AI chipmaker Nvidia (NVDA) continues to attract strong optimism from both investors and analysts, fueled by its dominant position in AI chipmaking and robust earnings growth. Many on Wall Street see the stock as a key beneficiary of the ongoing AI boom. Meanwhile, TipRanks’ A.I. Stock Analysis also assigns an Outperform rating for NVDA stock, echoing the broader bullish sentiment.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis delivers automated, data-driven evaluations of stocks, giving investors a clear and concise snapshot of a stock’s potential. Moreover, TipRanks’ A.I.-driven rating combines insights from multiple models, including OpenAI’s (PC:OPAIQ) GPT-4o and Perplexity’s SonarPro.

Nvidia Earns Outperform Rating

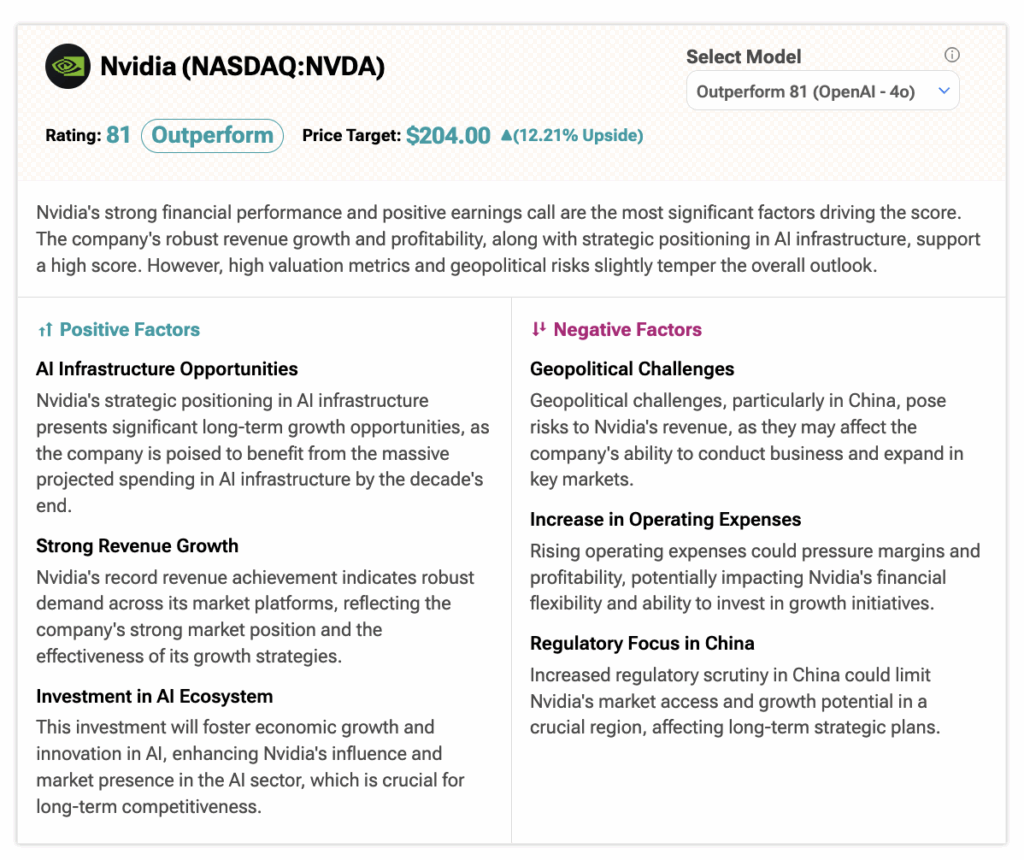

According to TipRanks A.I. Stock Analysis, Nvidia earns a solid score of 81 out of 100 with an Outperform rating. It also sets a price target of $204.0 for NVDA stock, implying an upside of over 12% from current levels. Nvidia’s score reaches as high as 88 under SonarPro’s evaluation, reflecting strong AI and market confidence in the stock.

Overall, Nvidia’s high score is largely fueled by its impressive financial results and upbeat earnings outlook. However, factors such as its elevated valuation and ongoing geopolitical uncertainties add a note of caution to the overall outlook.

Nvidia’s Strengths Shine, But Risks Remain

The A.I. Stock Analysis highlights both the positive and negative factors influencing the company’s stock performance.

Among the positive factors, Nvidia continues to benefit from strong AI demand, driven by major investments from hyperscale companies and new AI partnerships. Notably, in September, Nvidia and OpenAI announced a strategic partnership, with Nvidia committing up to $100 billion to OpenAI. This deal makes Nvidia OpenAI’s preferred partner for computing and networking.

