Source: The Little-Known Crypto Powerhouse Behind Billions in Trading

Compiled by LenaXin, ChainCatcher

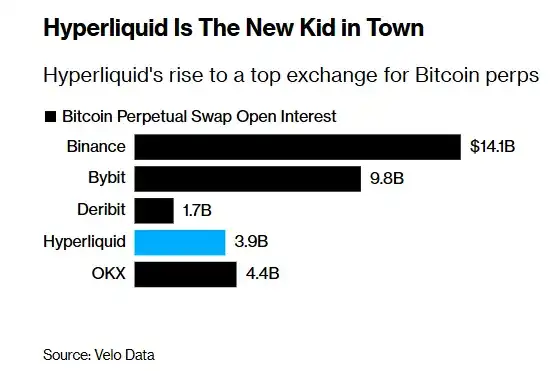

Hyperliquid, an anonymous decentralized exchange built by a small team of engineers, has attracted heavyweight investors and achieved trading volumes in the hundreds of billions within just two years. The platform focuses on perpetual contract trading, which are contracts without expiration dates and dominate the cryptocurrency speculative market, with a monthly trading volume exceeding $6 trillion.

Although significantly smaller in scale compared to industry leader Binance, Hyperliquid has surpassed Coinbase in certain areas and established a competitive advantage among decentralized exchanges.

Although significantly smaller in scale compared to industry leader Binance, Hyperliquid has surpassed Coinbase in certain areas and established a competitive advantage among decentralized exchanges.

Its development has made it a focal point in the untamed world of cryptocurrencies. Supporters praise its speed and transparency, but it also became the center of last week’s market crash, during which traders on the platform suffered $10 billion in losses.

Hyperliquid remains dominated by a small core group, raising questions among supporters about the extent of its decentralization. For backers like Paradigm and Pantera Capital, this represents both a bet on the future of digital finance and a warning that much of the industry’s activity still operates outside formal regulatory frameworks.

Earlier this year, during an industry summit hosted by Coinbase, where executives from BlackRock, Coatue, and the cryptocurrency community discussed development strategies, Jump Trading President Dave Olsen specifically highlighted Hyperliquid as Binance’s “first heavyweight competitor.”

What unique qualities does Hyperliquid possess? Why has it succeeded in attracting former Boston Fed Chairman Eric Rosengren to join the board of a Nasdaq-listed fund associated with its ecosystem and effectively capture market share?

Essentially, it is a minimalist trading platform operated by a team of approximately 15 people from Hyperliquid Labs in Singapore. Following industry norms, the platform blocks U.S. users on its frontend, but anyone can trade on its underlying blockchain. Its core appeal lies in the lack of identity verification, reminiscent of the rapid growth of early exchanges using similar models, which often quickly drew regulatory scrutiny.

Taran Chitra, founder of encryption risk modeling company Gauntlet, pointed out: ‘The markets with the highest growth rates are often the newest or least mature ones, as most existing market participants do not understand their underlying logic.’

Hyperliquid was co-founded by Jeff Yan and a co-founder using the pseudonym ‘iliensinc’. Previously having worked at Hudson River Trading, Jeff Yan had operated the crypto trading platform Chameleon Trading before transitioning to building high-speed trading systems that mostly operated outside traditional regulatory frameworks.

However, speed alone cannot ensure survival; the real test lies in liquidity. Platforms like dYdX and GMX once relied on token incentives to attract market makers, but their models became fragile when rewards dwindled. Hyperliquid’s solution is the introduction of the Hyperliquid Market Maker mechanism, where user deposits form a platform liquidity pool, and algorithms continuously post buy and sell quotes to ensure every trade has a counterparty. The system’s capital scale has now surpassed $500 million.

Felix Bucht, an algorithmic trader at Wintermute, stated: ‘Without users, there are no market makers; without liquidity, it’s impossible to attract users. Hyperliquid has successfully cracked this chicken-and-egg problem, as its HLP liquidity pool can provide quotes for any market.’

Some crypto experts have highlighted potential conflicts of interest: the protocol’s HLP mechanism may act as a counterparty in certain trades. Vishal Gupta, a former Coinbase executive, noted: ‘Operating an exchange should involve setting rules and serving as a referee, not participating directly in trading, as no one can guarantee impartial enforcement of the rules.’

Supporters argue that, unlike problematic exchanges of the past, every HLP transaction is recorded on-chain in real time, creating an auditable trail—a key difference from traditional platforms. As the platform matures and large external market makers join, the proportion of HLP-related trades has shown a declining trend. However, it is worth noting that, unlike many competitors, HLP’s code has not undergone public third-party audits.

A spokesperson for Hyperliquid Labs stated: ‘Unlike centralized exchanges, transparency is an inherent quality of Hyperliquid. Every trade, liquidation, and validation action can be verified in real time, and the platform never holds user funds.’

