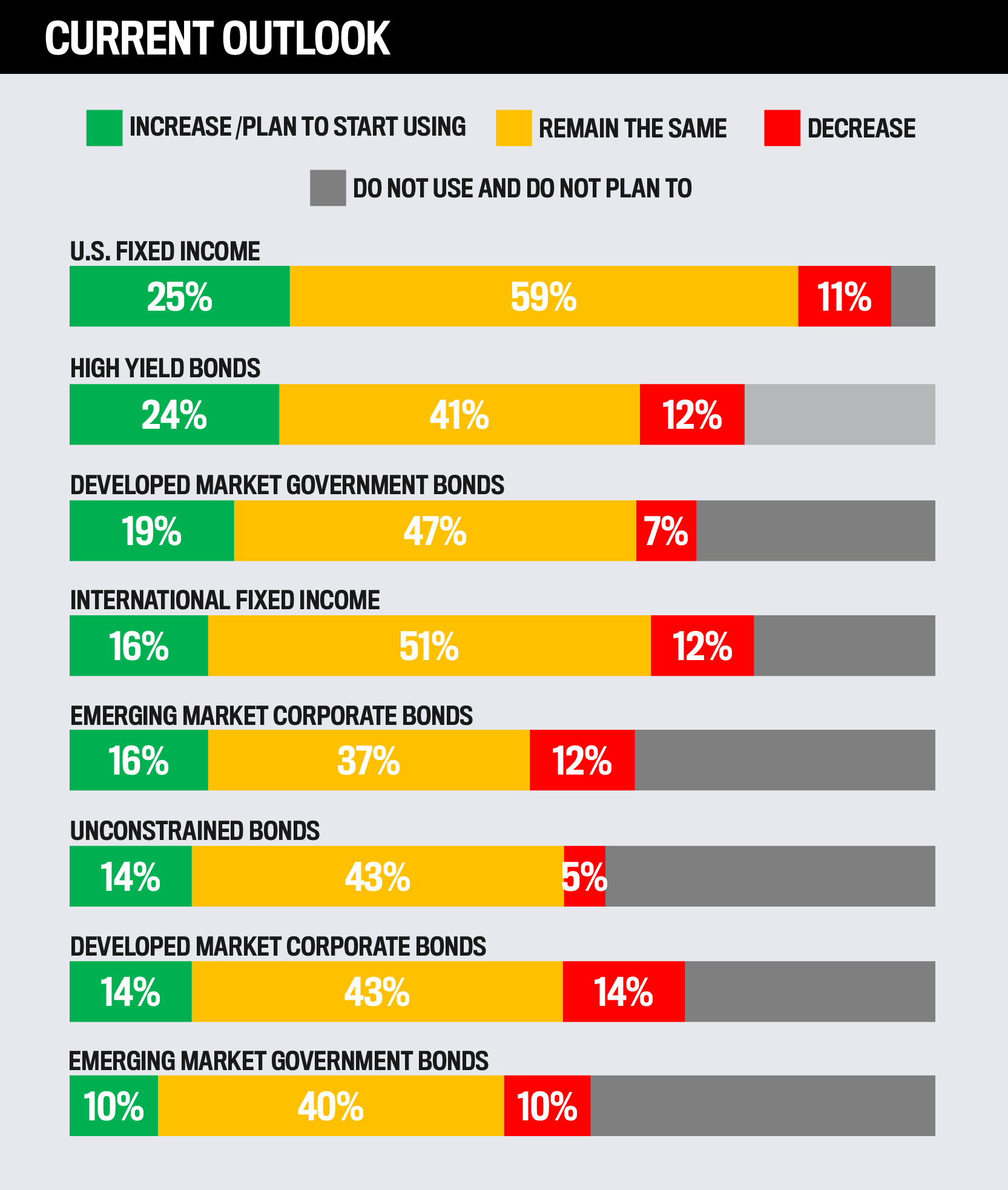

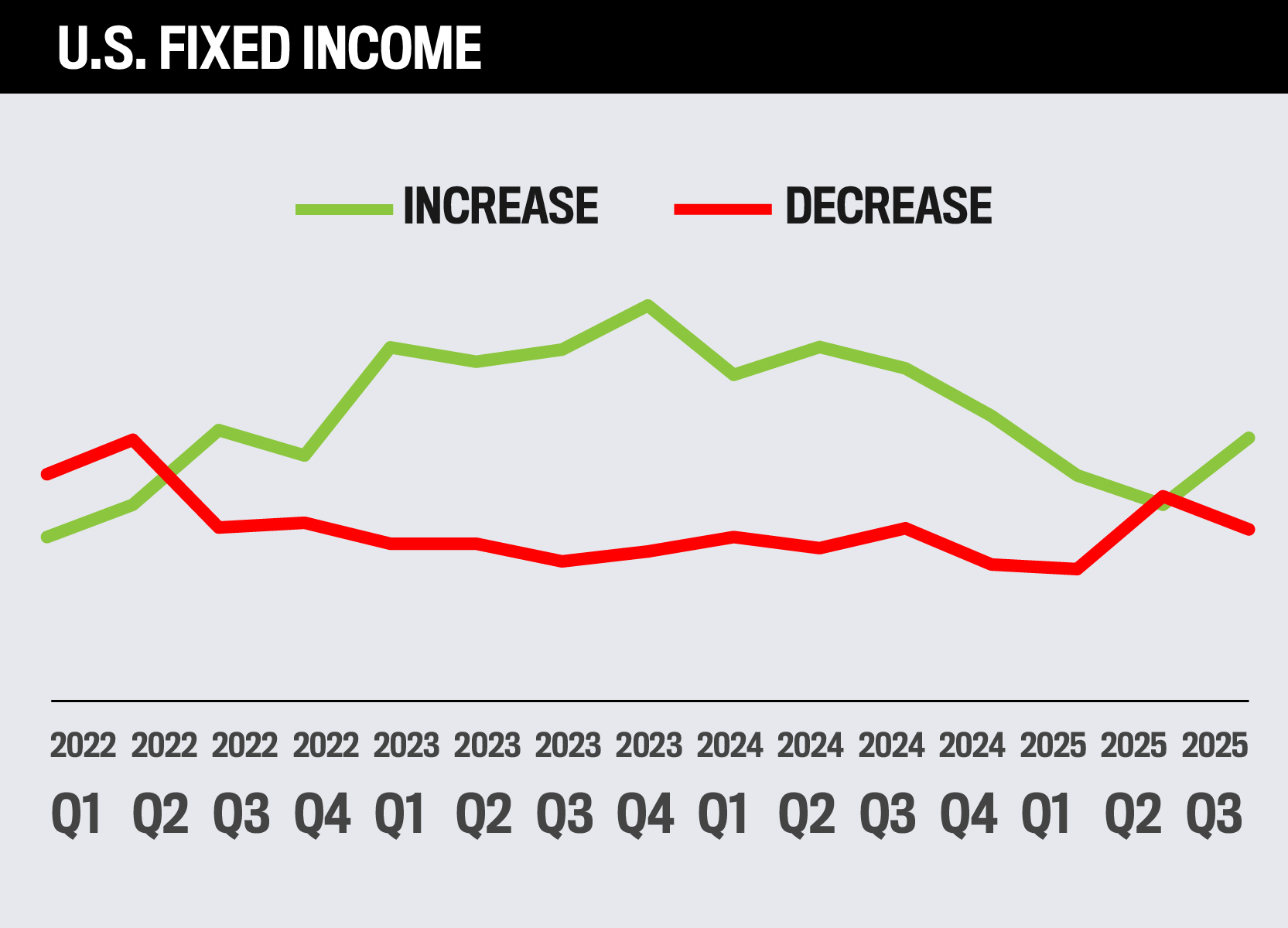

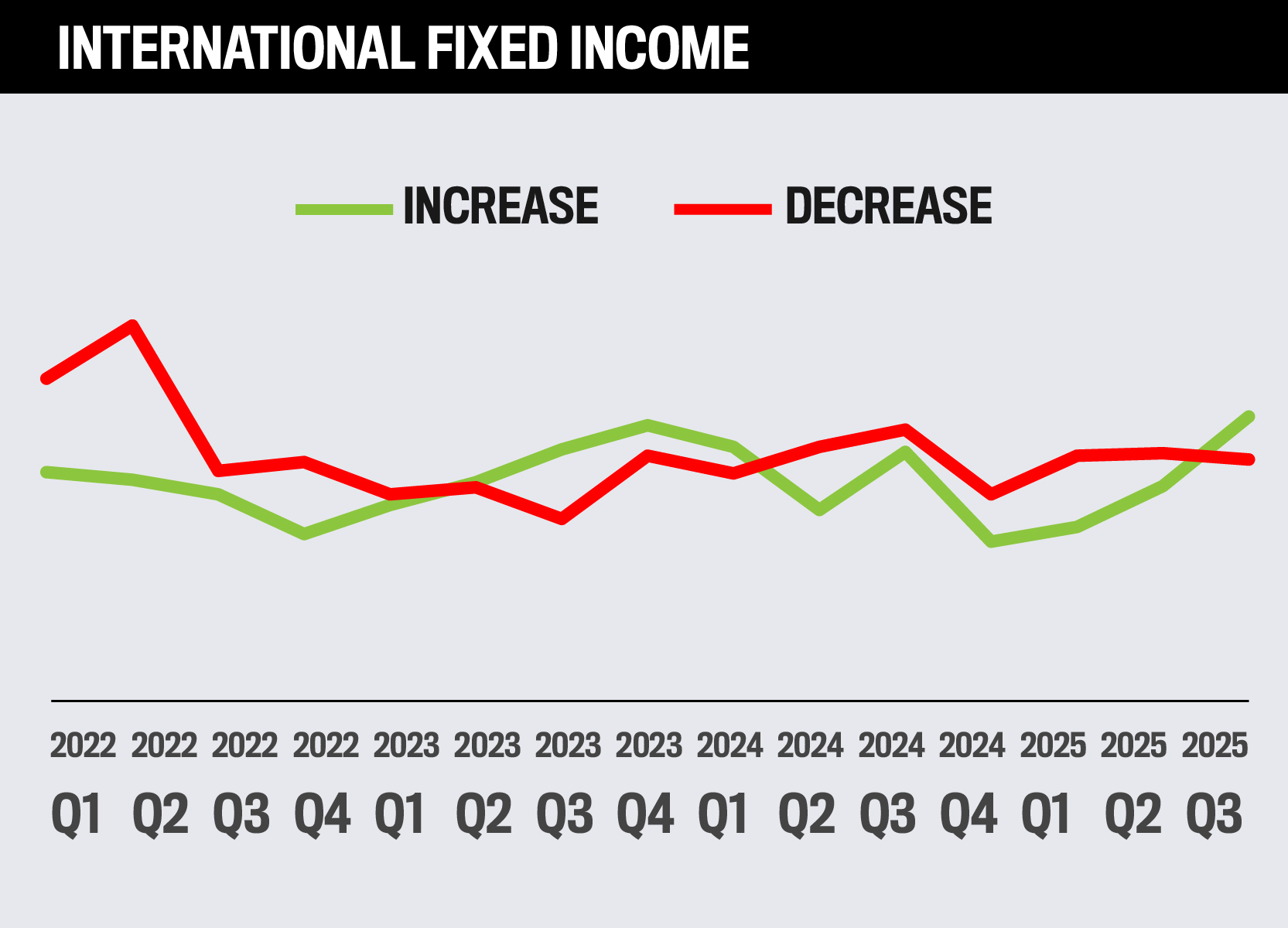

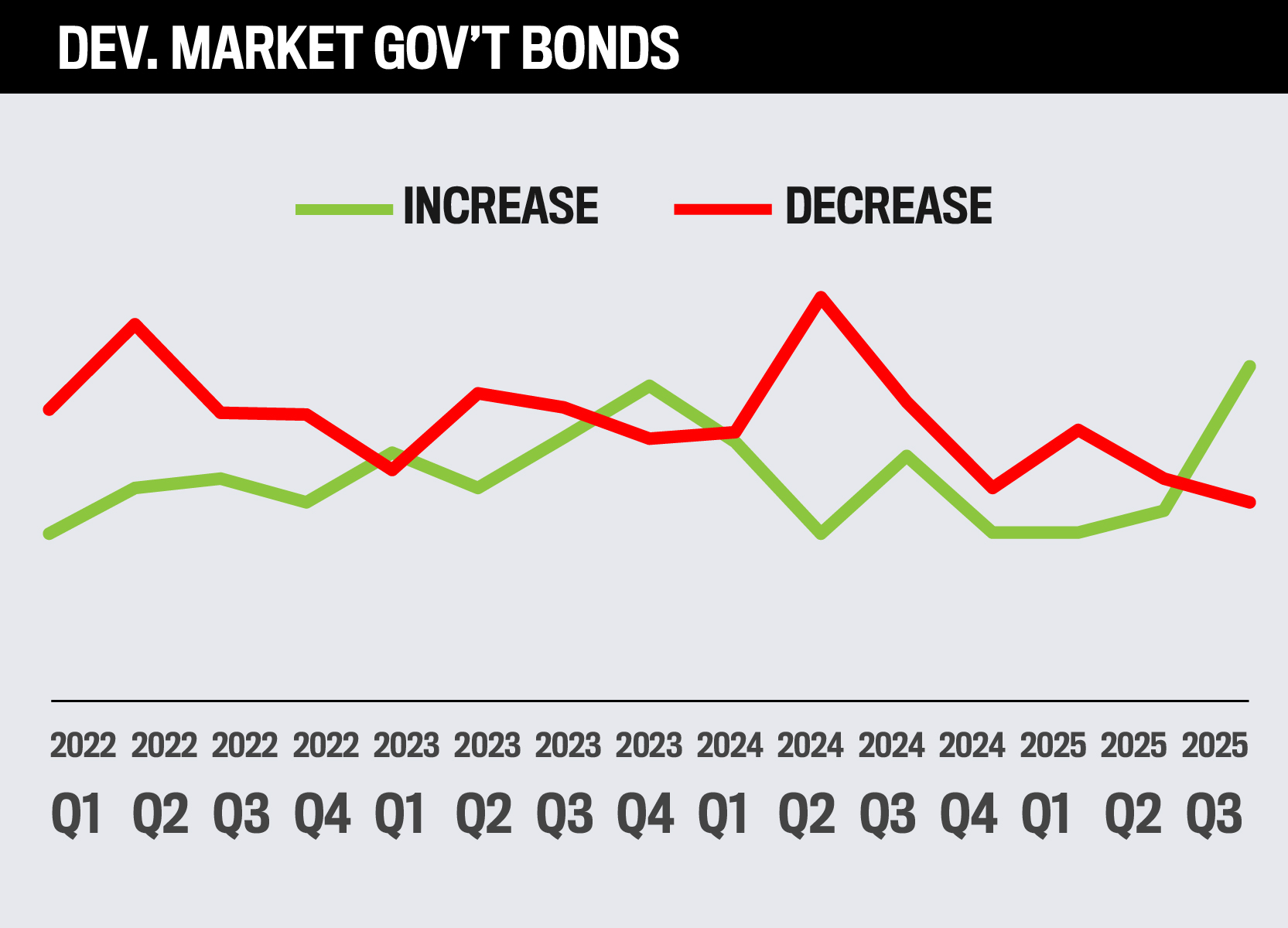

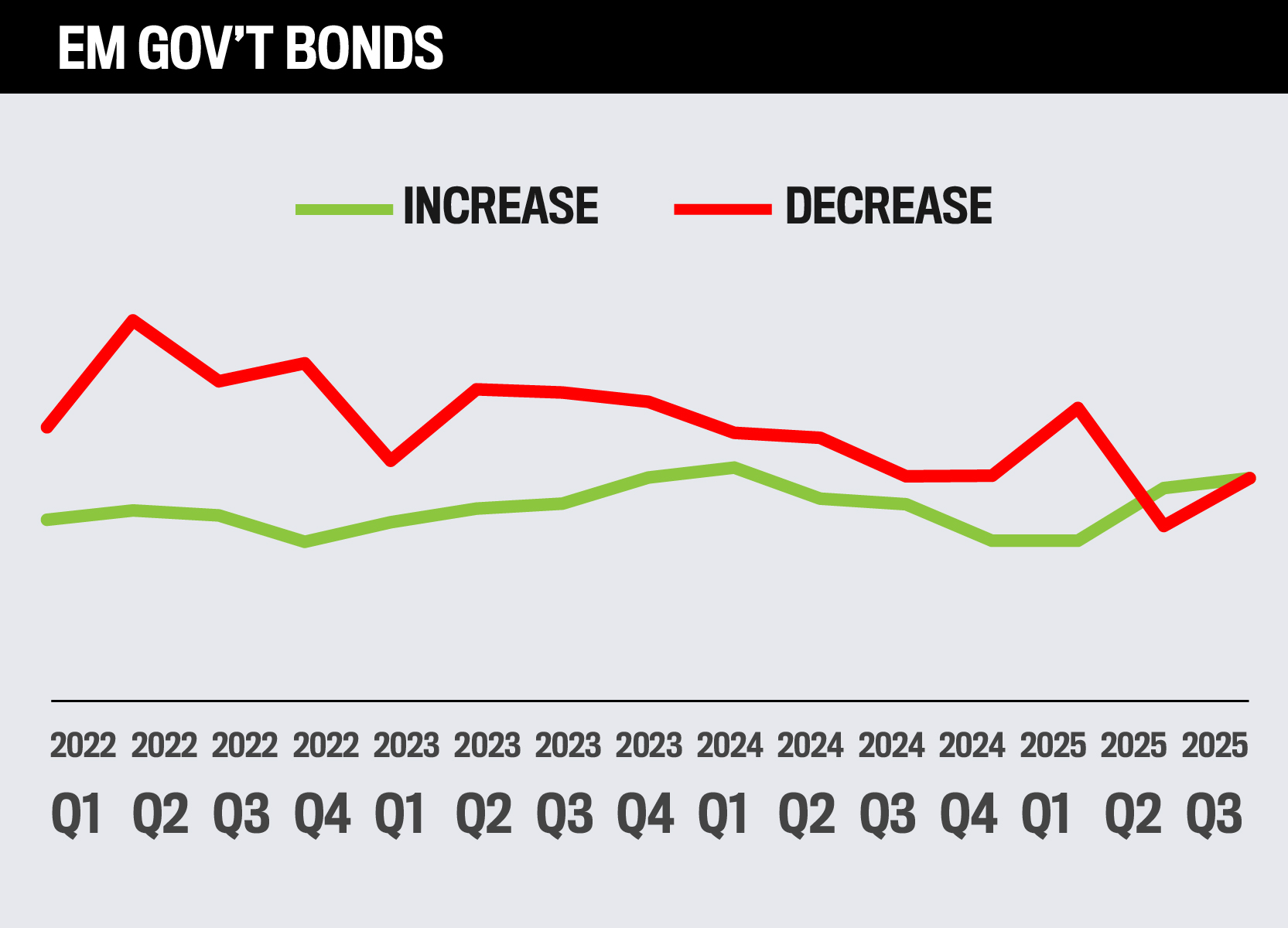

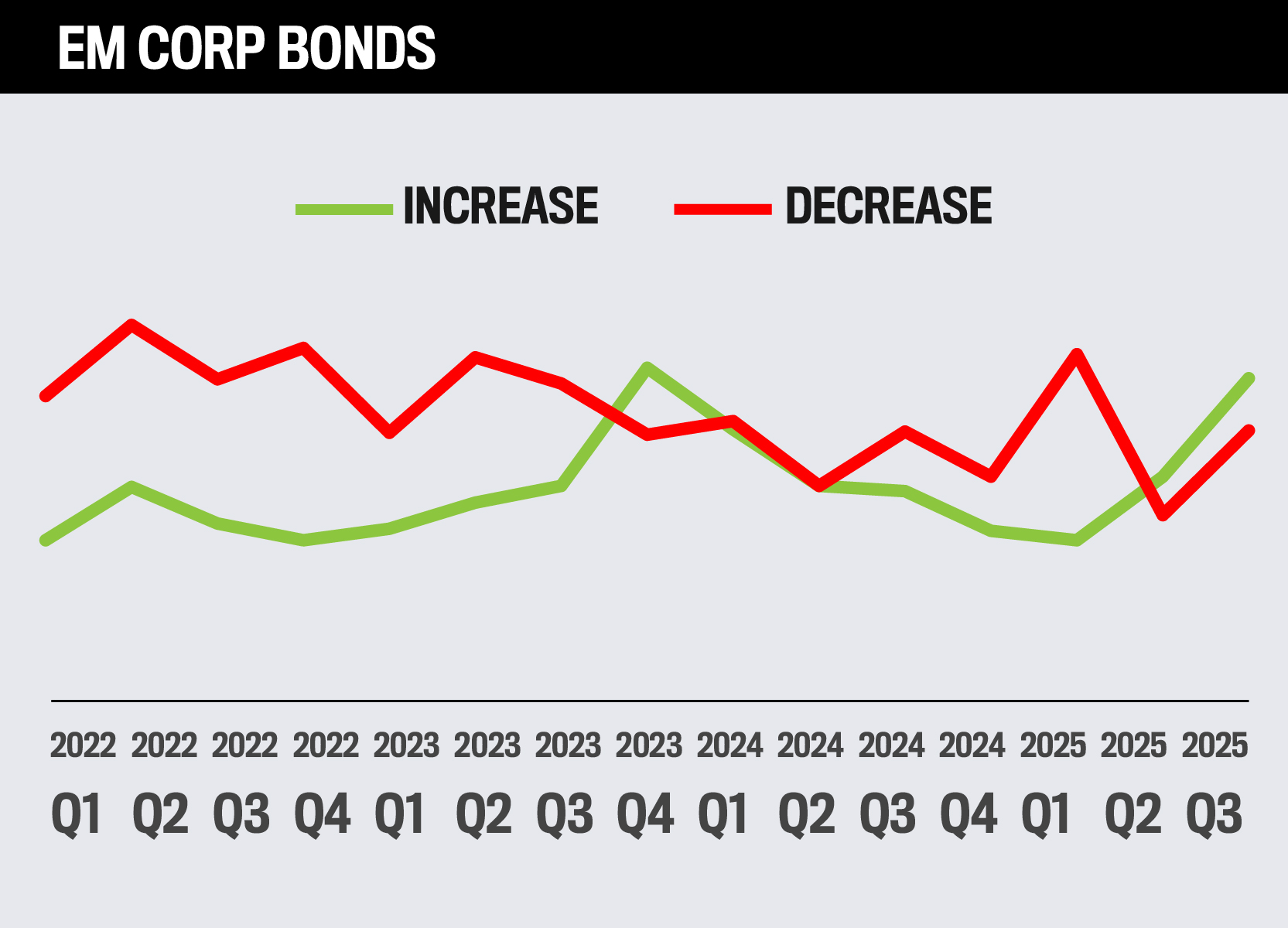

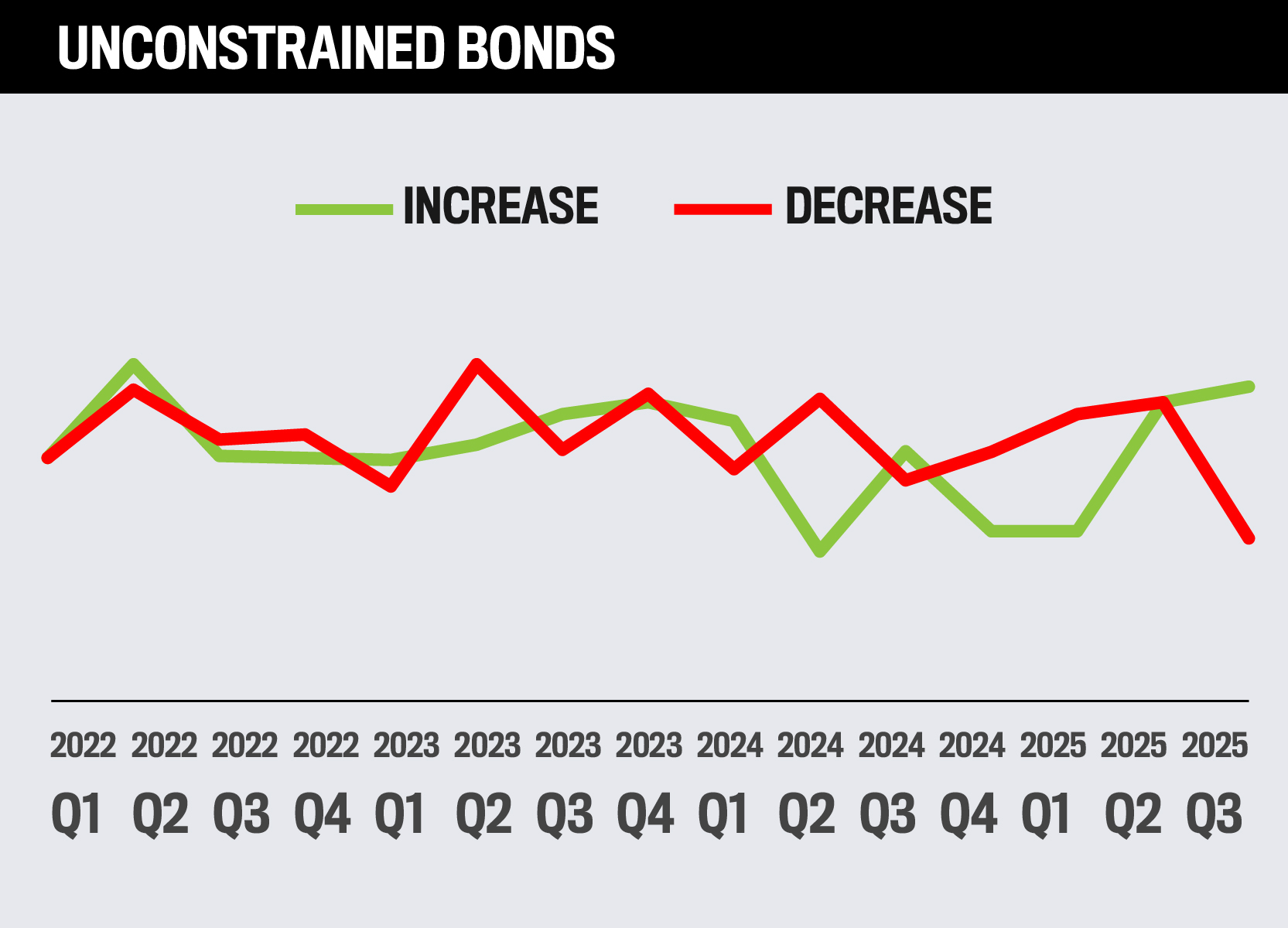

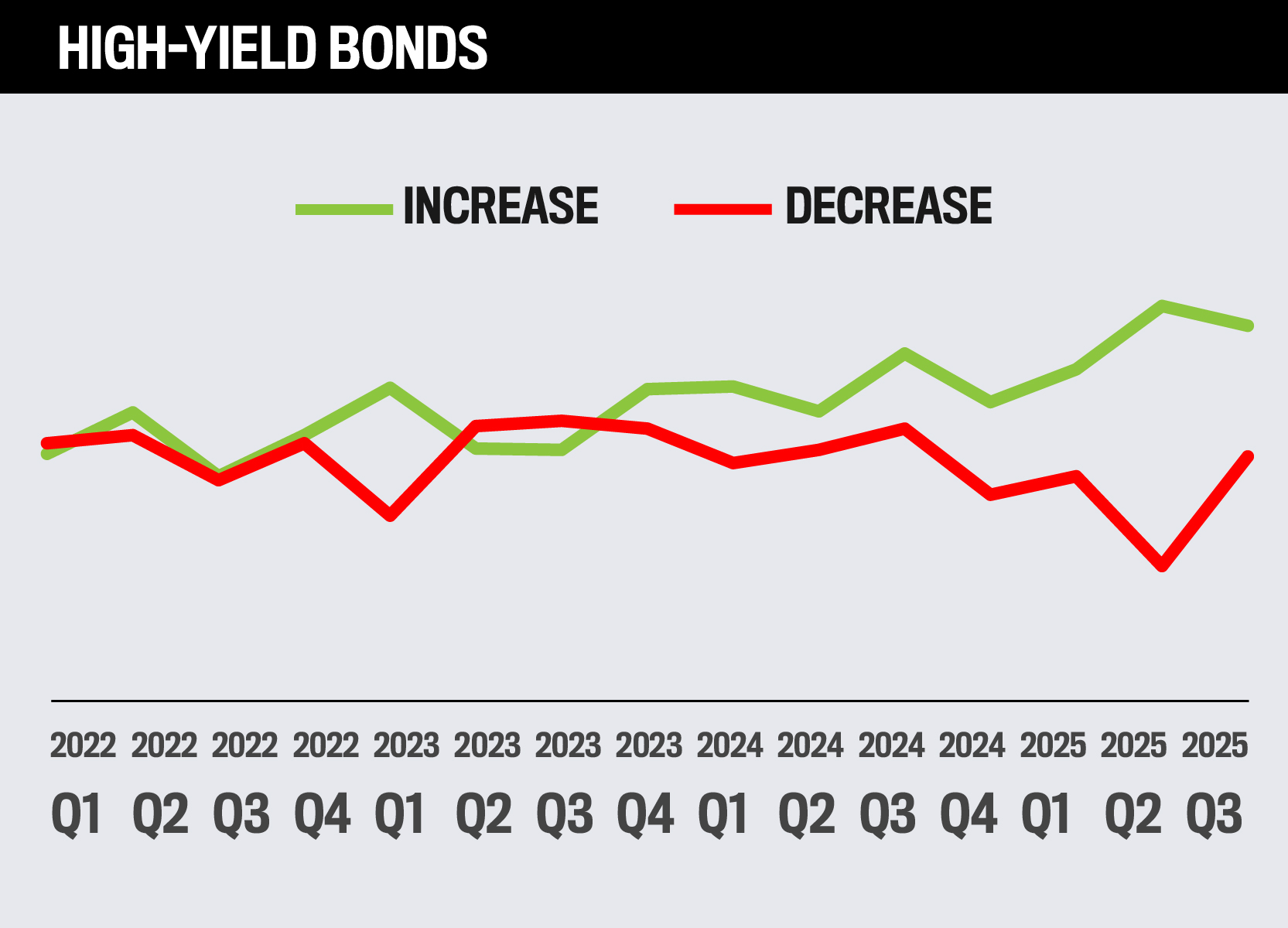

Fixed Income

How advisors plan to allocate assets to fixed income over the next year

Within fixed income markets, over the next year financial professionals plan to invest the most in U.S. fixed income , with 25% planning to increase or start using it. Emerging market government bonds are expected to see the least new investment, with only 10% planning to increase exposure, and a significant portion (40%) not using or planning to use them.

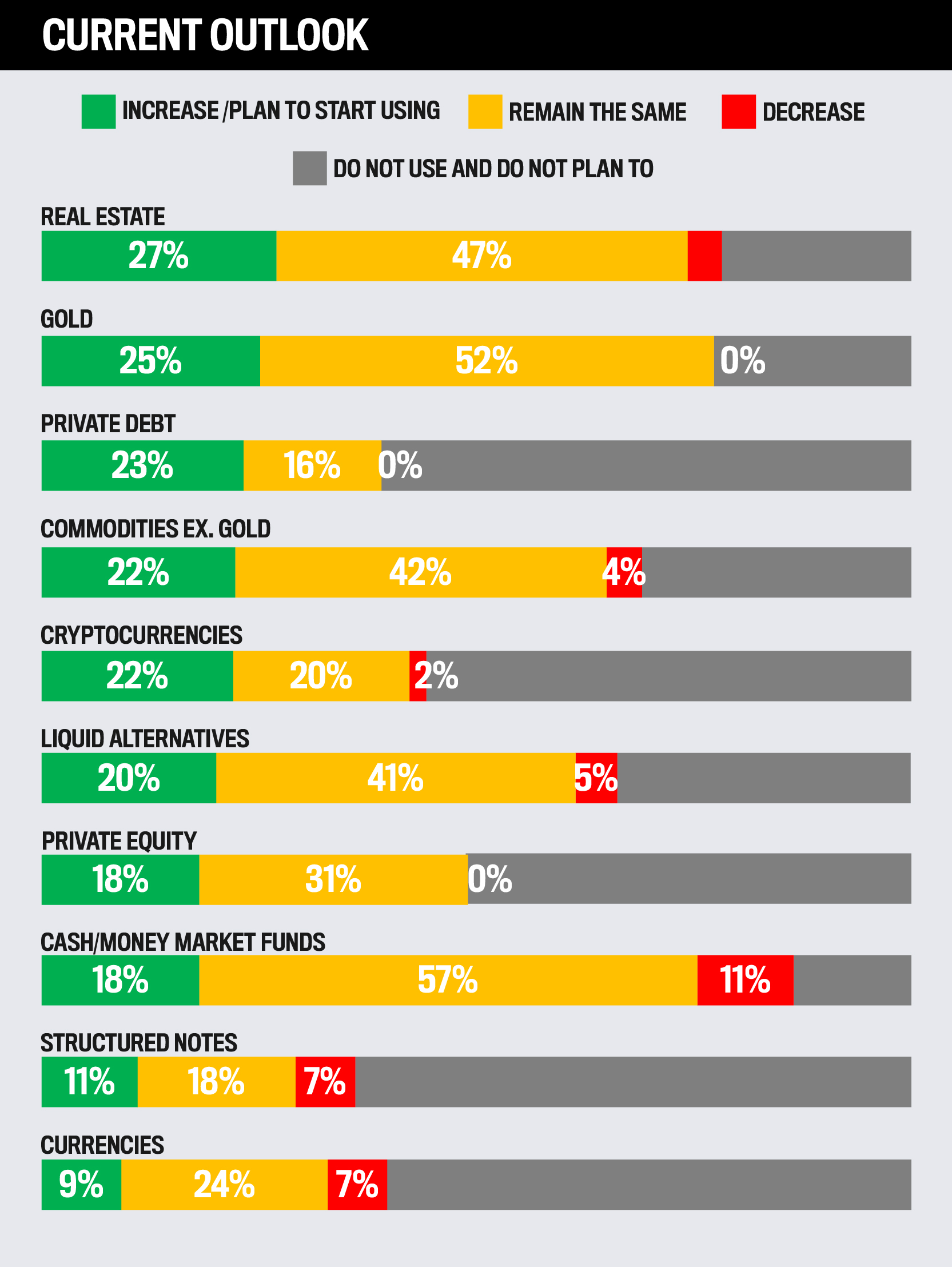

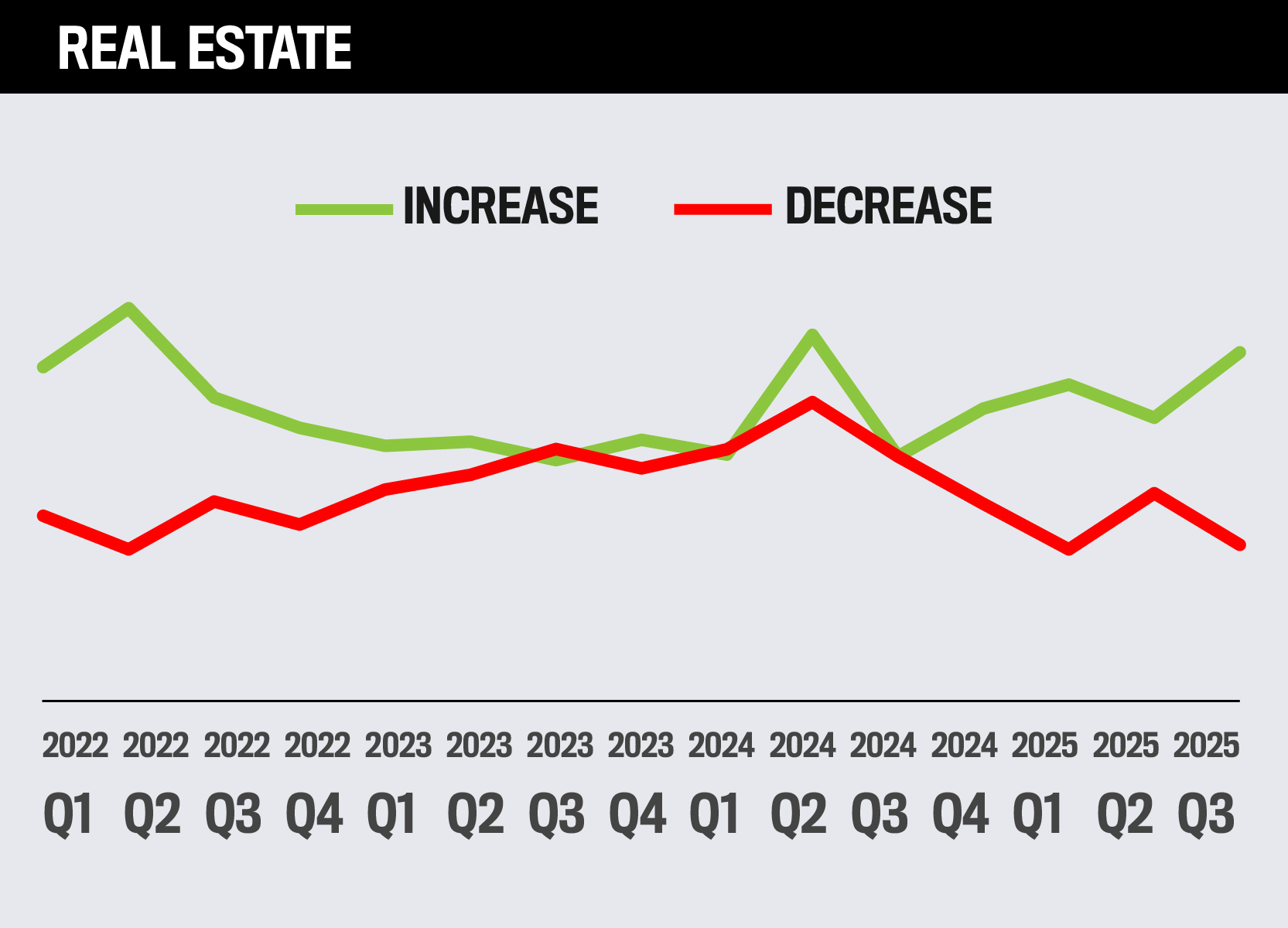

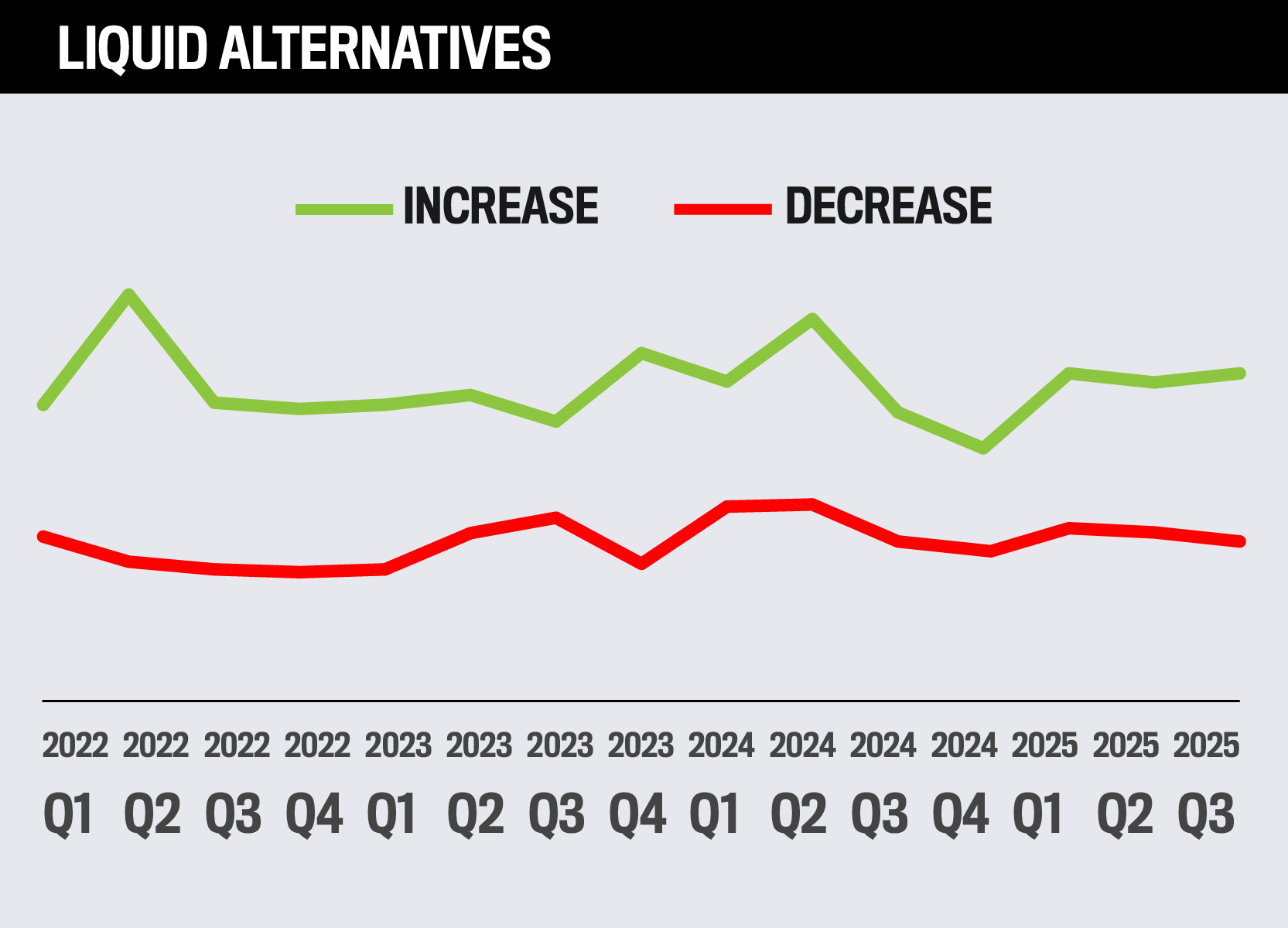

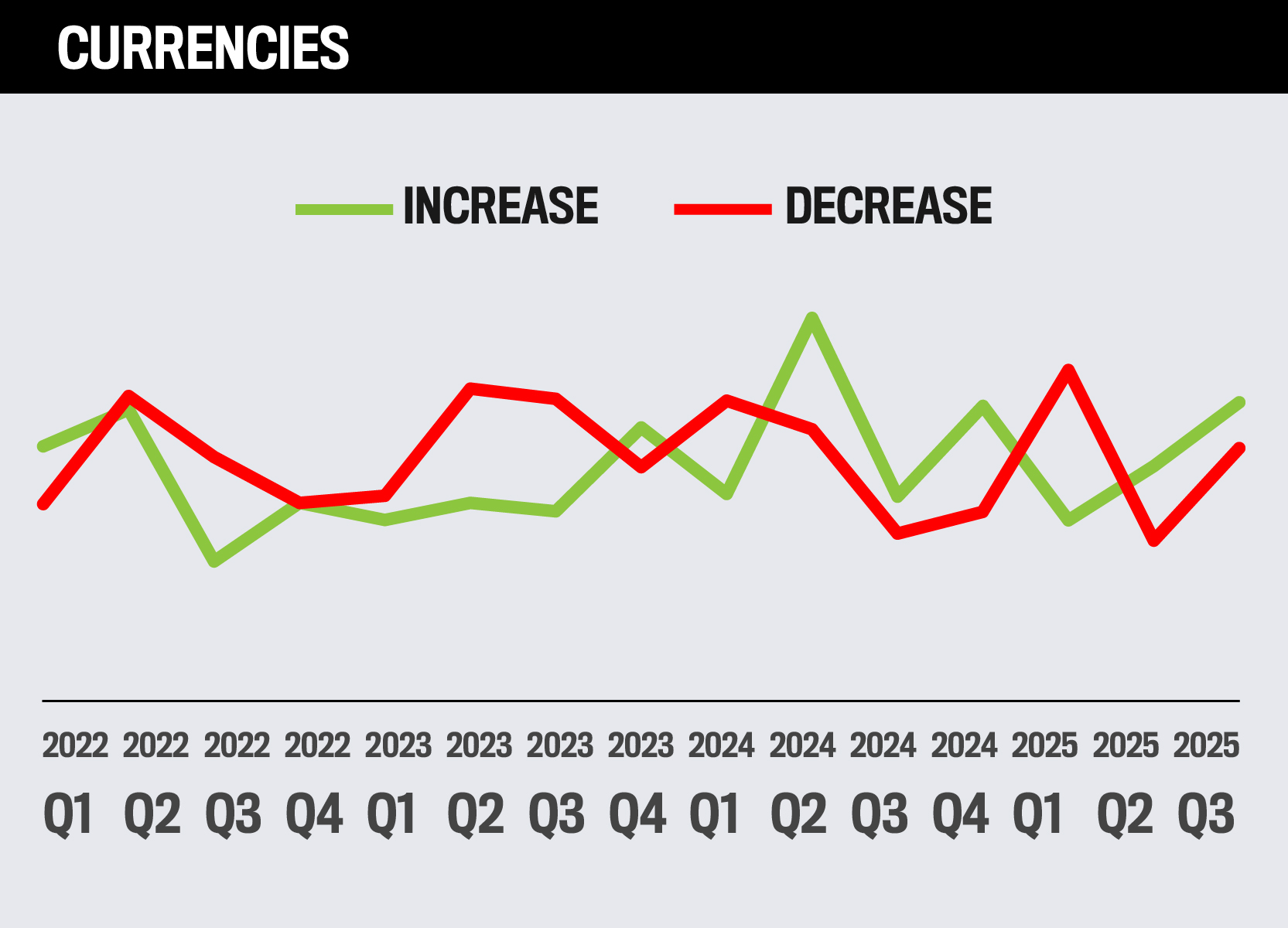

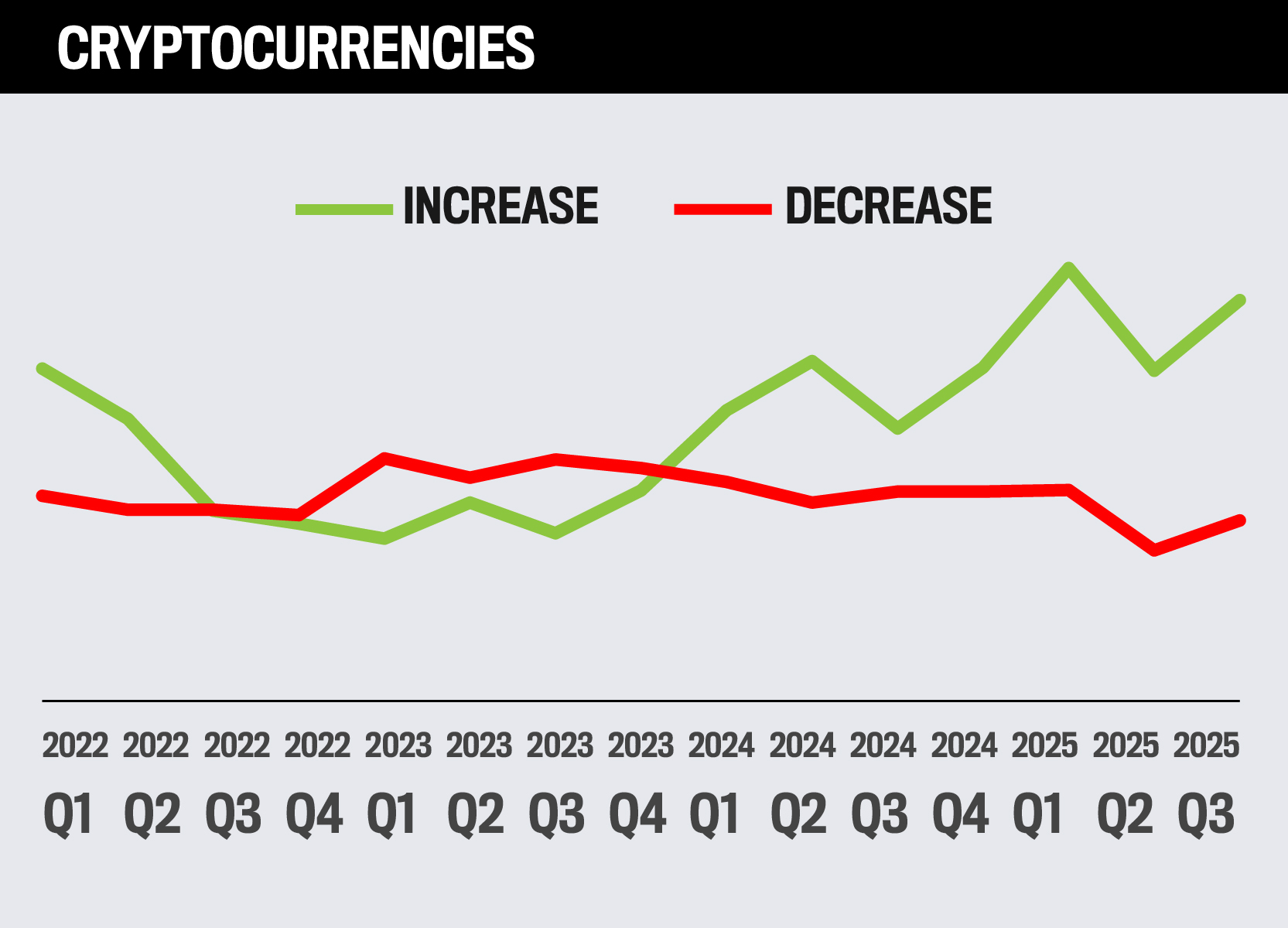

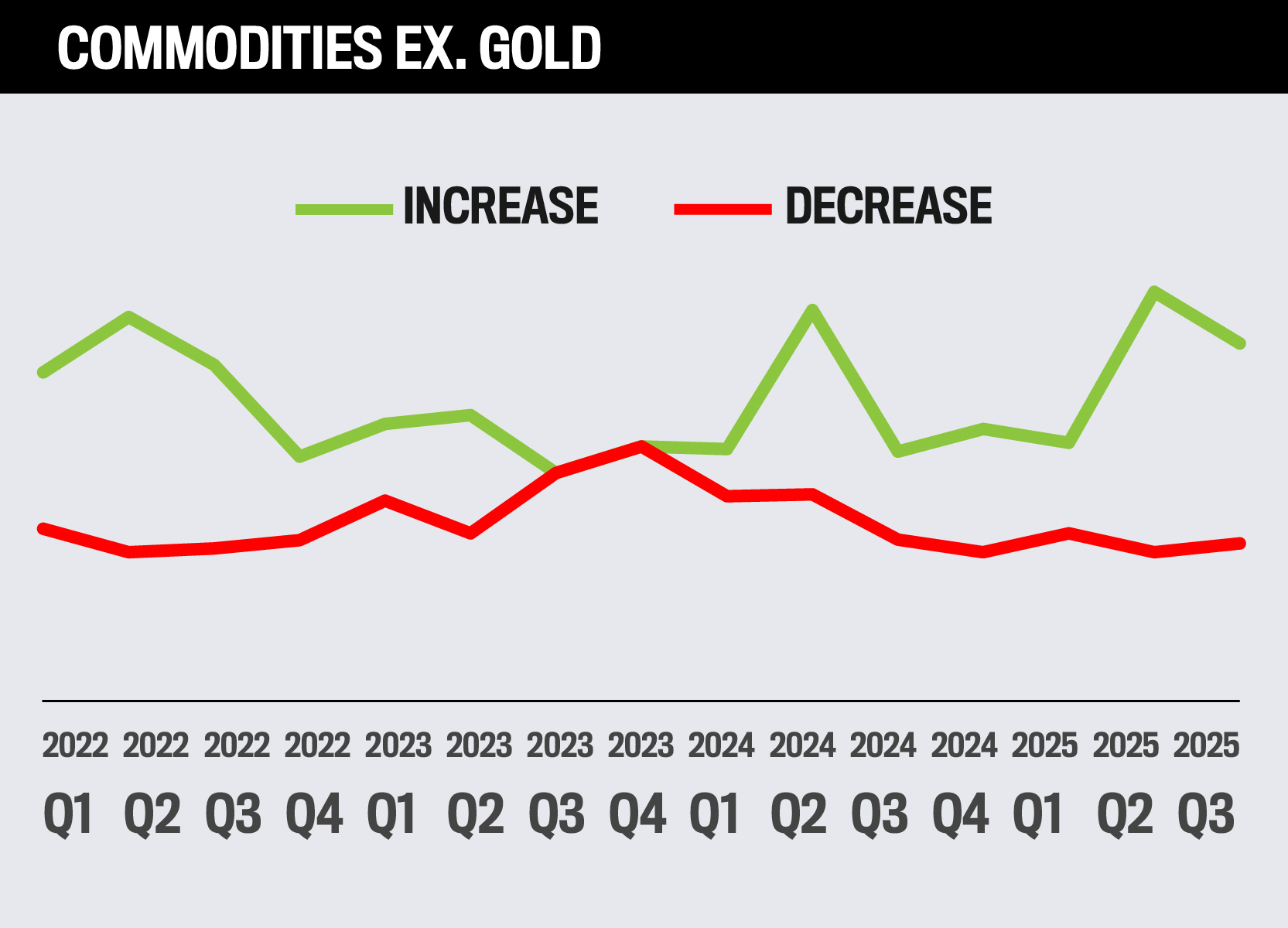

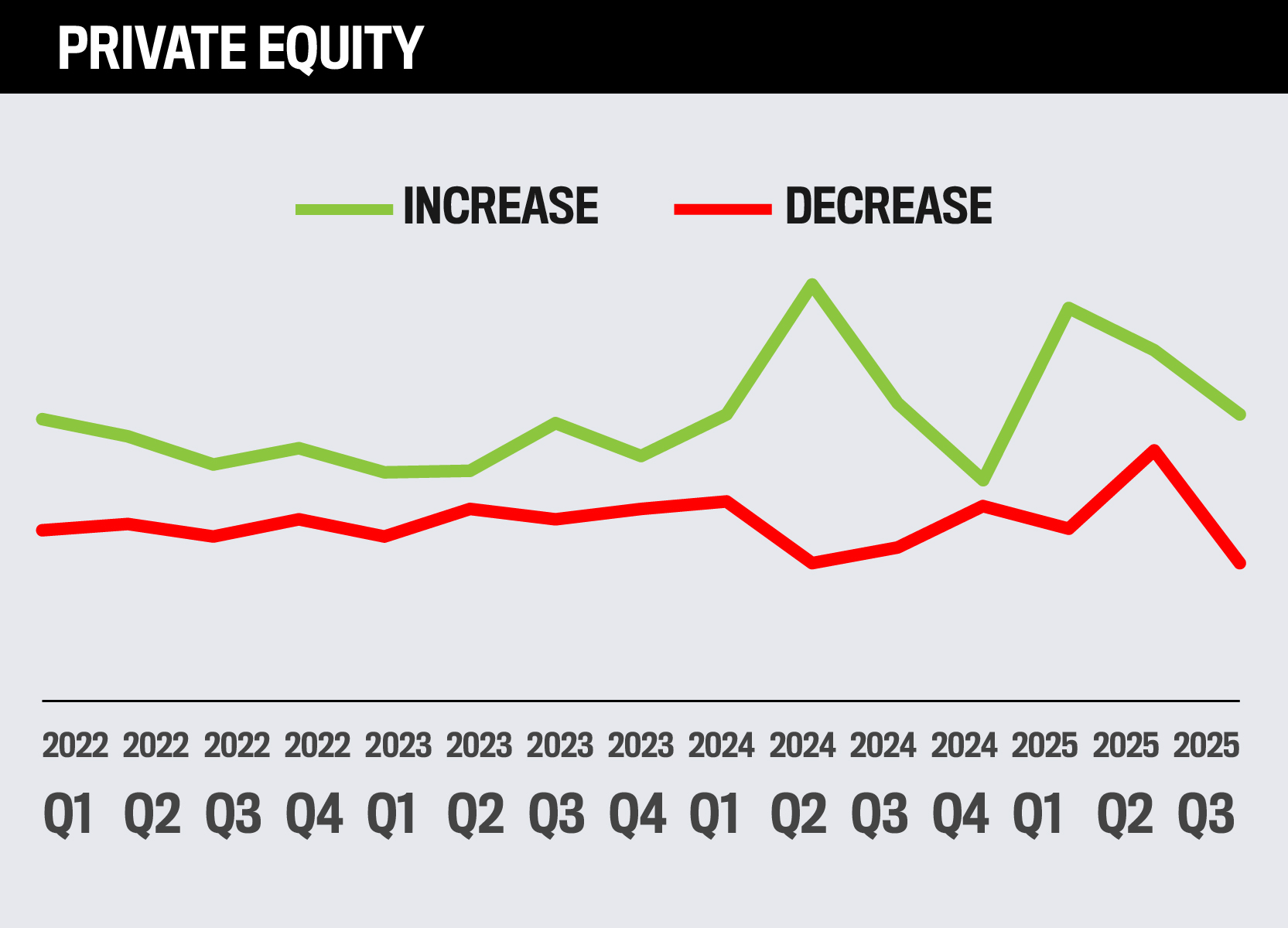

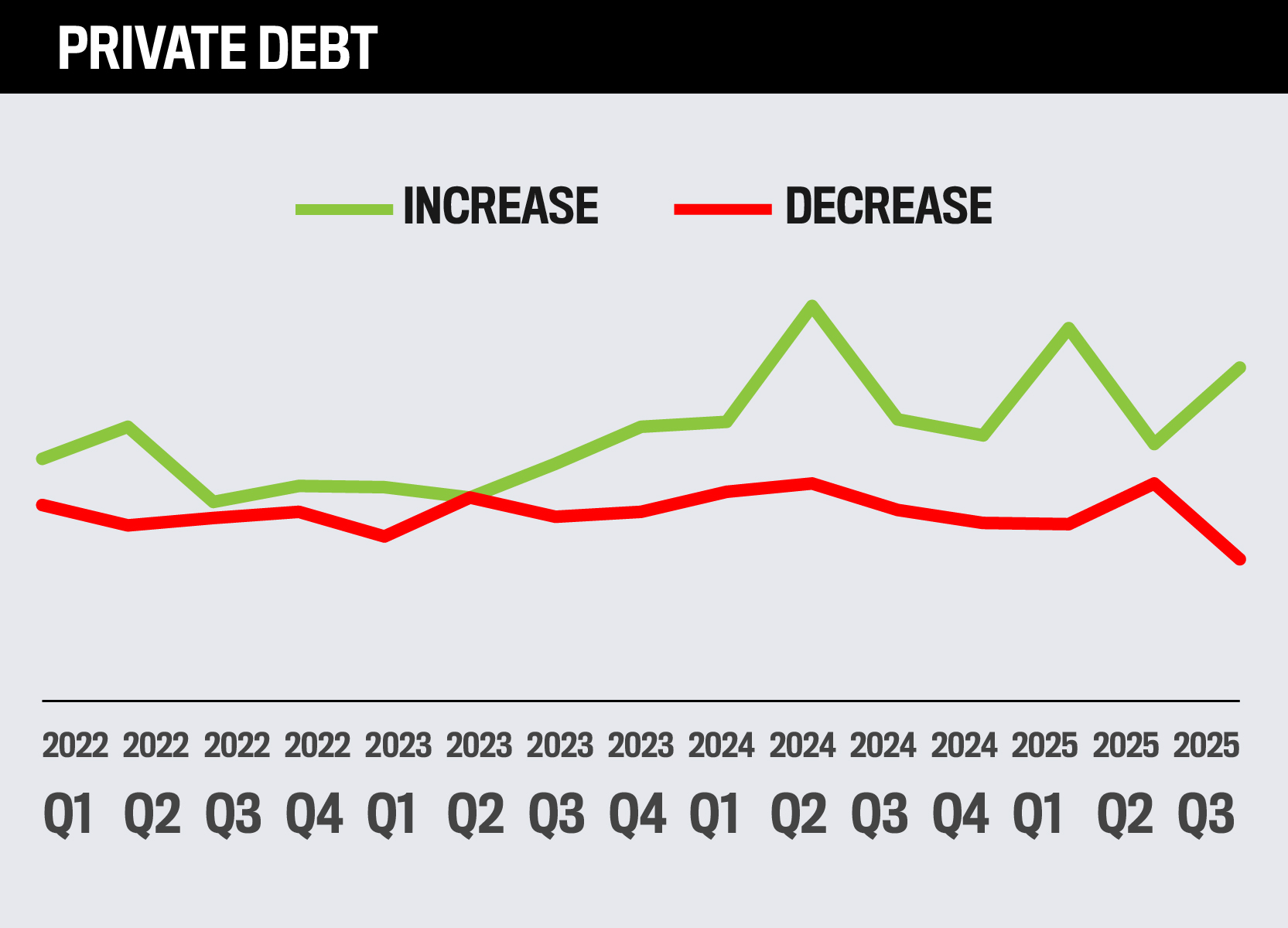

Alternatives

How advisors plan to allocate assets to alternative assets over the next year

Within the alternatives category, real estate (27%) and gold (25%) are expected to see the most investment over the next year. In contrast, currencies are expected to see the least, with only 9% planning to increase exposure.

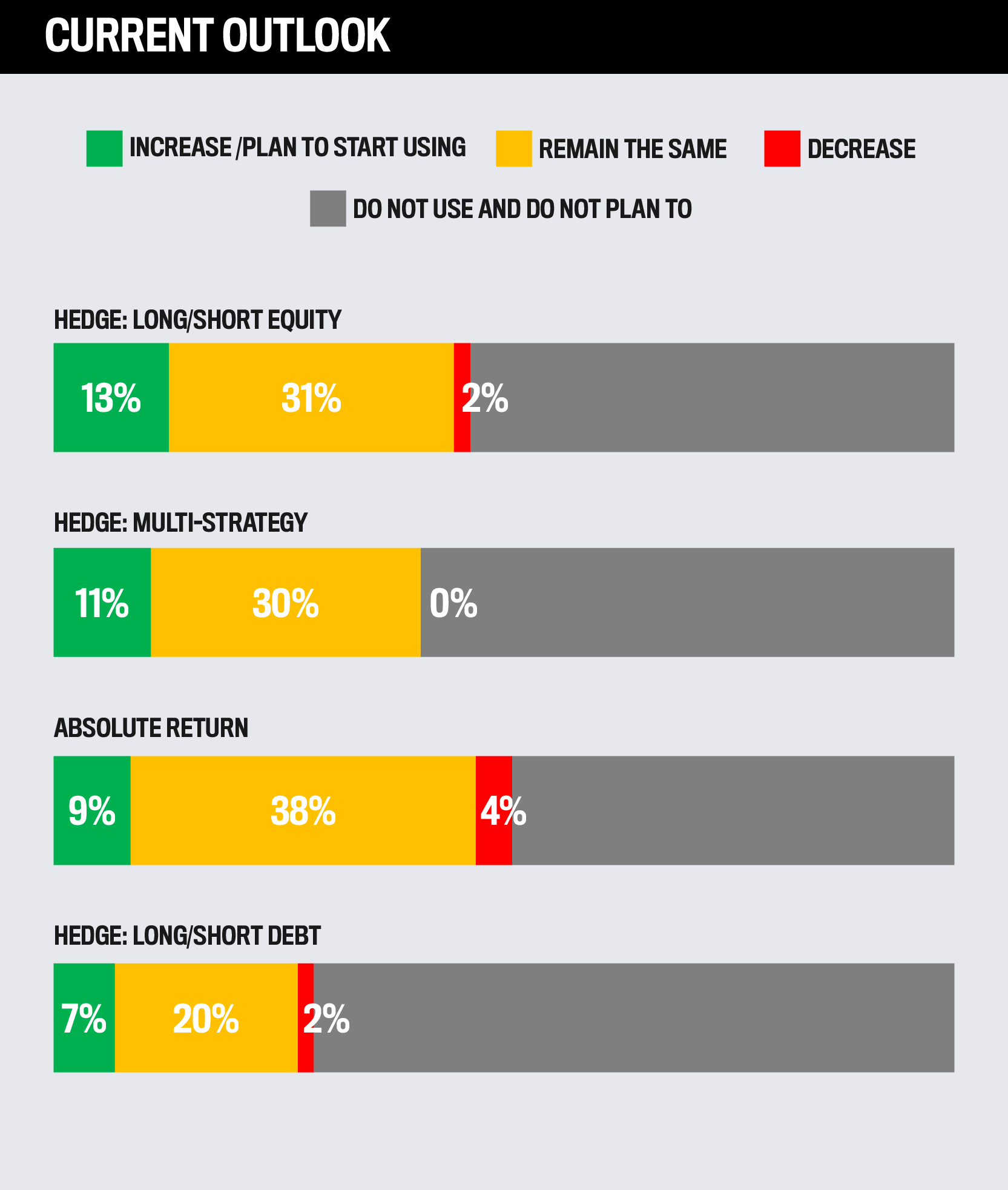

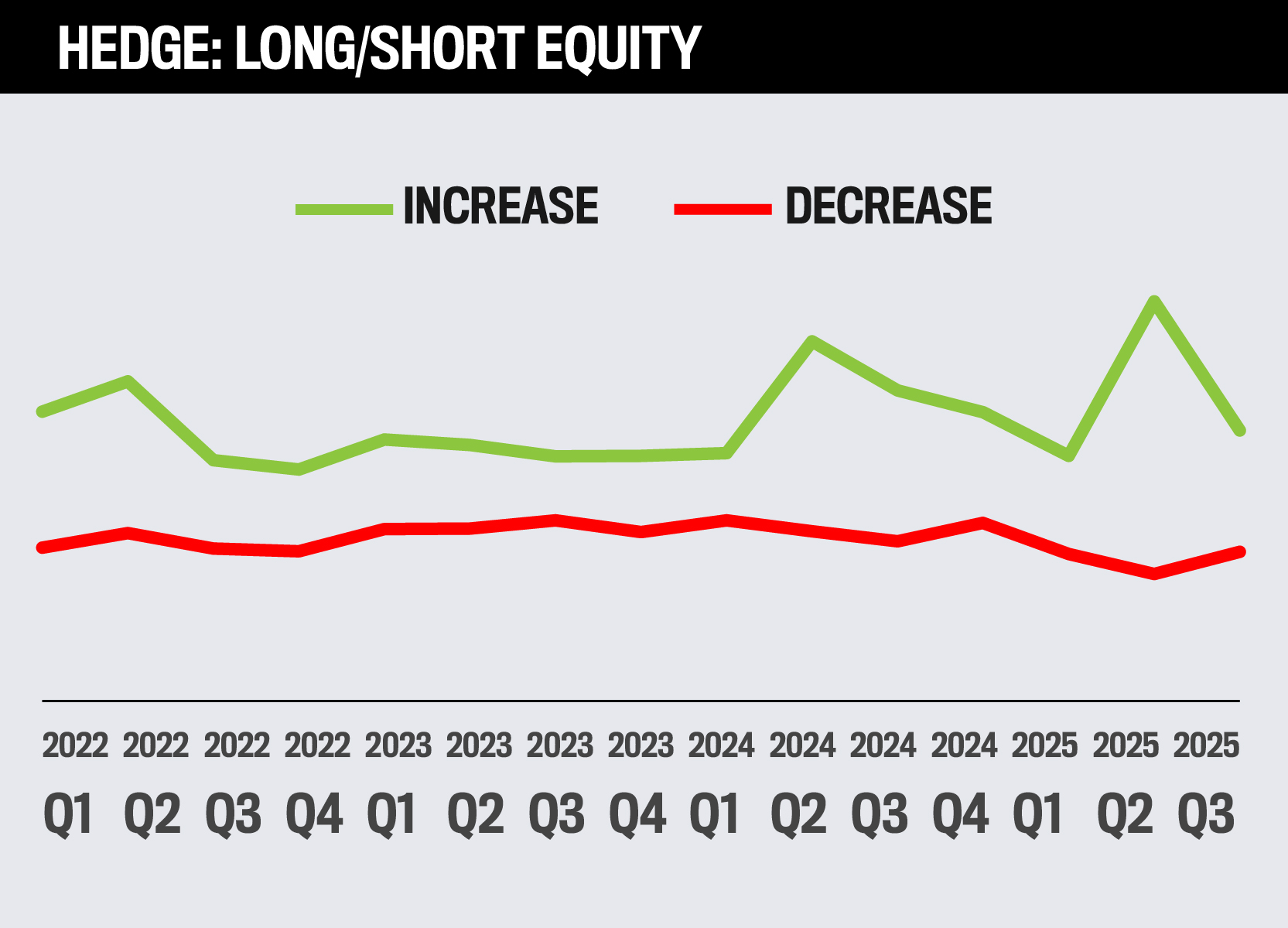

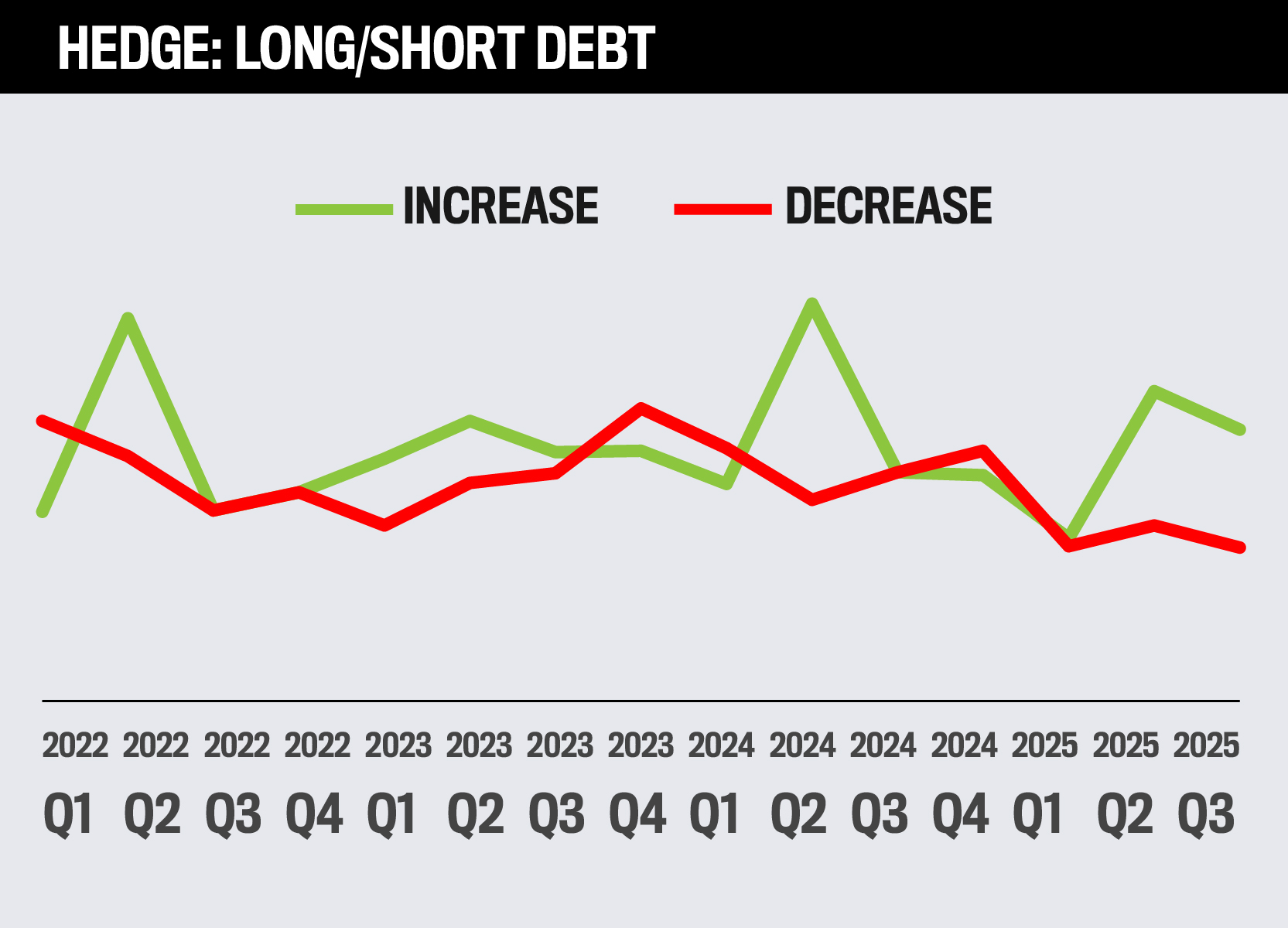

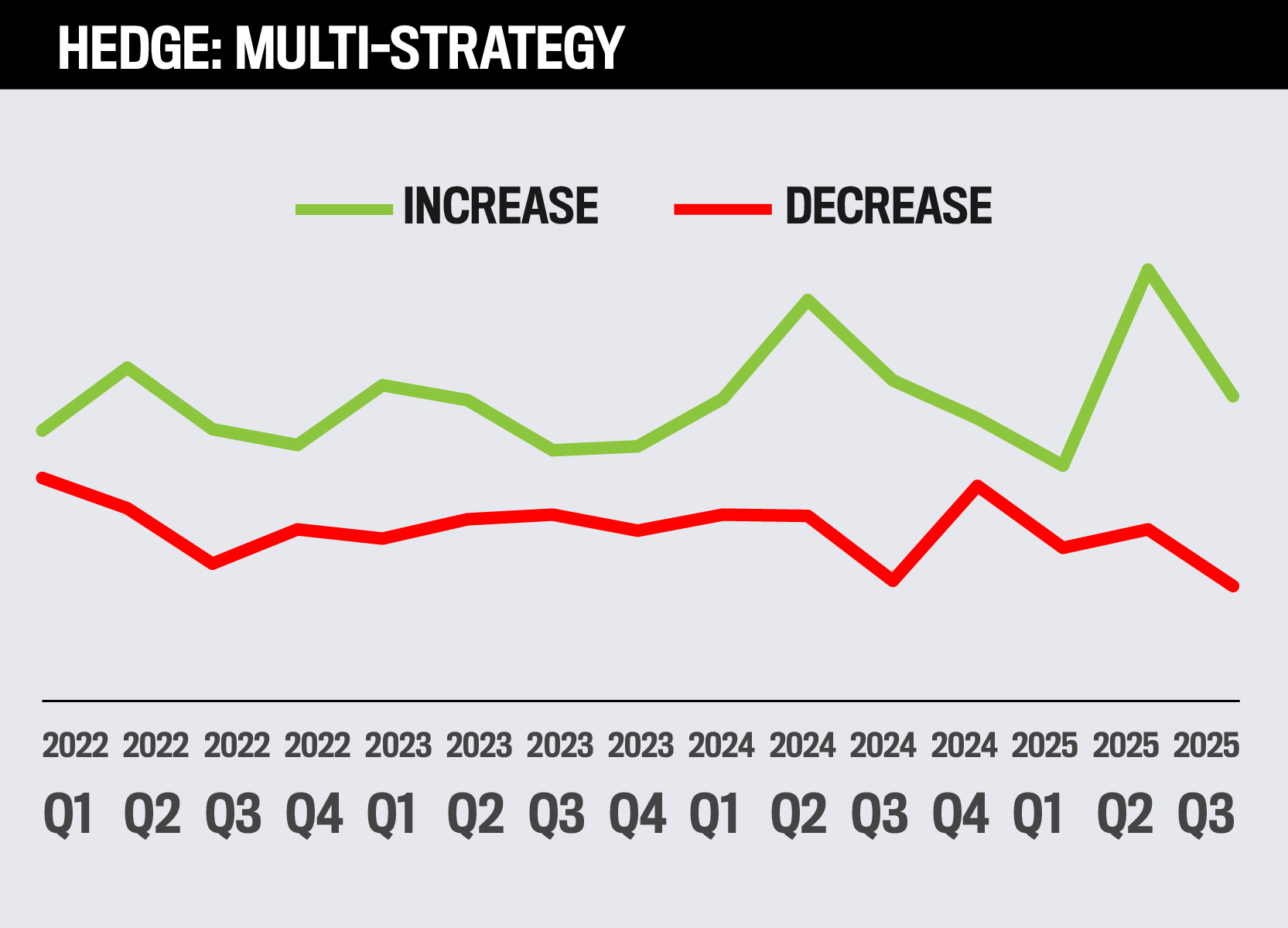

Advanced Strategies

How advisors plan to utilize advanced strategies over the next year

Within advanced strategies, hedge long/short equity (13%) and hedge multi-strategy (11%) are expected to see the most investment over the next year. In contrast, hedge long/short debt is expected to see the least, with only 7% planning to increase exposure.

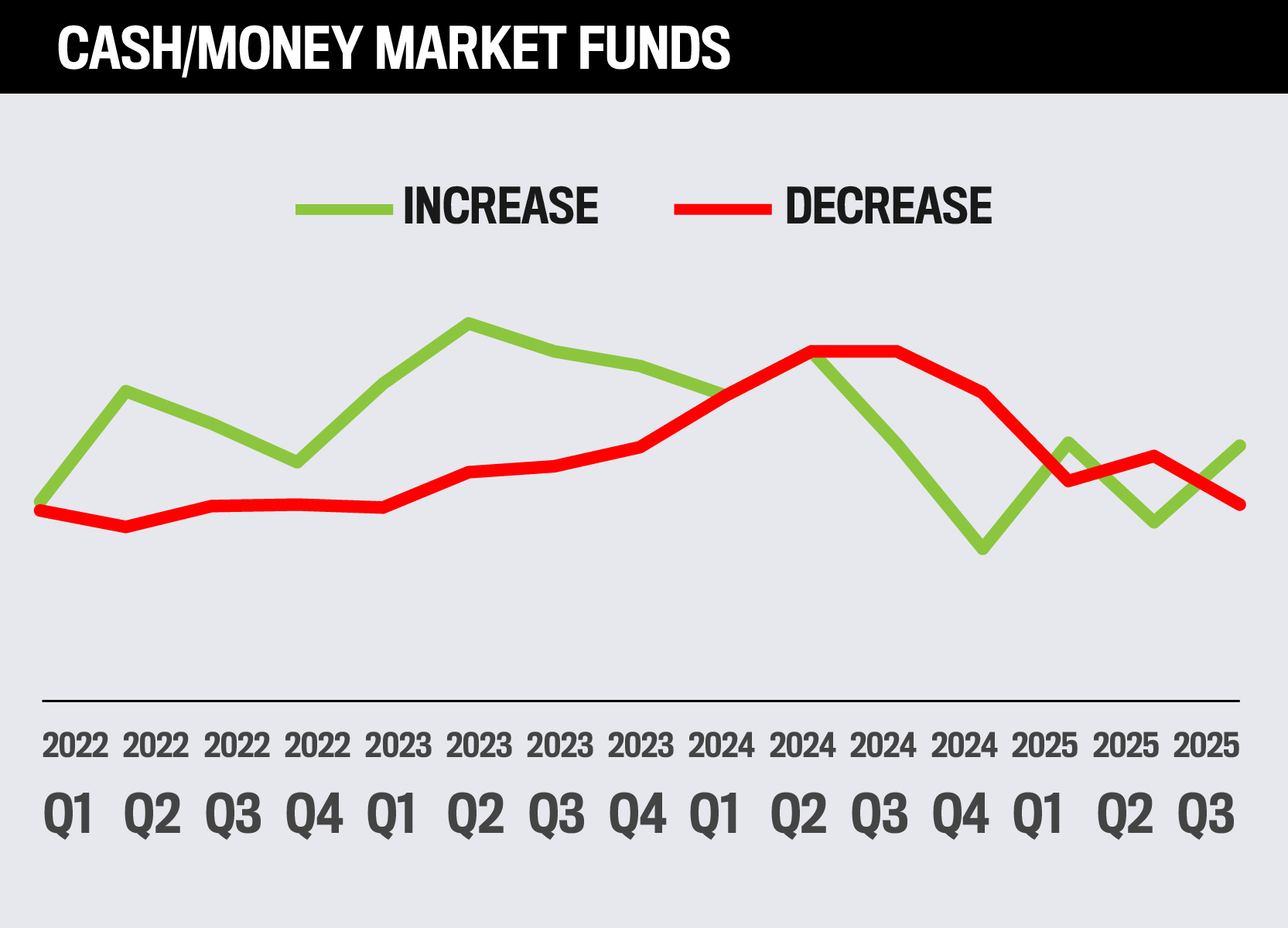

Other Products and Strategies

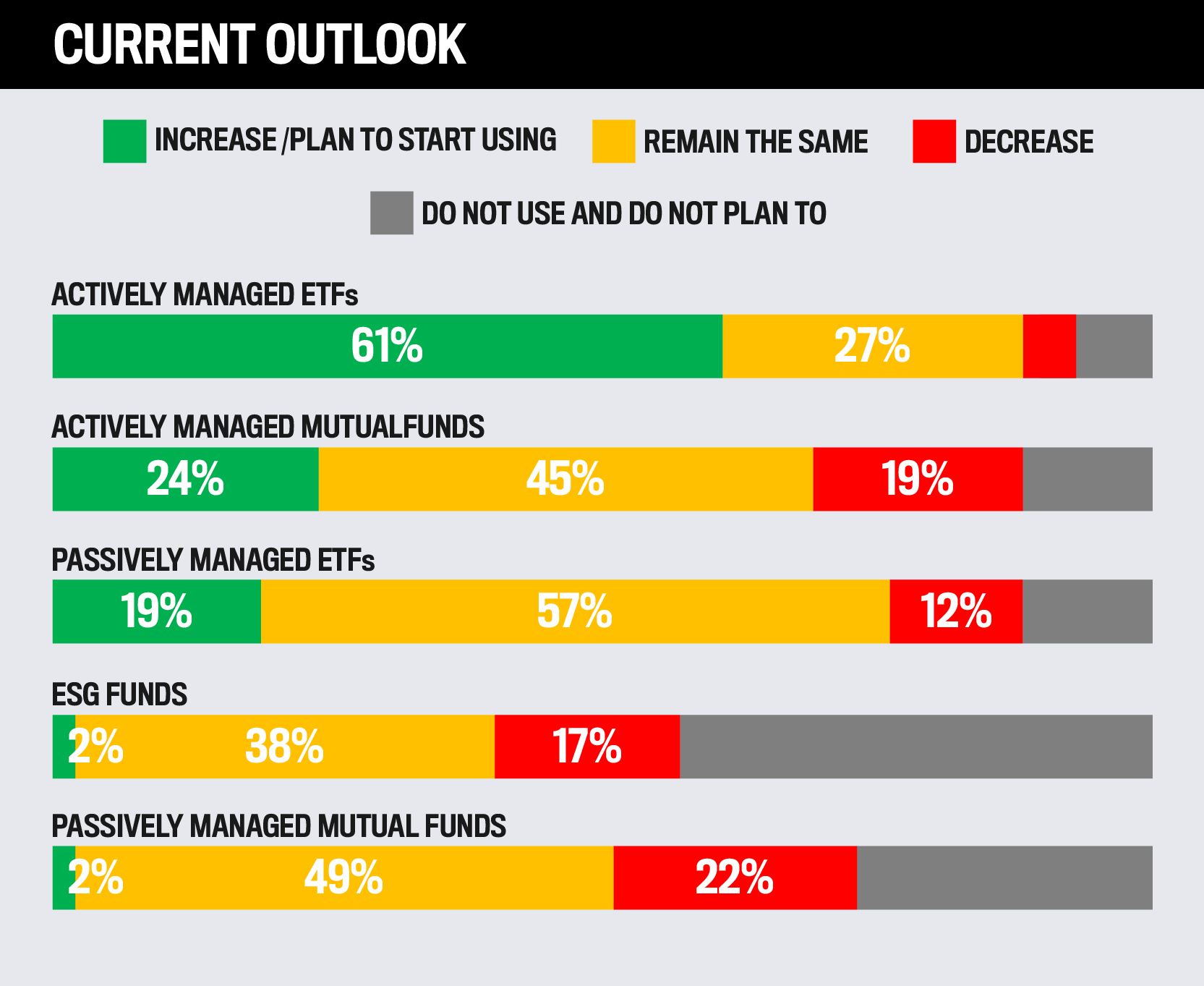

How advisors will use funds, annuity and other investment products over the next year

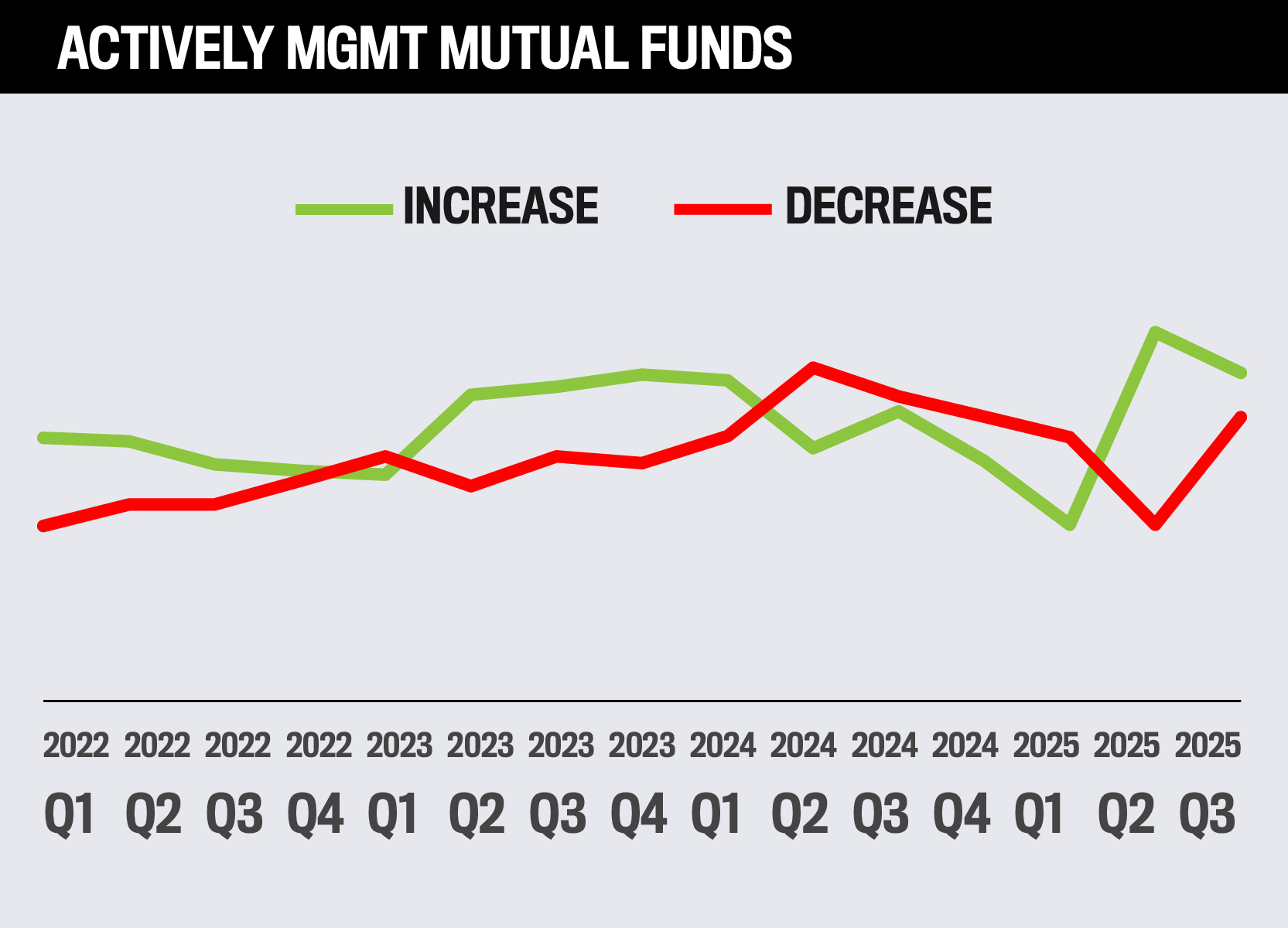

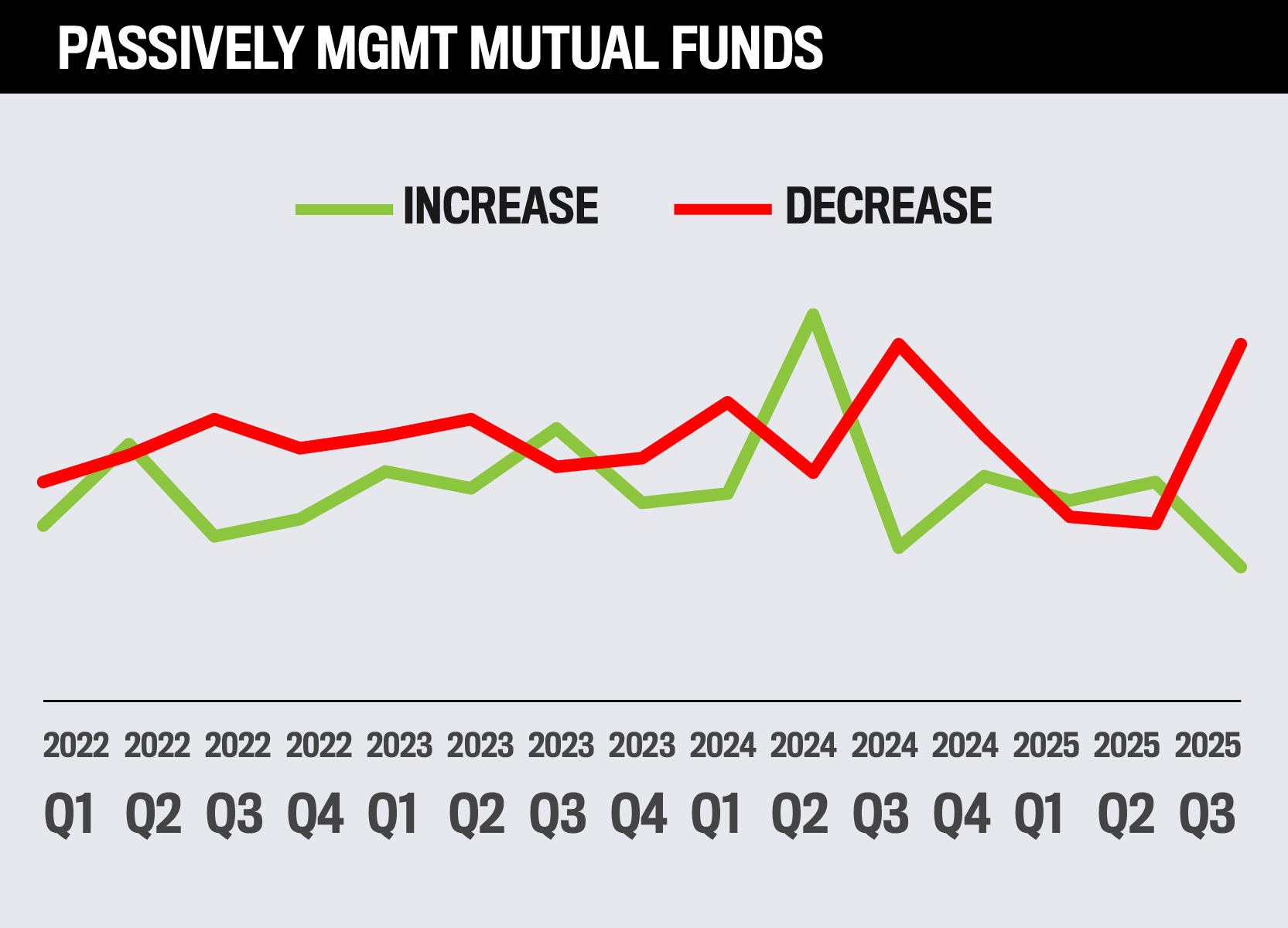

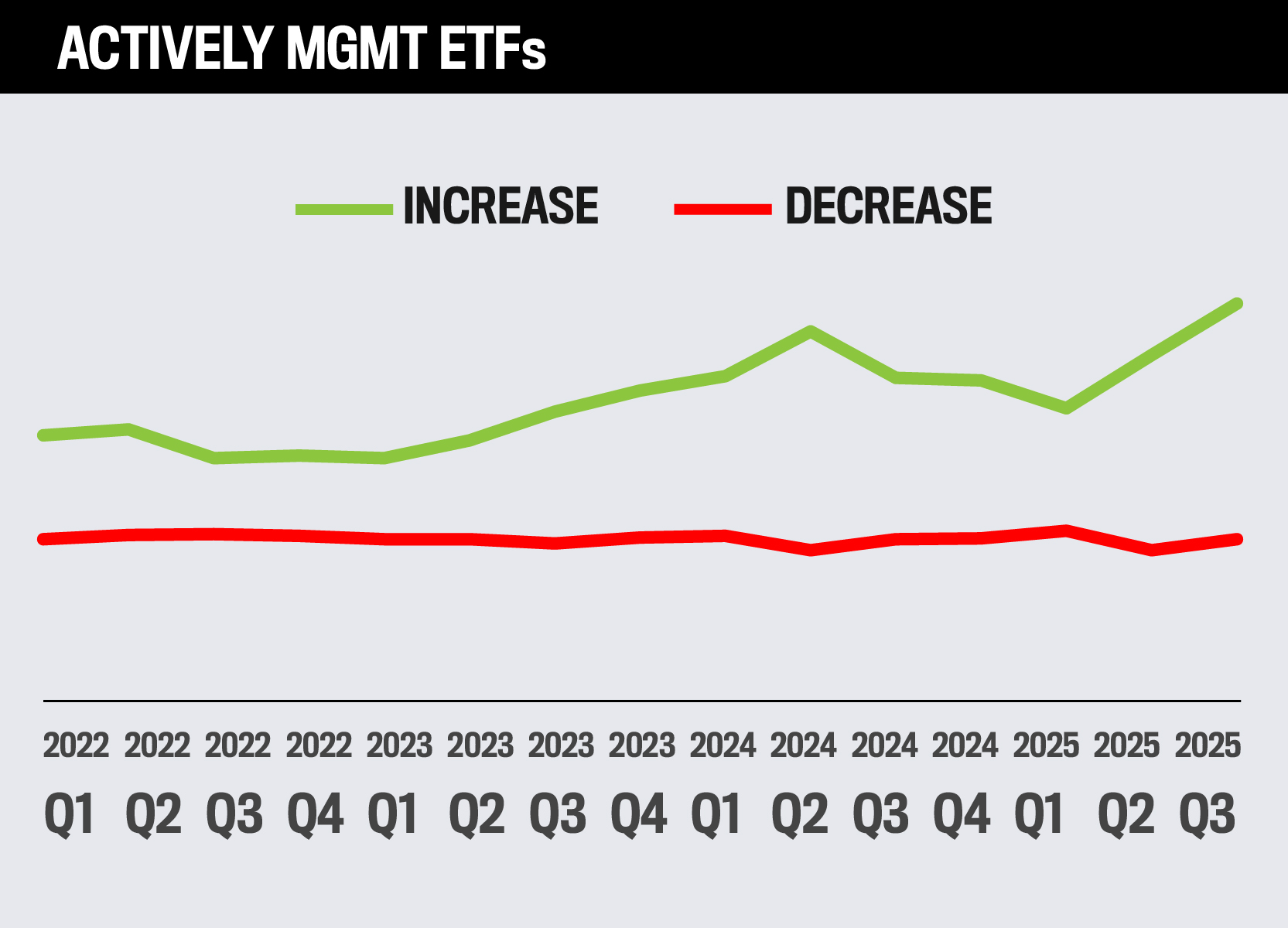

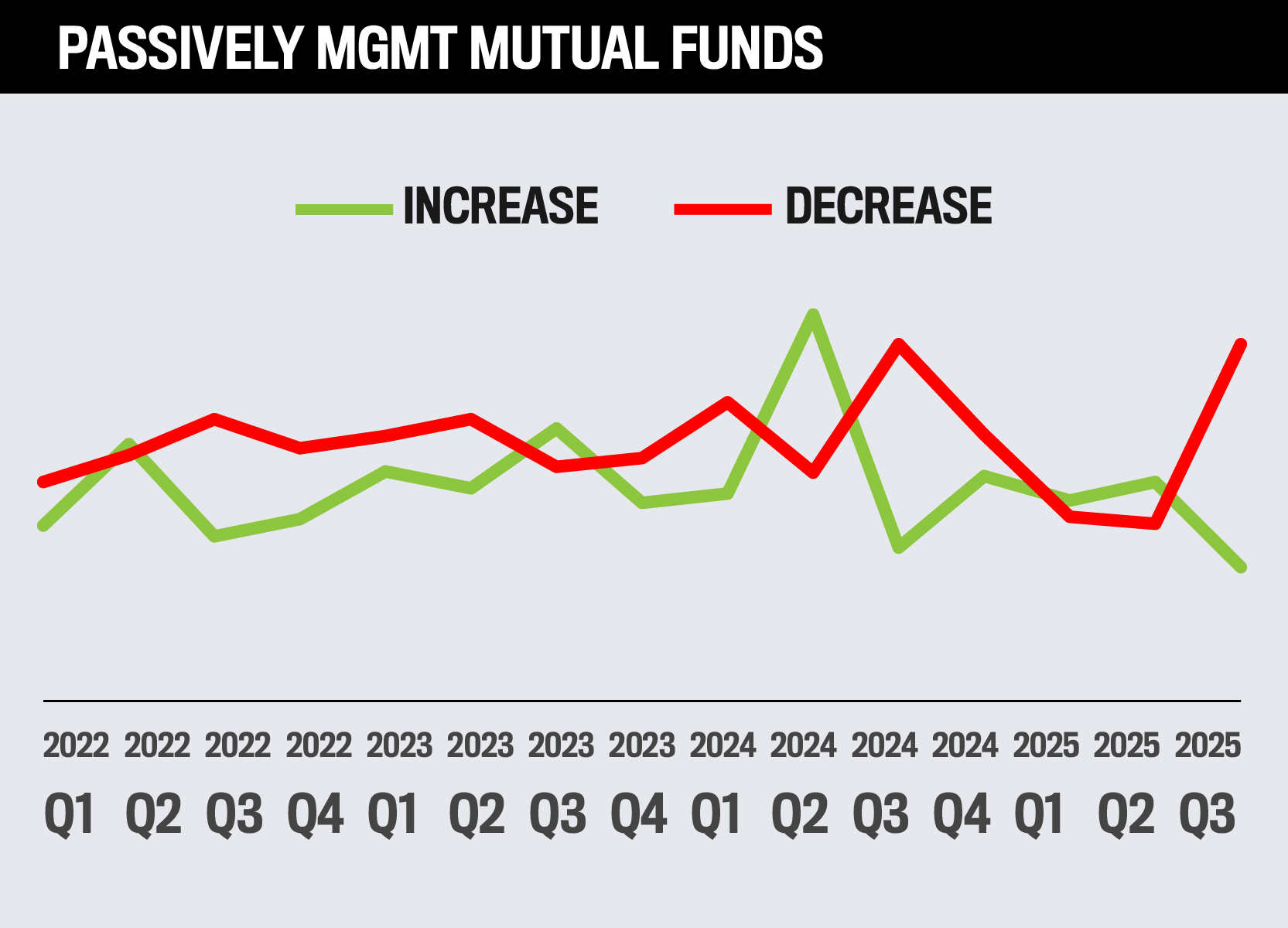

Across “other” products and strategies, actively managed ETFs stand out as financial professionals’ top choices, with 61% planning to increase or start using them over the next year. On the other hand, passively managed mutual funds are the least favored in this category, with just 2% of advisors planning to increase exposure.