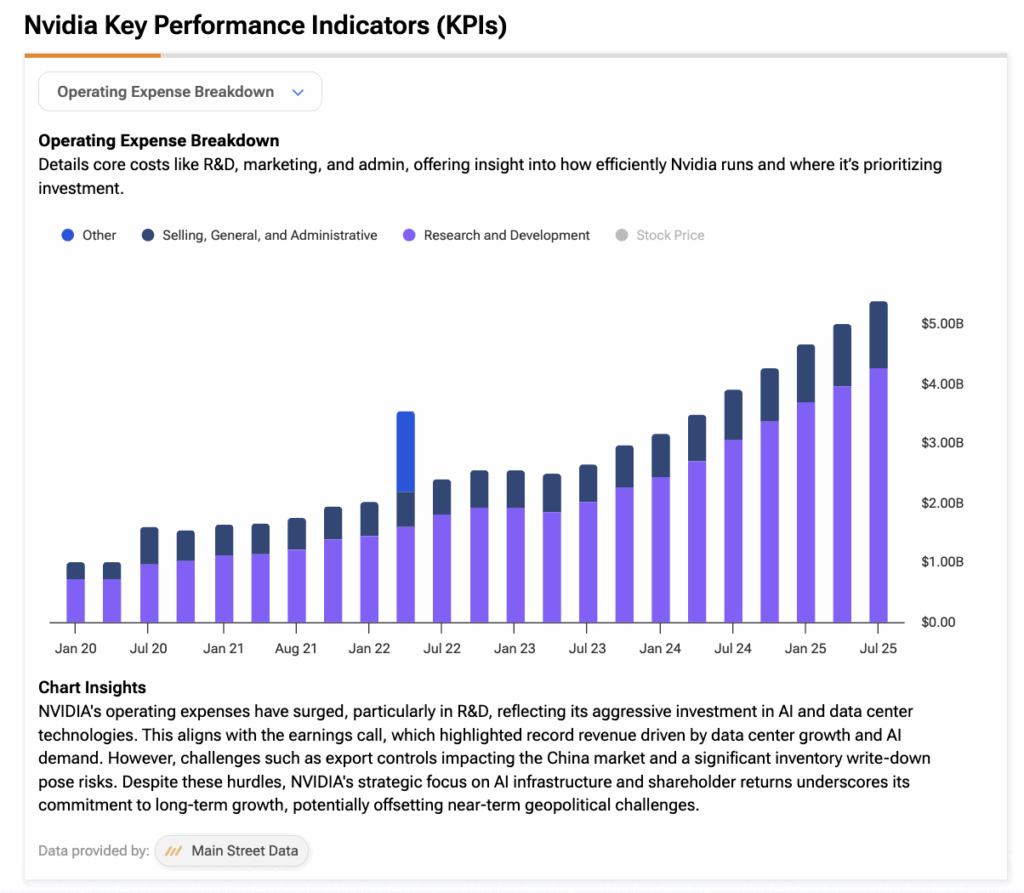

On the bearish side, Nvidia faces several challenges that could weigh on its stock. Geopolitical tensions, especially in China, may limit the company’s ability to grow and operate in a key market. Additionally, rising operating expenses could also squeeze profit margins and reduce financial flexibility, potentially slowing investment in future growth. Below is a screenshot showing how Nvidia’s operating expenses have grown over the last few years.

Wall Street Keeps Strong Buy on Nvidia Stock

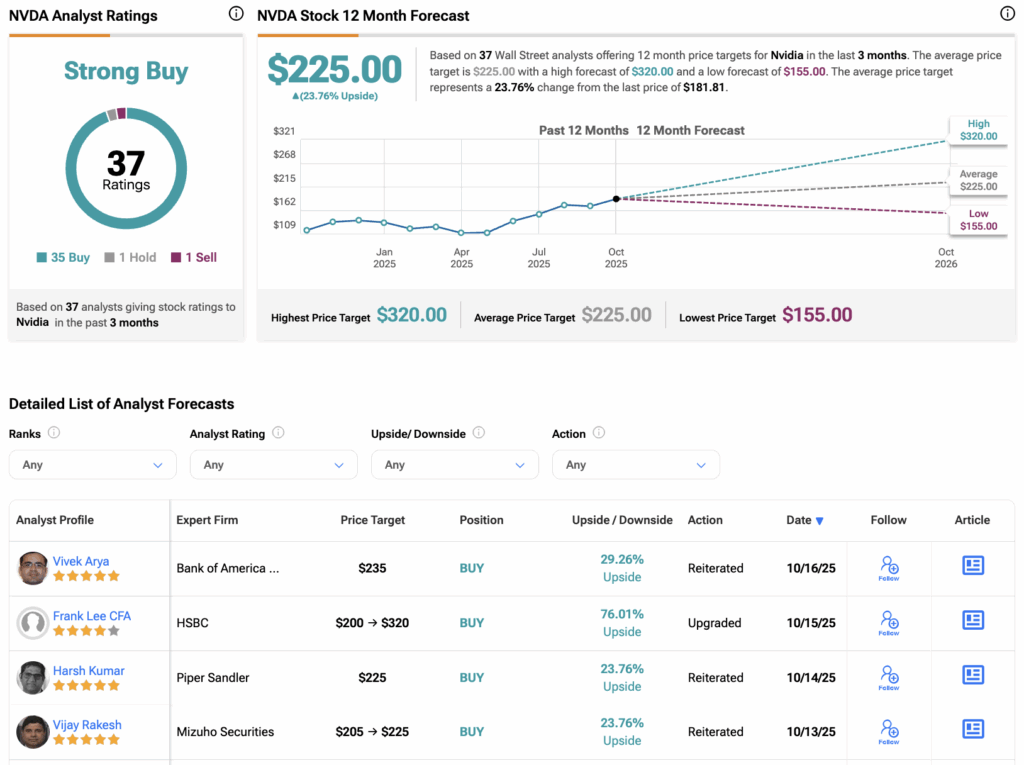

On Wall Street, analysts remain optimistic about Nvidia’s outlook. So far this month, six top analysts have raised their price targets on NVDA stock, while others have reaffirmed their Buy ratings.

For instance, HSBC’s four-star-rated analyst Frank Lee upgraded his rating on NVDA stock from Hold to Buy while raising his price target from $200 to Street-high of $320. Lee expects Nvidia’s AI chip market to keep expanding beyond just big tech companies. Projects like OpenAI-backed Stargate in the U.S. and overseas, along with OpenAI’s recent deal with Nvidia, could together generate as much as $400 billion in revenue for the chipmaker.

What Is the Target for Nvidia Stock?

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 35 Buys, one Hold, and one Sell assigned in the last three months. At $225.0, the Nvidia average share price target implies a 24% upside potential from the current level.

Year-to-date, NVDA stock has gained 35.4%.