During the weekend market selloff, the HLP mechanism drew attention. Public data showed that as large traders on the platform incurred losses, the liquidity pool gained approximately $40 million in profits. This crash also triggered the automatic deleveraging mechanisms common to crypto exchanges—when buffer funds are depleted, the system reduces profitable positions to absorb cascading liquidations.

In other words, Hyperliquid reduced its own losses—and even profited $40 million—by using winners’ money to compensate losers.

Analysts such as Taran Chitra of Gauntlet noted that Hyperliquid’s ADL rules exhibit textbook aggression, which may be one of the factors driving HLP profitability.

Following last week’s sharp decline, Jeff Yan posted on the X platform to emphasize that HLP is a ‘neutral liquidator that does not filter profitable liquidation opportunities,’ and explained that the seemingly large scale of Hyperliquid’s liquidations is due to data being ‘fully on-chain,’ whereas centralized exchanges often underreport liquidation volumes.

If HLP were compared to an engine, the validation nodes would be the control center. Hyperliquid has only about 24 validation nodes, a stark contrast to Ethereum’s network of over a million nodes. Critics argue that this represents excessive centralization, with the Hyper Foundation controlling nearly two-thirds of the staked HYPE native tokens, giving it significant influence over validation node decisions and governance, although in some recent resolutions its nodes have chosen to abstain to align with community consensus.

Kam Bumbry, Director of Research at blockchain validation firm Chorus One, pointed out, ‘Controlling more than two-thirds of the staked tokens means having the ability to do anything on the chain.’

This power imbalance was highlighted in the so-called ‘JELLY incident’: A large bet on illiquid tokens threatened the solvency of HLP, prompting validation nodes to vote to liquidate the trade while the foundation used its own funds to compensate affected users.

At that moment, Hyperliquid acted like an interventionist market operator, similar to traditional exchanges rolling back transactions. Jeff Yan described this as an ‘extreme situation’ requiring immediate action from the then-16 validation nodes to protect users.

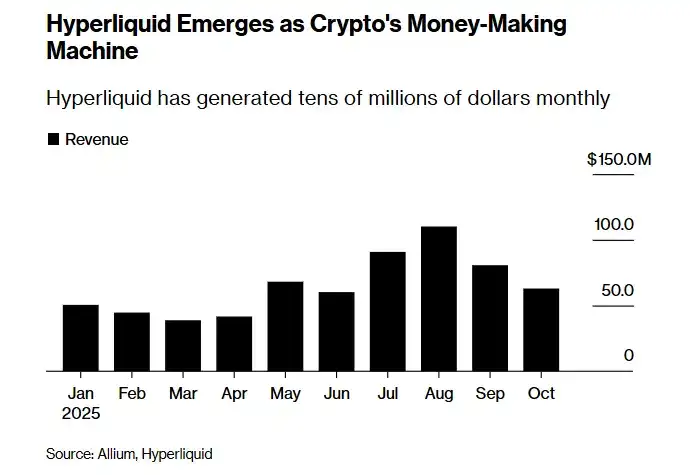

Hyperliquid’s financial structure allocates most transaction fees to repurchase HYPE tokens, creating a flywheel effect where trading volume drives token price increases. The assistance fund for repurchasing HYPE tokens using platform fees now holds over $1.4 billion. Supporters praise this mechanism as a growth engine, while critics warn that buybacks typically boost token prices only in the short term.

Santiago Roel Santos, a seasoned crypto investor, noted that token buybacks are ‘highly reflexive’ and depend on sustained trading volume growth to remain viable, with the model being sustainable only if Hyperliquid consistently outperforms larger competitors.

Proud of its innovation, Hyperliquid incentivizes user participation and liquidity through issuing tokens deeply tied to platform growth, though its approach appears somewhat traditional. Despite Hyperliquid’s transparent on-chain operations, previous platforms have shown that crises tend to follow when technical demand turns into greed for fragile reward protocols.

Market enthusiasm remains high. Paradigm invested $888 million to support a Nasdaq-listed fund holding HYPE, allowing traditional investors to participate without direct trading.

According to DefiLlama data, there are currently over 100 projects developing ecosystems based on Hyperliquid, with its scale now comparable to BNB Chain or Solana.

David Shammah, co-founder of Atlas Merchant Capital, stated: ‘It is both a Coinbase-style exchange and an Ethereum-like Layer-1 blockchain, integrated into a single system.’ He also revealed, as he will serve as the CEO of the fund, ‘With fewer than 15 full-time employees, the platform has already achieved an annualized free cash flow exceeding US$1 billion.’

Following Hyperliquid’s upgrade this week, experienced users can create perpetual futures markets within minutes, without requiring approval from a listing committee. Creators must stake millions of dollars worth of HYPE as collateral, and validators can slash the staked amount if misuse is detected.

This is a common risk control mechanism in proof-of-stake blockchains, which may give rise to trading markets for new tokens or volatility-tracking products. Essentially, Hyperliquid not only opens markets to traders but also allows them to build markets autonomously.