Author | Song Wanxin

Editor | Zhang Fan

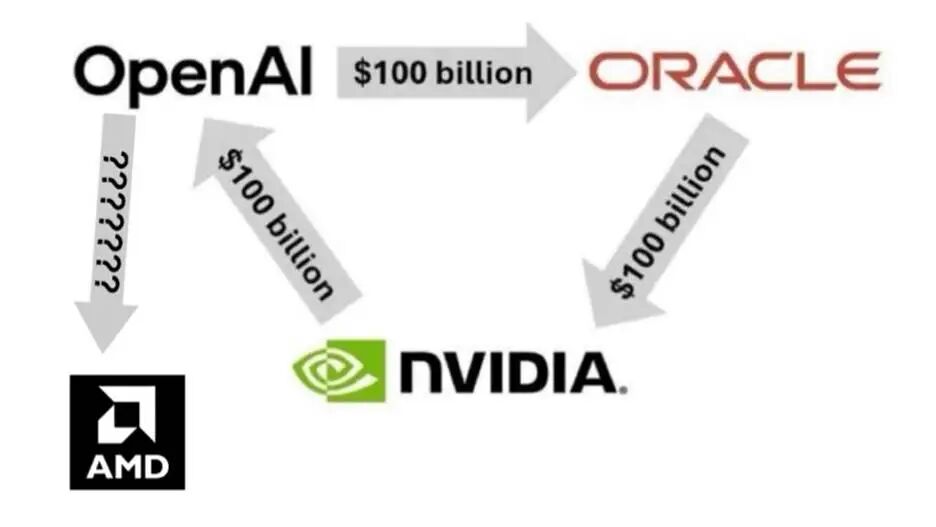

In the past two months, OpenAI has been actively engaged in capital operations. On one hand, it has locked in a large amount of computing power, elevating its valuation to $500 billion, making it the most valuable startup. On the other hand, leveraging its technological and application status, it has established a closely – knit internal circulation model in the upstream of the US AI circle.

Following its cooperation with Oracle worth $300 billion and NVIDIA worth $100 billion, on October 6th, OpenAI announced a partnership with AMD.

The announcement shows that the two parties have signed a multi – generation supply agreement for 6 gigawatts of AMD Instinct GPUs, which is one of the largest single AI chip procurement partnerships globally. Among them, the first batch of 1 gigawatt of computing power will use the AMD Instinct MI450 series of GPUs, and the deployment is planned to start in the second half of 2026.

What’s most important about this cooperation is still the particularity of its capital structure. As part of the agreement, AMD has granted OpenAI a warrant to subscribe for up to 160 million common shares of AMD, equivalent to 10% of AMD’s current total share capital.

However, for OpenAI to obtain these shares, it needs to meet some specified wagering requirements, and AMD will grant them in batches. The requirements include the progress of technology deployment, the future performance of AMD’s stock price, etc. Regarding the stock price, AMD has set a target of $600 for OpenAI, while its current stock price is $215.

Regarding such circular investment, there seem to be only two extreme interpretations. Either OpenAI is extremely confident in the future implementation of AI and has made a huge commitment to computing power costs in advance. Otherwise, it is the “artificial inflation of the US stock AI bubble” that the market is worried about – there is no cash flow yet, but the market value can multiply several times.

01 The AI Perpetual Motion Machine?

Currently, OpenAI is facing multiple pressures. Its deep – seated partnership with Microsoft has shown signs of strain. In the past year, OpenAI has repeatedly tried to negotiate with Microsoft to reduce costs and allow it to purchase computing resources from other companies, hoping to weaken Microsoft’s control over its AI products and computing resources.

However, without Microsoft, OpenAI’s investment in computing power has started the “equity – to – computing – power conversion” model, forming a perpetual motion machine for AI computing power.

Specifically, NVIDIA has made a strategic investment of up to $100 billion in OpenAI. In exchange for this investment, NVIDIA requires OpenAI to use only NVIDIA’s GPU chips in the next decade, consume NVIDIA’s GPU production capacity, and build a data center with a total capacity of 10GW.

More crucially, similar to AMD’s phased equity grants, NVIDIA’s investment will also be closely linked to the construction progress of OpenAI’s data center. NVIDIA’s investment will be fulfilled in phases through “option contracts” – for every 1GW of computing power (about 400,000 – 500,000 GPUs) deployed by OpenAI, NVIDIA will inject $10 billion accordingly until the 10GW target is completed.

For OpenAI, more computing power means a higher valuation, and a higher valuation can in turn exchange for more computing power, forming a positive feedback loop of “equity <-> computing power”. This design not only ensures a strong binding between the flow of funds and the implementation of computing power but also avoids the cash – flow risk of OpenAI’s current annual loss of $5 billion.

