Last week was the Global Fintech Fest in India—or as I like to call it: “UPI celebration week”.

This was the launch everyone was talking about:

India’s payments regulator, the National Payments Corporation of India (NPCI), has teamed up with fintech company Razorpay and OpenAI, backed by Microsoft, to introduce AI-driven payments on ChatGPT, the companies announced on Thursday, Reuters has reported.

Currently in a pilot phase, the initiative will enable users to make purchases through ChatGPT, powered by India’s homegrown Unified Payments Interface (UPI).

The pilot aims to explore how UPI can empower AI agents to “autonomously complete transactions on behalf of users in a safe, secure, and user-controlled manner,” according to a joint statement from the companies.

India rolls out pilot for e-commerce payments via ChatGPT, The Economic Times

The product demo was intriguing. It started off with someone uploading a grocery list on ChatGPT and asking it to place an order via Bigbasket. Then, within the chat interface, after a couple of confirmations, the purchase is complete, without the user ever leaving the screen, all using UPI.

As with most things around UPI, this was met with massive hyperbole.

Building a way for automated agents to complete payments right inside ChatGPT felt disruptive, innovative, and like a game-changer. Once again, India had used its world-class payment infrastructure to show the world how it was done.

Except the rest of the world already had it the previous week.

Here’s OpenAI’s announcement:

