U.S. Propane Market Size

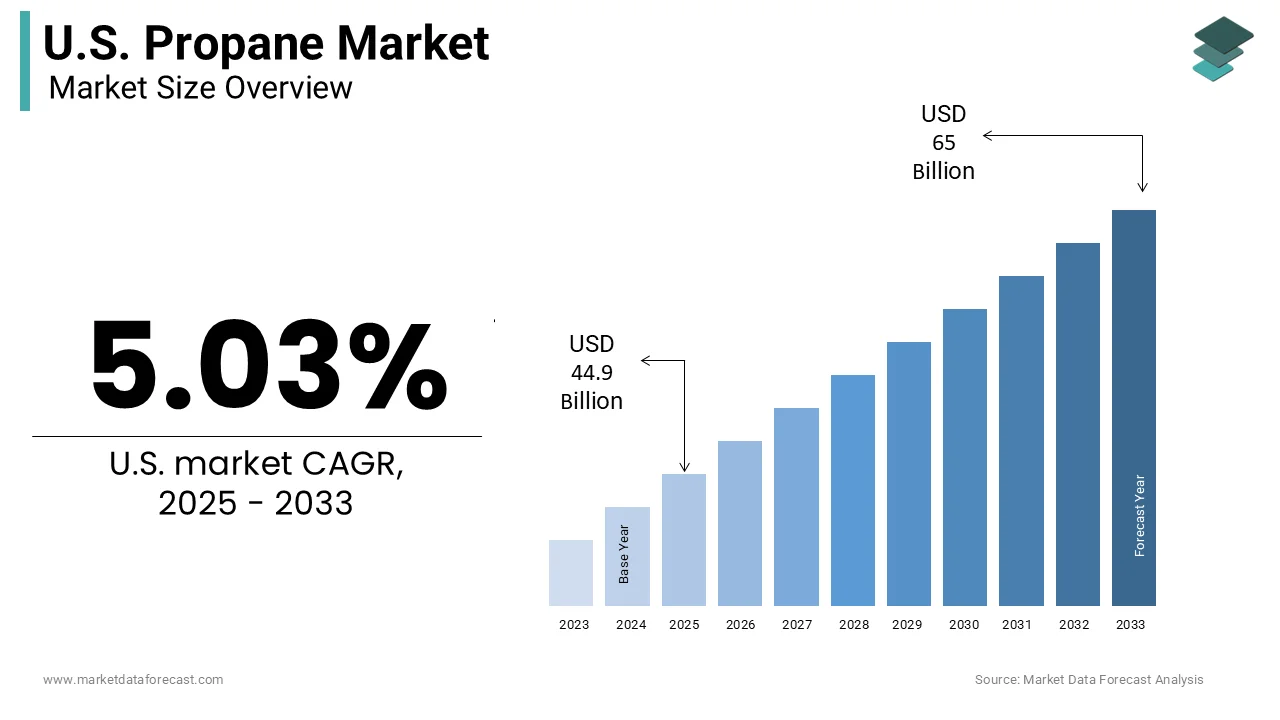

The U.S. propane market was valued at USD 42.7 billion in 2024, is estimated to reach USD 44.9 billion in 2025, and is projected to reach USD 65 billion by 2033, growing at a CAGR of 5.03% from 2025 to 2033.

The propane is a fuel sector that is a decentralized energy architecture embedded in the nation’s rural and suburban fabric, sustaining homes, farms, and industrial processes where pipelines do not reach. Its liquid state under modest pressure enables storage in portable tanks, granting it unique resilience during grid disruptions.

MARKET DRIVERS Rural Electrification Gaps and Grid Resilience Demands

The electric grid is brittle or absent in non-metro America, where climate volatility has exposed vulnerabilities in centralized power systems is gearing up the growth of the U.S. propane market. As per the Department of Agriculture’s Rural Development report, nearly 18% of U.S. rural households lack access to reliable natural gas lines, making propane the default for heating and cooking. In 2023, over 520,000 homes in the Great Plains and Appalachia experienced prolonged outages due to ice storms and wind events, prompting emergency procurement of propane-powered generators and space heaters through FEMA’s Disaster Recovery Program.