Now let’s look at Oracle. In June, OpenAI signed a procurement order for $300 billion in computing power services with Oracle for a term of about five years. According to the agreement, OpenAI will start paying Oracle about $60 billion annually from 2027.

To support this order, Oracle needs to purchase 4 – 5 million GPUs (worth about $100 billion) from NVIDIA. Thus, a capital circulation chain of “NVIDIA → OpenAI → Oracle → NVIDIA” has been formed.

The “AI Perpetual Motion Machine”

Data shows that Oracle’s “estimated cloud revenue for fiscal year 2026 is $18 billion”. After taking on OpenAI’s order, it is expected to soar to $144 billion in 2028, a growth rate of 700%, directly challenging the AI cloud hegemony of Microsoft Azure and AWS. Meanwhile, NVIDIA has secured a stable order, and OpenAI has obtained funds to purchase computing power.

Therefore, on the surface, OpenAI, NVIDIA, and Oracle have all invested hundreds of billions of dollars, but in fact, they have achieved capital leverage through the “discounting of future earnings” method.

For example, Oracle’s $300 – billion computing power order is essentially a long – term “pay – as – you – go” agreement, and its cost of purchasing GPUs from NVIDIA can be covered by future fees charged to OpenAI; NVIDIA’s $100 – billion investment is collateralized by OpenAI’s future computing power procurement orders.

Beyond the binding of interests, the three parties have also achieved a monopoly at the software ecosystem level.

NVIDIA’s CUDA system and TensorRT inference engine are deeply coupled with OpenAI’s large – model training framework, and the Oracle Cloud platform comes pre – installed with a complete NVIDIA AI software stack, ensuring that developers can use it “plug – and – play”. This technological lock – in means that if OpenAI switches to other training chips, it will have to bear a migration cost of up to hundreds of billions of dollars.

02 How to Digest a $500 – billion Valuation

Judging from the short – term market reaction, the “AI perpetual motion machine” has been well – received in the secondary market.

After announcing the cooperation with OpenAI, AMD’s stock price rose continuously by 43% within four trading days. On the day when NVIDIA’s cooperation with OpenAI was officially announced, its stock price also rose by more than 4%. Naturally, OpenAI’s valuation has also increased. The valuation of its for – profit department has soared from $260 billion at the beginning of the year to about $500 billion.

However, a market with only valuation but no cash flow will eventually return to rationality. An implicit assumption of the current computing – power perpetual motion machine is that the growth of computing power can boost future commercialization expectations and thus increase OpenAI’s valuation.

Financially, the latest data shows that OpenAI’s revenue in the first half of 2025 was $4.3 billion, and its net loss has rapidly expanded from $3.1 billion in the same period last year to $13.5 billion. It is estimated that the total cost of various agreements signed this year has reached up to $1 trillion, and Jensen Huang estimates that each gigawatt of AI data center will cost $50 – 60 billion.

On the cost side, in addition to the R & D cost of $6.7 billion, which accounts for the largest proportion, it is worth noting that in the first half of this year, OpenAI’s sales and marketing expenses have increased significantly to $2 billion, almost twice that of last year. It can be seen that after entering the competition at the implementation level, the company’s marketing costs have risen sharply.

Operationally, although the overall number of OpenAI users is on the rise, the cash flow generated still cannot keep up with the rate of burning money.