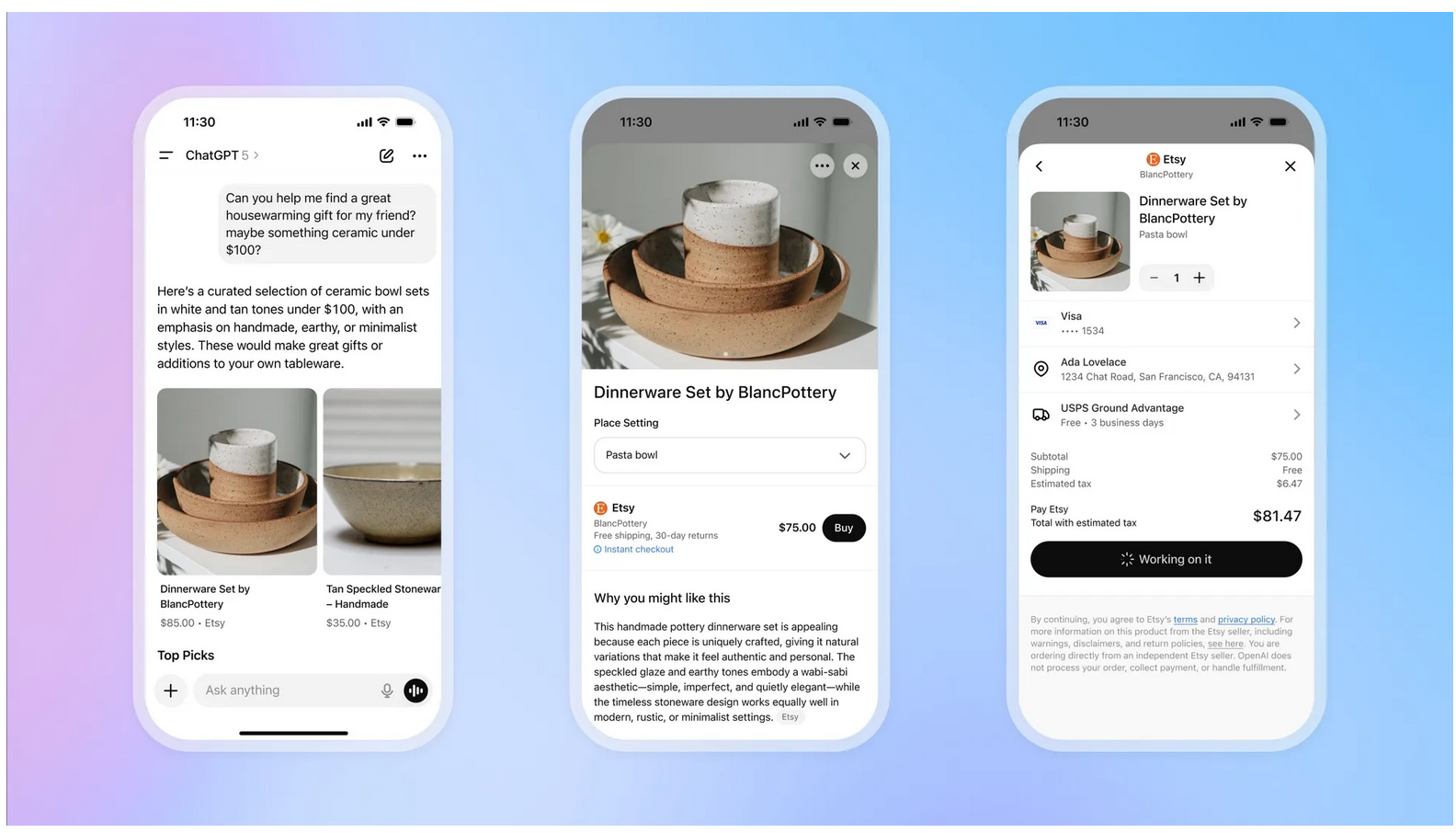

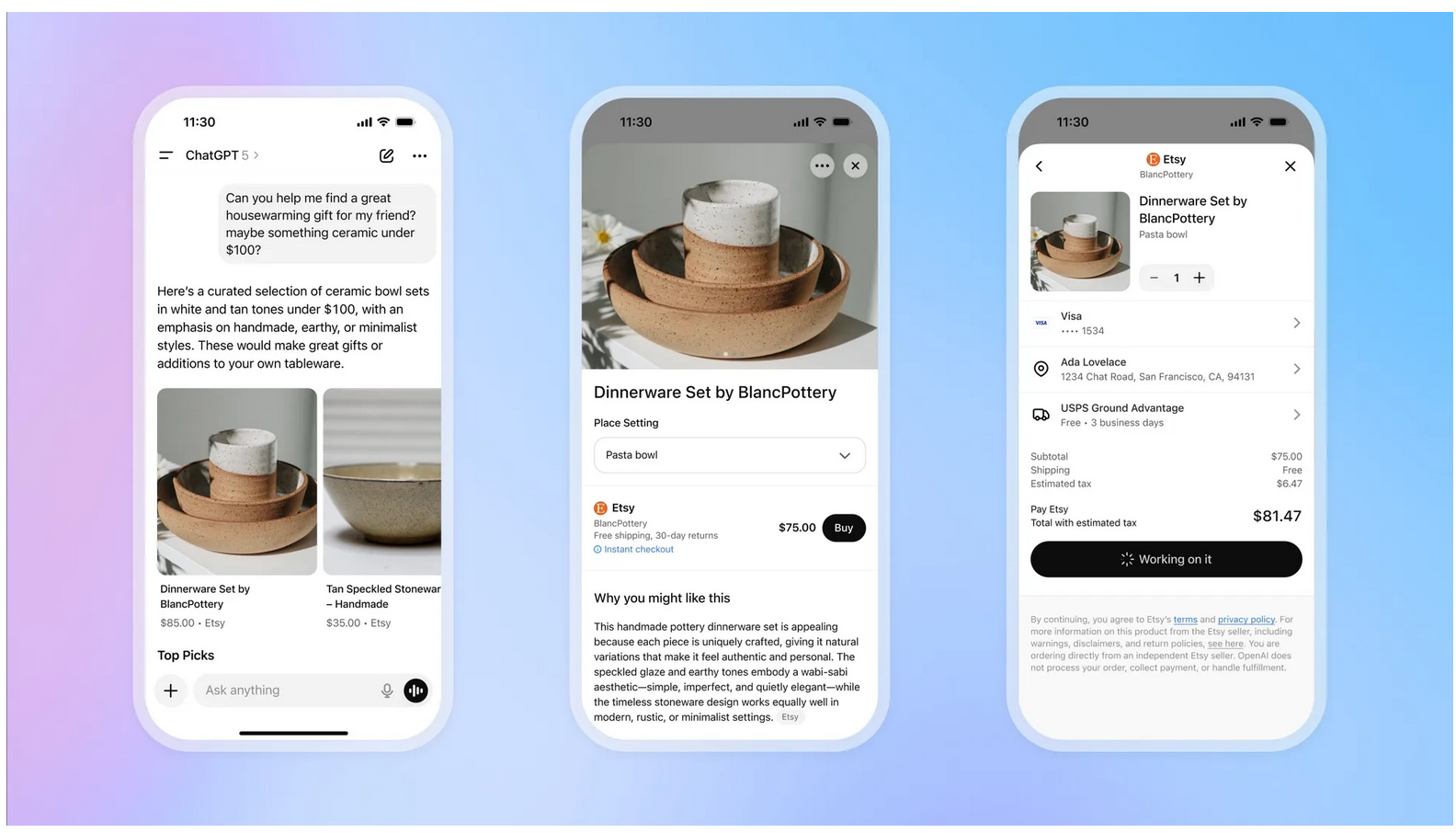

OpenAI said that they’re “taking first steps toward agentic commerce in ChatGPT with new ways for people, AI agents, and businesses to shop together.” Here’s how OpenAI described this feature in their launch announcement:

When someone asks a shopping question—“best running shoes under $100” or “gifts for a ceramics lover”—ChatGPT shows the most relevant products from across the web. Product results are organic and unsponsored, ranked purely on relevance to the user.

If a product supports Instant Checkout, users can tap “Buy,” confirm their order, shipping, and payment details, and complete the purchase without ever leaving the chat. Existing ChatGPT subscribers can pay with their card on file, or other card and express payment options.

Orders, payments, and fulfillment are handled by the merchant using their existing systems. ChatGPT simply acts as the user’s AI agent—securely passing information between user and merchant, just like a digital personal shopper would.

The reason I bring this up is because it’s yet another sign of something that’s becoming more obvious—UPI is slowly taking the long way around to end up where the rest of the world already was.

Making payments using QR codes on mobile devices is admittedly a great innovation, and if UPI had stopped there, it would have been fine.

But now, it’s trying to shove and contort itself to do things it was never intended to do.

Nothing makes this more apparent than AI and conversational commerce, which are forcing UPI to add features that look like “innovation” but actually make it a clunkier, less effective version of what credit card issuers had already figured out.

If you don’t believe me, UPI didn’t need one, but two major enhancements to make this work. The first was UPI Circle, which was primarily used as a way for users to “allow” other users to make payments from their account without needing to enter a PIN number. Until now, this was used by, say, parents who wanted to give access to their children or elderly parents. Then, last week, at Global Fintech Fest, they announced a new feature called “UPI Reserve Pay”, which lets users whitelist certain merchants to “reserve” funds and make payments without a two-factor confirmation, up to certain limits.

