(Bloomberg) — Beneath the surface of the short-term ups and downs of financial markets, a longer-term repricing of multiple assets may be underway as investors seek to protect themselves from the threats posed by runaway budget deficits.

While a fresh round of tariff threats between the US and China stole the headlines Friday and sent traders scurrying from riskier assets and into bonds, money managers have been increasingly discussing a phenomenon known as the “debasement trade.”

Most Read from Bloomberg

Those who believe in it are pulling away from sovereign debt and the currencies they are denominated in, fearful their value will be eroded over time as governments avoid tackling their massive debt burdens and even seek to add to them.

Further fuel is coming from speculation that central banks will face increasing political pressure to hold down interest rates to offset what governments owe — and in the process fan inflation by continuing to crank out cash.

Just last week, Japan’s yen and its bonds were hit by waves of selling as stimulus-friendly Sanae Takaichi took a step toward becoming prime minister. Another round of political turmoil in France over its finances jolted the euro, and a looming budget in the UK is unnerving a gilt market still scarred by the 2022 selloff that swept Prime Minister Liz Truss from power.

While the dollar (DX=F) has risen in recent weeks despite the US government shutdown, it’s still weaker over the course of this year after President Donald Trump’s trade war and tax-cut plans earlier sent it into the deepest tailspin since the early 1970s. His America First break with the global order and assault on the Federal Reserve’s independence have also sown doubts about whether Treasuries will continue to fully enjoy their status as the world’s main risk-free asset — underpinning long-term bond yields.

On the other side of the debasement trade, precious metals are benefiting from their traditional haven status and cryptocurrencies are rallying again, this time due to their purported function as a refuge from the impacts of government policy. Gold is up over 50% this year and recently surpassed a record $4,000 per ounce, while silver surged to an all-time high.

And while cryptocurrencies posted steep drops after Trump’s latest tariff threats spooked sentiment, Bitcoin is still up more than 20% this year and hit an all-time high.

Explainer: Why Wall Street Is Fixated By the ‘Debasement Trade’

Stephen Miller says he’s never seen as big a shift away from currencies and Treasuries into alternatives during his four decades of working in markets. The former head of fixed-income at BlackRock Inc. in Australia reckons it may just be the start.

“The debasement trade still has some way to run,” said Miller, who is now a consultant at GSFM, a unit of Canada’s CI Financial Corp. “US Treasuries just aren’t the unimpeachable safe harbor asset that they once may have appeared and it’s a phenomenon repeated across other bond markets.”

Billionaires Ray Dalio and Ken Griffin have captured headlines by suggesting that gold may be safer than the dollar. The head of the Canada Pension Plan Investment Board thinks US Treasuries are also at risk of losing their haven status. And the author and hedge-fund advisor Nassim Taleb says the ballooning US deficit is sowing the seeds of a debt crisis it appears virtually impossible to avoid.

“The world is seeing a deterioration not just in the inflation-adjusted value of their currencies amid slowing activity, but also a deterioration in the stability of government,” said Calvin Yeoh, who helps run the Merlion Fund at Blue Edge Advisors in Singapore and has been buying gold.

The term debasement dates back to when rulers such as King Henry VIII and Nero diluted or debased their gold and silver coins with cheaper metals such as copper.

There are plenty of doubts that the world is seeing a modern-day version, especially since there are multiple factors behind the surge in gold and Bitcoin. Moreover, premature warnings of an imminent debt crisis have been issued off and on ever since the Global Financial Crisis.