Agricultural Demand for Crop Drying and Livestock Operations

The growing agricultural and livestock operations in the United States are additionally driving up the growth of the U.S. propane market. The propane is the invisible backbone of American food production, which is powering more than 90% of corn and soybean dryers in the Midwest, as documented by the USDA’s Agricultural Marketing Service. In 2023 alone, U.S. farmers consumed 1.1 billion gallons of propane for crop drying, which is a volume equivalent to 1.5 million household heating needs for an entire winter.

MARKET RESTRAINTS Seasonal Price Volatility Driven by Weather-Linked Demand Spikes

The seasonal price volatility driven by the weather-linked demand spikes is restraining the growth of the U.S. propane market. These spikes occur because propane storage capacity lags behind peak consumption; only 18% of annual consumption can be held in above-ground tanks nationwide, as per the Propane Education & Research Council. In 2023, over 120,000 low-income households in Ohio and Pennsylvania received emergency propane assistance from the Low-Income Home Energy Assistance Program, up 28% from 2021.

Regulatory Scrutiny Over Tank Safety and Underground Storage Standards

The mounting regulatory pressure tied to aging infrastructure and public safety concerns is eventually degrading the growth of the U.S. propane market. In response, states like New York and California have enacted mandatory inspection regimes requiring recertification of aboveground storage tanks every five years, increasing compliance costs for small distributors by up to $1,200 annually per tank. The National Fire Protection Association’s revised Code 58, updated in 2023, mandates electronic leak detection systems for all new installations, which is a technology still unavailable to 60% of rural providers due to cost and connectivity barriers.

MARKET OPPORTUNITIES Propane as a Transition Fuel in Decarbonizing Fleets and Industrial Processes

The propane autogas is emerging as the most viable low-emission alternative for medium-duty fleets operating in off-grid environments, which is swiftly creating new opportunities for the growth of the U.S. propane market. The Environmental Protection Agency’s 2023 Clean School Bus Program awarded $1.2 billion to replace 5,000 diesel buses with propane models, which is citing reduced particulate matter and lower maintenance costs. Propane’s existing infrastructure, ease of storage, and compatibility with combustion technologies make it the only fossil fuel capable of bridging immediate decarbonization gaps in sectors resistant to electrification.

Integration with Renewable Propane and Bio-Based Feedstocks

The renewable propane derived from biomass and waste oils through hydrotreated vegetable oil (HVO) pathways will additionally fuel the growth of the U.S. propane market in the coming years. As per the Propane Education & Research Council, renewable propane production reached 120 million gallons annually in 2023, with two major U.S. facilities in Louisiana and Texas now blending it into conventional supply chains. Companies like World Energy and Neste have partnered with U.S. refiners to produce renewable propane at scale, achieving a 70% reduction in lifecycle carbon intensity compared to fossil propane.

MARKET CHALLENGES Distribution Network Fragmentation and Last-Mile Delivery Constraints

The system operates through a patchwork of over 2,500 independent distributors, many serving isolated communities with single-tank delivery routes is challenging the growth of the U.S. propane market. According to the National Propane Gas Association, the average distance traveled per delivery in rural Montana and eastern Kentucky exceeds 120 miles round-trip, consuming 37% of operational revenue in fuel and labor. Emergency responses to outages are hampered by outdated communication protocols, where many rural providers still rely on landline calls rather than digital dispatch platforms.

