The Morning Dump today will again be about vehicle affordability, specifically focusing on new data from Edmunds that shows Americans are so underwater on their trade-ins that even James Cameron couldn’t find them.

This is showing up in the failure of subprime lenders, starting with Tricolor Holdings. Did that company crash because of fraud, or was fraud a necessary condition of serving the subprime market?

![]()

![]()

That’s bleak, so perhaps something a little more positive to round it out? If you wanted a Subaru Outback, but not from Subaru, then Mitsubishi might have the car for you. And if you wanted a GM-built EV in August, but you didn’t want a GM-branded one, you probably got a Honda Prologue.

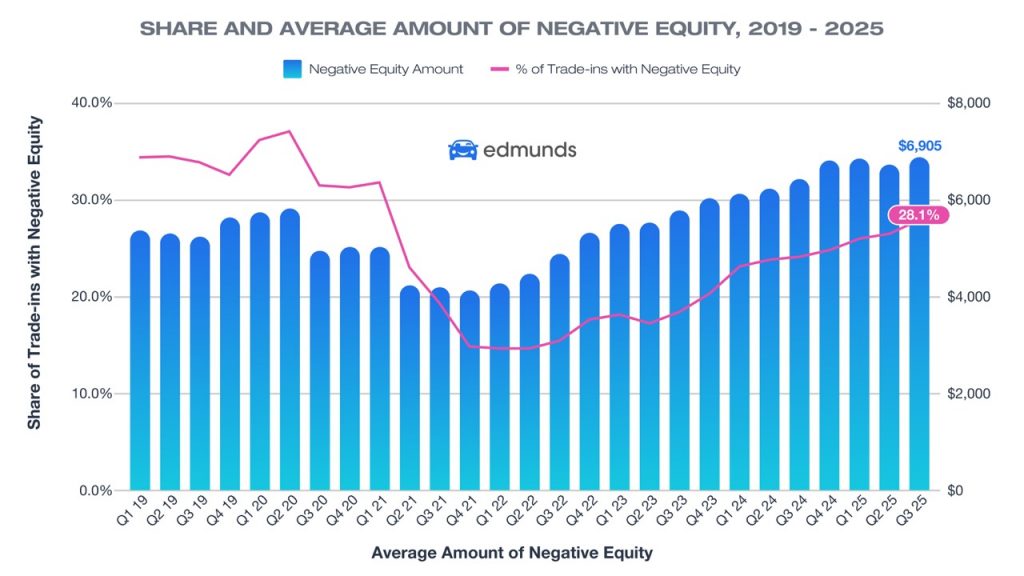

1-in-4 Trade-Ins Carried Negative Equity Of More Than $10,000 In Debt

If yesterday was about how wealthy buyers and electric cars skewed the average transaction price, today’s theme is that underwater buyers at the other end of the spectrum are drowning.

The numbers come via Edmunds, which titles its latest data report “Underwater and Sinking Deeper.” This seems accurate, as Q3 data shows that people trading in cars are extremely upside down on their loans.

About 28.1% of cars traded in last quarter were upside down, with an average amount of $6,905. That’s just the average. About a quarter owed more than $10,000 on their vehicles.

What’s happening? Some of this is the fact that the average trade-in is 3.7 years old, meaning these are the pandemic-era loans I was warning about back in 2023. This is the reaping/sowing moment for those unfortunate buyers. It’s also a sign that people are making even bigger mistakes by trying to buy another car too soon.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt.”

Americans do not love the idea of downsizing, and it may not always be a reasonable choice for everyone, but it’s probably necessary for many consumers.

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” said Joseph Yoon, Edmunds’ consumer insights analyst. “If you can, wait until you’ve paid down more of your balance before trading in. But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs. The right vehicle choice can prevent a short-term decision from becoming a long-term setback.”

You can imagine a scenario wherein a consumer took out a loan on a vehicle in 2022 for a car that was overpriced. For whatever reason, this consumer now trades in and rolls that debt into a new car, which is now even more underwater. That works so long as people keep staying employed and don’t take any other hits like, say, an increase in healthcare costs due to the expiration of ACA credits.

Of course, if this were happening, there would be warning signs like the failure of subprime lenders.