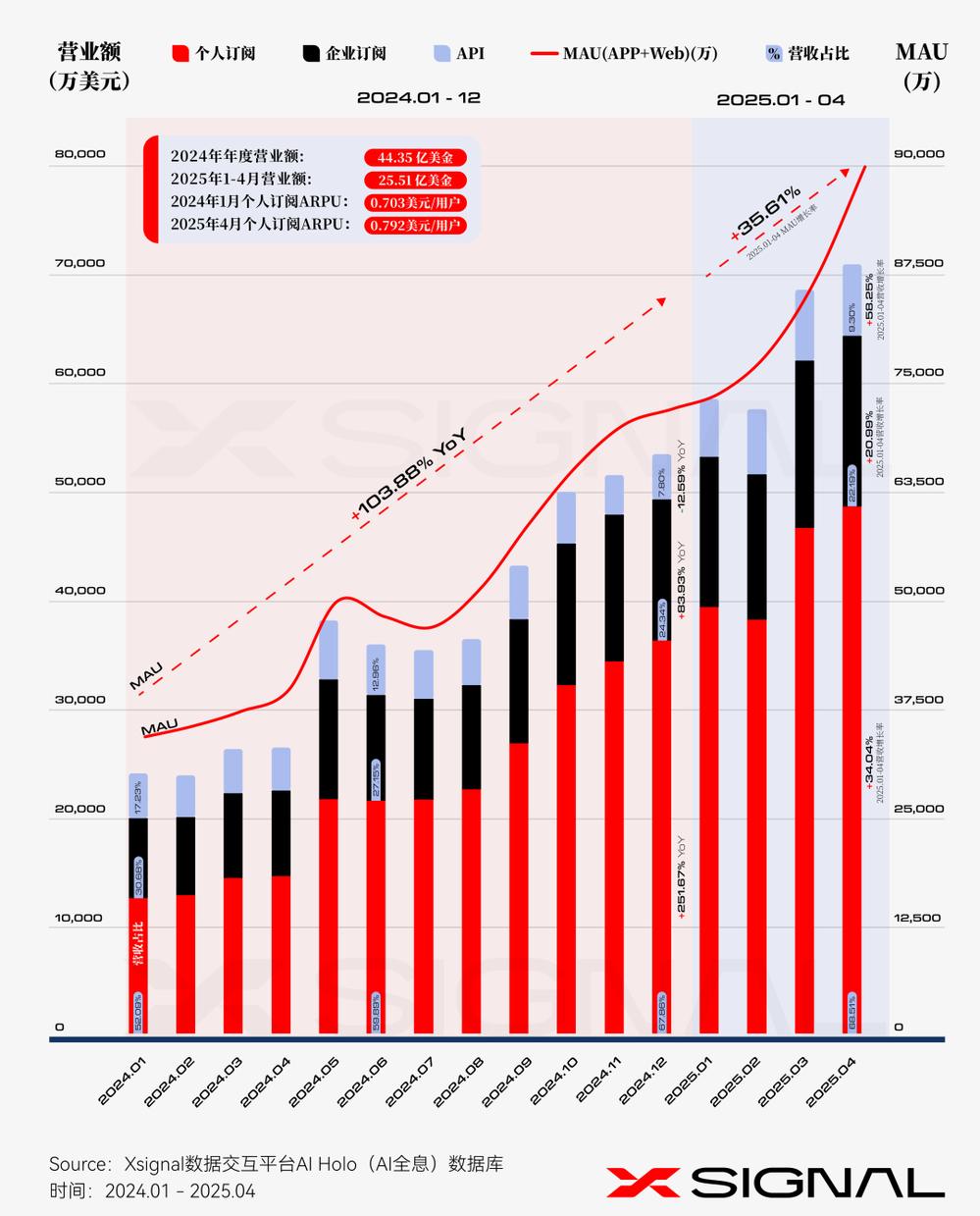

Changes in ChatGPT’s MAU and revenue from various segments

Looking back at the growth of ChatGPT’s user volume, data from the Xsignal AI Holo (AI Holographic) database shows that from its launch in November 2022 to December 2023, ChatGPT’s MAU exceeded 200 million. In 2024, the MAU continued to surge from 320 million to 650 million, with an annual growth rate of up to 103.88%. In the first quarter of this year, ChatGPT achieved a significant growth of 35.61%, and the MAU was close to 900 million.

In terms of monetization, OpenAI’s revenue mainly comes from three channels: individual subscriptions, enterprise subscriptions, and API services.

In terms of business, the individual subscription business has become OpenAI’s main source of revenue. In January last year, this segment accounted for 52%, and in April this year, it has risen to 68.5%. The ARPU has also increased from $0.703 per user in January last year to $0.792 per user.

However, it is worth noting that in December last year, the year – on – year growth of the individual subscription business reached 251.7%, far exceeding the 103.9% growth rate of MAU in the same period. In the first quarter of this year, the year – on – year growth rate of the individual subscription business dropped to about 35%, the same level as MAU, indicating that the penetration rate of OpenAI’s paying users is slowing down and may have passed the high – growth period.

With the growth of individual subscriptions, the proportion of enterprise subscriptions has dropped to 21%. This is due to the rapid growth of API and model – licensing businesses.

OpenAI’s API business experienced a trough last year. According to data from the Xsignal AI Holo database, the annual revenue scale of OpenAI’s API business last year was only $42 million, but it rebounded in the first quarter of this year, with API revenue increasing by 58.3% year – on – year, and the total revenue rising to $66 million, accounting for 9.3% of the company’s overall revenue.

Although the API accounts for a small share of the overall revenue, in the long run, the API business can allow AI capabilities to penetrate into long – tail scenarios that OpenAI can hardly cover at present by opening up model capabilities. Compared with C – end business, the API is an important anchor for building an ecosystem and revenue resilience.

OpenAI’s commercialization anxiety is palpable. Can the AI perpetual motion machine really keep running?

*Disclaimer:

The content of this article only represents the author’s views.

The market is risky, and investment should be made with caution. Under no circumstances do the information in this article or the opinions expressed constitute investment advice to anyone. Before making an investment decision, if necessary, investors must consult professionals and make decisions carefully. We have no intention of providing underwriting services or any services that require specific qualifications or licenses to engage in for the trading parties.

Follow for more information