Competition from Electrified Alternatives in Residential Heating and Cooking

The off-grid households, where rapid advances in heat pump efficiency and federal subsidies are eroding their foothold in suburban areas, are challenging the growth of the U.S. propane market. As per the Department of Energy’s 2023 Home Energy Efficiency Report, 44% of new homebuilders in the Northeast and Pacific Northwest now install cold-climate heat pumps as standard, incentivized by tax credits under the Inflation Reduction Act that cover up to $8,000 per unit.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Grade, End-Use, and Region.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

New York, Massachusetts, Pennsylvania, Illinois, Ohio, Michigan, Texas, Florida, Georgia, California, Washington, Colorado.

Market Leaders Profiled

AmeriGas Propane (UGI Corporation), Ferrellgas Partners L.P., Suburban Propane Partners L.P., Superior Plus Propane, Chevron Corporation, Valero Energy Corporation, Enterprise Products Partners L.P., MPLX LP, Targa Resources Corp., CHS Inc., GROWMARK Inc., CenterPoint Energy, NGL Energy Partners LP

SEGMENTAL ANALYSIS By Grade Insights

The HD-5 segment was expected to hold a dominant share of the U.S. propane market in 2024, with its stringent specification standards that limit propylene to strict control of sulfur and moisture, which makes it the only grade approved for use in residential appliances, vehicles, and sensitive industrial equipment. The National Fire Protection Association mandates HD-5 for all propane-fueled home heating systems, water heaters, and cooking stoves, ensuring safety and combustion efficiency. Furthermore, the entire fleet of over 240,000 propane-powered vehicles, including school buses and delivery vans, must adhere to HD-5 purity thresholds to meet EPA emissions certifications.

The commercial-grade segment is likely to grow with an anticipated CAGR of 5.8% throughout the forecast period, with the rapid expansion of outdoor hospitality infrastructure and portable power applications in sectors previously reliant on diesel or grid electricity. Simultaneously, event venues, construction sites, and emergency response units increasingly deploy propane-powered generators due to their quiet operation and low particulate emissions compared to diesel alternatives.

By End-Use Insights

The residential segment was the largest by occupying 54.3% of U.Sthe . propane market share in 2024. In states like Maine, West Virginia, and Oklahoma, propane furnaces are installed in more than 70% of new single-family homes built since 2020, per the National Association of Home Builders. Federal programs such as the Low-Income Home Energy Assistance Program allocate $1.1 billion annually to subsidize propane purchases for vulnerable households, reinforcing its role as an essential utility rather than a luxury.

The industrial segment is likely to grow with a CAGR of 7.2% during the forecast period, with the electrification of manufacturing processes and the rise of clean-burning process heat solutions. Industries such as food processing, ceramics, and metal fabrication are replacing coal and heavy fuel oil with high-efficiency propane burners to comply with tightening EPA air quality standards. Meanwhile, the semiconductor industry employs propane in wafer cleaning and annealing processes due to its precise thermal control and lack of residual contaminants.

COUNTRY LEVEL ANALYSIS Texas Propane Market Analysis

Texas was the largest contributor in the United States propane market by occupying 19.2% of share in 2024. The state hosts over 40% of the nation’s petrochemical crackers, which consume vast quantities of propane as feedstock for ethylene production, with a process that requires ultra-pure HD-5. The 2021 winter storm crisis exposed vulnerabilities in centralized power, prompting statewide mandates for propane-backed emergency generation in hospitals and nursing homes.

COMPETITIVE LANDSCAPE KEY MARKET PLAYERS

Some of the companies that are playing a dominating role in the U.S. propane market include

AmeriGas Propane (UGI Corporation) Ferrellgas Partners L.P. Suburban Propane Partners L.P. Superior Plus Propane Chevron Corporation Valero Energy Corporation Enterprise Products Partners L.P. MPLX LP Targa Resources Corp. CHS Inc. GROWMARK Inc. CenterPoint Energy NGL Energy Partners LP MARKET SEGMENTATION

This research report on the U.S. propane market is segmented and sub-segmented into the following categories.

By Grade

By End-Use

Residential Industrial Commercial

By Country

Texas Maine West Virginia Oklahoma Rest of the United States