‘When You See One Cockroach, There Are Probably More’ – Jamie Dimon

Photo: Chase

Photo: Chase

JPMorgan & Chase, the New York-based megabank, had to take a $170 million charge-off on the third quarter related to its exposure to Tricolor Holdings, a subprime auto lender.

According to Bloomberg, the quote above comes from JPMorgan boss Jamie Dimon, who added that “Everyone should be forewarned on this one.”

What does that mean? It sounds ominous.

A little background is required here, as Tricolor had both a very specific client profile as well as allegations of shenanigans. The company is said to have focused on people with low or no credit, including undocumented immigrants. That seems like a questionable area to be loaning to right now, given the shakiness of the job market.

There’s probably more to this than merely loaning to people at the lower end of the market. From another Bloomberg report:

Bankrupt subprime auto lender Tricolor Holdings appears to have been a “pervasive fraud” of “extraordinary proportion,” a lawyer helping oversee its liquidation said in court Friday, underscoring the scale of the company’s alleged misconduct even as investigators continue to unravel its finances.

Initial reports “indicate potentially systemic levels of fraud,” according to a presentation made in court by Charles R. Gibbs, who is representing the court-appointed trustee.

While Gibbs didn’t elaborate on the nature of the fraud, a preliminary examination of Tricolor’s records shows that at least 29,000 loans pledged to creditors were tied to vehicles already securing other debts, Bloomberg reported earlier Friday.

This kind of fraud shouldn’t be that easy to pull off, right? Also, what was the exit strategy here? It sounds like it’s being alleged that the company borrowed money multiple times from creditors for the same vehicle.

The subprime market is already a powder keg, so why not toss a few matches in and just see what happens…

There’s Gonna Be A Mitsubishi Outback-Like Thing

Mitsubishi makes reasonably nice cars at a reasonably nice price for, presumably, reasonably nice people. The brand recently added a Trail Edition trim to the Outlander, which Thomas had some opinions about.

Essentially, it’s a decent deal; it just made some of the best features optional. Perhaps the company is going to fix that? From a press release:

MMNA recently debuted a Trail Edition package on Outlander, and this new model will build upon the graphic features on that vehicle by adding off-road-specific bodywork, off-road-focused drive modes and performance upgrades, and unique interior styling with specific materials. This vehicle will take the company’s legendary Super-All Wheel Control (S-AWC) all-wheel drive system3, honed from Mitsubishi Motors’ 12 wins on the legendary Dakar Rally and on the muddy tracks of the World Rally Championship, to the next level, allowing families to explore further beyond where the pavement ends.

More details, including naming, imagery, technical specifications, pricing and on-sale timing will be the subject of future announcements.

So, it’s another Outlander, just more Outback-y maybe?

Honda Really Needs A Cheap EV Here

Photo: Thomas Hundal

Photo: Thomas Hundal

The tax credit-fueled boom of Q3 had a fun outcome: according to registration data put together by S&P Global Mobility and shared with Automotive News, the third best-selling EV in August was a Honda:

The Honda Prologue was among August’s biggest winners as registrations jumped 81 percent to 9,005 vehicles. The Prologue was the No. 3 most-popular EV for the month after the Tesla Model Y crossover and Model 3 sedan, S&P Global Mobility said.

Registration data serve as a proxy for sales because some EV makers don’t separate U.S. results or report sales by model. Many automakers also don’t report sales monthly.

The Prologue came with incentives of $12,704 per vehicle in August, compared with $5,813 a year earlier, Motor Intelligence said. In contrast, Honda’s gasoline-powered CR-V crossover had $2,016 in August incentives, the data provider said.

Obviously, the Prologue is a GM Ultium vehicle underneath. This goes to show that there are plenty of Honda buyers out there for a Honda EV crossover at the right price (which is much lower than the MSRP). Or is this a sign that people would buy an Equinox EV if it had CarPlay?

What I’m Listening To While Writing TMD

The sad news yesterday was that legendary soul and R&B singer D’Angelo passed away due to complications from pancreatic cancer. I was tempted to do “Untitled (How Does It Feel)” this morning, but I love his cover of Smokey Robinson’s “Cruisin.’” RIP.

The Big Question

What happens next?

Top photo: Edmunds, Dodge