Winter Weather Outlooks

La Nina effect unlikely to impact U.S. winter weather

Some forecasters see early season snowfall potential

Above-average temps expected for much of the country

LNG export capacity set for massive expansion

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

Some high-profile weather forecasters have released their Winter 2025/26 outlooks in recent days. Consensus currently exists that La Nina will be weak or may fail to develop at all this winter.

Accuweather’s long-range winter forecast predicts that the event which can lead to colder than average temperatures across the northern part of the Lower 48 may not officially develop over the course of this winter. They see warmer than average temperatures dominating the western third of the country as well as the Gulf and

Atlantic coasts from Houston to New York. Colder than average air will control upper Midwest.

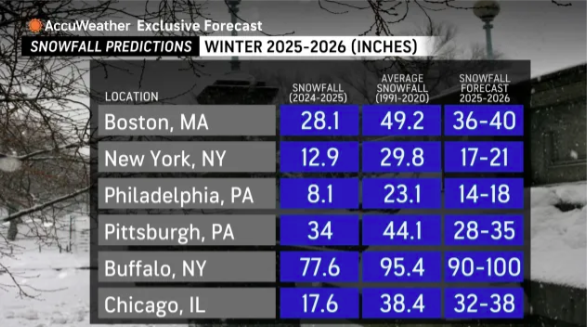

Accuweather forecasts above average precipitation over the Ohio River valley and the Mid-Atlantic states. Snowstorms in opening and closing weeks of the winter season could lead to snowfall totals higher than last winter for the Northeast, although lower than historical averages.

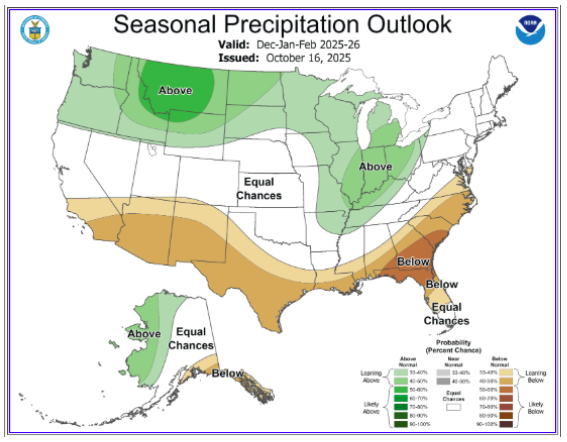

NOAA released their Long-Lead Seasonal Outlook last Thursday. Their team also sees a relatively weak and short-lived La Nina event. NOAA sees above-normal temperatures prevailing over much of the contiguous U.S. with the exception of the northernmost tier of country. Diverging slightly from the Accuweather forecast, NOAA predicts the above-average precipitation avoiding the Mid-Atlantic states and instead remaining mostly centered on the Ohio River valley.

Supply/Demand Balances

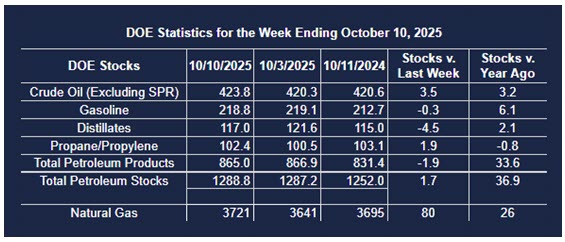

Supply/demand data in the United States for the week ending October 10, 2025, were released by the Energy Information Administration.

Total commercial stocks of petroleum increased (⬆) 1.7 million barrels to 1.2888 billion barrels during the week ending October 10th, 2025.

Commercial crude oil supplies in the United States were higher (⬆) by 3.5 million barrels from the previous report week to 423.8 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 1.4 million barrels to 8.1 million barrels

PADD 2: Up (⬆) 1.3 million barrels to 102.0 million barrels

PADD 3: Up (⬆) 0.1 million barrels to 244.6 million barrels

PADD 4: Up (⬆) 0.7 million barrels to 23.1 million barrels

PADD 5: Unchanged (=) at 46.0 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.7 million barrels to 22.0 million barrels.

Domestic crude oil production increased (⬆) 7,000 barrels per day from the previous report to 13.636 million barrels per day.

Crude oil imports averaged 5.525 million barrels per day, a daily decrease (⬇) of 878,000 barrels. Exports increased (⬆) 876,000 barrels daily to 4.466 million barrels per day.

Refineries used 85.7 percent of capacity; a decrease (⬇) of 6.7 percent from the previous report week.

Crude oil inputs to refineries decreased (⬇) 1,167,000 barrels daily; there were 15.130 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 1,209,000 barrels daily to 15.568 million barrels daily.

Total petroleum product inventories decreased (⬇) by 1.9 million barrels from the previous report week, down to 865.0 million barrels.

Total product demand decreased (⬇) 2,264,000 barrels daily to 19.726 million barrels per day.

Gasoline stocks decreased (⬇) 0.3 million barrels from the previous report week; total stocks are 218.8 million barrels.

Demand for gasoline decreased (⬇) 464,000 barrels per day to 8.455 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 4.5 million barrels from the previous report week; distillate stocks are at 117.0 million barrels. EIA reported national distillate demand at 4.233 million barrels per day during the report week, a decrease (⬇) of 113,000 barrels daily.

Propane stocks rose (⬆) 1.9 million barrels from the previous report to 102.4 million barrels. The report estimated current demand at 495,000 barrels per day, a decrease (⬇) of 979,000 barrels daily from the previous report week.

Natural Gas

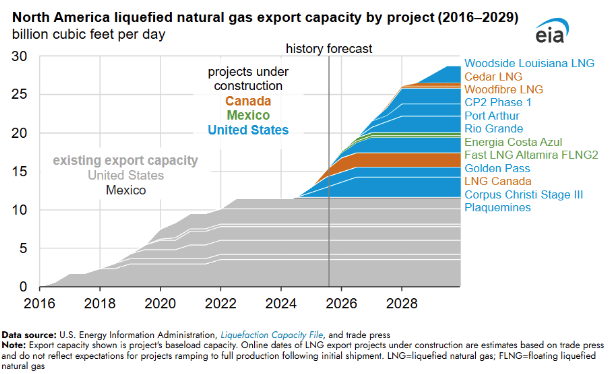

The number of LNG export projects that have been fully permitted by FERC over the next four years is truly impressive. By 2029, U.S. liquefaction capacity will increase by 13.9 Bcf/d, nearly doubling current export capacity if operations continue as planned.

According to the EIA:

Net injections into storage totaled 80 Bcf for the week ending October 10, compared with the five-year (2020–24) average net injections of 83 Bcf and last year’s net injections of 77 Bcf during the same week. Working natural gas stocks totaled 3,721 Bcf, which is 154 Bcf (4%) more than the five-year average and 26 Bcf (1%) more than last year at this time.

The average rate of injections into storage is 13% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 8.9 Bcf/d for the remainder of the refill season, the total inventory would be 3,907 Bcf on October 31, which is 154 Bcf higher than the five-year average of 3,753 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2025 Powerhouse Brokers, LLC, All rights reserved