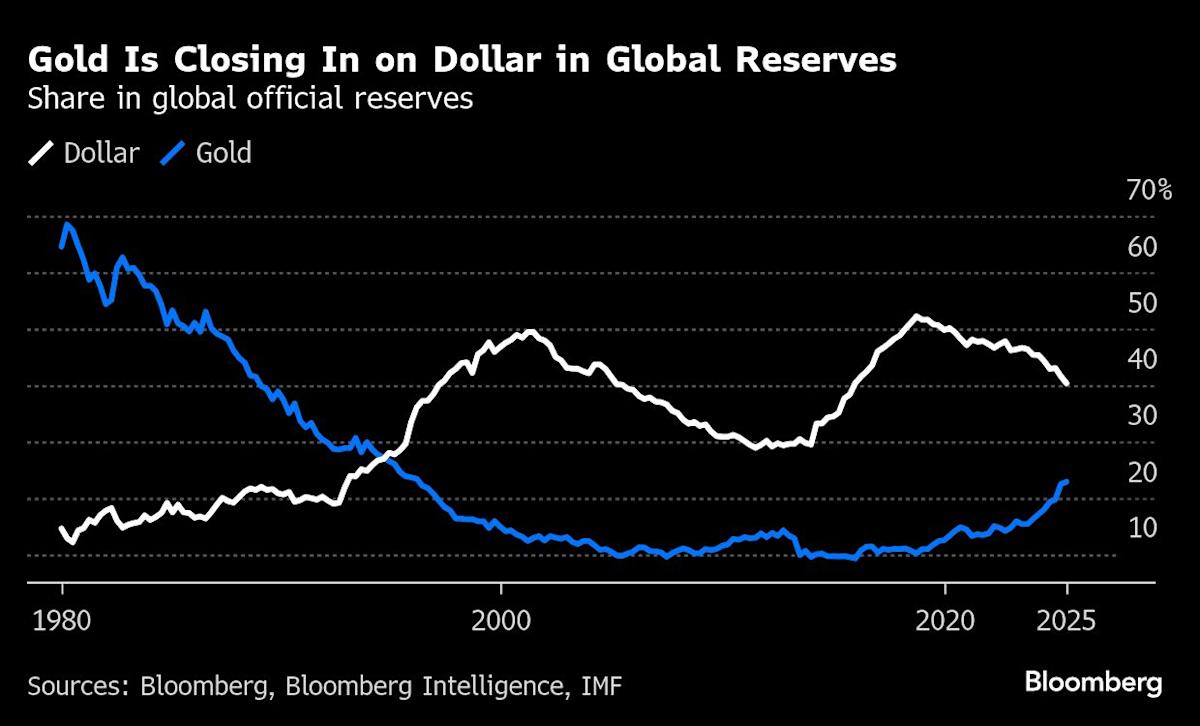

The freezing of Russian assets after its invasion of Ukraine highlighted the vulnerability of foreign currency holdings to external sanctions, increasing the allure of the yellow metal. Central banks have also been increasing their gold stockpiles to diversify their reserves.

And the crypto world is no stranger to purely momentum-driven booms and busts: The argument that Bitcoin functions as a harbor was undercut when it tumbled during the post-pandemic inflation surge along with other speculative assets and again in recent days as it swooned after increased trade tensions.

For all their recent wobbles, the greenback, euro and yen still dominate trade to banking systems and remain the anchor for trillions of dollars in daily transactions. Government debt also underpins collateral frameworks and the plumbing of the world’s financial system.

The surging US stock market also challenges the view, given foreigners will need dollars to trade, and despite Trump’s destabilizing shifts overseas investors have continued to increase their holdings of US Treasuries.

“Whoever thinks currencies and bonds are replaceable with bitcoin and gold needs a reality check,” said Shoki Omori, Tokyo-based chief desk strategist at Mizuho Securities Co., one of Japan’s biggest brokerages.

Omori thinks markets are just witnessing a “momentum trade,” in which more and more investors pile into a seemingly winning trade regardless of fundamentals.

What Bloomberg Strategists are saying…

“Debasement seemed a pretty rational way to describe the extraordinary market moves of recent months. But now that we’ve got a nice moniker for the trading regime we have been in, it’s perhaps a sign that everyone is skewed too much one way and we’re due some volatility and a shake-out.”

— Mark Cudmore, Executive Editor for Markets Live

But there are also solid reasons why investors are having the debate over debasement, even if it ultimately proves an academic one that doesn’t upend the market status quo.

Strategists at Eurizon SLJ Capital Ltd. reckon governments have become “addicted to deficit spending” thanks to the flood of cheap money witnessed in the financial crisis and pandemic as central banks slashed interest rates and hoovered up bonds.

“If the reserve managers continue to divest from not just the dollar but all fiat monies, gold could continue to march higher,” the Eurizon strategists wrote last week. “If central banks’ gold holdings match those of dollars, all else being equal, gold could reach $8,500. Why not?”

At Andromeda Capital Management, Alberto Gallo says as debts rise and populations age, the “process of monetary debasement” will accelerate as it’s easier for politicians to embrace that than ignite growth or impose austerity. He sees central banks risk being roped into the effort.

“Policymakers are toying with ideas of monetary reform, be it gold reserve revaluation, bank deregulation or changing central bank targets,” Gallo said in a report. “The end results are likely entrenched inflation, further fiat currency depreciation, higher long-end rates and positive risk-free risky-asset correlations.”

In the US alone, where the Fed has kept rates elevated to cool inflation by restraining growth, Trump moved fiscal policy in the opposite way with tax-cuts that are projected to add to the already nearly $2 trillion deficit. Debt could be almost double the size of gross domestic product by 2050, the Government Accountability Office warned in February.

Trump and his administration have also campaigned for the Fed to slash rates, in part because officials argue doing so would lower the cost of debt, and are testing the limits of the bank’s independence by trying to oust Governor Lisa Cook. The shifting trade war, the US government shutdown and the president’s use of the Justice Department to target his domestic foes have underscored worries about political dysfunction and unpredictability.

In France, investor angst rose again after Prime Minister Sebastien Lecornu became the country’s fifth prime minister to resign in two years amid stalemate over the budget. Last week ended with him being reappointed.

As for Japan, Takaichi’s potential elevation to the premiership comes as the collapse of the decades-old ruling coalition increases doubt about the outlook. The pro-stimulus lawmaker’s victory in her party’s recent leadership election raises the prospect of slower rate hikes at a time inflation remains well above the central bank’s target.

Against such a backdrop, some still see room for the debasement trade to extend.

“This is how much the world has changed and it could be a sign that digital assets are becoming a more trusted source of value in the current environment,” said Kathleen Brooks, research director at XTB Ltd. in London. “We do not see this coming to an end any time soon.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.