You can see where this is going. Imagine creating a UPI Circle but instead of adding family members, you add a digital agent. Then, combine that with UPI Reserve Pay, which lets you whitelist certain merchants. If you link the two and integrate them properly, you can technically make UPI payments from within a chat window.

Now really look at this. You’ll notice that UPI Circle is essentially a way to let someone make a purchase on your behalf without needing a PIN number, which the rest of the world has already solved by letting customers add authorised users to their credit cards.

UPI Reserve Pay is just a new avatar of something India had already figured out a decade ago—making funds available exclusively at the merchant level, like wallets used to do.

For me, the really infuriating part is that UPI’s success came largely because the RBI sidelined credit cards and wallets to make room for it. Through a combination of onerous loops that included killing recurring payments, adding full KYC requirements and introducing zero MDR (merchant discount rate), UPI ate wallets and credit cards in India.

And now, UPI is adding new features and twisting existing ones so that it doesn’t get left behind in the agentic commerce era.

Some might argue, “Sure, UPI is starting to look a lot like credit cards and wallets, but at least India is doing this on its own terms, using a payment infrastructure it fully controls. And maybe that, in itself, is a win.”

That may be true, but here’s the most important part of OpenAI’s announcement:

We’re also open-sourcing the technology that powers Instant Checkout, the Agentic Commerce Protocol, so that more merchants and developers can begin building their integrations. The Agentic Commerce Protocol is an open standard for AI commerce that lets AI agents, people, and businesses work together to complete purchases. We co-developed it with Stripe and leading merchant partners to be powerful, secure, and easy to adopt.

The real risk is that this new AI world is already creating standardised protocols and standards for payments using familiar mechanisms like credit cards, and India’s UPI isn’t really fitting in cleanly into this. UPI is wonderful, but I’m struggling to think of a universe where the payments infrastructure of the world bends itself to accommodate it.

Maybe agentic shopping will happen. Maybe it won’t. As it stands today, while the rest of the world is building one kind of system, India is trying to join the game with what it’s already built and committed to.

