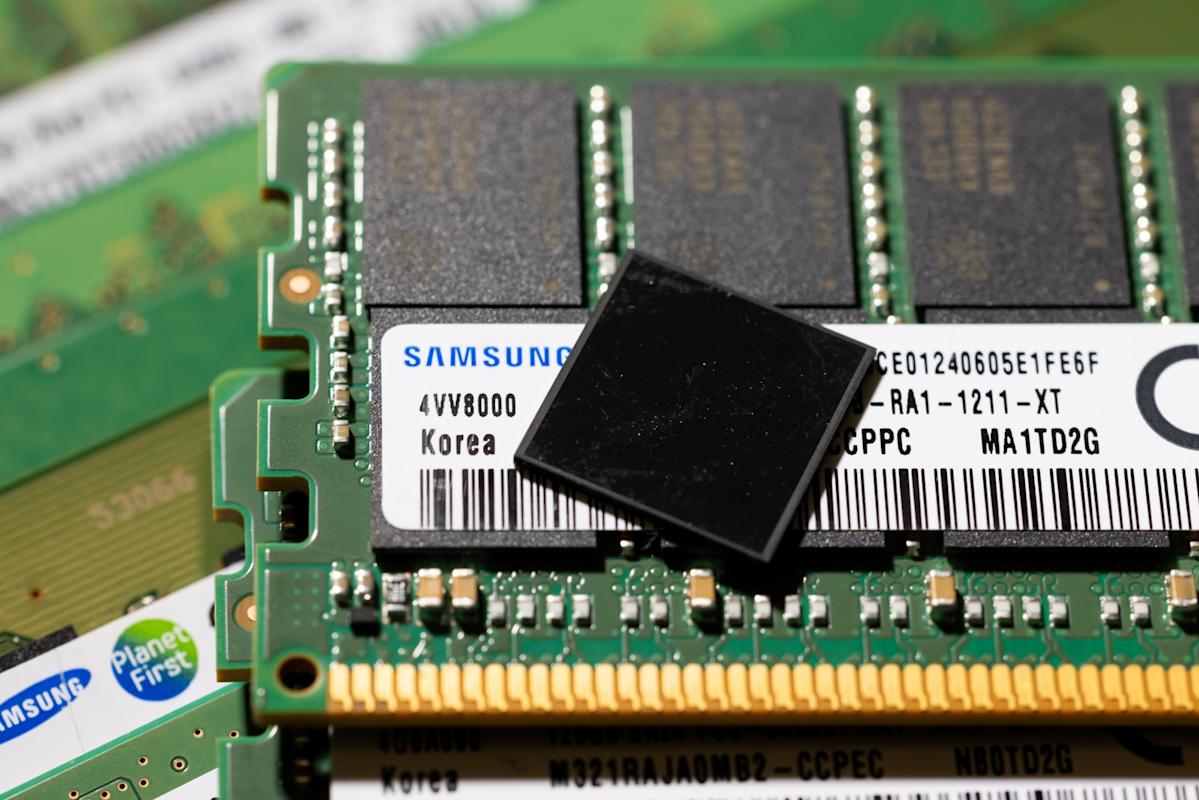

Samsung’s 12-layer HBM3E chip, top, and other DDR modules.

(Bloomberg) — Samsung Electronics Co. reported its biggest quarterly profit in more than three years in a sign of healthy AI chip demand, though investors hoping for outsized numbers cashed in some of the company’s recent stock market gains.

Most Read from Bloomberg

Its shares slid as much as 2.1% in Seoul, reversing strong early advances. That’s after Samsung reported a better-than-projected 32% rise in operating income to 12.1 trillion won ($8.5 billion) for the September quarter, while revenue rose about 9%.

The tepid market reaction reflects in part lofty expectations for the global leader in memory, a fundamental component of Nvidia Corp. accelerators and data centers. South Korea’s largest company has gained more than 60% of market value since June, buoyed by signs of recovery in its pivotal semiconductor division.

Samsung’s recent run-up underscores confidence in the durability of demand for AI servers and chips as tech firms scramble to build and amass computing power. It suggests investors are betting on the company’s chances of regaining ground in the high-bandwidth memory segment lost to SK Hynix Inc. following years of setbacks.

“Traders who were long into the print are just locking in gains,” said Haris Khurshid, chief investment officer at Karobaar Capital LP. “Some rotation is also happening across semis after the HBM hype trade ran hot. Structurally, nothing’s changed.”

Samsung Reverses Gain After Best Profit In 3 Years: Street Wrap

The Samsung booth at the IFA Consumer Electronics and Home Appliances trade fair in Berlin last month.Photographer: Krisztian Bocsi/Bloomberg

The company will provide a full financial statement with net income and divisional breakdowns on Oct. 30.

Like much of the tech sector, Samsung seeks to ride an anticipated AI boom in coming years. It’s made progress with its latest HBM chips, securing an order from Advanced Micro Devices Inc. while awaiting final approval on HBM3E chips from Nvidia.

“Samsung’s operating profit was much bigger than anyone was expecting,” said Sanjeev Rana, head of research at CLSA Securities Korea. “Its high-bandwidth memory shipments have recovered, rising 70% to 80% from the previous quarter, and there is a possibility that the size of the writedowns in the foundry business was much smaller than expected.”

This month, Samsung and SK Hynix both struck agreements to supply chips to OpenAI’s Stargate project. Their projection for demand represented more than twice the current global capacity of HBM, underscoring Stargate’s enormity and quickening global AI development.

That, together with rising memory chip prices, has prompted dozens of analysts to lift their price targets for Samsung recently.

Related Story: Samsung Electronics Shares Hit Record High on AI, Chip Optimism

Samsung may have reclaimed its spot as the top memory maker in terms of revenue after AI-related investments bolstered prices and sales volumes of general-purpose DRAM and NAND, said MS Hwang, research director at Counterpoint.

But the volume impact of its HBM3E shipments to Nvidia remains limited, he cautioned. “To regain its previous market leadership, Samsung needs to carry this momentum into its next-generation product, HBM4,” he said.

Samsung’s advances come after a series of development missteps allowed SK Hynix to take a huge lead in the high-margin AI arena.

Samsung said during its most recent earnings call in July that it expects “meaningful expansion” in high-end memory products for servers in the second half of the year. Earnings should improve steadily as the year progresses, Chief Financial Officer Park Sooncheol said at the time.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.