Snippets

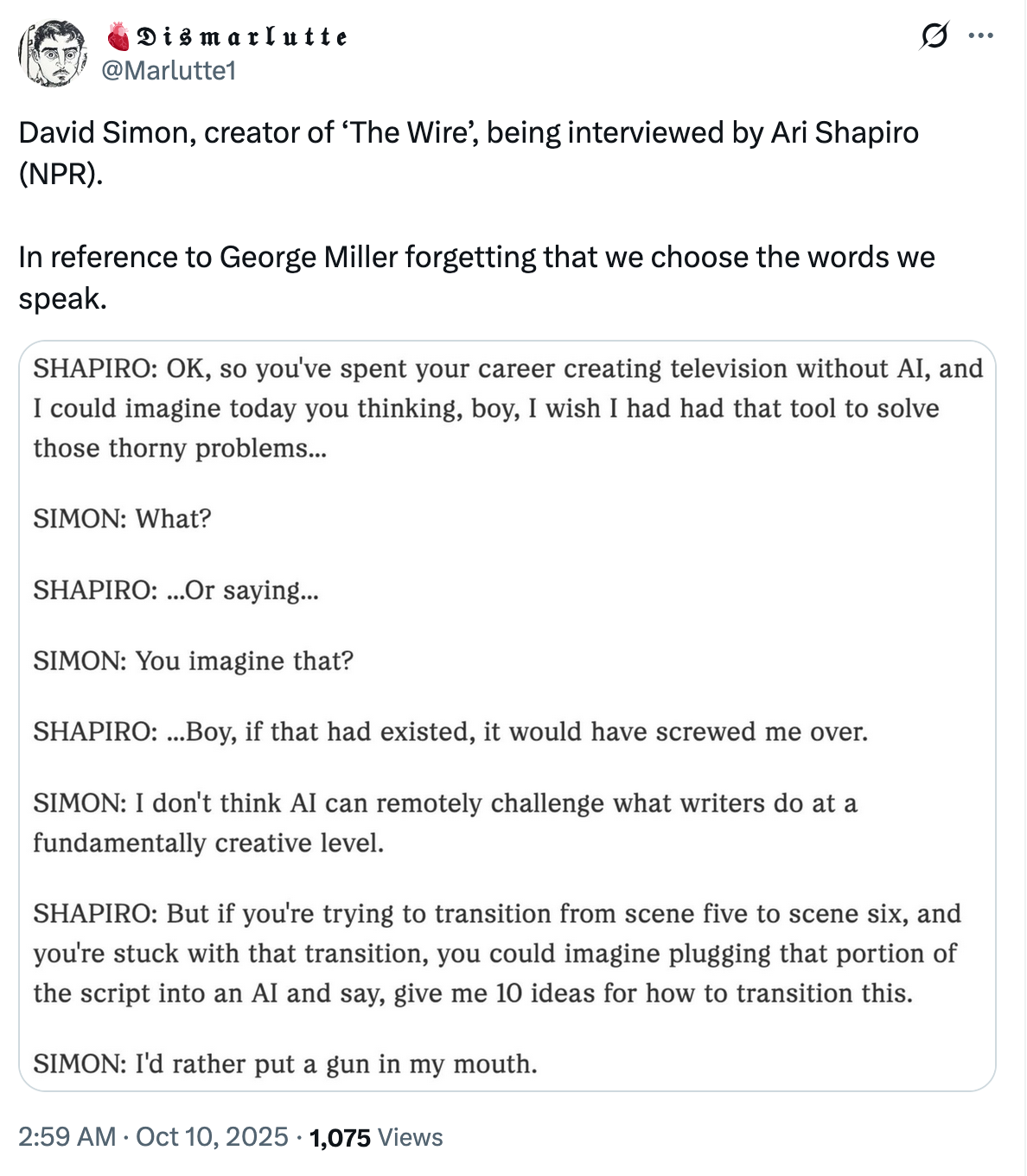

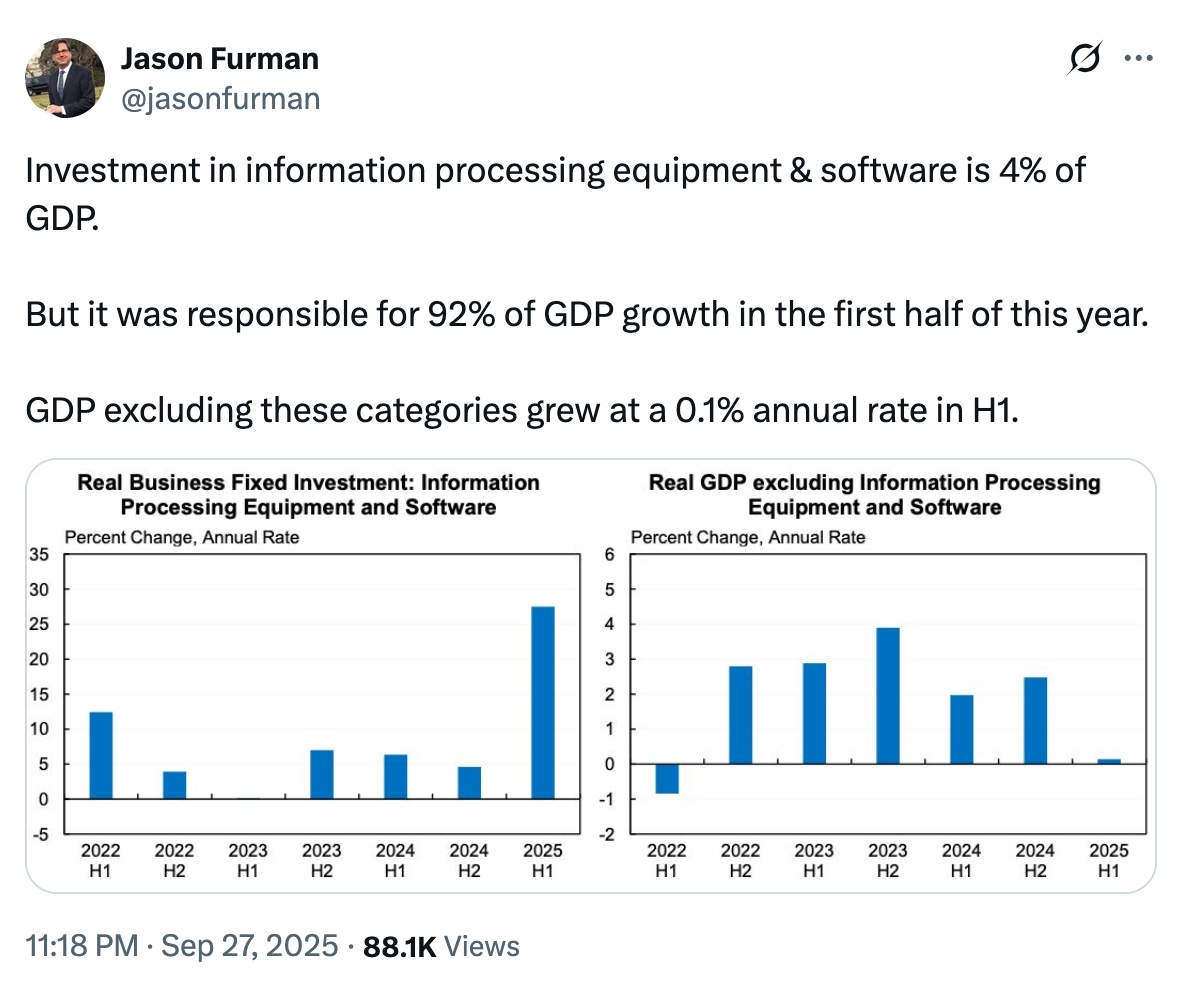

Here are a couple tweets about AI I stumbled upon that made me go “wow”.

The Zero Shot Podcast

In this week’s episode of Zero Shot, our new AI-focused podcast, Brady, Rohin, and I did something new—we each brought the most “interesting” AI development of the past week to the table and discussed it for 10–15 minutes each.

What did we talk about?

Brady → Why Claude’s Sonnet 4.5 is a consequential threat to Microsoft

Praveen → Vibe-coding has started cooling off. But who is *not* using it?

Rohin → Perplexity’s perplexing competitive strategy

If you’re looking for a fun, weekly podcast on the most interesting things happening with AI, this is the one. It’s free, so check it out if you haven’t already. You can listen to it here: